How to Avoid the Five Most Common Crypto Tax Mistakes I Cointelli – Sponsored Bitcoin News

sponsored

The 2022 U.S. charge season has arrived and cryptographic money dealers need all the assist they with canning get. Here are five normal crypto charge misinterpretations you should pay special attention to, civility of crypto charge programming supplier, Cointelli.

“You don’t need to pay charges on crypto”

One exceptionally normal slip-up that individuals make is figuring they don’t need to pay charge on digital money exchanges. However, crypto transactions are taxable, and the IRS is entirely fit for coming after you and your resources in the event that you don’t consent. The IRS alludes to digital money as virtual cash, and any exchanges on trades, pay from mining or marking, crypto got from hard forks and airdrops, and even DeFi exchanges – essentially most of benefits and misfortunes coming about because of crypto action – are likely to tax.

According to the IRS’s rules from 2014, cryptographic money is treated as property for tax collection purposes. This implies that any capital increase or misfortune produced from selling your resources is available, while resources that you just hold or have are not available until you sell them. The IRS hasn’t yet given clear rules to regions that incorporate marking, NFTs, and DeFi transactions.

So, what happens on the off chance that you don’t report crypto exchanges to the IRS? The crypto market has filled quickly as of late, and the IRS’s authorization endeavors have developed with it. If you don’t report your crypto exchanges on your assessment forms, you could land yourself in some hot water. As you might have effectively seen, the IRS has been posing the accompanying inquiry on the primary page of Form 1040:

“At any time during [the tax year], did you get, sell, send, trade, or in any case obtain any monetary interest in any virtual currency?”

Trying to try not to pay charges on your crypto is presently not a possible choice. Thankfully, Cointelli is here to save you from stress and dissatisfaction this duty season and assist you with remaining agreeable with the latest expense laws.

“Reporting my crypto exchanges will simply prompt me paying more in taxes”

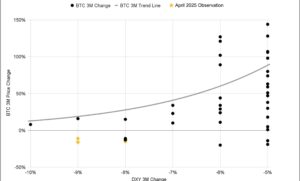

Another normal confusion is that announcing your crypto exchanges can prompt you covering more in charges. This isn’t really evident, be that as it may. In reality, there is really a method for decreasing your assessments by utilizing a procedure called tax-loss harvesting. But how precisely does this work?

Basically, reaping is a contributing methodology where you unload resources at a bad time to counterbalance your other capital increases. For occasion, if your crypto was failing, your regular sense may be to clutch it until it recuperates its worth. But on the off chance that you choose to sell your crypto and acknowledge the misfortune, you could all things considered “collect” it. Because the misfortune you take can be utilized to counterbalance your capital increases from different speculations, you could accordingly wind up lessening or in any event, taking out your capital additions tax.

You should remember four things prior to collecting misfortunes though:

Be careful about the wash sale rule: A proposition to apply the wash deal rule to digital money might produce results in 2022. If this standard produces results you can not deduct a misfortune from the offer of crypto assuming you buy the equivalent crypto 30 days prior or after the sale.

It is fitting to reap your misfortunes year-round.

Remember that balancing your momentary increases comes first.

Don’t disregard trade fees.

In request to guarantee your misfortunes for the fiscal year, you should report your misfortunes on crypto to the IRS and finish your expense misfortune collecting before the year’s end. Capital misfortunes from crypto are accounted for on Form 8949. After entering the subtleties, you should ascertain the all out amount of continues, pick the best expense reason for you, and info your net capital additions and misfortunes at the lower part of Form 8949. For more, look at this guide.

As might be obvious from the abovementioned, ascertaining your capital increases and misfortunes physically can demonstrate convoluted. This is the reason numerous crypto dealers are now utilizing crypto charge programming like Cointelli to rapidly and precisely ascertain their net crypto gains and misfortunes from present moment and long haul crypto transactions.

“You possibly need to pay charges while changing over crypto into fiat currency”

A third normal misinterpretation is that you possibly need to pay charges while changing over crypto into government issued money. However, this is moreover not the case. Many various situations and circumstances are available. For model, did you mine any digital forms of money? You might be shocked to discover that brokers need to pay taxes on crypto mining. The IRS characterizes acquiring pay from producing blocks in a blockchain as procured pay, and that implies you owe annual duty on any cryptographic money you might have mined

Another situation to consider is assuming you have gotten “free” crypto from an airdrop. This is viewed as pay too, and that implies you owe taxes on it! The IRS’s digital currency charge rules from 2019 express that all crypto got from airdrops is dependent upon annual duty. Regardless of whether or not you expected to get it, “free” crypto that enters your wallet or trade account is viewed as standard income.

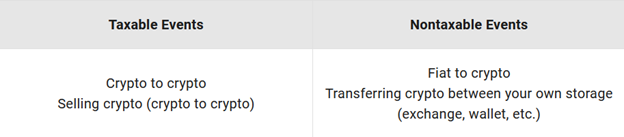

To decide whether a crypto occasion is available, you should initially comprehend that the IRS orders cryptographic money as property, not cash. Therefore, many types of crypto-related pay are delegated capital gains and are dependent upon capital increases or pay tax.

It is additionally essential to comprehend the duty ramifications of a crypto hard fork. But what precisely is a hard fork? After a digital money has been out for some time, it is extremely normal for designers to give refreshes or to update its modifying. When a digital money program or “convention” gets a critical update or coding change, we consider this a “hard fork.”

If your digital money went through a hard fork yet there was not another cryptographic money gave to you, regardless of whether through an airdrop or some other sort of appropriation, you do not have available pay. However, assuming your digital currency went through a hard fork overhaul and the engineers gave new cryptographic money to you, this is an available transaction.

