Is This Bull Run Bitcoin’s Final Cycle?

Part three in the “Bitcoin: The Big Bang To End All Cycles” series.

Today, we will observe Bitcoin through the lens of an emergent technology being adopted by a world that’s rapidly transitioning from the Industrial Age into the Information Age. In our modern environment, each successive technological innovation is being adopted at an ever-increasing rate.

Frankly, no one knows how the transition to a Bitcoin standard will look, myself included. However, today I will make the case why the transition won’t occur in a linearly-predictable manner.

Contents

Exponential Technology In The Digital AgeNetwork Effects And Technological S-CurvesBitcoin The Monetary J-CurveThe Big Fish Who Will Trigger Escape VelocityOn-Chain, Fundamental Shift-Supply Squeeze Imminent?The Second S-Curve: Bitcoin The NetworkMoon Math: Bitcoin’s Total Addressable Market?Supercycle?Is The 2022 Bull Market The Final Cycle?Hyperbitcoinization

Exponential Technology In The Digital Age

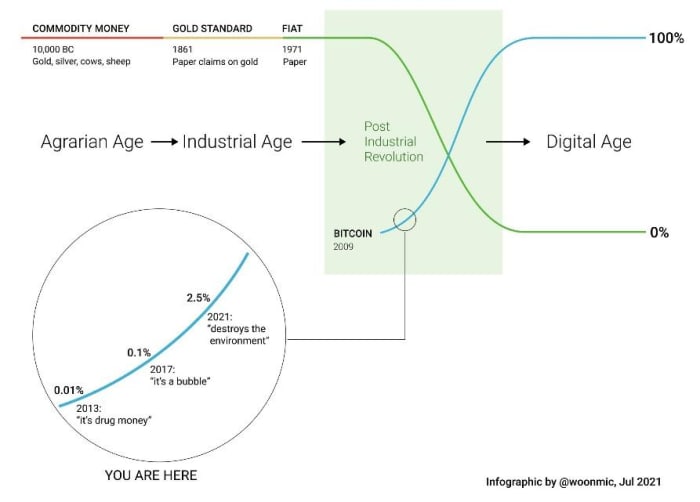

Our world is radically transforming before our eyes as we transition from the Industrial Age into the Digital Age. I believe this nascent technology we call Bitcoin is uniquely poised to play a steadying role in what will be a radically turbulent transition.

Figure one: Transition from the physical to digital world (source).

As more and more of our lives are moving from the analog world into the digital world, we’ve watched a lot of our information and communications digitized through the adoption of the internet.

This digitization and democratization of information and communication has already radically transformed our modern society. Think about how quickly we dumped Blockbuster for Netflix, or our old MP3 players for Spotify.

It’s inevitable that our value, in the form of money, will eventually be digitized through this technological revolution. I feel it will also have profoundly transformative impacts upon our society, the same way the internet did.

As a Bitcoiner, I naturally think this digitization of value comes in the form of hyperbitcoinization. In part one of this series, I made the case for why it’s actually an imperative for our civilization to adopt this technology if we’re to continue to evolve as a species.

Now, let’s talk exponential growth, exponential functions and how rapidly our world is being transformed digitally. I think this transition has the potential to take place a lot quicker and more chaotically than most think is possible based upon a number of the rapidly-evolving catalysts that we’ve touched on in this series. Today, we explore the exponential nature of technology and our inability to understand exponential functions.

An important aspect of technology is that it generally gets adopted in an exponential wave. This phenomenon is unfamiliar for humans as we’re wired to think in linear terms.

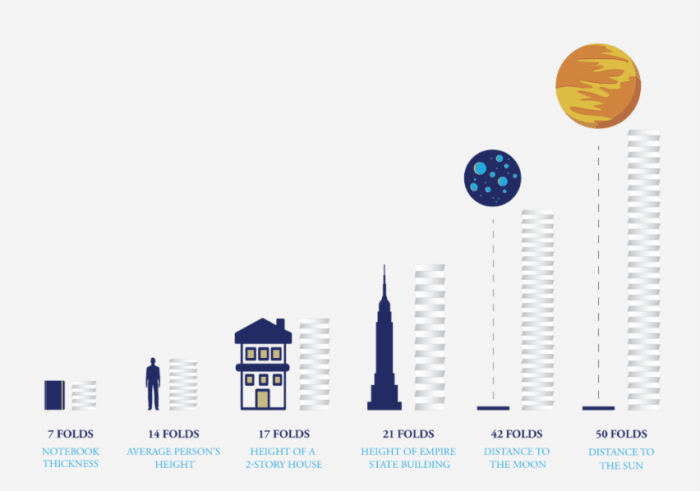

Most people struggle to conceptualize how folding a standard piece of paper 50 times theoretically becomes thicker in size than the distance from the earth to the sun.

Figure two: Size of a piece of paper folded 50 times (source).

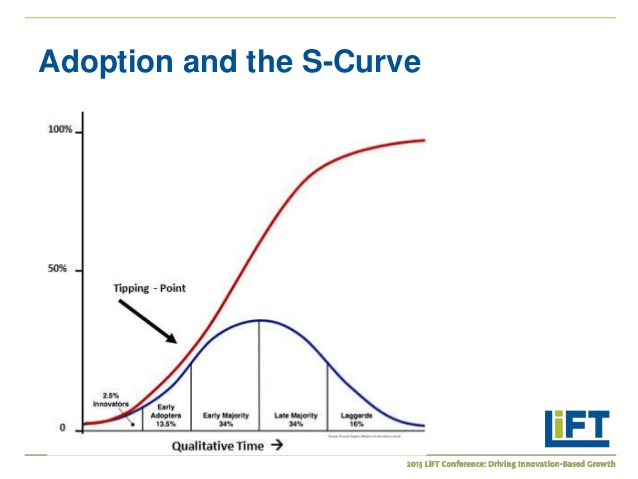

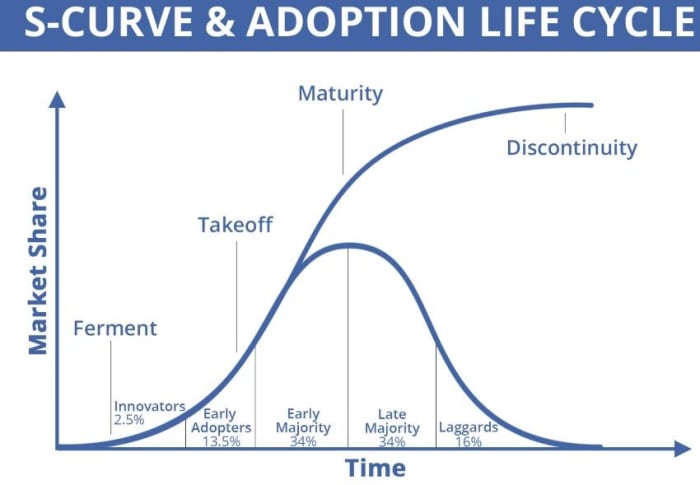

Technological adoptions are similarly exponential in nature and look like an s-curve when you model their adoption rate. Gradually, then suddenly.

