Crypto Chartbook – Bitcoin Is Needed As An Alternative (Cryptocurrency:BTC-USD)

peshkov/iStock by means of Getty Images

The late conflict environment has spurred a higher interest for bitcoin. Significantly more evident turned into (*’s) (BTC-USD) use for abundance conservation. Also, there is one more viewpoint that will probably come to the front. Driving monetary standards need to stream uninhibitedly to satisfy their preeminent rule for of trade. The worth of a world cash gets decreased, whenever sanctions are forced. Obviously, contest is evoked to make a medium that can be utilized as an installment technique. The opposition between various countries has been continuous for a really long time to expose their advanced monetary standards. However, this earnestness has been underlined by the current political environment.BitcoinThe debilitated US-Dollar and the present unforeseen environment appear to be not to be completely reflected in bitcoin’s cost. Therefore, bitcoin costs could take off in the not-too-far off future.

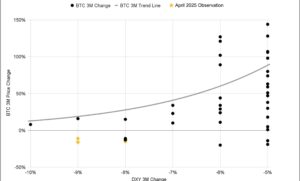

/gold-proportion, day to day graph, base building:

Bitcoin/Gold-Ratio, day to day outline as of March fifteenth, 2022. (Midas Touch and The standard.io)

BitcoinA peculiarity in the midst of emergency is that people search for absolutes or limits to determine troublesome conditions. We rather advocate a more standard based course of tackling issues, a methodology of decisions. With respect to safeguarding, this would mean gold (XAUUSD:CUR) and silver (XAGUSD:CUR) close by bitcoin.

The day to day outline of the bitcoin/gold proportion shows the base structure after a downtrend. At present, one can buy a bitcoin for twenty ounces of gold. Almost half as much as five months prior. For sure, a valuable chance to turn one’s valuable metal holding somewhat into a modest bitcoin acquisition.

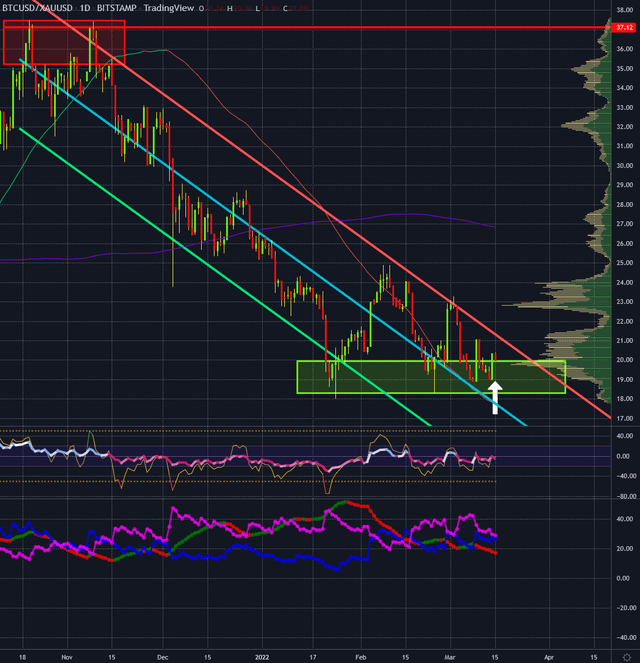

, month to month outline, in holding up position:

Bitcoin in USD, month to month diagram as of March fifteenth, 2022. (Midas Touch and Thestandard.io)

BitcoinWar intrinsically partitions countries, and that doesn’t mean restricting just the ones straightforwardly in struggle with one another. It is this partition that, what’s more, energizes the opposition for every country to be first in their computerized money discharge. Authorized nations have restricted admittance to the US-Dollar. Thus, they are exceptionally energetic to make a substitute installment method.

The month to month graph isn’t showing this basic help for bitcoin. Early indications of a triangle show that we view as prone to break to the potential gain. Slow stochastic pointer perusing (A) shows that the last time around at these levels, a solid up move followed. Like the yellow CCI super line-level perusing (B). Before such a move, we saw a fast cost spike down (C), which would be no surprise.

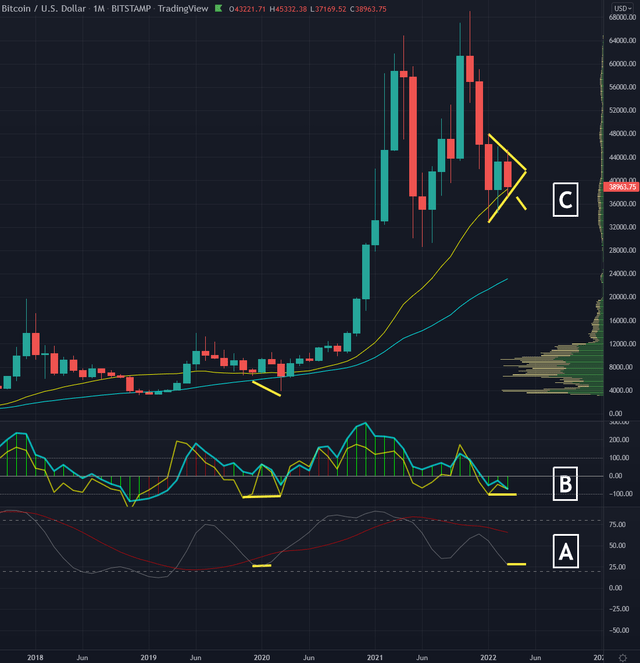

, week after week outline, bitcoin as an option is required:

