Esteem Locked in Defi Drops Below $200 Billion, April’s Dex Trade Volume Drops 21% Lower Than March – Defi Bitcoin News

While the crypto economy shed billions this week, the complete worth locked (TVL) in decentralized finance conventions sneaked by the $200 billion territory to $196.6 billion. The TVL in defi lost generally 3.16% during the last day, and the $592 billion in savvy contract convention tokens dropped in esteem by 3.5% over the last 24 hours.

Defi TVL Slips Below $200 Billion, Numerous Protocols Shed Billions, Dex Trade Volume Dives

The esteem secured defi has sneaked by the $200 billion imprint interestingly since March 16, 2022. At the hour of composing the absolute worth locked (TVL) is generally $196.6 billion, down 3.16% during the last 24 hours.

All ten of the top defi conventions, aside from Anchor, have seen huge 30-day TVL rate declines. Bend Finance is down 11.74%, Lido has lost 13.73%, Makerdao shed 16.81%, and Convex Finance has lost 10.59% since last month.

The greatest washout during the most recent 30 days is the Aave Protocol which lost 21.98% since the month before. Bend Finance is the main defi convention as it rules by 9.56% with the present TVL of around $18.8 billion.

Data recorded on May 1, 2022, shows the ongoing complete worth secured defi conventions is $196.6 billion, as per defillama.com insights.

Data recorded on May 1, 2022, shows the ongoing complete worth secured defi conventions is $196.6 billion, as per defillama.com insights.

The TVL hung on Ethereum-based defi conventions actually wears the pants today with 55.55% dominance or $109.21 billion today. Land blockchain is the second biggest as far as defi TVL with 14.36% of the $196.6 billion. Land’s TVL today compares to $28.23 billion and $16.48 billion dwells in Anchor.

Behind Ethereum and Terra, as far as defi TVL size, incorporates blockchains like BSC ($12.04B), Avalanche ($9.38B), and Solana ($6.09B).