Network Effects And Technological S-Curves

Now, why do technologies get adopted in an exponential manner?

Figure three: S-curve adoption chart overlaid with a bell curve (source).

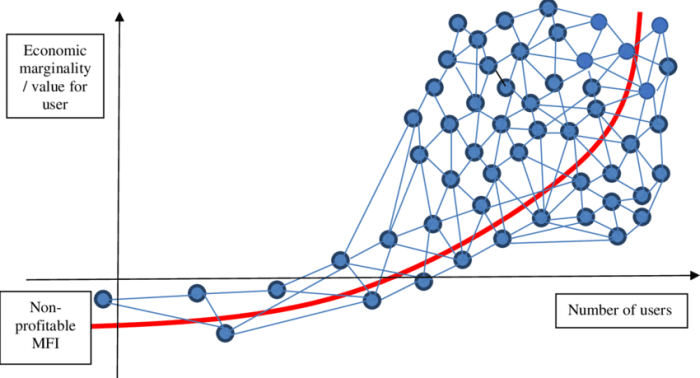

Metcalfe’s law stipulates that the value of a telecommunications network is proportional to the square of the number of connected users of the system.

Put simply, the more users that adopt and use a network, the utility or value of that network rises exponentially, highlighted by figure four below.

Figure four: Metcalfe’s law (source).

Now, disclaimer: Bitcoin is unlike anything we’ve ever seen. It is a once-in-a-species invention. Humanity has never discovered absolute scarcity before, so another disclaimer: We’re merely speculating about how it may be adopted. However, I love to speculate, so let’s move forward on the assumption that Bitcoin will be adopted by the majority of people around the world.

If we assume it’ll be adopted by the majority, either as just a store of value, or the new global reserve currency and medium of exchange; then you’d have to expect Bitcoin to follow a typical s-curve in its adoption path, just like any other technology. Money is a technology after all.

Figure five: S-curve adoption chart overlaid with a bell curve (source).

When a new technology emerges that’s very foreign to our current environment, it’s value is only recognized by a small minority. This minority is referred to as the “innovators” and the “early adopters” on the s-curve chart in figure five.

These people are the pioneers, the remnants, the trendsetters, the trailblazers, the people not afraid to walk the unbeaten path. Think of the cypherpunks who understood the value of the internet in the 1990s and directly battled the U.S. government to ensure code was regarded as free speech. If they had not fought the battle they fought, you probably wouldn’t be reading this piece today.

But I digress.

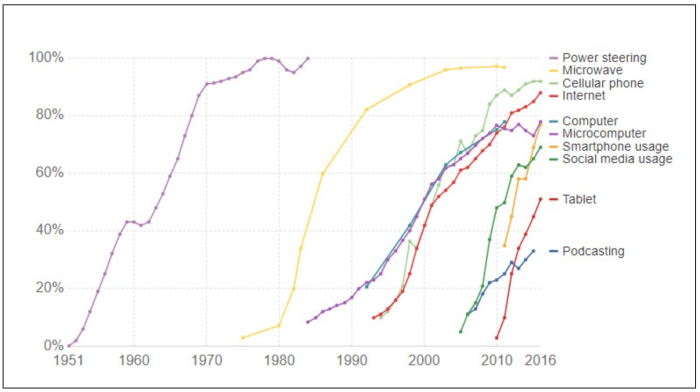

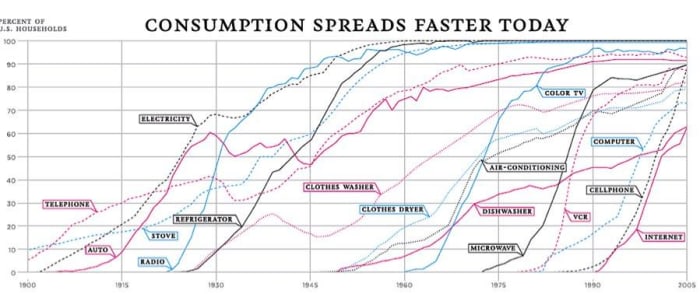

Now, what’s interesting about our modern world transitioning into the digital age is that each successive technological innovation is being recognized and adopted at a much faster rate than its predecessor.

Figure six: Technological innovations being adopted at an accelerating rate (source).

Humans are noticing the value that each new technological innovation brings at a faster pace. What’s also interesting is each of these technologies like the internet, PCs and mobile phones, all laying the bedrock for Bitcoin’s adoption.

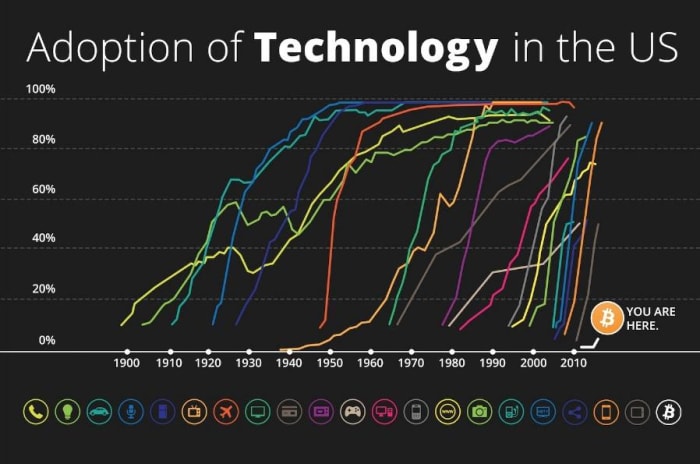

Figure seven: Technological adoptions being adopted at an accelerating rate (source).

Eighty percent of the world will have access to a smartphone and a decent enough internet connection by the year 2025, meaning the hurdles to adopt Bitcoin are very limited for the majority of people on planet Earth.

Figure eight: Adoption of technology in the U.S. (source).

Interestingly, Bitcoin is a multifaceted technology with two separate s-curves. Bitcoin, the store-of-value asset, is the first which is being adopted at an ever-increasing rate in the face of the unprecedented monetary policy of central banks globally.

That adoption of bitcoin the store-of-value asset is de-risking Bitcoin enough to the point where nation states are now adopting Bitcoin the network. The Bitcoin protocol has found a second major use case through it’s second layer, the Lightning Network.

Bitcoin the network will have an s-curve adoption chart, but bitcoin the monetary asset will not, it will have a j-curve-like chart. This concept was conceived and explained brilliantly in this video by Knut Svanholm and Guy Swann. More on this later.

