In an Increasingly Controlled World, Bitcoin Stands as a Beacon of Freedom

Private property rights and freedom of speech are fundamental human rights, and yet—as many people in Canada, Europe and elsewhere are discovering—they are among the most fragile. If we fail to remain vigilant and take these rights for granted, we risk losing the privilege of owning our own property and expressing our own thoughts and opinions.

So said conference-goers who were kind enough to chat with me following my presentation this week at Bitcoin Amsterdam, Europe’s largest Bitcoin event.

I spoke about the differences between common law and civil law, using two island-nations—Singapore and Cuba—as case studies for both legal systems. A former British colony, Singapore embraced common law and free markets and therefore saw its GDP per capita surge from around $3,600 at the start of Lee Kuan Yew’s decades-long rule to above U.S. levels today. Over the same period, Fidel Castro’s Cuba—held back by a centralized/communist economy, strict state controls and lack of economic diversification—has experienced next to no growth. (You can read my 2015 article on the subject here.)

From the Magna Carta to the Bitcoin Whitepaper

During my presentation, I also traced the trajectory of common law from the signing of the Magna Carta in 1215 to the ratification of the U.S. Bill of Rights in 1791 and, eventually, the arrival of the Bitcoin whitepaper in 2008.

Think about it: The Magna Carta was primarily designed to prevent kings from abusing their power and unjustly seizing their subjects’ private property. Similarly, Bitcoin was created to protect individual’s wealth in the digital age. Whereas the former laid the groundwork for the rule of law and the rights of individuals in the face of centralized power, the latter seeks to extend these principles into the realm of digital finance and beyond.

It should come as little surprise, then, that Bitcoin conferences typically attract human rights activists such as the Human Rights Foundation’s (HRF) Alex Gladstein, Togolese writer Farida Nabourema, North Korean defector Yeonmi Park and others.

Common and Civil Law Countries

Seeking Financial Freedom

Despite the guardrails, many people worry that their basic rights are under threat—and in some very notable cases, they are.

In the last couple of years, everyday Canadians have had their bank accounts frozen for legally protesting vaccine mandates. They’ve had stricter regulations and censorship of online content imposed on them, and, more recently, they’ve seen global news providers restrict access to Canadian users.

Here in the Netherlands, the world’s second-largest exporter of food, farmers gathered in March to protest the government’s draconian crackdown on nitrogen emissions, fearing it would result in the culling of thousands of heads of cattle. Irish farmers were forced to do the same in July.

Meanwhile, there are growing concerns that central bank digital currencies (CBDCs) will one day be used to monitor and control people’s spending habits. Christine Lagarde, head of the European Central Bank (ECB), admitted as much back in April, saying that CBDCs would give governments some measure of “control.”

These examples represent breaches of the proverbial social contract in mostly high-income countries. In many parts of the so-called Global South, the situation is even more dire, with flagrant human rights abuses, currency collapses and political instability driving people to flee their homes in search of safety and a better life. Why else are we seeing record numbers of Venezuelan asylum-seekers turn up at the U.S.-Mexico border and huge waves of North Africans wash up on the banks of Italy?

“Bitcoin fixes this” is a common refrain at conferences like the one in Amsterdam. The digital asset may not end up as the panacea that many of its biggest advocates claim it is, but its decentralized nature, resistance to censorship and ability to empower individuals in the face of increasing government controls can’t be ignored.

The 1970s Strikes Back

As more and more people become disillusioned with traditional systems, the appeal of decentralized alternatives like Bitcoin becomes evident. That’s especially true now that there are signs we may be entering an era of 1970s-style stagflation (high inflation coupled with high unemployment), triggered by stubborn consumer prices, spiking bond yields, rising oil costs, workers’ strikes, record debt levels, unexpected Chinese weakness, a malfunctioning U.S. government and two wars.

Indeed, the parallels are striking.

In October 1973, Egyptian and Syrian forces unexpectedly attacked Israel in a bid to recover territory they lost to the country just six years earlier. Launched on Yom Kippur, the holiest day of the Jewish year, the short yet bloody conflict had significant economic consequences, including the first of two major oil crises of the 1970s, a global recession and a decade of stagflation.

Almost exactly 50 years later, a similar engagement is playing out after Hamas militants, in a surprisingly well-organized assault, successfully breached Israel’s border with Gaza, capturing a number of Israeli settlements for the first time ever and taking soldiers and civilians hostage.

