Esteem Locked in Defi Swells by $7 Billion, Tron’s TVL Spikes 34.85%, Ethereum Dominates by 62% – Defi Bitcoin News

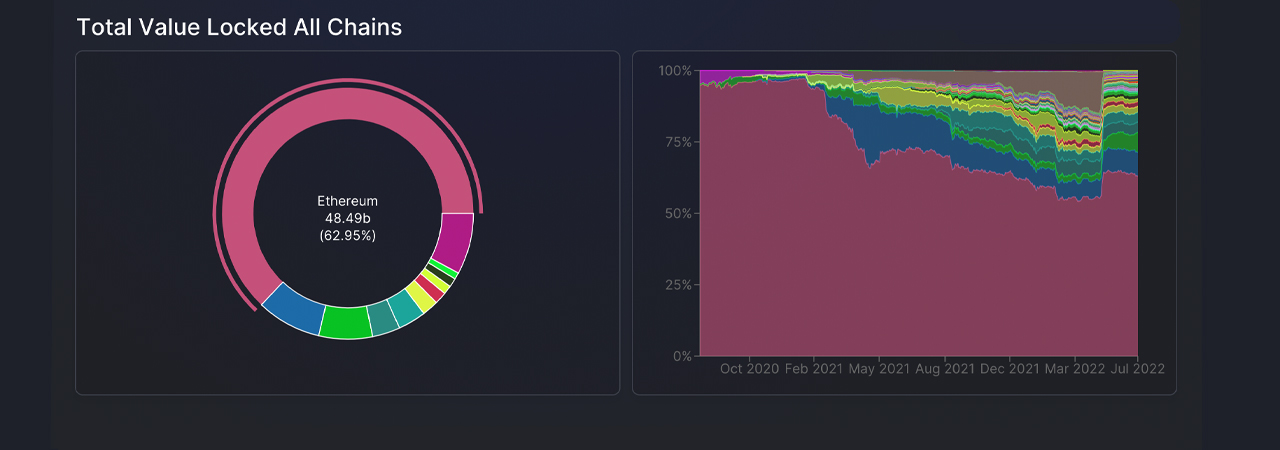

After tapping a 2022 low of $70 billion on June 19, the all out esteem locked (TVL) in decentralized finance (defi) has expanded by more than $7 billion. During the most recent seven days, the TVL in defi held inside the Ethereum blockchain has expanded by 4.47% as Ethereum’s TVL orders 62.92% predominance or $48.17 billion of the present $77.11 billion. In the mean time, Tron’s TVL soar this week, hopping 34.85% during the beyond seven days.

This Past Week Tron’s TVL Jumped by Double-Digits, Smart Contract Tokens Rise, Dex Applications Command Today’s Top Defi TVL Positions

During the last week, six out of the ten top blockchains in defi saw their TVL details increment by twofold digits. Ethereum hopped 4.47%, BSC expanded 7.02%, Tron spiked 34.85%, Avalanche recorded a 2.81% expansion, Solana rose by 9.10%, and Cronos expanded by 2.33%.

On Thursday, July 7, 2022, there’s roughly $77.11 billion secured defi and that measurement expanded by 1.40% during the most recent 24 hours. The biggest defi convention TVL is Makerdao’s $7.54 billion or a predominance rating of around 9.78%.

Makerdao’s TVL strength is trailed by conventions like Aave, WBTC, Curve, Uniswap, Lido, Convex Finance, Pancakeswap, Justlend, and Compound separately. Makerdao saw a 1.56% expansion this previous week yet the biggest gainer in the main ten was Tron’s Justlend with a 90.15% spike last week.

Tron’s Justlend has $2.79 billion locked and at the hour of composing, USDD supply stores get 12.83% yearly rate yield (APY) and the get APY is 21.76%.

In terms of misfortunes, the blockchain Fantom saw 6.7% leave the chain’s TVL and Arbitrum was the greatest failure out of the main ten rundown as Arbitrum’s TVL diminished by 11.01% this week.

Out of the present $77.11 billion, 481 decentralized trade (dex) applications order $24.67 billion all out esteem locked, 155 defi moneylenders catch $17.55 billion, and 22 defi span applications right now have $11.31 billion locked.

In expansion to the ascent in defi’s TVL across different blockchains, the top shrewd agreement stage tokens have hopped 5.6% higher as of now to $272 billion. This previous week, ethereum (ETH) expanded by 11.3%, BNB bounced 10% higher, Cardano (ADA) is up 1.6%, solana (SOL) is up 13.3%, and Polkadot expanded by 2%.

The greatest brilliant agreement token gainers this previous week were counterparty (XCP) which hopped 25.3%, komodo (KMD) expanded by 25%, and ubiq (UBQ) rose by 19.3% during the last seven days.

Cross-chain span TVLs consolidated lost 60.4% during the most recent 30 days and Polygon’s extension is the biggest with $3.55 billion TVL. Polygon’s extension TVL is trailed by Arbitrum, Avalanche, Optimism, and Near Rainbow.

The top five advanced resources utilized on cross-chain span tech incorporate USDC, WETH or ETH, USDT, WBTC, and DAI respectively.

This week, the most horrendously terrible TVL misfortunes in decentralized finance come from conventions like Piggbank DAO, Metavault DAO, Houses of Rome, Jade Protocol, and Risk Harbor. The greatest TVL convention expansions in defi during the beyond seven days were recorded by Hermes Defi, Maple, Omni Protocol, OGX, and Strategyx Finance.

Labels in this story

Aave, Binance Smart Chain, Cardano, Cross-chain Bridges, Curve, decentralized finance, decentralized finance conventions, DeFi, Defi measurements, defi records, defi details, ether, Ethereum, Ethereum (ETH), Lido, makerdao, Market Dominance, Smart Contract, shrewd agreement stage coin, Solana, TVL

What is your take on the condition of the defi scene today and the TVL enlarging by $7 billion? Tell us your opinion regarding this matter in the remarks segment underneath.

![]()

Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for enlightening purposes as it were. It’s anything but an immediate deal or requesting of a proposal to trade, or a suggestion or support of any items, administrations, or organizations. Bitcoin.com doesn’t give speculation, charge, legitimate, or bookkeeping guidance. Neither the organization nor the writer is capable, straightforwardly or in a roundabout way, for any harm or misfortune caused or claimed to be brought about by or regarding the utilization of or dependence on any happy, labor and products referenced in this article.

More Popular News

In Case You Missed It

Source link

#Locked #Defi #Swells #Billion #Trons #TVL #Spikes #Ethereum #Dominates #Defi #Bitcoin #News