How Bitcoin Exchange Outflows Rose In January

As we’ve talked about in past Daily Dives, March 2020 was a critical impetus and defining moment for bitcoin. We can see that in the conduct of trade adjusts which have shown reliable net outpouring in the course of the most recent two years.

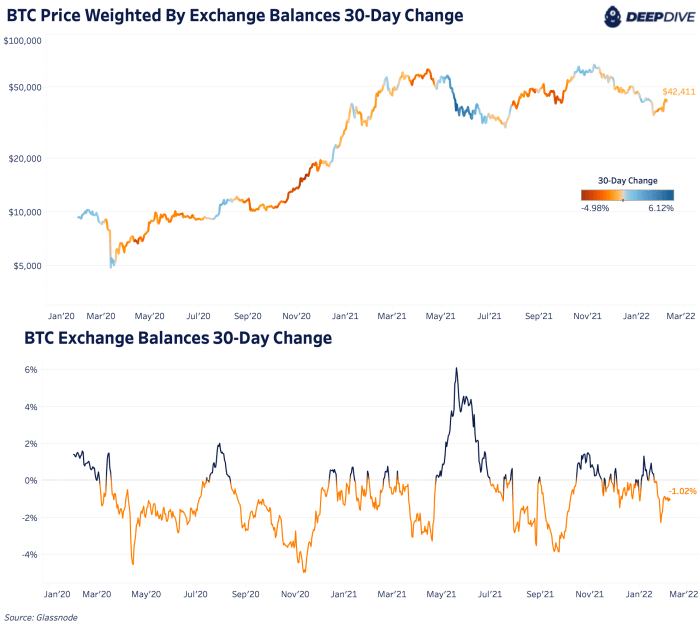

The two latest times of huge inflows were just before both 2021 bitcoin nearby value tops. These tops in April and November agreed with the earlier month showing net trade inflows of bitcoin in both March and October.

January was the biggest surge month since September 2021. Keeping an eye on trade stream elements can assist us with following interest feeling and when that is in a general sense changing for market participants.

Source: Glassnode

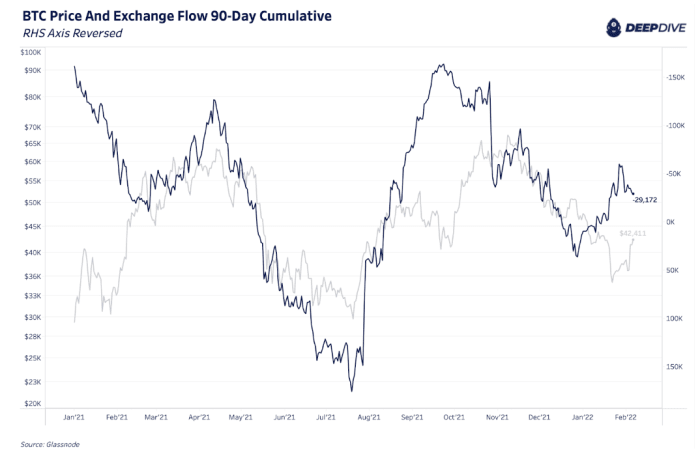

The 90-day total trade stream has reliably moved with cost in the course of the last year. In the graph underneath, the right-hand side pivot is switched to show how a diminishing net trade stream corresponds with a rising cost and bad habit versa.

What we’ve seen in January is a defining moment in the 90-day aggregate netflow with more bitcoin streaming out of trades. This signals expanded purchasing interest in the course of the last month and we’ve seen bitcoin cost stick to this same pattern throughout the most recent couple of days. This is occurring while we’re likewise seeing amassing patterns in long haul holders and whales throughout the last not many weeks.

Source: Glassnode

Looking at the 30-day change in return adjusts, we’ve seen a solid deceleration in the course of the last two weeks.

Source: Glassnode

Another method for review trade volume elements is to check out the net trade stream comparative with gauges for changed stock. Adjusted supply eliminates coins that haven’t moved in seven years which is a suspicion to represent (*’s) coins and lost coins. Satoshi changed stockpile is around 15.58 million bitcoin, 82.2% of the coursing supply. Current#

Source link

#Bitcoin #Exchange #Outflows #Rose