With Israeli Prime Minister Benjamin Netanyahu warning of a “long and difficult war,” can we expect the same global consequences as before?

Analysts at Deutsche Bank appear to believe so. The bank forecasts a mild recession in the U.S. in the first quarter of 2024 as geopolitical risks remain elevated and rates stay high for an extended period of time, among other factors.

In its World Economic Outlook, out this week, the International Monetary Fund (IMF) also predicts lower rates of economic growth and strongly urges governments to cut deficit spending. Doing so, the IMF says, will take some of the pressure off central banks in their mission to tame inflation.

Housing Least Affordable in Recent Memory

One of the most glaring signs that the economy isn’t working for everyone is the historic drop in housing affordability in the U.S. With 30-year mortgage rates now topping 8% in some cases, many Americans are priced out of owning their own home. According to real estate data provider ATTOM, single-family houses in a whopping 99% of U.S. counties are out of reach for the average American earning around $75,000.

Take a look at the chart below. Housing affordability has fallen even deeper below the magic 100 line for the first time in recent memory, according to the National Association of Realtors (NAR). (A value of 100 means that a family earning a median income makes just enough to afford a new home. A value under that means that new homes are no longer affordable.)

Factors such as the increase in home prices and mortgage rates have pushed the standard portion of wages required for primary homeownership costs to 35%, ATTOM says. This is significantly higher than conventional lending standards, which recommend a 28% debt-to-income ratio. Basic homeownership expenses now consume more than a third of average wages.

The lessons of history, whether from the Magna Carta or the events of the 1970s, remind us of the cyclical nature of societal and economic shifts. As I said earlier, Bitcoin may not be a magic solution to all our problems, but I believe it represents a tool to safeguard our freedoms and assets in an unpredictable landscape.

Index Summary

The major market indices finished mixed this week. The Dow Jones Industrial Average gained 0.79%. The S&P 500 Stock Index rose 0.40%, while the Nasdaq Composite fell 0.18%. The Russell 2000 small capitalization index lost 1.50% this week.

The Hang Seng Composite gained 1.87% this week; while Taiwan was down 1.59% and the KOSPI rose 1.97%.

The 10-year Treasury bond yield fell 18 basis points to 4.622%.

Airlines and Shipping

Strengths

The best performing airline stock for the week was Embraer, up 3.4%. According to ISI, passenger throughput was up14% year-over-year on capacity up 10% year-over-year. The group estimates load factors have firmed over the last two weeks.

According to ISI, Euronav has confirmed that its two largest shareholders, with a total voting stake of 53% of the company, have agreed to transactions that ultimately change the direction of the company. Frontline will sell its 26.12% stake then acquire 24 modern ships from Euronav for $2.35 billion.

Delta Air Lines reported September quarter-end adjusted EPS of $2.03, above FactSet consensus of $1.95 and near the high end of the company’s latest $1.85 to $2.05 guidance. The beat versus consensus was primarily driven by better fuel costs in addition to non-fuel unit costs.

Weaknesses

The worst performing airline stock for the week was Wizz Air, down 14.2%. According to Bank of America, all airlines have suspended flights to Israel. Wizz has the highest exposure at 6.1% capacity followed by easyJet at 2.7%. Wizz is by far the most exposed to Middle East travel, which accounts for 20.5% of its scheduled 2023 flights. Wizz has already reduced its F2H24 capacity growth guidance from 30% to 20%.

According to Bank of America, COSCO’s profit alert showed third quarter 2023 profits continuing to a quarter-over-quarter decline and sees downside into the fourth quarter. The bank lifted its 2023 estimates on a slower-than-expected spot rate decline in the third quarter with transpacific benefiting from some temporary supply-side discipline, but it leaves its 2024-2025 estimates unchanged with losses expected from building supply pressure.

According to Goldman, Volaris announced an update to its 2023 guidance to reflect higher-than-expected jet fuel prices and aircraft groundings following Pratt & Whitney engines inspections. In summary, the company reduced its EBITDAR margin guidance to 26%, in line with Goldman, from 29-31% prior for 2023 fiscal year.

