Forget The Federal Reserve, The Market Is Pivoting Anyway

5 min read

“Fed Watch” is a macro podcast, true to bitcoin’s insurgent nature. In every episode, we query mainstream and Bitcoin narratives by analyzing present occasions in macro from throughout the globe, with an emphasis on central banks and currencies.

Watch This Episode On YouTube Or Rumble

Pay attention To The Episode Right here:

On this episode, CK and I cowl our reactions to the FTX debacle, the most recent client worth index (CPI) numbers from the U.S. and the brand new central financial institution digital forex (CBDC) pilot by the Federal Reserve and banks. We contact on the G20 assembly in Bali, however run out of time on the finish and don’t cowl it in depth.

CPI Numbers From The U.S.

We needed to skip final week’s present as a result of scheduling conflicts, so we missed overlaying the CPI numbers. This week, I learn out a few of the vital particulars of the info.

October’s headline CPI change was +0.4%, virtually half of the Cleveland Fed’s CPI Nowcast projection of 0.76%, and much beneath the trade forecast of 0.6%. It actually shocked the market and shares rallied exhausting.

Bitcoin’s anticipated response would have matched that of shares if it weren’t for the FTX collapse taking place on the time — despite the fact that FTX didn’t maintain any bitcoin anyway, because it seems. This transfer within the bitcoin worth was subsequently a sympathetic transfer with the trade. The correlation between altcoins and bitcoins received out over bitcoin’s correlation with shares. Nonetheless, that’s proof that bitcoin is oversold from a fundamentals perspective.

Shelter was the biggest part within the month-to-month CPI and accounted for nearly half of the rise. On the present, I spend a while explaining how the shelter part is designed to lag by 12-24 months. With out the addition from the lagging housing sector, CPI would have been 0.2% for the month. Annualized, that’s 2.4%.

You will need to deal with the month-over-month change as a result of that’s the basic unit used to create the year-over-year (YOY) headline quantity. The YOY change doesn’t do a very good job of recognizing directional modifications like peak CPI. You may consider it like a 12-month interval transferring cumulative change, much like a transferring common. The affect on the 12-period transferring cumulative change of a sudden qualitative shift might be minimal within the first few durations. It is just after the brand new pattern is properly established that the broader 12-period common plainly communicates the info.

On this case, the YOY change in CPI continues to be 7.7%, despite the fact that the final 4 months have been 0%, 0.1%, 0.4%, and 0.4%. In case you annualize the final 4 months, you get 2.7%, not 7.7%. Don’t forget as properly, that half of the current rises are because of the lagging shelter part. It isn’t a stretch to say that the present fee of change in costs is below 2% on an annualized foundation.

Charts

We went via 10 charts on the present, however I received’t cowl all of them right here.

First up is bitcoin. You may see clearly the breakout of the sample and the following FTX dump. The horizontal zone was earlier assist turned to possible resistance. I additionally added a inexperienced line to indicate the extent with essentially the most quantity by worth resistance as properly, particularly $19,000.

Bitcoin hourly chart

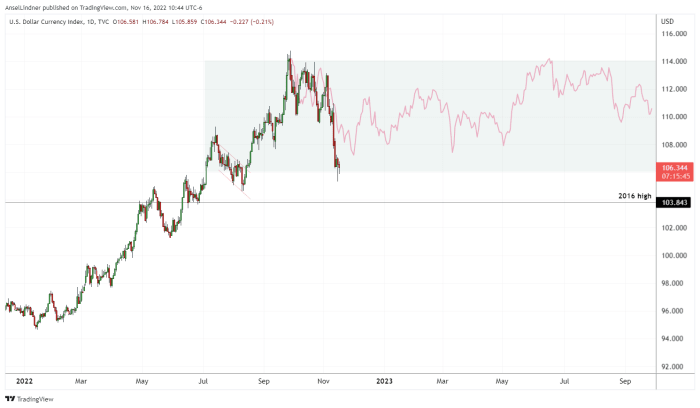

Subsequent up is the U.S. greenback. Exhibiting is the present rally, prime and doable new greater vary. I anticipate the conduct of the greenback to stay much like the period after the World Monetary Disaster (GFC).

