Can Riot Platforms Weather Crypto Winter With Increased Bitcoin Production?

KanawatTH

Riot Platforms (NASDAQ:RIOT), previously Riot Blockchain, is without doubt one of the premier Bitcoin mining corporations from a profitability perspective (I’ve lined this agency a number of occasions up to now, and you may filter for your complete historical past of my protection here, full with crypto cheatsheets and {industry} commentary).

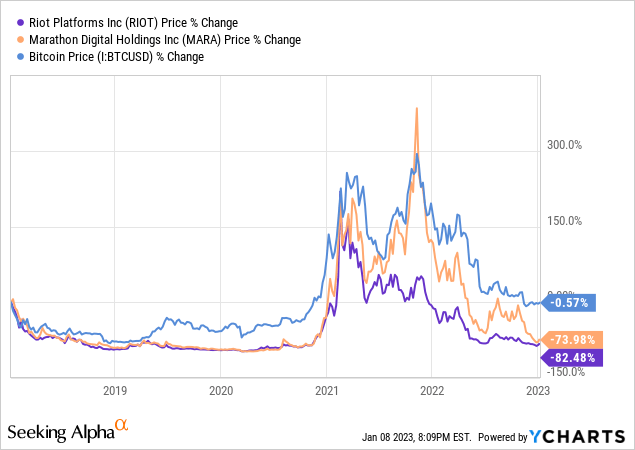

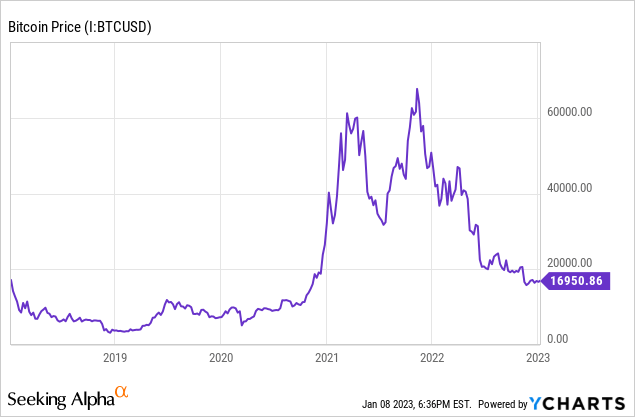

It has been a troublesome 12 months for Riot shareholders. The sharp crypto selloff has battered the inventory, and there’s no signal of a backside in sight. Regardless of the numerous PR and legislative commentary up to now, crypto mining corporations can nonetheless be seen as small corporations in that they normally produce one product, and for Riot, that product is Bitcoin. With the complexity and glossy object syndrome surrounding Bitcoin, at occasions, it’s simple to overlook that Bitcoin miners function in the identical manner basically as uncommon earth miners in that they stockpile tokens at low costs and distribute them at advantageous costs. On account of this dynamic, the worth motion for miners is vastly decided by the worth of the crypto token they mine, which explains what has been occurring with Riot. The inventory has fallen off a cliff regardless of clear indicators of progress internally.

Knowledge by YCharts

Knowledge by YCharts

Earnings & Production Replace

In December 2022, Riot produced 659 bitcoins, a rise of 26% from the earlier month and 55% greater than its December 2021 manufacturing.

Firm Sort January December November October September 3-Month AVG Riot Bitcoins mined 659 521 509 355 563 Click on to enlarge

Creator estimates tailored from In search of Alpha

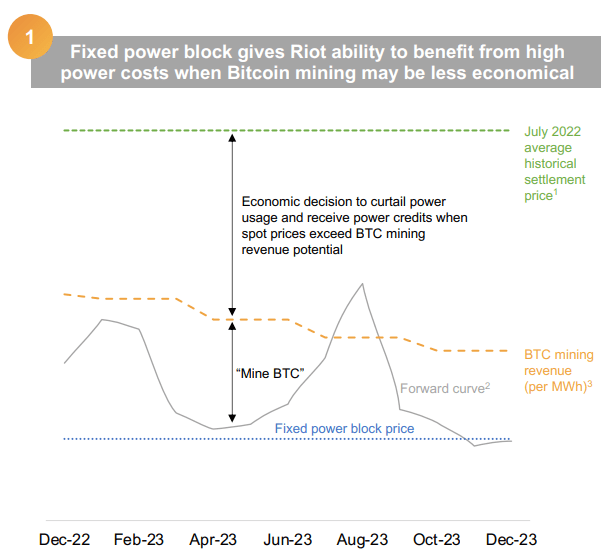

The corporate earned $4.9 million in energy credit in the course of the month, which is equal to roughly 290 bitcoins utilizing the December 2022 weighted common every day closing worth of $16,967. The corporate has been strategically executing its energy technique to drive decrease energy prices. A abstract of the technique might be discovered under:

Riot Platforms

Riot bought 600 bitcoins in December, producing internet proceeds of round $10.2 million, and held roughly 6,952 bitcoins as of December 31, 2022. Pressured gross sales or gross sales at disadvantageous costs are sometimes crimson flags for Bitcoin mining corporations like Riot, however within the context of a crypto bear market, it’s comprehensible to see some liquidation at this level. Buyers must be effectively conscious of the dangers for mining corporations on this setting by now, so it’s unlikely that additional gross sales might be met by any sensational worth motion.