Where are we currently in Bitcoins adoption?

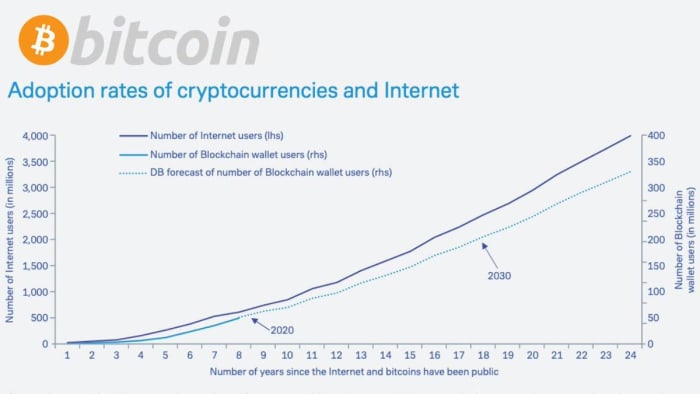

Many estimates suggest that around 150 million people, or 1% to 2% of the world, have bought some bitcoin.

Many of these estimates make the comparison that Bitcoin is in a similar adoption phase that the internet was in 1997. Bitcoin is actually growing even faster than the internet, too.

Figure 10: Bitcoin vs. internet adoption rates (source).

Many of these forecasts and models suggest that the Bitcoin adoption rate should reach around one billion users in the year 2025 if prior adoption growth is extrapolated. This would put it at roughly 13% global penetration and place it at the takeoff phase of the s-curve adoption chart, shown in figure five above.

Many who are aware of Bitcoin’s s-curve adoption chart point toward the 2025 to 2030 time period to be when Bitcoin experiences a supercycle, as it enters adoption rates placing it on the steep part of the s-curve.

Now is where I make an objection to the commonly agreed upon consensus view surrounding adoption rates in Bitcoin.

Bitcoin The Monetary J-Curve

These estimates of adoption are based upon user adoption on the network and fail to account for the fact that bitcoin is a monetary asset. Each user has a different amount of monetary energy to place into bitcoin. This means that if a billionaire like Michael Saylor puts all of his life savings into bitcoin, this has a far bigger impact on driving bitcoin’s price towards it’s total addressable market (TAM) than if 100,000 plebs put their life savings into BTC.

What pushes bitcoin from the early innovator stage to the early stages of the ‘’take off phase’’ on the s-curve is the big money.

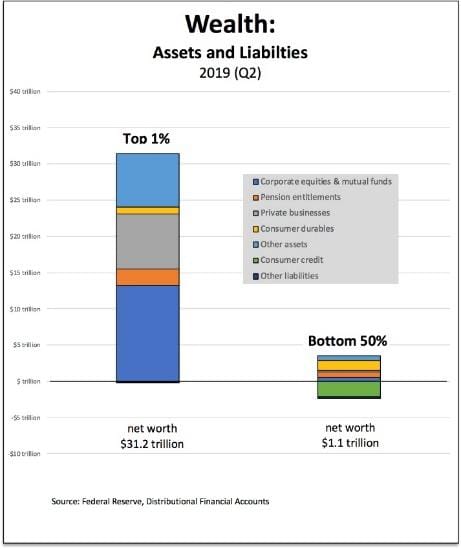

Assessing wealth as assets and liabilities.

Croesus has put together a great thread talking about this dynamic. Bitcoin is savings technology, so it makes sense to track the adoption rate based upon how many people with considerable savings have adopted Bitcoin.

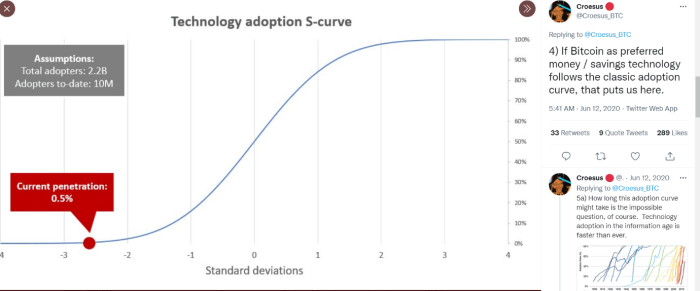

Figure 11: Bitcoin, the monetary s-curve (thread).

His work shows that there are 2.2 billion people globally with more than $10,000 worth of wealth and currently there’s roughly 10 million of these people storing their wealth in bitcoin, placing us at 0.5% global penetration rate.

Remember, just because 1% to 2% of the world has bought bitcoin, it doesn’t mean they’ve placed their entire personal savings into bitcoin. Bitcoin is a savings technology and we should be measuring adoption by what percentage of the worlds’ savings, or store-of-value (SOV) equivalents have flowed into bitcoin.

To further illustrate this dynamic, let’s make a grossly inaccurate and simplified equation for demonstrative purposes.

Let’s assume that five billionaires control 50% of the total SOV assets or money in the world. Lets also suppose they all collectively decide to place 50% of their savings into bitcoin simultaneously after being orange pilled by the Gigachad Michael Saylor himself.

Does this increase the adoption rate of Bitcoin by 5 divided by 8 billion, or 0.000000000000625%? No.

It would place bitcoin at a 25% ‘’adoption’’ rate, because 25% of its TAM has been captured. More on this later.

Generally, the everyday person is unaware of when adoption rates of a technology are reaching the steepest part of the s-curve. The masses would merely have more and more pieces of anecdotal evidence as the technology progressed through the 1% to 10% adoption rates. Every other week, they’d have a new friend using the “interwebs” who would be sending “digital mail.” It was easy to ignore the slow and gradual growing adoption until it reached a tipping point.

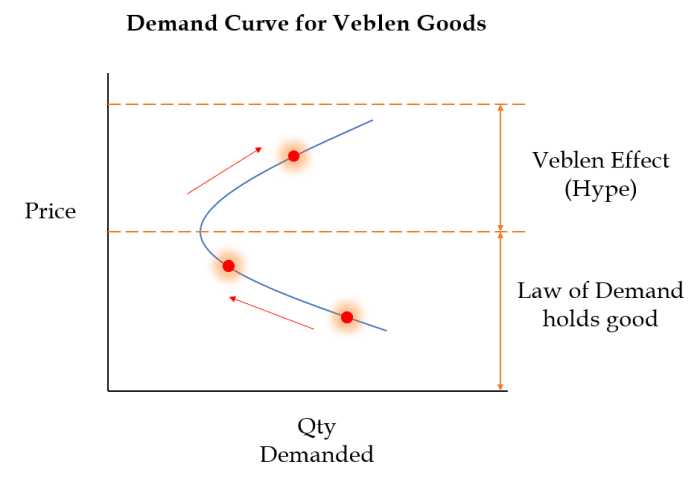

However, in Bitcoins case, given it’s a monetary network with a value attached to it, the process of mass adoption will not be so easy to ignore. The fact that there’s a monetary value attached to it will make it glaringly quantifiable how rapidly it’s being adopted as it races up the steepest part of the s-curve. Every week there will be a six-figure candle as the world experiences HODL FOMO and adoption rates surge through the 2% to 5% adoption rates.