Greenback chart with new proposed vary and ghost sample from 2015 excessive

To this point, the conduct of the greenback has been similar to 2015 when the greenback rallied to the 1.618% Fibonacci extension after which was vary sure — as you may see within the pink line. A replica of the sample with tops matched up.

I anticipate the greenback to stay vary sure because the monetary system recovers slowly from the harm executed by the acute greenback scarcity. We will see this restoration in lots of forex charts, just like the Hong Kong greenback, the Japanese yen and the euro.

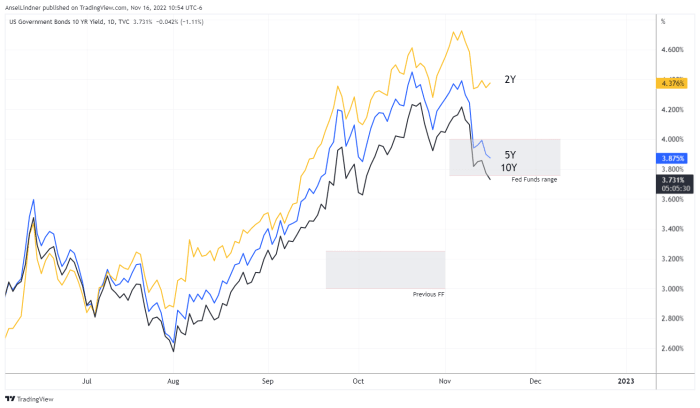

U.S. Treasury yields for 10-year, 5-year and 2-year with the Fed Funds goal vary

We spent a couple of minutes discussing the above chart. For the primary time on this cycle, the 5- and 10-year Treasury yields have entered the Fed Funds goal vary. Not solely that, however the 10-year has fallen beneath the reverse repurchase settlement (RRP) fee of three.8% and the decrease restrict of the Fed Funds of three.75%.

It is a main change and a serious part of my evaluation of the Fed’s financial coverage going ahead. If charges cease listening to Jerome Powell, the Fed might be compelled to pivot.

Federal Reserves Digital Greenback Pilot

We have been shocked to listen to of the Federal Reserve’s pilot program with banks going ahead to check a brand new greenback CBDC. We’ve got been fairly clear on “Fed Watch” that we don’t anticipate the Fed to approve the usage of a CBDC, as a substitute they’ll legitimize USD stablecoins, bringing them into the Federal Reserve system.

I learn from an article on The Avenue, nevertheless, in the course of the present I ran out of time to cowl it intimately. I like to recommend studying it in full.

“The proof of concept (PoC) project will test a version of the regulated liability network design that operates exclusively in U.S. dollars where commercial banks issue simulated digital money or “tokens” — representing the deposits of their very own clients — and settle via simulated central financial institution reserves on a shared multi-entity distributed ledger.”

I don’t blame you if you happen to don’t perceive that phrase salad. CK and I are bitcoin specialists and we will barely observe it. Nothing on this pilot program exhibits that the Fed is near a CBDC. We keep our reasoning that Jerome Powell and the Fed won’t go down this street, however they’ve to maneuver shortly to make their intentions clear and produce USD stablecoins into the fold or else the following chairman may observe together with globalist leanings.

I additionally quote from Vice Chair Randal Quarles’ 2021 speech about CBDCs the place he demonstrates a agency grasp of the CBDC recreation. We advocate studying it in full, as properly.

“I emphasize three points. First, the U.S. dollar payment system is very good, and it is getting better. Second, the potential benefits of a Federal Reserve CBDC are unclear. Third, developing a CBDC could, I believe, pose considerable risks.”

Lastly, we cowl the G20, however to be sincere, we don’t have time to do it justice. Here is a link to The Guardian’s 5 takeaways from the G20 assembly.

It is a visitor put up by Ansel Lindner. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc. or Bitcoin Journal.

Source link

#Forget #Federal #Reserve #Market #Pivoting