Here’s What A Reg M Will Entail For Genesis, DCG And Bitcoin

4 min read

After Genesis Buying and selling’s lending arm shut down its companies final week, the rumor mill began buzzing a few attainable chapter of Digital Foreign money Group (DCG). Particularly scorching are the rumors that Grayscale and its Bitcoin Belief (GBTC) and the Ethereum Belief (ETHE) may very well be caught up in insolvency.

The crypto neighborhood is all of the extra eagerly awaiting excellent news from Genesis and DCG in the mean time. As was revealed within the late afternoon hours yesterday (USA East Coast), Genesis spent the weekend in unsuccessful fundraising efforts.

Bloomberg reports that Genesis is now warning of attainable chapter as post-FTX fundraising falters. “We have no plans to file bankruptcy imminently,” a consultant for Genesis mentioned.

In an emailed assertion Genesis additional disclosed that their objective is “to resolve the current situation consensually without the need for any bankruptcy filing. Genesis continues to have constructive conversations with creditors.”

A bit later, the WSJ reported that Genesis had approached crypto alternate Binance and Apollo World Administration to bid for its mortgage ebook. Nonetheless, Binance already declined, fearing that a few of Genesis’ trades might result in a battle of curiosity.

Moreover, journalist Frank Chaparro learned from an nameless supply that Genesis has lowered its goal from $1 billion to $500 million.

What Choices Are On The Desk For Genesis?

As Bitcoinist reported yesterday, DCG might conceivably need to step in to save lots of Genesis. To take action, DCG must promote massive parts of its liquid belongings and enterprise investments.

Nonetheless, rumors are circulating that DCG has borrowed dangerous debt and used it to purchase GBTC. This could make the Genesis scenario a lot worse, as Adam Cochran of Cinneamhain Ventures defined.

Hmm rattling my evaluation didn’t issue within the chance that the dangerous debt might have been loaned to dcg and used to purchase GBTC, that’s one of many few situations that will make it a lot worse. https://t.co/laikAfTzOu

— Adam Cochran (adamscochran.eth) (@adamscochran) November 21, 2022

One choice that’s presently being closely mentioned within the rumor mill is a Reg M for Grayscale’s trusts. One of many greatest proponents of this answer is Messari founder Ryan Selkis.

Reg M would permit holders of GBTC and ETHE to redeem them for underlying belongings at a 1:1 ratio. So at a present low cost of about 40% on GBTC, traders would obtain $1 of BTC for 60 cents of GBTC. DCG and Genesis might subsequently use this cash to pay lenders and keep away from insolvency.

What is explosive about this selection is that DCG is the most important holder of Grayscale Bitcoin Belief (GBTC). Different holders should buy again their GBTC however wouldn’t have to promote. Nonetheless, the huge low cost to the spot value gives an incredible arbitrage alternative.

That is additionally why rumors surfaced yesterday that Grayscale could have purchased extra GBTC after the low cost dropped from -50% to -43%. Whether or not that is true stays to be seen. Additionally it is vital to notice that redemptions could not happen for a number of weeks.

Would this clarify the GBTC promote stress?

— Ryan Selkis 🥷 (@twobitidiot) November 21, 2022

Nonetheless, Will Clemente, co-founder of Reflexivity Analysis warned that “a lot of the people who hold GBTC do so because they cannot get access to BTC spot for compliance purposes. These people will not be holding BTC upon Reg M distribution.”

Ryan Selkis, then again, argues that “it [the Bitcoins] won’t hit the market if SEC approves in kind redemptions.” Selkis went on to elucidate by way of Twitter that “it’s a relatively small figure. $10bn. If $5bn sold it might be a temporary 5-10% spot market hit. But bounce back quicker and remove a structural black cloud.”

With that in thoughts, Selkis urges DCG CEO Barry Silbert to “do the right thing,” strategy the SEC and ask for Reg M aid given the circumstances:

The ETF is just not occurring. The trusts sponsor & AP should do proper by traders.

In-kind redemptions can be trivial to execute on condition that Coinbase is the custodian, and the SEC can be sympathetic to the request given the acute injury that has been completed to traders, and the contagion that GBTC continues to trigger as poisonous collateral.

Do the appropriate factor!

One of many most important sources for the rumors in current days has been Andrew Parish, co-founder of ArchPublic. He presently claims that Wednesday might come to an “drop dead” date for Genesis. Nonetheless, it isn’t recognized which sources led him to this declare.

UPDATE: ‘drop dead’ date for Genesis chapter resolution is Wednesday.

The beforehand undisclosed $1.1B promissory notice from Genesis to DCG nonetheless exists.

Lack of liquidity and mortgage losses at Genesis nonetheless exists.

Reg M redemptions at Grayscale nonetheless being thought of.

— Andrew (@AP_ArchPublic) November 21, 2022

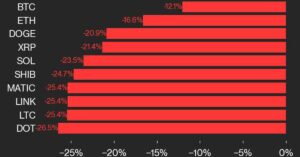

Bitcoin continues to be struggling beneath the mounting promoting stress because of the rumors on impacts to GBTC. At press time, BTC was close to its new bear market low of $15,478 from yesterday.

Bitcoin 1-hour-chart. Supply: TradingView

Source link

#Heres #Reg #Entail #Genesis #DCG #Bitcoin