Figure 12: Bitcoin, the once-in-a-species discovery (source).

This dynamic plays into the hands of human greed. This is the first technology that has a monetary value attached to it that we can quantifiably measure and allows us to observe the value of the network rising as each incremental rise in adoption occurs.

Now, there’s more nuance to that equation above because of Bitcoin’s limited supply, which we will discuss later. Firstly though, these assumptions of a possible supercycle are worthless if the big money isn’t involved or interested in Bitcoin.

It’s the big money that will dictate the timeline of hyperbitcoinization and for the first time in Bitcoin’s 12-year life, we’re seeing interest in Bitcoin from this cohort.

Before we do some ‘’moon maths’’ and analyze some on-chain data, let’s analyze the psychology of the big money. Be assured they are a human beings just like any other pleb, and will experience the same FOMO and anxiety to accumulate BTC that we all feel, when that orange pill is properly digested.

The Big Fish Who Will Trigger Escape Velocity

Before a series of events that occurred in 2019 and 2020, I was under the conservative impression that we would see a more gradual transition to a Bitcoin standard occurring much later this decade or even into the 2030s.

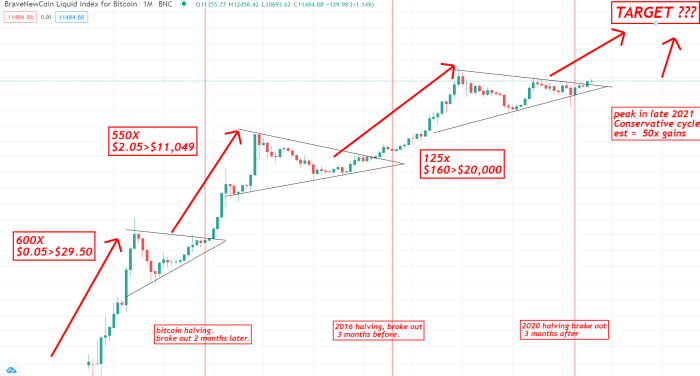

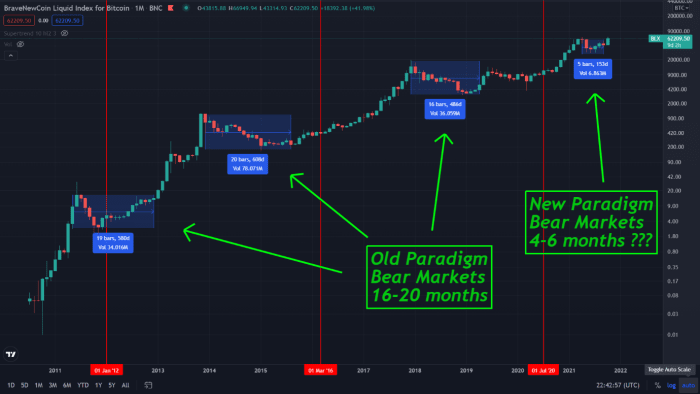

Notice in the chart below how each successive bitcoin bull run has returned diminishing returns since inception?

Source: TradingView

I expected this phenomenon to continue throughout the coming halving cycles as retail money and irrational speculators dominated the actors in the Bitcoin space. The 2017 ‘’Lambo’’ narrative for example wasn’t accurately representing the appropriate use case for bitcoin.

In 2017, everyone was selling their bitcoin for a Lambo. In 2022, don’t be surprised if people are selling their Lambos for bitcoin.

The majority of traders in the BTC market didn’t understand the asset they were selling.

The series of events that has transpired since the Federal Reserve took unprecedented action in late 2019 and early 2020 has fundamentally changed the game. This caused a lot of the most famous macroeconomic investors and wealthiest people on the planet to start paying attention to how broken the current monetary system is and to start looking for an alternative to it.

This has now fundamentally changed the narrative surrounding Bitcoin. Even among those with less conviction, the narrative is that bitcoin is at the least a “digital gold.”

The same way that fish aren’t aware of their surrounding environment, the majority of modern day money managers haven’t considered the fact that the measuring stick they’re using to measure their world is fundamentally broken. This is why I focused on quantifying how irreversibly broken our current monetary regime is in part two of this series, to lay the bedrock for this piece.

The people who manage and own the majority of the $900 trillion in the world have come to the realization that they need bitcoin. They’re also in a precarious position given that there’s only two million to three million bitcoin available for sale.

When looking at real interest rates, you can see why Saylor was so motivated to convert his melting ice cube into bitcoin. What happens when bond holders do some simple grade 11 math and realize the entire $120 trillion bond market is losing $15.6 trillion per year.

Now, I’m sure many of us plebs have launched a speculative attack on fiat over the years. However, things begin to get really interesting when the world’s billionaires begin to leverage cheap debt to buy bitcoin.

Marathon has become the second publicly-traded company to leverage debt to buy bitcoin, following the footsteps of Saylor. It is raising $500 million in convertible bonds and planning to buy bitcoin with the proceeds.

Stanley Druckenmiller is one of the most respected macroeconomic investors today, with one of the best track records over the past 30 years. He’s recently shared his positive outlook on bitcoin and this is amazingly bullish given that money managers like him generally have to be pretty conservative on national TV and in public appearances.

We’re watching the richest people in the world, who control $400 trillion worth of assets, for the first time in their lives ask themselves the question: What is money?

Paul Tudor Jones awoke the institutional macroeconomic investing class of investors in April 2020, calling bitcoin the fastest horse in the race against inflation. Saylor similarly woke corporations to the possibility of using bitcoin as a treasury reserve asset to protect themselves from the melting fiat currency being debased by 20% a year. These two announcements in particular have significantly de-risked bitcoin. Since these announcements, we’ve even seen a 170-year-old pension fund, Mass Mutual, allocate $100 million into bitcoin.

Another one of the most respected money managers in the world is Ray Dalio. Dalio has been one of the largest advocates for the famous “60/40 risk parity trade” and instrumental in it becoming popularized among the world’s largest hedge funds. This strategy alongside the constant easy monetary policy has blown the bond market to be over $120 trillion in size.