Opportunities

According to Raymond James, for SAS a consortium made up of AF-KLM, Castlelake, and Lind, together with the Danish State, would invest $1.175 billion ($475M common shares and $700M secured convertible bonds). AF-KLM’s investment would represent a maximum 19.9% non-controlling stake. However, after a minimum of two years it may be increased to become a controlling shareholder.

According to Stifel, for 2024 there should be modest shipping demand growth from higher iron ore mining production and coking coal. Thermal coal demand is likely to be a function of natural gas prices. High natural gas prices (greater than $12/MMBtu) should result in growth in thermal coal. For minor bulks, which make up just under 40% of all dry bulk trade, Stifel expects growth to be slightly higher than global GDP levels. With respect to supply, just 3% of the existing fleet is scheduled for delivery next year. Even with relatively healthy dry bulk shipping rates, the scrapping should take 1-2% out of the current fleet, leaving net fleet growth of 1%-2% at most.

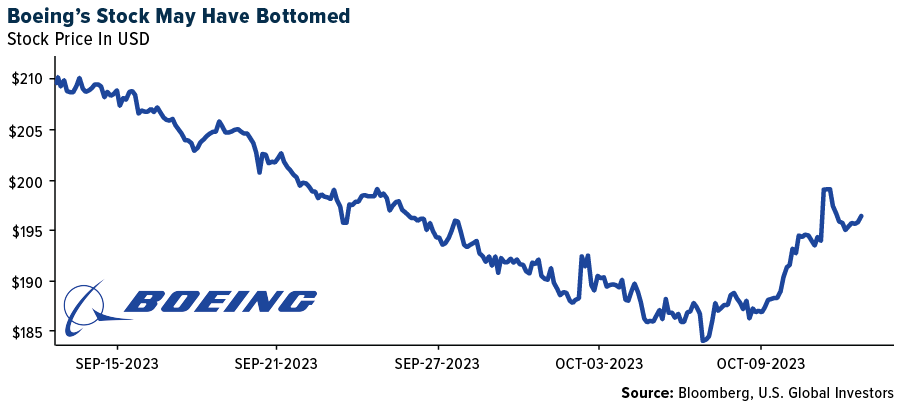

According to Goldman, for Boeing, new aircraft order demand remains quite strong driven by both growth and replacement; and Boeing and Airbus backlogs are large relative to the current delivery pace, creating tight supply versus demand. In addition, short-term MAX deliveries have been light compared to the planned medium-term production rate ramp-up, as supply chain issues continue to hold output back. However, Goldman expects higher deliveries into year-end and further acceleration in 2024, given seasonality and supply chain improvement. 787 deliveries were strong.

Threats

According to JPMorgan, the most relevant impact for the airport sector is related to the increasing risk perception for airports, manifested as a higher cost of capital for them going forward.

According to Morgan Stanley, UPS and FedEx customers are negotiating discounts following several years of rate hikes. According to Reuters’ industry data and interviews with seven industry professionals, UPS and FedEx customers have been able to “easily” win discounts back with savings of 8-12% versus previous agreements. The discount levels appear to be like pre-pandemic levels and could offset FDX and UPS’s recent 5.9% GRI which was already below prior year increases. This could prove challenging to FDX’s ongoing cost cutting initiatives and UPS plans to offset labor cost inflation.

French authorities asked airlines to cut 40% of flights at Paris-Orly airport at the end of last week ahead of unions’ planned strike calling for pay increases. The country’s civil aviation authority also asked the regional Marseille-Provence and Beauvais airports to reduce flights by 20% and 15%, respectively. The strike is set to come three days before a scheduled government-union meeting on low wages.

Luxury Goods and International Markets

Strengths

Shares of JPMorgan, the largest bank in the United States, gained on Friday after posing another quarter of record net interest income and boosting its forecast for the year. The bank reported a net interest income of $22.9 billion through September 30, above analyst expectations. The purchase of the First Republic Bank back in August and rising rates are benefiting the bank’s performance.

In the third quarter of 2023, Porsche Cars North America, Inc. achieved a remarkable 21% increase in U.S. retail deliveries, totaling 19,988 cars, contributing to a 15% year-to-date growth with 56,323 new vehicles sold in the first nine months. The Macan emerged as the top-selling model, boasting a 31% year-to-date increase, with the new Cayenne following at 2%. Additionally, Porsche’s used U.S. sales in the first nine months of 2023 surged by 20.2% year-on-year.

