How much gold is a bitcoin worth?

Using cost information from TradingView, this realistic looks at the two resources by showing how much gold is identical to one bitcoin, while likewise imagining bitcoin’s market capitalization and 2021 gold creation as gold cubes.

What is a bitcoin’s weight in gold?

With a solitary bitcoin worth around $22,600 at the hour of the perception, this is comparable to a little 3D square of gold a little more than 20 cm3, with each side estimating around 2.7 centimeters, or a little more than one inch.

This small gold solid shape that fits in the center of a hand isn’t just worth $22,600, yet in addition gauges a noteworthy 12.6 official ounces (just shy of 0.8 lbs or around 357 grams) because of gold’s very high thickness of 19.32 g/cm3.

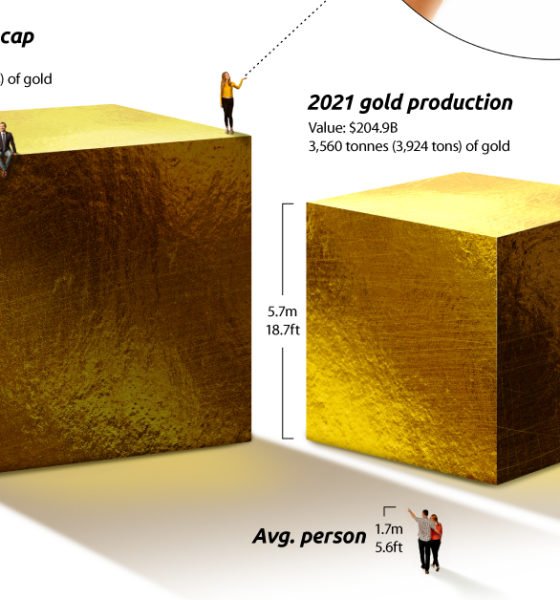

When changing over the worth of bitcoin’s whole market capitalization of $432.7 billion to actual gold, the gold block would be 7.3 m (23.9 ft), taller than four individuals stacked on top of one another. To place this in context, we additionally envisioned how much gold mined in 2021, which was around $204.9 billion worth, tipping the scales at 3,560.7 tonnes.

Comparing bitcoin’s computerized gold to actual gold

In its short 13-year life expectancy bitcoin has developed hugely to arrive at almost a portion of a trillion in market capitalization presently, yet compared to gold it’s still small.

Just 2021’s gold creation was worth almost 50% of bitcoin’s whole market cap, and with gold’s market cap assessed to be around $11.7 trillion, it’s a greater number of than multiple times bigger than that of the cryptocurrency’s.

While at first this could appear to be a downside for bitcoin, its little market cap has to some degree empowered its stratospheric cost expansions in bull runs.

Due to bitcoin’s more modest market cap, cash streaming into bitcoin brings about a bigger rate increment than if a similar measure of cash streamed into gold, giving the digital currency more possible potential gain yet in addition much more volatility as cash moves in and out.

A story of two stores of value

While gold has for quite some time been a place of refuge resource or store of significant worth for financial backers, in 2021 bitcoin and other digital currencies definitely stood out as the orange coin’s cost flooded by 59% and arrived at an untouched high of $69,000. In any case, starting from the beginning of 2022, bitcoin’s cost has fallen by 49%, and is over 65% from its unsurpassed high of last year.

As a consequence of this unpredictability, bitcoin is presently beneath any cost exchanged 2021, meaning any individual who purchased bitcoin in 2021 and hung on is currently down on their investment.

Meanwhile, gold fell by 4% in 2021, and is down another 2% in 2022, so while gold purchasers of 2021 are likewise down on their speculation, they’ve had a much smoother ride with more modest misfortunes along the way.

Whatever lies ahead for these two extraordinary resources, as far as market cap size, returns, and instability, the computerized gold that is bitcoin has far to go before it makes up for lost time to the genuine thing.

(This article previously showed up in the Visual Capitalist Elements)

Source link

#gold #bitcoin #worth