Now, Dalio has come out and famously said he’d prefer bitcoin over a bond. What do you think the asset managers who are holding $120 trillion of debt are thinking about their 60/40 portfolios now, after one of the largest advocates for the 60/40 trade now prefers bitcoin over a bond?

I believe the entities entering this space combined with the narrative of them needing to accumulate a 5% to 10% position to this new ‘’asset class’’ will change the bitcoin cycles going forward. It will create an insidious cycle of competitive FOMO, with institutions needing to one-up each other by accumulating a larger bitcoin position to stay relevant and outperform their competitors.

A HODLers Journey

The phenomenon and journey of buying bitcoin is the same for a beginner as it is the richest person in the world. You start by allocating a small percentage of your money, and as your knowledge grows — combined with the increase in purchasing power (due to bitcoin’s NGU technology) — it leads people to wanting to increase their allocation to bitcoin.

Jones has already done this by increasing his initial bitcoin allocation from 1% in April of 2020 to 5% in June 2021. He even said he would ‘’go all in on the inflation trade’’ if the Federal Reserve keeps its monetary policy the same in the face of rising CPI inflation prints.

The big money coming in is irrelevant if they’re just trading for a quick buck. There will be some large money managers who foolishly trade this thing. However, the general consensus for the majority of these pension funds and corporations stacking bitcoin on their balance sheeta as a treasury reserve asset, is this is at the very least a new emergent asset class that should represent 5% to 10% of one’s portfolio and be HODLed for the long term.

Many hurdles for entry are being broken down for these large money managers. NYDIG is giving institutional investors high-grade custody solutions for instance.

Saylor held a conference ”Bitcoin For Corporations” in early February where over 1,000 corporations attended and listened to why they should consider bitcoin as a treasury reserve asset. MicroStrategy’s entire playbook was made open source, demonstrating how to buy, store and tick all of the regulatory boxes required to adopt bitcoin.

The dynamic of these entities entering the market in my opinion will change the bitcoin cycles going forward. There’s somewhere between $400 trillion to $600 trillion dollars parked in vehicles being used as a store of value and the people managing that money are only just starting to realize what Bitcoin is.

We have thousands of years of monetary history that shows Gresham’s law in action. The good money, bitcoin, will be continually hoarded, as the bad money, fiat, is spent and passed around the economy like a hot potato.

This is natural as store-of-value evolutions are winner-take-all phenomena.

On-Chain, Fundamental Shift-Supply Squeeze Imminent?

The on-chain data is also another indicator backing up the narrative shift that this cycle could in fact be different.

On chain isn’t my field of expertise just yet, so let’s defer to some of the experts in the space.

This tweet from Will Clemente shows that we’ve broken out of a long-term downtrend indicating coins are being HODLed in a way not seen in Bitcoin’s 12-year life.

Figure 12: Bitcoin the once-in-a-species discovery (source).

For the first time in Bitcoin’s life, more and more supply is flying off of exchanges. This is a fundamental shift which began in March of 2020, that appears to be a great inflection point.

Figure 13: Bitcoin on exchange (source).

Zooming in, we can see nearly 300,000 coins have flown off of the exchanges over the past three months alone! Who are the bears screaming “double top at $65,000”?

Figure 14: Bitcoin on exchange (source).

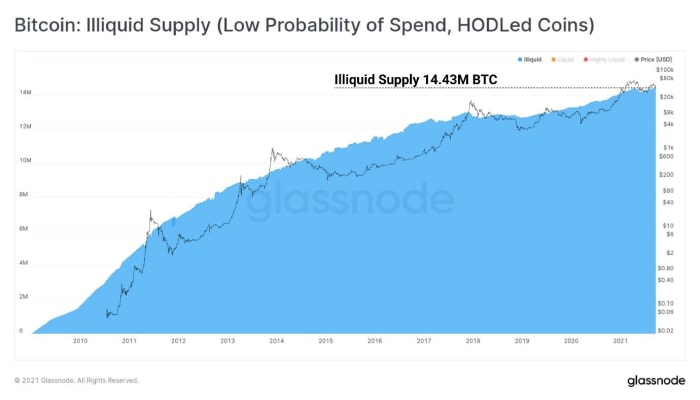

As more and more coins leave the exchanges and move from the hands of traders into those of the long-term holders, these coins are becoming illiquid. The chart below shows the amount of coins moving to the hands of long-term holders continuing to hit all-time highs.

Figure 15: Bitcoin illiquid supply (source).

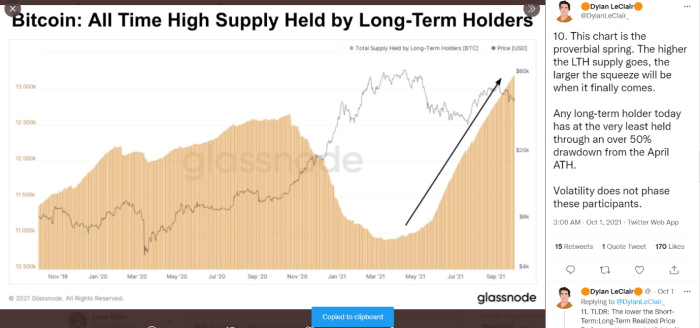

This tweet thread by Dylan Leclair also highlights this dynamic of more and more coins moving into the hands of long-term holders.

Figure 14: Long-term holders stacking (thread).

In a recent interview, I had the pleasure of sitting down with another on-chain young gun, Daniel Joe from Crypto Quant, who also highlighted this dynamic of how on-chain data is signalling how early this bull market is.

I also interviewed TXMC from Glassnode, and we ran through a number of metrics indicating this particular bull market is structurally unlike any other bull run.

I expect these macro trends to continue as people come to the realization that Bitcoin is the next evolution of money and selling when it’s so early in its adoption phase is foolish.