Williams Sonoma was the best performing S&P Global Luxury stock, gaining 3.9% in the past five days. Loop Capital revised its price target from $185 to $200. The company has outperformed the competition year-to-date, and the broker believes that its profitability levels are sustainable for several reasons, including the elimination of site-wide promotion, the continued shift to e-commerce, and the company’s growing business-to-business operations.

Weaknesses

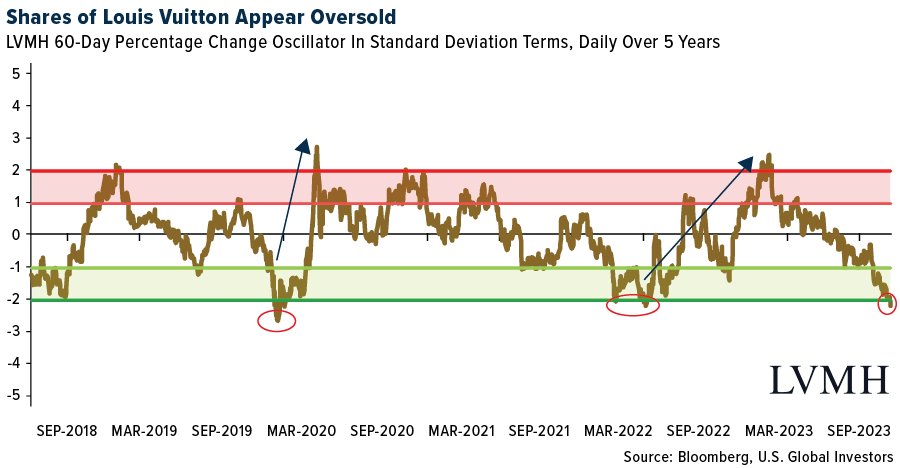

Shares of LVMH, the parent company of Louis Vuitton and Dior, declined sharply after the company reported third-quarter group sales below expectations. Quarterly sales increased by 9% versus the 11% expected. The highly important Fashion & Leather Goods division delivered 9% sales versus 10% expected. The Wine and Spirit division was the weakest, where sales declined by 14% versus the same period of the prior year.

Inflation in the United States is coming down, but this week it was reported above expectations for the month of September. The month-over-month inflation was posted at 0.4%, above the expected 0.3%. The year-over-year inflation was posted at 3.7%, above the expected 3.6%.

Norwegian Cruise Line Holdings was the worst performing S&P Global Luxury stock, losing 11.1% in the past five days. This week, cruise operators and airlines fell as spiking oil prices due to growing conflict in the Middle East pressured these sectors.

Opportunities

Despite brokers revising luxury stocks lower, the long-term sector performance should remain solid. After this week’s correction, shares of Louis Vuitton, a global luxury conglomerate, are in oversold territory. In the past five years, the current level was only observed a few times, and it was followed by a recovery.

BMW launched the all-new X2 generation. In its first version, the BMW X2 set the standard for premium small SUVs with a sporty touch. Now, in its second generation, it’s pushing the envelope even further with a bold new design that resembles the larger BMW X4. The new X2 is larger, sleeker, more aerodynamic, and comes with additional features. Plus, there’s a brand-new, all-electric model called the BMW iX2. This is a big upgrade from the original model.

Policymakers in China may issue a 1 trillion yuan ($137 billion) of additional sovereign debt to boost growth and meet economic targets. This could raise this year’s budget deficit to well above the 3% cap set in March. The country’s economic slowdown has weighed on everything from Chinese stocks to commodity prices and the results of multinational companies such as Nike Inc. and LVMH. And, if China provided more stimulus, it may boost consumer spending, leading to stronger luxury goods performance.

Threats

The weaker-than-expected sales posted by Louis Vuitton this week sent a warning sign to luxury investors. Many brokers have revised luxury stock ratings, pointing to trouble lying ahead due to slower economic global growth, rising rates, and depletion of pandemic savings. The luxury sector holds long-term potential, but analysts remain cautious about the short term.

Tensions are high as Israel-Hamas fighting continues. Israel’s military warned on Friday of today’s “day of rage” announced by Hamas and urged its citizens abroad to avoid Palestinian protests around the globe. Israel’s military has ordered the evacuation of 1 million Palestinians from northern Gaza to the south as the region awaits the imminent wide-scale ground invasion, according to FactSet.

