Global Uncertainty Is Bitcoin’s Opportunity

The beneath is from a new version of the Deep Dive, Bitcoin Magazine’s premium business sectors pamphlet. To be among quick to get these bits of knowledge and other on-chain bitcoin market investigation directly to your inbox, subscribe now.

The Larger Macro Picture

Last night, Dylan shared an extensive thread on Twitter covering the current full scale picture across stocks, securities and unpredictability on the lookout. In the present Deep Dive, we’re developing a portion of those thoughts and outlines more inside and out as these are a portion of the more significant market elements that will influence all business sectors in 2022, bitcoin included.

The by and large ethos of the string and a postulation we’ve talked about commonly in the Deep Dive is that we’re in uncommon times with north of a time of negative genuine rates adding to the all that air pocket we’re in today. The market currently needs to confront the second request effects.

Official expansion rates contrasted with the Fed reserves rate show most noteworthy expansion in decades.

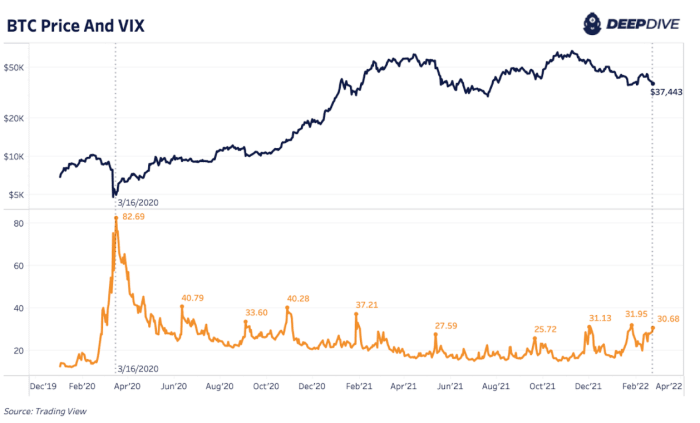

Second request impacts, like higher times of unpredictability, have been more incessant in the course of the most recent couple of months. Higher instability is an immediate aftereffect of lower credit market liquidity. Looking back at an outrageous time of unpredictability during March 2020, advertises savagely auction notwithstanding a credit loosening up. Like most gamble resources, bitcoin is seriously impacted in these higher times of market unpredictability and rising U.S. dollar strength as told through the VIX relationship. We’re possible due for more market unpredictability going forward.

Bitcoin is impacted in higher times of market instability and a rising U.S. dollar strength.

Yet in the repercussions, this is the chance for bitcoin. Is bitcoin a recipient of the monstrous credit bubble all over the planet? Undoubtedly. If credit markets keep on loosening up will the cost of bitcoin face headwinds? Almost certainly.

“In the end, strategy creators generally print. That is on the grounds that starkness causes more torment than benefit, large restructurings clear out an excessive amount of abundance excessively quick, and moves of abundance from haves to those who lack wealth don’t occur in adequate size without unrests.” – Ray Dalio

Bitcoin is the response to the finish of the drawn out obligation cycle.

Source link

#Global #Uncertainty #Bitcoins #Opportunity