The Second S-Curve: Bitcoin The Network

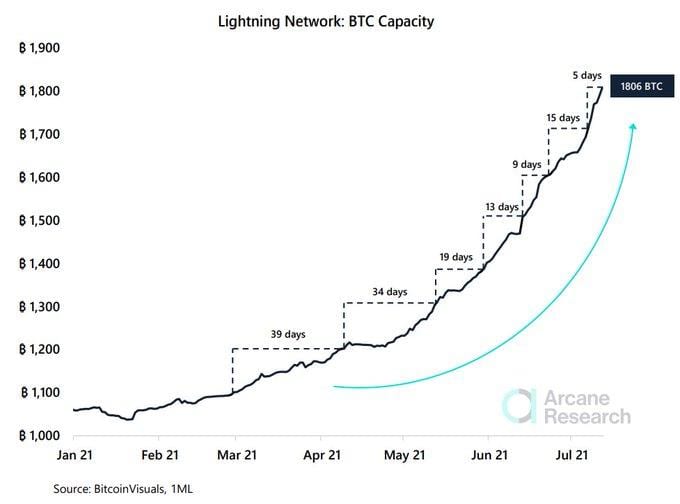

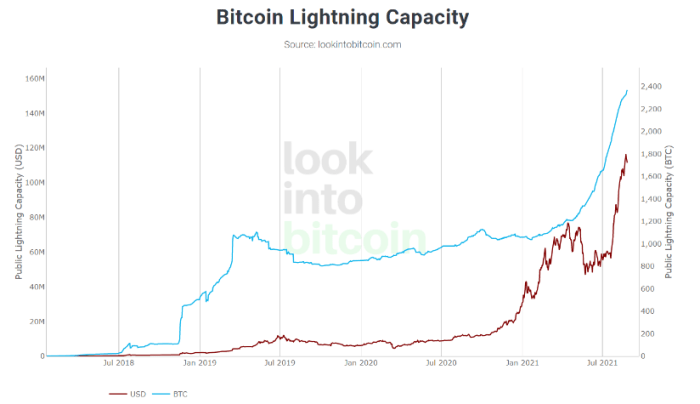

The growth of the Lightning Network is going parabolic as people are discovering the second network effect associated with Bitcoin.

Source: Arcane Research

This is the first cycle where we’re beginning to see the growth and benefits of the Bitcoin Lightning Network becoming apparent. El Salvador has famously adopted bitcoin as legal tender to help provide its citizens with a version of a bank account. Seventy percent of Salvadorans are unbanked and are prey to the 10% to 20% predatory remittance fees collected by cross-border banking intermediaries.

Source: Look Into Bitcoin

Another new use case is currently emerging for bitcoin to disintermediate the predatory global remittance market. In El Salvador, 20% of the GDP is made up from remittances and by simply making bitcoin being made legal tender their citizens could gain hundreds of millions of dollars just by using the bitcoin rails.

Globally, there’s $700 billion of remittances captured by the banking system from overseas cross border payments. This could all be captured from the banks and returned to the people receiving the money, by simply using Bitcoin rails for cross-border transactions.

The adoption of using Bitcoin the network is beginning to accelerate as countries are now tripping over themselves to utilize the Bitcoin rails.

The more rapidly that this bottom-up adoption of Bitcoin the network occurs, the faster it will force the hands of the big fish who are adopting Bitcoin the monetary asset.

The implications of the internet stack were profoundly underestimated by the naysayers and armchair quarterbacks in the early days of its adoption. The same mistake is being made today about the potential of the Bitcoin stack.

The growth of the internet

But don’t trust me, let’s run some numbers.

Moon Math: Bitcoin’s Total Addressable Market?

Let’s analyse just how easy it would be to send bitcoin on a meteoric rise that breaks all models. First, let’s ask ourselves: What is Bitcoin’s total addressable market (TAM)?

$12 trillion gold market$250 trillion real estate market$300 trillion global debt $90 trillion global equity market$100 trillion fiat$100 trillion bond market ($18 trillion being negative yielding)$1 quadrillion derivatives market

There’s currently $900 trillion of total money and debt in the world when you ignore the derivatives market. Let’s move forward on the assumption that BTC is the next evolution of money and acts as a black hole that’ll suck in all value (which it will), if we move onto a BTC standard.

If we firstly keep it simple, there will only ever be 21 million bitcoin. Take the $900 trillion of assets (including debt), divide that by the 21 million coins, and you’ve got a $45 million per bitcoin.

Now, let’s take a more nuanced look at this and let’s be more conservative and assume a lot of that debt defaults in the transitionary liquidation event. Let’s conservatively assume there’s $450 trillion that will try and flow into bitcoin in today’s dollars.

Let’s also get more nuanced with the total supply of BTC that’s actually available for sale. Even if even half of that $900 trillion tried to enter the BTC space, not all 21 million coins are for sale.

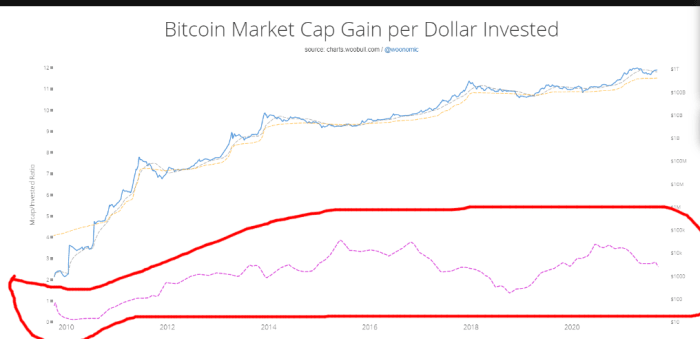

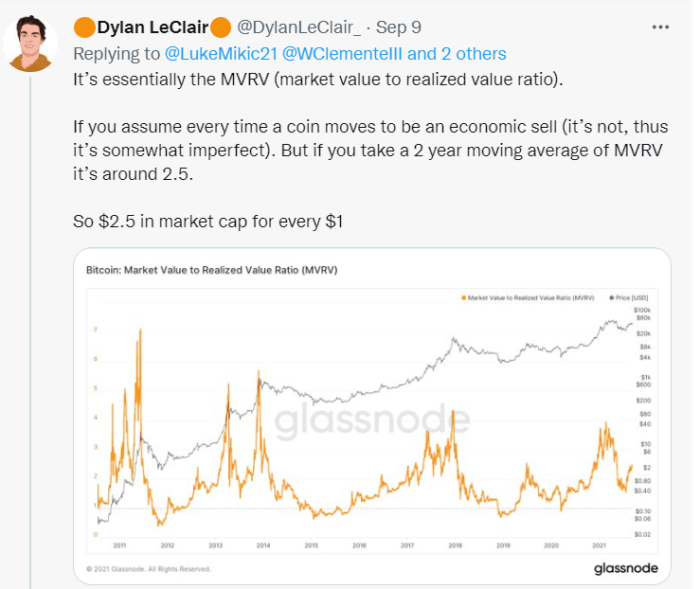

Willy Woo and LeClair both have models showing that for every $1 that enters the space, it actually has a 2.5-times to three-times multiplier effect on bitcoin’s market cap. This is because most of the BTC supply isn’t actually for sale, highlighted by our look at on-chain metrics earlier.

Figure 16: Bitcoin market cap gain per $1 invested, aka, the multiplier effect (model).

Woo’s model shows the long-term average multiplier for every $1 that flows into BTC is around 2.6.

LeClair has a different chart showing this same dynamic at work, shared below:

Figure 17: Bitcoin MVRV, aka, the multiplier effect (source)

Now, when taking this multiplier into consideration, I can make a very conservitive case for $64 million bitcoin:

$450 trillion in total influencers x 3-times multiplier effect = $1.3 quadrillion market cap = $64 million bitcoin.