Shifting on to the fleet, Riot deployed an extra 16,128 S-19-series miners, bringing its hash price capability to a brand new all-time excessive of 9.7 EH/s. Nevertheless, a few of the firm’s operations at its Rockdale facility sustained harm from extreme winter climate in Texas, which impacted round 2.5 EH/s of its complete hash price capability. Riot expects to have a complete of 89,708 miners deployed with a hash price capability of round 9.9 EH/s, with shipments of an extra 5,130 S19-series miners anticipated to be obtained in January 2023. It’s fascinating that Riot continues to speculate closely in its fleet. At this level, the businesses are promoting tokens at a loss, and plenty of miners have mining prices that hover across the ten thousand greenback mark. It’s important to notice that spreading mounted prices like administration and actual property amongst many miners will help margins, however that is vastly capital intensive, and the businesses should steadiness this profit towards the dangers of illiquidity ought to Bitcoin costs stay depressed for an prolonged interval.

Within the current third-quarter earnings name, Riot introduced that the corporate had a complete income of $46.3 million, in comparison with $64.8 million in the identical interval in 2021. The lower was primarily attributable to decrease Bitcoin manufacturing ensuing from the corporate’s energy technique and a 49% lower out there worth of Bitcoin. It is a pattern we’re seeing with a few of the larger miners.

The corporate earned $13.1 million in energy curtailment credit within the third quarter of 2022, in comparison with $2.5 million in the identical interval in 2021. It produced 1,042 Bitcoin within the third quarter of 2022, in comparison with 1,292 in the identical interval in 2021. The corporate’s mining income within the third quarter of 2022 was $22.1 million, in comparison with $53.6 million in the identical interval in 2021. Its information middle internet hosting income was $8.4 million within the third quarter of 2022, in comparison with $11.2 million in the identical interval in 2021.

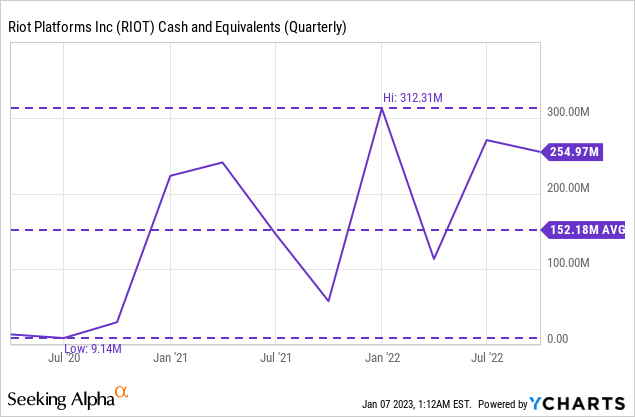

The corporate had $369.8 million in working capital and $255.0 million in money readily available as of September 30, 2022, and it produced 6,766 Bitcoin in that interval. Buyers will need to pay eager consideration to the money steadiness sooner or later as these depressed Bitcoin costs and elevated price of manufacturing start to take agreed to impact on the corporate’s steadiness sheet. We will see that the current gross sales together with prior dilution have vastly improved the corporate’s liquidity place.

Knowledge by YCharts

Knowledge by YCharts

Riot has at all times finished comparatively effectively with managing its money steadiness and liquidity place. This has led to some analysts branding it the highest decide of the Bitcoin mining area. It is very important be aware that regardless of the superior capital controls, Bitcoin mining corporations are basically the identical enterprise, and so they can not maintain long-term depressed costs. The corporate had a internet lack of $14.9 million within the third quarter of 2022, in comparison with a internet lack of $47.3 million in the identical interval in 2021.

Low-Value Producer

So earnings recommend Riot is definitely displaying some clear indicators of progress regardless of the large crypto meltdown, and far of that is attributable to their operational prowess. We’ve got seen manufacturing disruptions severely impression targets for different corporations, however Riot has at all times appeared to be blissful to proceed to construct out its fleet regardless of the large industry-wide decline in profitability. Many analysts have painted an image of doom and gloom due to the losses and harsh headlines, however Riot is a bit completely different. Riot is what you name a low-cost miner; that’s, they can handle their direct prices of Bitcoin manufacturing higher than many different companies. Within the early Bitcoin mining explosion, many producers had their direct prices hovering across the $10k mark, and so they might shortly promote their tokens available on the market for 3 to five occasions that on the open market to fund different enterprise bills. Since then, the price of vitality has gone via the roof, and plenty of miners have grow to be more proficient at managing these non-direct prices since they’ve restricted management over vitality charges. That is the place Riot units itself other than the remainder. Regardless of the rise in vitality prices, Riot has managed to enhance its direct mining prices from $15,250/BTC to simply $11,346/BTC.

Knowledge by YCharts

Knowledge by YCharts

On the time of the writing of this text, Bitcoin was hovering at a worth of ~$17,000. This implies the corporate nonetheless has room to contribute to non-direct prices at present costs. It is very important emphasize that that is not at all a cushty state of affairs for buyers or shareholders.

As issue charges proceed to extend, we’ll see direct prices naturally go up (mentioned in better element here), holding all different issues fixed. Additionally, for profitability to have a shot at occurring at this stage, the corporate would want to considerably improve the dimensions of its fleet, which might possible require extra cash than Riot can moderately entry. In addition they must hope that their rivals keep away from doing the identical or that Bitcoin’s community hashrate falls off a cliff.

The Verdict

I’ve been a long-time fan of shopping for the wash on mining corporations and ready for the eventual Bitcoin rally to unload, however this time feels completely different. The {industry} has been hit by a wave of defaults, and legislators might use Bitcoin miners as a scapegoat for investor losses. I see Riot as top-of-the-line corporations within the {industry}, however that {industry} is struggling proper now. I’m a long-term Bitcoin bull, however I do have issues relating to whether or not some mining companies will make it to the opposite facet of this slowdown. The chance of extra losses or dilution will possible stay excessive for the prolonged future, however I proceed to stay bullish on Riot. I price the inventory as a speculative purchase.

Source link

#Riot #Platforms #Weather #Crypto #Winter #Increased #Bitcoin #Production