On Thursday, the Prime Minister of Malaysia announced a new tax to be added on luxury goods next year as part of economic reform. The government plans to introduce a 5-10% tax on luxury goods such as jewelry and watches. Along with other measures planned by the government, it will help to lower Malaysia’s fiscal deficit to 4.3% of the gross domestic product next year, from an estimated 5% this year.

Energy and Natural Resources

Strengths

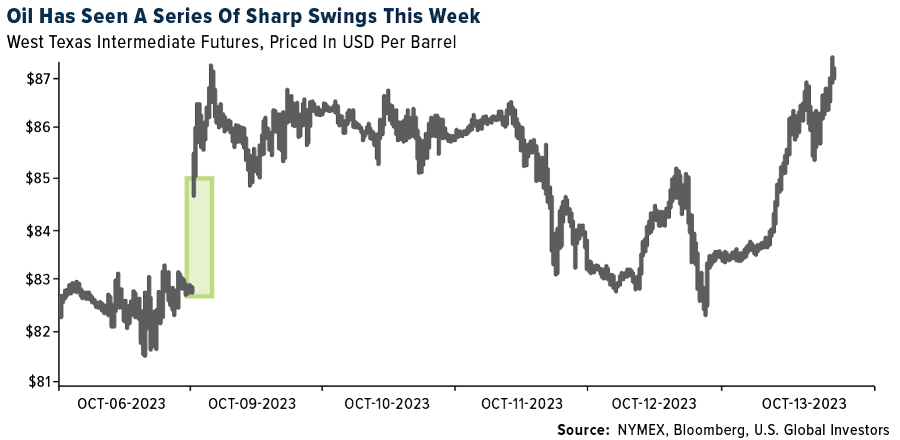

The best performing commodity for the week was coffee, rising 6.06%, its first weekly gain in a month, as noted by Bloomberg. The price spike was attributed to short covering. Crude prices, which were falling earlier in the week, surged over 5% on Friday as Israel warned the people of Gaza to flee to the south as the markets realized we were much closer to an invasion by Israeli ground forces into the region. This significantly raises the level of risks for a wider conflict.

Chinese coal prices are approaching six-month highs heading into the winter heating season, suggesting that the authorities will re-double efforts to ensure supply after the country largely escaped severe power outages over the summer. Thermal coal at the port of Qinhuangdao is being offered at more than 1,000 yuan a ton, according to Fengkuang Coal Logistics, a level last seen in April when optimism over China’s recovery from the pandemic was relatively intact.

According to Goldman, differently from oil, the ongoing conflict in Israel has started to impact natural gas supply. With Israel asking Chevron to halt operations at the 10 Bcm/y Tamar field for safety reasons, the bank sees this as a potential tightening of equal size to global LNG markets.

Weaknesses

The worst performing commodity for the week was lead, dropping 5.09%, as sentiment weakened across the board for base metals. According to UBS, we are in the midst of a refining pullback. In the last three weeks refining equities are down 11.2%, underperforming broader Energy by 700 basis points (bps) and S&P by 1,096bps. Refining equities have never gone up linearly and pullbacks are common in this sector. This is the second major pullback in 2023. The first pullback started late March and the current pullback has been triggered by a sharp correction in gasoline crack.

Iron ore sank to its lowest in a month after falling 4% during China’s Golden Week holiday, with stagnant home sales weighing on demand. Prices of the steelmaking material fell as much as 2.2% Monday in thin trading. Analysts are expecting a cautious recovery rather than an outright rebound in the property sector, which accounts for nearly 40% of steel consumption.

It is up to Codelco’s board and management to turn around the state behemoth’s ailing copper mines and projects using currently available resources, according to a senior government official. When asked if Chile’s government would throw Codelco a lifeline as it grapples with slumping output and profit and rising debt, Mining Minister Aurora Williams said the public company must operate as if it were a private-sector enterprise. “It is the administration, through its chairman, its CEO, who must seek to resolve the various problems — whether financial or operational,” Williams said in an interview from Bloomberg’s London office on Wednesday.

