Cointelli Makes It Easy to Report Coinbase, Binance, and Kraken Transactions to the IRS – Sponsored Bitcoin News

Many crypto trades send tax documents to the IRS, each with their own rundown of upheld tokens and data that doesn’t really coordinate. This can make a great deal of disarray for U.S. citizens. Fortunately, Cointelli can quickly and dependably make a brought together expense report with the press of a button.

And assuming there are any between stage irregularities, Cointelli has a strong mistake rectification include that allows clients effectively to alter information. Cointelli’s calculations make it simple to order every one of the information from Coinbase, Binance, Kraken, and numerous others into one assessment report. And for the truly reasonable cost of just $49!

What is the Best Software for Crypto Taxes?

American digital money merchants and financial backers need all the assist they with canning get with regards to exploring the duty framework really. Digital money has made things confounded for some individuals, as the IRS arranges it as ‘property’ for tax assessment purposes – destroying a typical misguided judgment that there is no tax on crypto. U.S. financial backers, specifically, are focusing harder on announcing charges on digital currency. With bullish development in digital currency venture, and the market expected to develop greatly, the U.S. government has sloped up its endeavors to get its cut of the pie. The IRS originally drafted its cryptographic money charge rules back in 2014, and Washington has as of late given the organization one more $80 billion to track and catch charge evaders.

Crypto charges aren’t not difficult to understand. Doing them accurately frequently includes precisely revealing complex exchanges across numerous crypto stages. Accordingly, having the right programming can be a lifeline with regards to getting it squarely on time. Cointelli is a cloud-based crypto charge arrangement programming arrangement that uses its one of a kind innovation to help people, organizations, and CPAs save more on crypto charges. Cointelli spends significant time in assisting clients with receiving the most crypto charge rewards conceivable while announcing their crypto charges accurately.