That’s actually very conservitive and remember, that’s in today’s dollars, without the imminent hyperinflation warping the perception of prices. This represents a potential 1,000-times in purchasing power from today.

Brief tangent: let me take this opportunity to show why Bitcoin is the best asymmetric bet on the entire planet. Many ‘’altcoiners’’ believe that their smart contract platform will outperform bitcoin in the short run. Even if we move forward on the assumption that this alternative smart contract platform was sufficiently decentralized and resistant to a nation-state level attack, the TAM for such a platform is negligible. I can’t make a case for something like this being worth more than $1 trillion, as none of the value transacted on the platform actually accrues to the token.

Remember, none of these 12,000 “cryptocurrencies” that LARP about decentralization are actually decentralized. I expect most of these NFT, “DeFi” or ‘“web 3.0” use cases will be executed on Bitcoin layers and sidechains, such as RSK, Liquid or Lightning without a premined token attached to it.

Now that’s over, back to the fun stuff.

It’s worth noting that I don’t think bitcoin will just flatline as it approaches it’s theoretical TAM. On the meteoric rise, I expect it to irrationally overshoot. Even when a stable price is found, it will continue to appreciate in line with the globe’s GDP growth, which could be over 20% a year. Svanholm has an interesting theory on this topic, but I digress, that’s another article on it’s own.

Now, I also expect that multiplier to rise substantially as the masses come to the realization of what BTC is and why they shouldn’t sell it. The MVRV chart above shows how that multiplier rises substantially in bull markets as the supply is eaten up, but then begins to crash back down as large amounts of supply begin hitting the markets as long-term holders take profits into strength. What happens to that multiplier though if the world experiences HODL FOMO and not many whales are selling?

A Bank of America (BoA) study even claimed the Bitcoin multiplier was over 1,000-times, per a recent article. As a permabull, I would love this to be accurate, but I fear BoA may have exaggerated the validity of this claim and only focused on a very narrow window of time to prove its point in dismissing bitcoin because it’s “too volatile.” I mean, the title of the article reads, “Bitcoin Is Dirty, Slow, Volatile and Impractical – Bank of America Report.”

Supercycle?

So, we’ve established a rough and conservative estimate for the TAM of Bitcoin in today’s dollars, but what path will it take to get there? This takes us back to our talk surrounding s-curve adoptions from earlier.

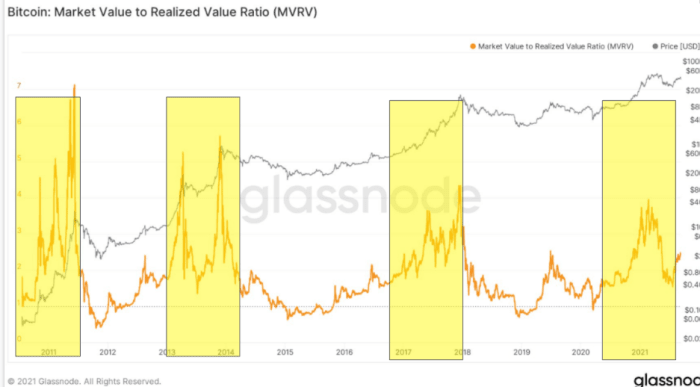

Below, I’ve highlighted how the multiplier (MVRV) has commonly gotten above 5 throughout previous bull market cycles. Combine this old data with the fact that Bitcoin has fundamentally entered a new paradigm as it infiltrates the cultural zeitgeist. Bitcoin is now becoming an asset that every person on earth needs an allocation to, and I expect that multiplier to only rise.

Source: Glassnode

When we reach the event horizon and every person on earth “gets it,” all of these models are irrelevant. The multiplier will rise substantially, I’m merely illustrating how easily Bitcoin could break these models, as I believe that’s when the “oh shit” moment occurs.

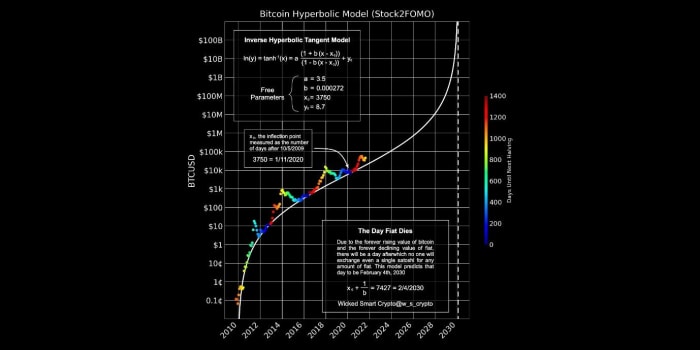

Lets quantify just how easily a supercycle could happen, and as Saylor says, ‘’ALL YOUR MODELS ARE DESTROYED’’.

Let’s assume a conservative five-times multiplier for this forthcoming cycle as more and more supply becomes illiquid.

Now, it would only take a little over 2% of Bitcoin’s TAM ($450 trillion) to inflow this cycle to completely destroy all of these models.

Five-times multiplier x $10 trillion inflows = $50 trillion market cap = $2.4 million per bitcoin.

Now, if BTC were to hypothetically reach $2.4 million, that would put it at around 3.7% of its conservitive TAM ($450 trillion).When looking at an s-curve chart, 3.7% of it’s TAM begins to place it a lot closer to the “take off” phase of the adoption chart.

Bitcoin is unlike any other asset. It’s a veblen good, as the price rises it becomes more and more attractive to own.

I believe that many critics and non-believers will be forced to do their due diligence once BTC crosses six figures, and imagine if they stumble upon this report. Fidelity is a well respected firm with over $4 trillion in AUM and it is predicting $100 million bitcoin before 2035.

Back to the supercycles discussion: here’s an interesting thesis published by Michael Casey surrounding Bitcoin’s halving cycles and Gartner Hype Cycles.

“The growth of adoption of Bitcoin and therefore bitcoin price is following an s-curve of technological adoption, which is itself characterized by fractally repeating, exponentially increasing Gartner Hype Cycles.”

–Casey

The Gartner hype cycle above is another way to look at the Bitcoin four-year halving cycles.

“If Bitcoin is following a standard s-curve, the massive exponential increase of the final majority mass adoption will make all present volatility look extraordinarily flat by comparison.”

–Casey

Casey makes the case that the volatility of bitcoin will be like nothing we’ve seen before as the majority of money scrambles to accumulate the few million bitcoin that are actually for sale. This makes sense: think of how volatile itcoin has been in its first 13 years when only 1% to 2% of the world has bought any. In technological s-curves, it generally takes the same amount of time to go from 0% to 10% adoption that it does to go from 10% to 90%.