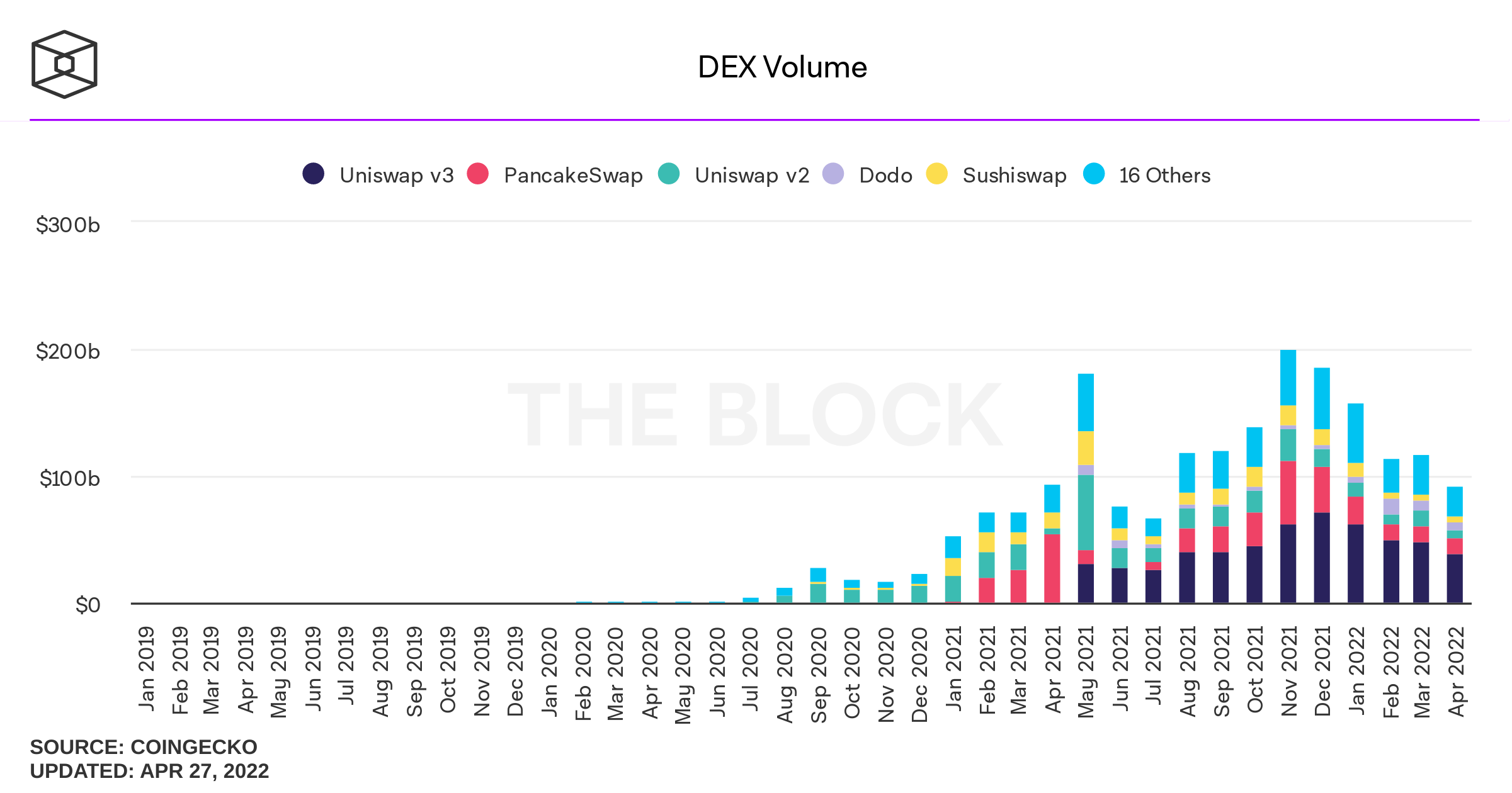

April’s decentralized trade (dex) exchange volume dropped 21% lower than in March.

April’s decentralized trade (dex) exchange volume dropped 21% lower than in March.

The best five defi conventions, as far as defi TVL size, incorporates Curve, Lido, Anchor, Makerdao, and Convex Finance. Land’s Anchor Protocol saw a multi day TVL increment of around 4.15% last month.

Aave form three (v3) saw a critical increment during the most recent 30 days regardless of the first shedding 21.98%. Aave v3 has a TVL today of around $1.38 billion, up 2,711% since keep going month.

Statistics show that on Saturday, May 1, 2022, there’s 428 decentralized trade (dex) stages with a joined TVL of around $61.44 billion. There’s likewise 142 defi loaning conventions with $48.87 billion complete worth locked.

Data further shows that dex exchange volume dropped during the period of April. In March dex volume was around $117 billion and insights show that April’s dex exchange volume was uniquely around $92.18 billion.

Labels in this story

30-day dex exchange volume, Aave, Aave v3, Anchor, Binance Smart Chain, Curve, decentralized finance, decentralized finance conventions, DeFi, Defi measurements, defi records, defi details, dex exchange volume, ether, Ethereum, Ethereum (ETH), Lido, makerdao, Market Dominance, Smart Contract, brilliant agreement stage coin, Solana, Terra, TVL

What is your take on the worth secured defi slipping underneath the $200 billion territory this week? Tell us your opinion regarding this matter in the remarks area below.

![]()

Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for instructive purposes as it were. It’s anything but an immediate proposition or requesting of a proposal to trade, or a suggestion or underwriting of any items, administrations, or organizations. Bitcoin.com doesn’t give speculation, charge, legitimate, or bookkeeping guidance. Neither the organization nor the writer is capable, straightforwardly or in a roundabout way, for any harm or misfortune caused or asserted to be brought about by or regarding the utilization of or dependence on any happy, labor and products referenced in this article.

More Popular News

In Case You Missed It

Source link

#Locked #Defi #Drops #Billion #Aprils #Dex #Trade #Volume #Drops #March #Defi #Bitcoin #News