Claim Accuses Binance US of Selling Unregistered Securities, False Advertising Terra UST as ‘Safe’ – Bitcoin News

A legal claim against Binance US has been documented in California that affirms the trade deceived financial backers and offered unregistered protections to approximately 2,000 offended parties. The case was documented by the law office Roche Freedman LLP, an organization known for prominent crypto claims during the most recent couple of years. The claim blames Binance US for promoting terrausd (UST) as a solidly fixed stablecoin attached to the worth of the U.S. dollar.

Class-Action Lawsuit Filed Against Binance US Over the Terra UST Collapse — 2,000 Plaintiffs Say They Were Misled by the Exchange

On Monday, the U.S.- based Binance exchanging stage Binance US has been presented with a claim that blames the organization for selling unregistered protections and misdirecting financial backers. The allegations get from last month’s Terra UST de-fixing occurrence and the whole Terra Classic blockchain biological system getting obliterated.

The legal claim was documented in California and the law office behind the case is Roche Freedman LLP, the organization that was associated with the Kleiman versus Wright case and other notable crypto lawsuits.

Binance US CEO Brian Shroder is additionally named in the claim.

Binance US CEO Brian Shroder is additionally named in the claim.

The claim blames Binance US for not being resolved to its clients by not consenting to U.S. government and state protections regulations when it recorded terrausd (UST). The claim claims UST was sold as a “safe” resource and as “an early supporter of [Terraform Labs], Binance US is intimately familiar with UST and LUNA.”

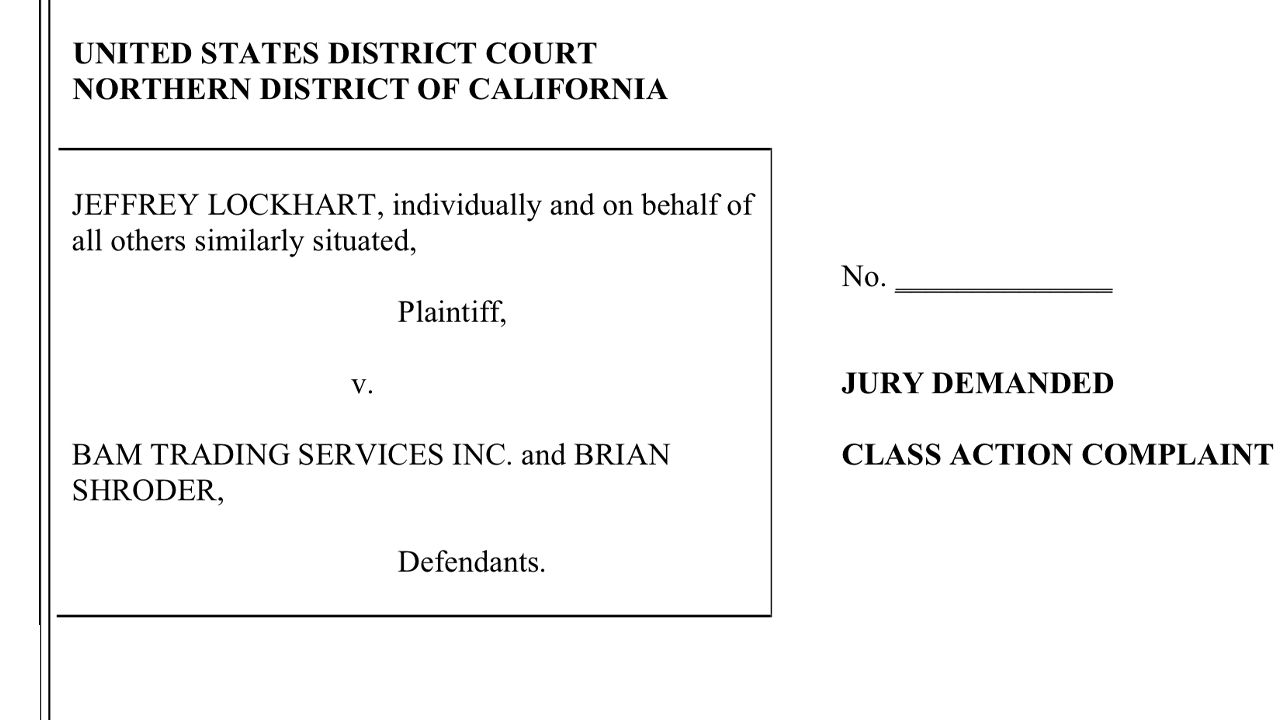

Screenshot of the claim against Binance US.

Screenshot of the claim against Binance US.

The claim shows a notice showing Binance offering locked marking on UST and it says “high yield, safe & happy earn.” Another ad displayed in the claim calls UST “fiat-backed.” The class activity says that Binance US neglected to uncover that “UST is in fact a security” and Binance “refused to register” with the U.S. Protections and Exchange Commission (SEC) as a “securities exchange or as a broker-dealer.”

“Binance US’s failure to comply with the securities laws, and its false advertisements of UST, have led to disastrous consequences for Binance US’s customers in May 2022, in the span of just a few days, UST lost essentially all its value — a loss of approximately $18 billion,” the claim charges. As per the claim, after the UST breakdown Binance eliminated the bogus adverts yet takes note of that Binance has not quit selling Terra-based securities.

The claim states:

Binance US’s parent organization joyfully compounded an already painful situation when, on May 31, 2022, it started selling Luna 2.0 — another symbolic which, very much like LUNA, is midway constrained by [Terraform Labs].

Whistleblower Fatman Says the Binance Lawsuit Is Just the Beginning as Another Class-Action Lawsuit Aimed at Helping Terra Investors Is Coming

The notable informant Fatman helped the suit push ahead by get-together 2,000 Terra financial backers. Fatman has uncovered that another class-activity suit pointed toward aiding lamenting Terra financial backers will follow the case documented by Roche Freedman on Monday. Fatman tweeted about the ongoing class activity against Binance US on Monday as well.

“We begin today,” Fatman tweeted. “Partnered with one of the law firms I’m working with, Roche Freedman, our group of UST victims are bringing a class action against Binance US for tortious deceit [and] more. I prefer a world where when crypto companies lie [and] prey on the weak, there are consequences.”

Labels in this story

2000 Investors, 2000 Plaintiffs, Binance, Binance.us, Class Action Lawsuit, Crypto, crypto resources, do kwon, law office, Lawsuit, Roche Freedman LLP, Securities, Terra, Terra UST Collapse, terraform labs, TerraUSD, TFL, unregistered protections, US SEC, UST

What is your take on the claim against Binance US and its supposed association with Terra UST? Tell us your opinion regarding this matter in the remarks area underneath.

![]()

Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons, Editorial photograph credit: Iryna Budanova

Disclaimer: This article is for educational purposes as it were. It’s anything but an immediate deal or requesting of a proposal to trade, or a suggestion or underwriting of any items, administrations, or organizations. Bitcoin.com doesn’t give speculation, charge, lawful, or bookkeeping guidance. Neither the organization nor the writer is mindful, straightforwardly or by implication, for any harm or misfortune caused or asserted to be brought about by or regarding the utilization of or dependence on any happy, labor and products referenced in this article.

More Popular News

In Case You Missed It

Source link

#Lawsuit #Accuses #Binance #Selling #Unregistered #Securities #False #Advertising #Terra #UST #Safe #Bitcoin #News