Cryptocurrency Exodus: Bitcoin and Ethereum at the Forefront of Exchange Migration

There are signs that retail investors in the cryptocurrency space are becoming more long-term believers, as there has been a recent decrease in the balances of Bitcoin (BTC) and Ethereum (ETH) on centralized exchanges. Recent data indicates that user balances for both top cryptocurrencies have dropped to levels not seen in four years, which analysts see as a positive sign for the future.

Investors seem to be waiting for higher prices in a bullish market, as the user balances of Bitcoin (BTC) and Ethereum (ETH) on centralized exchanges have significantly decreased, according to Glassnode data.

The value of Bitcoin now stands at less than 2.3 million coins, approximately $158 billion, while Ethereum’s value is below 16 million coins, less than $58 billion.

‘Diamond Hands’ And Dollar-Cost Averaging

The decline in exchange balances, which started before the July 2020 bull market, continues. This indicates a shift in investor mindset, with users choosing to hold their coins for the long term rather than actively trading them.

Source: Glassnode

This new confidence could be attributed to various factors. Recent market disruptions, inflation, and financial uncertainties have made assets like Bitcoin more attractive as a hedge due to its limited supply.

Related Reading: Crypto Heist Heats Up: Orbit Chain Hackers On The Move With $48 Million

Some analysts have observed a new breed of crypto investors who are holding onto their coins rather than seeking quick profits, adopting a “diamond hands” approach. Many are also using dollar-cost averaging to gradually build their positions over time.

Total crypto market cap at $2.3 trillion on the daily chart: TradingView.com

Wall Street Whales Dive In, DeFi Heats Up Ethereum’s Engine

The positive sentiment extends beyond retail investors as institutional giants like BlackRock and Fidelity have increased demand for Bitcoin by introducing spot Bitcoin ETFs. Companies like MicroStrategy have also made significant investments in Bitcoin.

For Ethereum (ETH), the bullish narrative is driven by its dominance in the Decentralized Finance (DeFi) sector, where it powers a $68 billion ecosystem, positioning it as a key player in the future of finance.

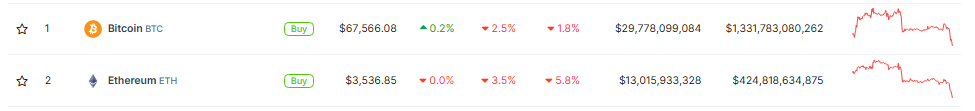

Bitcoin and Ethereum price action and market cap. Source: Coingecko

Bitcoin and Ethereum price action and market cap. Source: Coingecko

Long-Term Value Proposition

With over 25% of Ethereum’s supply currently staked, investors clearly see long-term value in the platform. The thriving DeFi ecosystem, staking options, and the upcoming switch to proof-of-stake paint a promising future for Ethereum.

The recent decrease in exchange balances indicates growing confidence in the long-term potential of these digital assets, as investors prefer to hold their crypto rather than trade it actively.

Featured image from The Science of Birds, chart from TradingView

Source link

#Crypto #Exodus #Bitcoin #Ethereum #Lead #Migration #Exchanges