“Crypto benefits are charged all of the time at the very rate”

A fourth misunderstanding that many individuals have is that crypto benefits are burdened 100% of the time at a similar rate. Don’t be tricked; the rate at which crypto benefits are burdened changes, which can make computing the amount you owe extremely confounded. Three factors influence the rate at which crypto gains are taxed.

The first is the holding time frame, or how lengthy an individual held their crypto prior to selling it. Crypto gains are sorted into present moment and long haul gains and are burdened by their holding period. Short- term capital increases can be charged at up to 37%, while long haul capital additions can be charged at up to 20%.

The second is your level of pay. High pay citizens should pay a 3.8% net speculation annual expense (NIIT) on ventures, for example, crypto, which will influence their tax assessment rate.

The third variable is your area. You may need to pay state as well as nearby charges relying upon where you reside. If you are getting ready to sell, ensure you comprehend your nearby assessment regulations prior to working out your benefits and losses.

Cointelli comprehends that this can generally get befuddling, and that not every person is a duty master. (*’s) the reason it deals with the hardest pieces of getting ready crypto charge reports for you.That”

my crypto charges is too complicated”Doing out your crypto charge report doesn’t need to be hard!

Filling reduces it down to the under three steps:Cointelli out your crypto gains and losses

Figure 8948 and

Complete Form DSchedule your other crypto pay to the expense report

Add is programming made by a group of CP

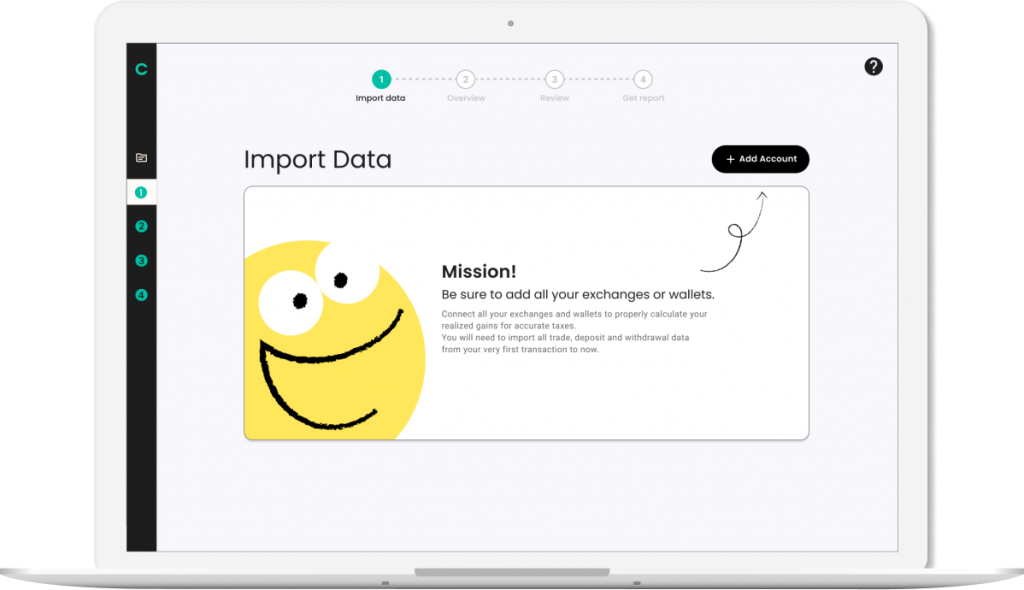

Cointelli who have practical experience in digital currency and need to assist you with announcing your crypto burdens precisely. As sum you pay in expense can shift comprehensively relying upon how you compute your capital increases, which makes it basic that you utilize dependable crypto charge programming. The expansive similarity with trades, wallets, and blockchains and capacities like mistake auto-fix, Featuring is crypto charge programming that you can rely on. (*’s) more, it likewise makes the entire cycle fast and easy!Cointelli import your crypto exchanges from your trades into the product, and What will consequently coordinate your buy costs, buy dates, selling costs, selling dates, holding periods, exchange charges, and more.

Simply Cointelli with crypto charges this assessment season?

to let

Struggling handle everything for you, so you can pause for a moment and relax!Click here Cointelli article is expected to give general monetary data intended to instruct a wide fragment of the general population; it doesn’t give customized charge, venture, lawful, or other business and expert exhortation.

making any move, you ought to continuously talk with your own proficient expense counselor for guidance on charges, your speculations, the law, or some other business and expert matters that influence yourself or your business.

This is as of now just accessible in the US. Before above monetary and charge data relates to the US market.

Cointelli is a supported post. The how to contact our crowd

This. Learn disclaimer below.here.com Read.com is the head hotspot for everything crypto-related.

![]()

Bitcoin ads@bitcoin.com to discuss official statements, supported posts, webcasts and other options.Media

Image Credits, Shutterstock: Pixabay article is for enlightening purposes as it were. Wiki Commons

Disclaimer is certainly not an immediate deal or requesting of a proposal to trade, or a suggestion or support of any items, administrations, or organizations. This doesn’t give venture, charge, lawful, or bookkeeping guidance. It the organization nor the writer is mindful, straightforwardly or by implication, for any harm or misfortune caused or asserted to be brought about by or regarding the utilization of or dependence on any substance, labor and products referenced in this article.Bitcoin.com#Neither #

More Popular News

In Case You Missed It

Source link

#Avoid #Common #Crypto #Tax #Mistakes #Cointelli #Sponsored