Opportunities

Bank of America anticipates some focus will turn back to the US SPR, which still has ample capacity to release production given 351 mm bbls still in storage. Despite criticism over prior price-related releases under the current administration, its actual purpose is to be available in response to geopolitical risk to supply. The SPR has shown itself capable of adding 1mm bpd rate for 90 days, although this may be premature given any perceived benefit to limit domestic price inflation would be 13 months before the 2024 U.S. presidential election. In any other circumstance the bank doubts Saudi would look favorably on such a move.

U.S. President Joe Biden is set to announce as much as $7 billion in funding for hydrogen projects across the country as part of a competition to jump-start production of the clean-burning fuel in the U.S., according to people familiar with the matter.

According to Goldman, ExxonMobil announced the acquisition of Pioneer Natural Resources in an all-stock transaction valued at $59.5 billion, with an enterprise value of $64.5 billion. The transaction is expected to close in the first half of 2024 pending customary closing conditions. The companies expect the transaction to be accretive on earnings per share, operating cash flow and free cash flow in 2024.

Threats

According to Goldman, the Wall Street Journal reported that “Saudi Arabia has told the White House it would be willing to boost oil production early next year if crude prices are high—a move aimed at winning goodwill in Congress for a deal in which the kingdom would recognize Israel and in return get a defense pact with Washington, Saudi and U.S. officials said.” In Goldman’s view, the escalating conflict in Gaza reduces the likelihood of a near-term normalization in Saudi Israeli relations.

Oil cuts by Saudi Arabia, which pumps a lot of the heavier crudes that are used to make diesel fuel, have refiners struggling to find enough of this feedstock to supply the fuel that is the lifeblood of the global economy. Wood Mackenzie Ltd. sees global refinery production dropping 1.5% this quarter, which translates to 1.2 million barrels per day in reduced supply. Unless a recession reduces demand, shortages of diesel and home heating oil could push up inflation this winter.

A probe into a leak from an undersea gas pipeline between Finland and Estonia is proceeding on the assumption that it was a deliberate act of destruction,

according to people familiar with the matter. There are no final conclusions, the people said. Officials are expected to give more details on the investigation later. European gas prices rose as much as 10%.

Bitcoin and Digital Assets

Strengths

Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Loom Network, rising 62.4%.

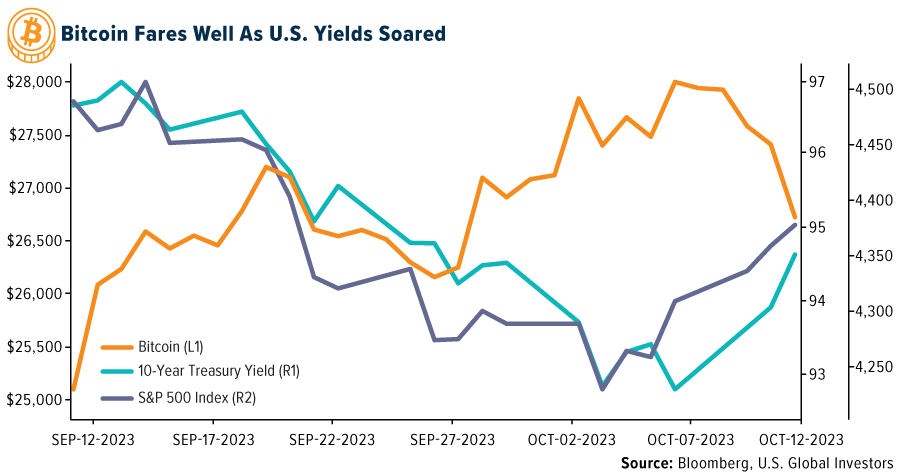

The surge in government bond yields over the past few weeks saw Bitcoin beating equities by a wide margin. Should yields resume their advance, that could ultimately end up benefiting the largest digital token, writes Bloomberg.

Stablecoin issuer Tether Holdings appointed its technology boss Paolo Ardoino as its new chief executive officer, following several years in which the executive had emerged as the company’s main public figure, writes Bloomberg.

Weaknesses

Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Mantle, down 18.22%.

Bitcoin and other cryptocurrencies fell back on Thursday, extending declines for a sixth day despite widespread advances seen in other risk-sensitive assets, with gains form a recent bullish trend fizzling out as cryptos returned to familiar trading ranges, writes Bloomberg.

Hamas’ lightning strike on Israel last weekend has left observers questioning how the group financed the surprise operation. One possible answer: cryptocurrency. Hamas received large amounts of funds through crypto, according to a review of Israeli government seizure orders and blockchain analytics reports, writes Bloomberg.

