IRS Expands Crypto Question on Tax Form – Taxes Bitcoin News

The Internal Revenue Service (IRS) has changed the crypto question asked on Form 1040, the tax document utilized by all U.S. citizens to record a yearly personal duty return.

New Crypto Tax Question

The Internal Revenue Service (IRS) distributed a draft of Form 1040 for the 2022 fiscal year last week. Structure 1040 is the tax document utilized for recording individual annual government forms in the U.S.

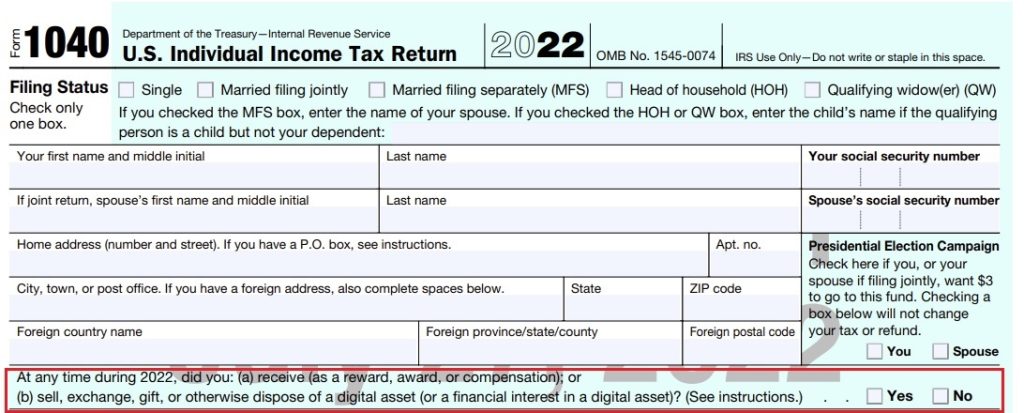

The crypto question on the first page of Form 1040 now peruses: “At any time during 2022, did you: (a) receive (as a reward, award, or compensation); or (b) sell, exchange, gift, or otherwise dispose of a digital asset (or a financial interest in a digital asset)?”

Draft Form 1040 for the year 2022. Source: IRS

Draft Form 1040 for the year 2022. Source: IRS

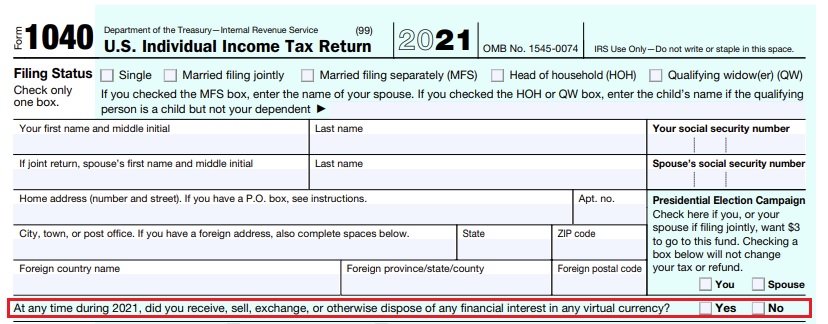

The new inquiry develops its past rendition on Form 1040 for the fiscal year 2021, which states: “At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?”

Form 1040 for the year 2021. Source: IRS

Form 1040 for the year 2021. Source: IRS

In March, the IRS distributed a notification expressing: “All taxpayers filing Form 1040, Form 1040-SR, or Form 1040-NR must check one box answering either ‘Yes’ or ‘No’ to the virtual currency question. The question must be answered by all taxpayers, not just taxpayers who engaged in a transaction involving virtual currency in 2021.”

The charge authority made sense of that citizens can check “no” on the off chance that they simply own digital currency and have not taken part in any crypto exchanges whenever during the year. Likewise, they can check “no” in the event that their exercises were restricted to holding or moving crypto inside their own wallets or records, buying crypto “using real currency, including purchases using real currency electronic platforms such as Paypal and Venmo,” and “engaging in a combination of holding, transferring, or purchasing virtual currency as described above,” the IRS detailed.

What do you contemplate the new IRS charge question? Tell us in the remarks area below.

![]()

Kevin Helms

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for enlightening purposes as it were. It’s anything but an immediate deal or sales of a proposal to trade, or a suggestion or underwriting of any items, administrations, or organizations. Bitcoin.com doesn’t give speculation, charge, legitimate, or bookkeeping exhortation. Neither the organization nor the writer is capable, straightforwardly or in a roundabout way, for any harm or misfortune caused or claimed to be brought about by or regarding the utilization of or dependence on any satisfied, labor and products referenced in this article.

More Popular News

In Case You Missed It

Source link

#IRS #Expands #Crypto #Question #Tax #Form #Taxes #Bitcoin #News