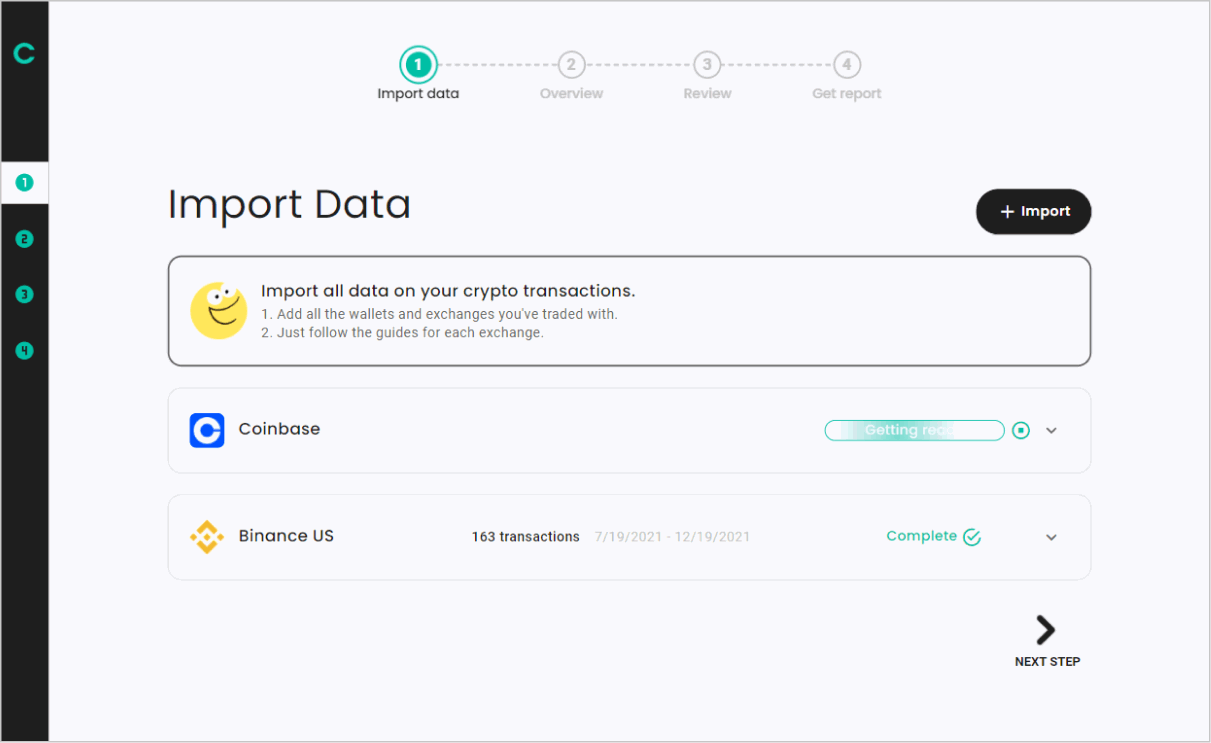

So, what else sets Cointelli apart? Indeed, the basic initial phase in working out your crypto charges with charge programming is gathering and bringing in your exchange information from across numerous trades and wallets. This cycle might look direct, yet there are a few fundamental advances you really want to take to guarantee accuracy.

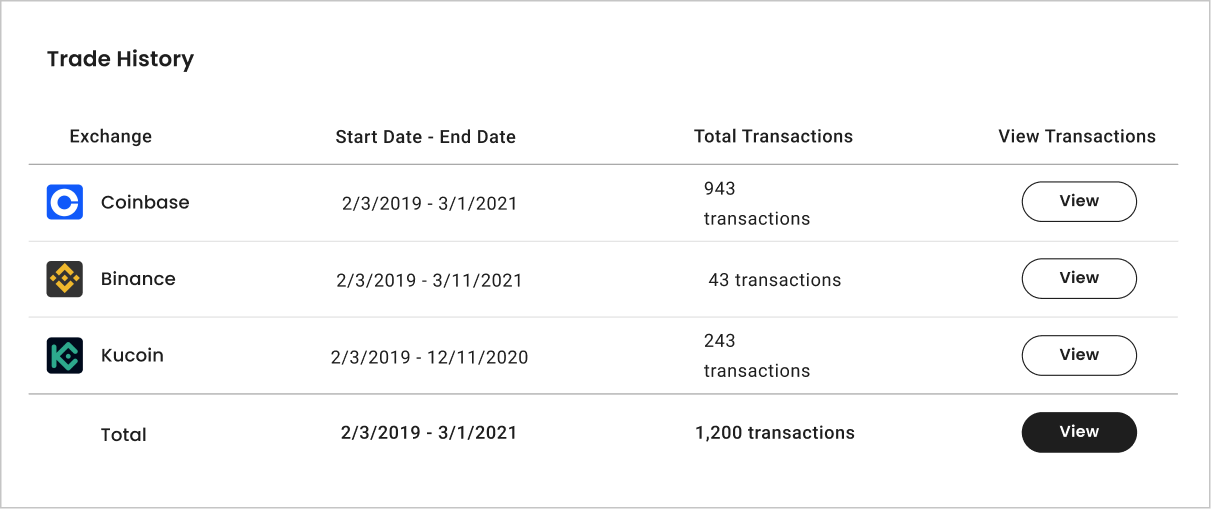

First, you need to check the number of crypto trades and wallets the product upholds. Cointelli, for instance, upholds a significantly bigger number of major crypto trades than numerous contenders – and with full import capacities. Instances of trades upheld by Cointelli incorporate significant ones like Coinbase, Binance, KuCoin, and a lot more specialty trades also. To add to this, Cointelli likewise includes support for something like 15 blockchains, including well known ones like Bitcoin, Ethereum, and even Dogecoin.

Cointelli offers support for additional wallets and trades and gives the least demanding strategies for bringing in exchange information from across these stages. These advantages likewise make Cointelli extremely simple to use for amateurs, making it a fantastic pick while picking your crypto charge software.