Bitcoin in USD, week by week diagram as of March fifteenth, 2022. (Midas Touch and Thestandard.io)

BitcoinZooming into the week by week time period, we can make out the fight among bulls and bears in more detail. Throughout the most recent three weeks, costs were dismissed over the POC (place of control = high volume hub, where our volume profile investigation ranges over the past fifteen months). Too, value conduct is mirroring the conflict environment’s vulnerability. Simultaneously, the bulls have held consistent any endeavor of the bears attempting to push costs beneath US$37,500. Consequently, we should see a significant move once exchanging wakes up from this

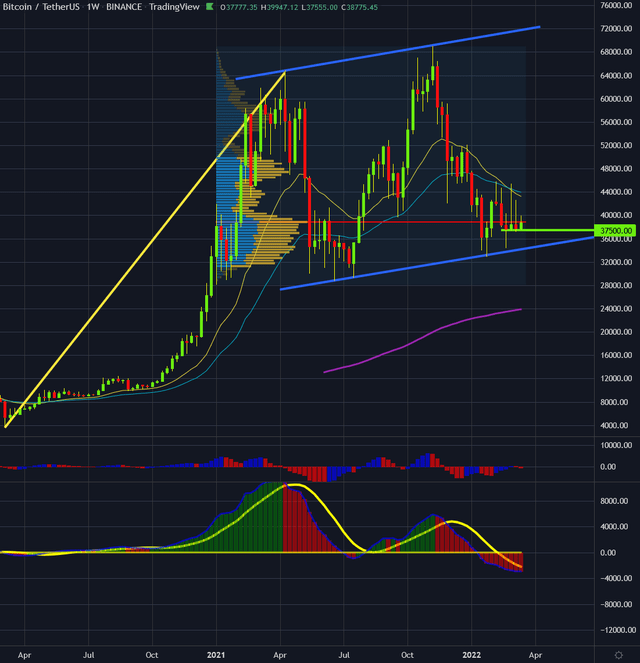

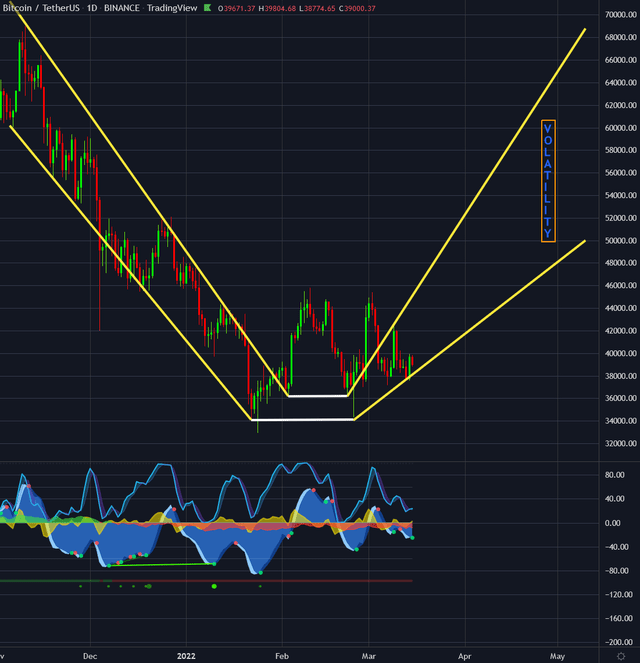

to the high-volume node.”magnet trading”, day to day outline, gains and volatility:

Bitcoin in USD, day to day diagram as of March fifteenth, 2022. (Midas Touch and Thestandard.io)

BitcoinThe everyday outline of

, as well as the Grayscale Bitcoin Trust (OTC:GBTC) above, depicts how we see the future unfurl. We expect the cost to arrive at record-breaking highs inside the forthcoming month. Sadly, not in bitcoins’ common swing exchanging way. We predict a rough, unpredictable market. Subsequently, short and midterm exchanging will challenge. Moving forward in a time period is a useful way to deal with stay away from noise.Bitcoin is required as an alternative:

BitcoinGovernments will attempt to keep their syndications and power. Notwithstanding, we don’t believe that the reception of an advanced dollar by the majority won’t be just simple. We view this particularly obvious as in an exceptionally temporary season of quick changes and some challenges.

Typically, various purposeful publicity waves through media feel a little doubtful however could have lost a portion of its dependability. Subsequently, bitcoin has a fair opportunity for mass reception similarly as well. It as of now has a set of experiences and conveys inborn highlights of opportunity that individuals could ache for more than anticipated.

#Crypto #Chartbook #

Source link

#Needed #Alternative #CryptocurrencyBTCUSD