Decentralized Exchange Trading Volumes Remain Lackluster within the New Year, Uniswap Leads the Way with Daily Swaps – Defi Bitcoin News

In keeping with statistics, decentralized trade (dex) month-to-month buying and selling volumes have dropped considerably since Jan. 2022. After a short spike in quantity in Nov. 2022, dex commerce volumes have been lackluster for the previous 44 days. As of Jan. 14, 2023, Uniswap model three (V3) has the best commerce quantity throughout the previous 24 hours at $1.9 billion and the second-highest whole worth locked (TVL) at $3.57 billion. Metrics present that Curve holds the second-largest commerce quantity on Saturday with $399 million in 24 hours and the best TVL by way of property locked in dex platforms, with $4.19 billion locked.

Uniswap V3 Dominates Dex Trading as Decentralized Exchange Volumes Remain Flat

After the primary two weeks of Jan. 2023, and as of Jan. 13, 2023, metrics point out that there was $15.33 billion in international swaps settled amongst decentralized trade (dex) platforms. Final month, dex protocols recorded roughly $43.65 billion in swaps, which means that throughout the first two weeks of the brand new yr, 35.12% of final month’s quantity has been reached.

With the latest spike in international cryptocurrency market costs, leaping 6.24% within the final 24 hours, dex commerce quantity has been fueled over the previous few days. Uniswap V3 has captured probably the most quantity over the past 24 hours with $1.9 billion in swaps.

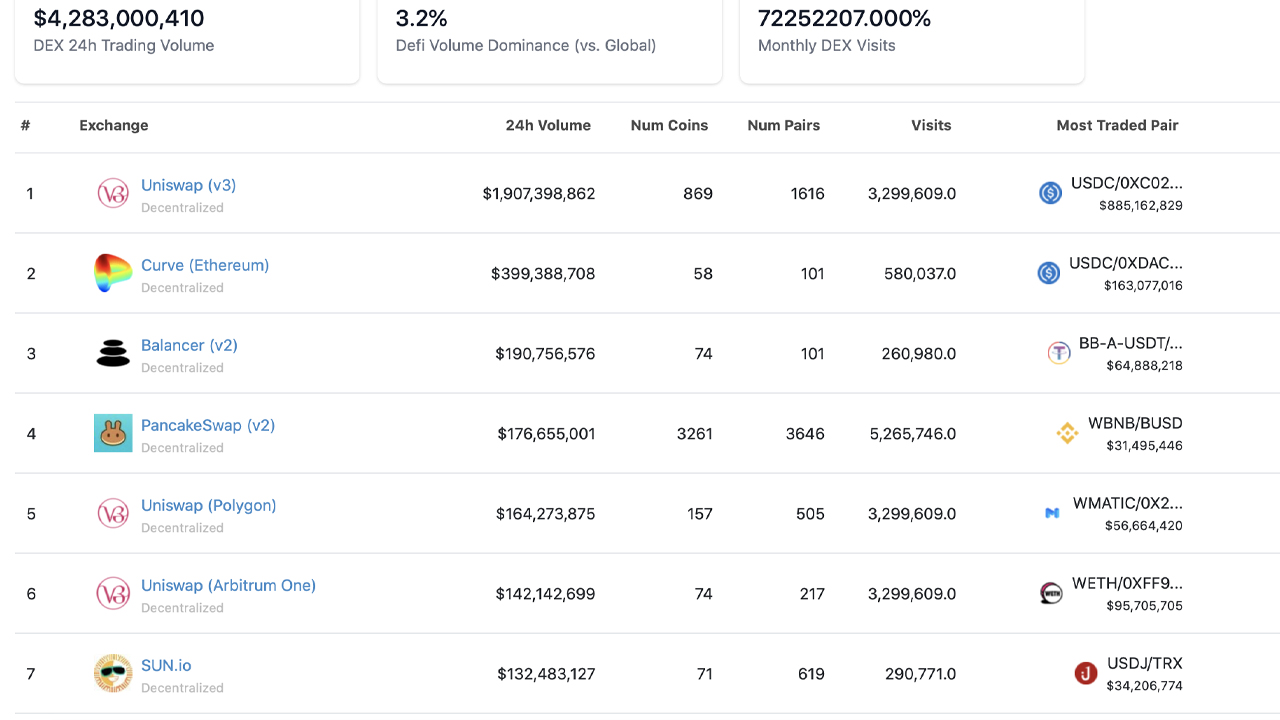

24-hour decentralized trade quantity on Jan. 14, 2023, in line with coingecko.com.

24-hour decentralized trade quantity on Jan. 14, 2023, in line with coingecko.com.

Uniswap is adopted by Curve ($399 million), Balancer ($190 million), Pancakeswap ($176 million), Uniswap Polygon ($164 million), Uniswap Arbitrum ($142 million), Solar.io ($132 million), Uniswap V2 ($91 million), and Uniswap Optimism ($77 million).

It’s value noting that the top five good contract platform tokens have captured double-digit positive factors over the past week. Ethereum jumped 20.6%, Binance Coin (BNB) rose 16.6%, Cardano elevated by 25.4%, Polygon has risen by 23.2%, and Solana jumped 68.5% increased in opposition to the U.S. greenback over the past seven days.