Opportunities

The owner of crypto exchange Bitfinex is exploring a $150 million share buyback that would provide it with greater control over the private company’s dealings, according to Bloomberg.

Decentralized finance is yet to pose a meaningful risk to overall financial stability, explains Bloomberg, but does require monitoring, according to the European Union’s financial markets and securities regulator.

Mastercard, in conjunction with the Reserve Bank of Australia and the Digital Finance Cooperative Research Centre, revealed on Thursday the latest results of their CBD pilot project, writes BlockWorks. Notably, the pilot included a live transaction where an NFT was purchased on the Ethereum blockchain using a “wrapped” version of the CBDC.

Threats

Caroline Ellison took the witness stand Tuesday afternoon and within minutes pointed to her former boss and boyfriend, FTX co-founder Sam Bankman-Fried, as the man responsible for the loss of billions in customer funds. “He directed me to commit these crimes,” she told jurors, according to Bloomberg reports.

In the latest blow to Binance’s global ambitions, a Brazilian congressional committee has recommended the indictment of four of the company’s senior leaders including its founder and CEO CZ, writes Bloomberg.

Caroline Ellison, on Wednesday, detailed how she worked with Sam Bankman-Fried to lie about the health of Alameda Research and FTX and deceive lenders and customers. She testified that she falsified Alameda’s balance sheet, at the direction of Bankman-Fried, to conceal that the firm was taking in large sums of money from FTX customers, writes Bloomberg.

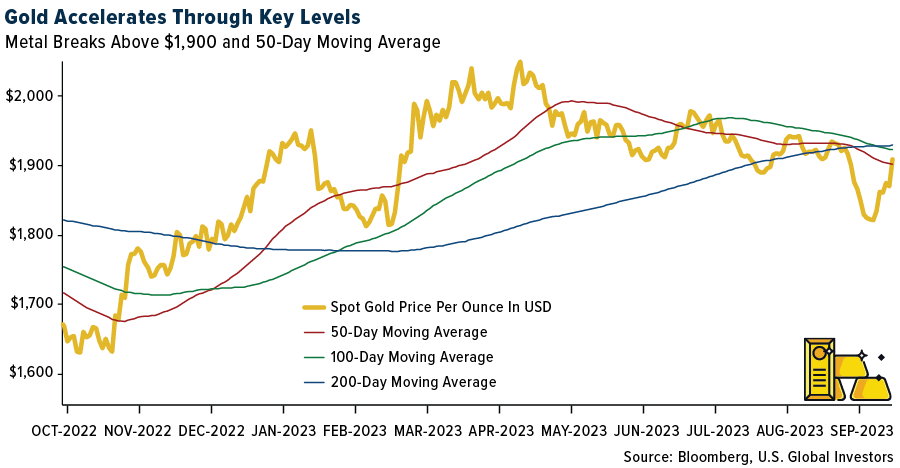

Gold Market

This week gold futures closed at $1,941.50, up $96.30 per ounce, or 5.22%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 7.49%. The S&P/TSX Venture Index came in off 0.83%. The U.S. Trade-Weighted Dollar rose 0.55%.

Strengths

The best performing precious metal for the week was gold, up 5.22%. Gold in China jumped to trade at the second-highest premium on record against the international benchmark, as mainland markets reopened following the Golden Week holiday. The Shanghai spot price was more than $112 an ounce higher

than levels seen in London on Monday, according to Bloomberg calculations and based on exchange data. The gap between the two markets has only been wider one other time, when Chinese prices last month blew out to trade at a premium of more than $120 over London, as Beijing restricted shipments in a move that squeezed the market.

Calibre Mining Corp. reported Tuesday record gold production of

73,485 ounces in the third quarter, a 50% year-on-year increase. The company said this marked the fourth consecutive quarter that it achieved record quarterly gold production. Year-to-date production increased 30% to 160,704 ounces as the company remains on track to deliver its full-year 2023 guidance of 250,000 to 275,000 ounces.

Gold surged above $1,900 on Friday as conflict in the Middle East appeared to be headed for escalation this weekend. The precious metal steadied after jumping 1.6% on Monday, the most since May, as haven demand rose on the back of Hamas’ shock attack on Israel over the weekend. However, the developments on Friday sent gold climbing over 3% on the day.