Reporting Taxes to the IRS

Many critical trades like Coinbase, Binance, and Kraken send different tax documents to the IRS (for example, Coinbase reports 1099-MISCs and Kraken reports extra sorts of 1099 structures). In any case, these trades just have any familiarity with the exchanges that occur in their own frameworks. Each critical trade likewise has its own rundown of upheld digital currencies, which will not really coordinate with different records. For this reason it’s so essential to have a crypto charge programming arrangement that rapidly and precisely totals all of this data in a single spot and cycles it for you.

Cointelli conveys these administrations, yet makes them achievable for all, with full access accessible for a simple, flat-fee of $49 each year and no secret expenses. Furthermore, clients can run the program so that free might perceive the amount they will be covering in crypto burdens, and won’t pay anything until they choose to download the finished Form 8949. As well as making it simple to finish up and download the finished reports and structures, Cointelli likewise has a consistent and simple to-utilize interface and gives every minute of every day client service.

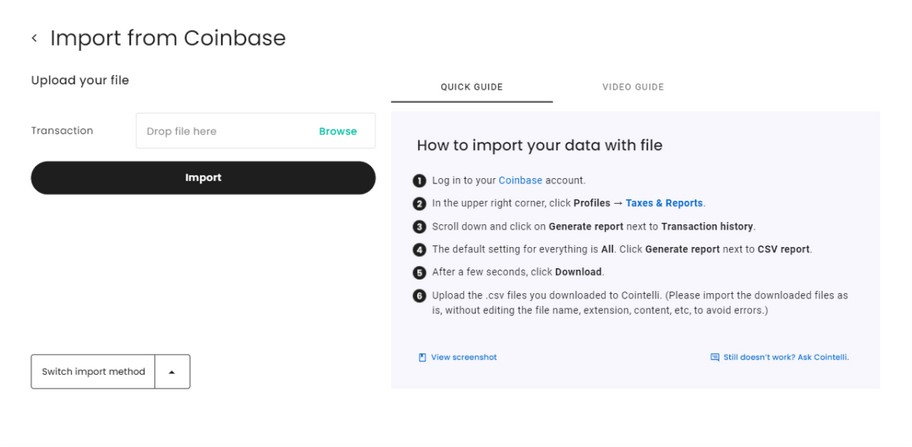

Importing exchange information into Cointelli from different trades like Coinbase, Kraken and Binance.US is a clear issue. Be that as it may, for anybody experiencing difficulty, Cointelli gives definite and enlightening aides and walkthroughs to show you precisely how it’s done.

For model, to import your information from Binance.US, you would just follow the means below:

How to Import Exchange Data from Binance.US

To begin with, sign up on Cointelli

Then, at that point, sign in to Binance and create your API key

Reorder your API key into the page, as beneath

When the import is finished, and the exchange information has been effectively added, you will actually want to affirm your exchanges. Whenever that is done, Cointelli will then, at that point prepare your Form 8949.

When the import is finished, and the exchange information has been effectively added, you will actually want to affirm your exchanges. Whenever that is done, Cointelli will then, at that point prepare your Form 8949.

But imagine a scenario where you’ve exchanged elsewhere, as on Kraken or Coinbase. Don’t worry about it! Simply adhere to Cointelli’s guidelines for each trade, and before long you’ll have your tax documents in hand.

Click here for more information.

This article is expected to give general monetary data intended to teach a wide section of the general population; it doesn’t give customized charge, speculation, lawful, or other business and expert exhortation. Prior to making any move, you ought to continuously talk with your own proficient duty guide for counsel on charges, your speculations, the law, or some other business and expert matters that influence yourself or your business.

Cointelli is as of now just accessible in the US. The above monetary and charge data relates to the US market.

This is a supported post. Figure out how to contact our crowd here. Peruse disclaimer below.

Source link

#Cointelli #Easy #Report #Coinbase #Binance #Kraken #Transactions #IRS #Sponsored #Bitcoin #News