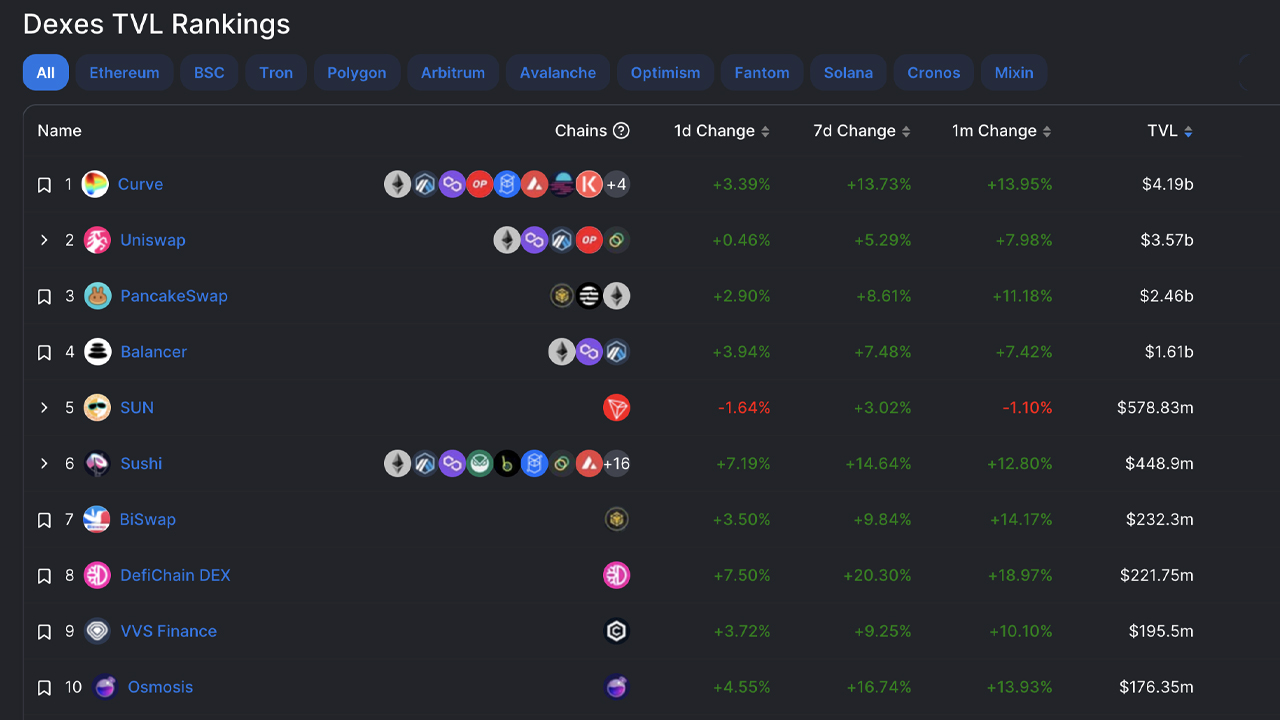

Complete worth locked (TVL) ranks by dex platforms in line with defillama.com.

Complete worth locked (TVL) ranks by dex platforms in line with defillama.com.

The whole good contract platform coin financial system has gained 8.5% in opposition to the U.S. greenback in 24 hours. Knowledge additionally reveals that the dex Curve is the highest decentralized finance trade with probably the most whole worth locked on Saturday afternoon at 3:00 p.m. Jap Time.

On the time of writing, Curve instructions a $4.19 billion whole worth locked (TVL) and Uniswap is slightly below the protocol with $3.57 billion. Each Curve and Uniswap are adopted by Pancakeswap ($2.46 billion), Balancer ($1.61 billion), Solar.io ($578.83 million), Sushi ($448.9 million), and Biswap ($232.3 million).

Out of the 671 dex platforms or protocols that permit a consumer to swap or commerce cryptocurrency, there may be $17.4 billion whole worth locked among the many decentralized finance (defi) protocols. Non-custodial exchanges have grow to be a mainstay on the planet of crypto property by permitting customers to commerce tokens with out the necessity for an middleman.

Whereas dex platforms have seen commerce volumes decline, centralized spot market exchanges have additionally seen volumes slide throughout the previous few months. The crypto winter has taken no prisoners so far as centralized and decentralized trade buying and selling volumes are involved, and Dec. 2022 was particularly disappointing.

Tags on this story

Belongings, Balancer, Binance, Biswap, Cardano, Centralized, crypto property, Crypto Winter, Cryptocurrency, Curve, Decentralized, decentralized finance, decline, Defi protocols, DEX, Dominance, Ethereum, Ethereum blockchain, Exchange price, Exchanges, lackluster, Liquidity, Liquidity suppliers, Market Value, Non Custodial, Non-custodial trade, Pancakeswap, Polygon, Swimming pools, self-executing contract, self-execution, Good Contract, Solana, spot market, Solar.io, SUSHI, Tokens, commerce execution, buying and selling, buying and selling platform, TVL, uniswap, uniswap v3, Volumes

What does the longer term maintain for dex platforms within the ever-evolving world of cryptocurrency buying and selling? Share your ideas within the feedback under.

![]()

Jamie Redman

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss prompted or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

Extra Common News

In Case You Missed It

Source link

#Decentralized #Exchange #Trading #Volumes #Remain #Lackluster #Year #Uniswap #Leads #Daily #Swaps #Defi #Bitcoin #News