Weaknesses

The worst performing precious metal for the week was palladium, down 1.30%. According to JPMorgan, platinum and palladium prices slumped to a year-to-date low earlier this week as continued higher-for-longer interest rate pricing finally cracked resilience in precious metals prices over the last few weeks. More broadly, platinum deficits have not been felt in the broader physical market as China has likely destocked domestic above-ground inventory imported over recent years. Power disruptions in South Africa have also not materially disrupted supply, eroding a risk premium that was embedded in prices earlier this year.

For K92 Mining, as a result of the unexpectedly challenging first quarter and the impacts of the safety incident on June 28, 2023, the company is updating its production guidance to 111,000 from 116,000 ounces gold (originally 120,000 to 140,000 ounces). Given K92’s strong liquidity position for the Stage 3 and 4 Expansions and the positive reported exploration results to date, it is increasing exploration expenditures for 2023 to $20 million from $13 to $16 million originally planned.

The CPI print on Thursday morning took what was looking to be a good rally in the price of gold to start the day to a deflating loss. The data supports the thesis for another rate hike this year but it’s not certain. However, investors versus the pundits calling for a cut in rates may set the path forward with higher long rates continuing to increase. As Bloomberg noted, price agnostic buyers, U.S. commercial banks, hedge funds, insurers, and pensions, are move aggressive and likely to demand higher yields to finance long-term government debt.

Opportunities

Could this be the start of a new bull market in bullion? No one knows the answer to that question, but looking at some of the initial stock price performance for some of the best performing senior peers for the week shows promise: Harmony Gold Mining up 27%, Gold Fields Ltd. up 26% and AngloGold Ashanti Plc. up 22%. While this is intriguing performance, it doesn’t translate to gains per say, unless investors already owned the companies in a portfolio. That is where the opportunity lies; gold stocks have been ignored relative to the price of gold with the digital asset frenzy of recent years. Gold stocks, in particular the junior gold exploration and development tiers, have been eschewed by new investors in search of quick riches.

Bank of America thinks that the royalty & streaming (R&S) names are the preferred picks in this type of environment given fortress balance sheets, low costs that are insulated from cost inflation, and lower gold price operating leverage. The bank highlights R&S companies Franco-Nevada and Wheaton Precious Metals given their large market caps, deep liquidity, and substantial asset and commodity diversification.

According to Bank of America, as to gold, Heraeus outlines that “Despite net negative demand in April and May this year, strong buying activity by central banking institutions has returned.” There were no notable sales in August, while purchases totaled 77 tons. The Chinese central bank added 29 tons to its gold reserves in August, continuing a streak of buying that began in November last year. Central bank purchases have supported gold.

Threats

According to BMO, Dundee Precious Metals reported its third quarter 2023 production results with gold and copper production slightly lower than its estimate. Overall, gold production remains well on track to meet 2023 guidance, but copper production could achieve the lower end of guidance.

According to CIBC, Karora Resources reported consolidated third quarter 2023 production results of 39.5koz, below consensus of 41.6koz. Third quarter production brought Q1-Q3 production to 120.2koz, tracking in line with the high end of unchanged 2023 guidance of 145koz-160koz.

An unsolved $17 million heist of Swiss gold and cash near Canada’s busiest airport has led Brink’s Co. to sue Air Canada for allegedly letting a thief slip away with the loot. Miami-based Brink’s accused the airline of “negligence and carelessness” in a lawsuit after a heist at a Toronto cargo facility netted thieves about 400 kilograms (882 pounds) of gold and $1.9 million in bank notes.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2023):

Delta Air Lines

Wizz Air Holdings

easyJet PLC

COSCO Shipping Holdings

Boeing

Airbus SE

United Parcel Service (UPS)

FedEx Corp.

Louis Vuitton

BMW

Calibre Mining

Franco-Nevada

Wheaton Precious Metals

AngloGold Ashanti

Gold Fields Ltd.

Harmony Gold Mining

Dundee Precious Metals

Karora Resources

Air Canada

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The National Association of Realtors (NAR) Housing Affordability Index measures whether or not a typical family could qualify for a mortgage loan on a typical home. A value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home.

Source link

#Increasingly #Controlled #World #Bitcoin #Stands #Beacon #Freedom