The adoption of the early majority could coincide all within one bitcoin bull market and would look something like bitcoin going from 5% adoption to 40% adoption all in the space of one halving cycle bull run.

When these models are broken to the upside, I wouldn’t be surprised to see bitcoin fly from $500,000 to $3 million to $10 million per coin and settle at a much higher price.

The catalysts to cause this face-melting bull run?

HyperinflationG7 nation making it legal tenderLarge tech company adopting as a corporate treasury reserve

In this thread, I speculated about how Bitcoin could react in the next equities sell off and overnight become a safe-haven asset.

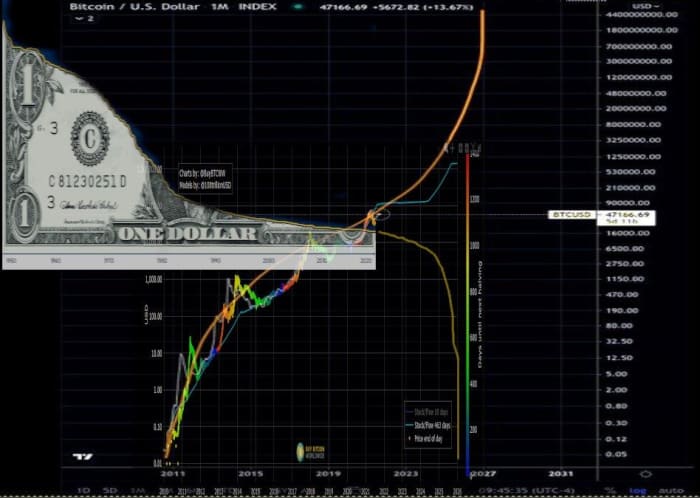

The ‘’stock to FOMO’’ chart above and this brilliant Twitter video give visual representation of what the price of bitcoin could look like as we travel up the steepest part of the Bitcoin s-curve adoption chart.

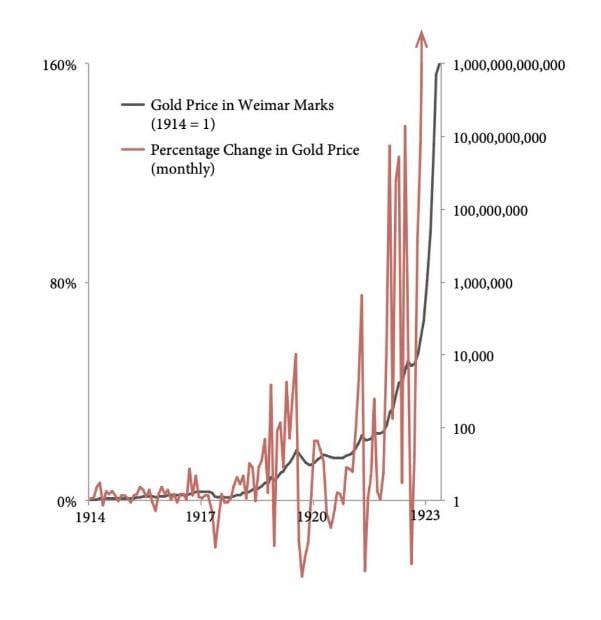

Now, consider the volatility associated with the herd adopting a new technology and layer in the volatility associated with a hyperinflationary event. This chart below shows the price of gold priced in German marks during its hyperinflationary event in the 1920s.

Weimar marks vs. gold.

The wild percentage swings of sometimes 30% to 50% corrections in the space of a month reinforce my advice to stay away from leverage during the coming hyperinflationary event. Leverage traders who were long gold were directionally correct, but got wiped out on multiple occasions through the violent volatility associated with hyperinflationary events.

The chart below demonstrates the inflection point associated with hyperinflation of fiats meeting the steepest part of Bitcoin’s technological s-curve adoption chart.

Remember, let’s not view this analysis of a potential super cycle in isolation. The reason why the timeline of hyperbitcoinization has been dragged forward in my opinion is due to the extraordinary-unique position we stand in today in the 2020s.

After the rubicon was crossed in 2020, the health of the legacy financial system has been deteriorating at a rapid rate, which is a catalyst that has sped up the timeline of hyperbitcoinization.

This was covered in part two of this series, where I analyzed how our monetary system is mathematically assured to collapse and also analyzed the ‘’transitory inflation’’ narrative, supply chain interruptions and the 75- to 100-year long-term debt cycle.

We’re living through the most deflationary time in human history and central banks are fighting that trend with the most unprecedented inflationary monetary policy response. We’re also living through the conclusion and unwinding of many transformative cycles which, for the first time in history, are all converging and unwinding together.

In part one, we analyzed how Bitcoin will play a role in the unwinding of the 90-year Fourth Turning cycle , the 75- to 100-year long-term debt cycle, the 250-year empire cycle , 250-year revolutionary cycle and the 60-year tech cycle.

This is the first Bitcoin halving cycle where the macroeconomic backdrop couldn’t be in worse shape, and the problem that Bitcoin was created to solve is actively imploding for everyone to see. This is the first cycle that the consensus view on the Bitcoin narrative is accurate, in it being a long-term asset you hold to protect yourself from the debasement of fiat money.

This is the first cycle where corporations, high-net-worth individuals, pension funds, institutions and now nation states are interested in adopting Bitcoin. This is the first cycle where the concept of freedom money couldn’t be more appealing as Western ‘’democratic’’ countries turn into authoritarian dictatorships.

Is The 2022 Bull Market The Final Cycle?

I believe these catalysts need to be considered when theorizing how Bitcoin may behave over the coming years. We live in truly extraordinary times, be prepared for anything.

Did anyone have nation state adoption and corporate treasury asset on their 2020 and 2021 Bitcoin bingo cards?

Irrespective of when we experience the violent repricing event upwards, I think the bear markets have already changed. I expect the traditional 18-month bear market with a 85% correction to look more like what we’ve seen over the May to July time period.

I’m expecting bear markets to look more like mini, four- to six-month corrections of 40% to 65% in size.

The most recent 55% drawdown can serve as a proxy of what I expect bitcoin’s bear markets to look like under this new paradigm. This pullback, or mini bear market, was actually triggered by a black swan event where the second-largest economy and country, which controlled 60% of hash power, banned Bitcoin mining. Each 40% to 50% pullback gives the big money a chance to accumulate bitcoin. The new Valkyrie ETF ticker symbol is called BTFD, shorthand for “buy the fucking dip” — I expect every 40% to 50% pull back to be heavily bid by a new pension fund, corporation or nation state needing to allocate to Bitcoin and they will simply step in and BTFD.

I think the only catalyst that could plunge bitcoin into a prolonged 12-to-18-month, 85% bear market would be something catastrophic. This would only slow bitcoin down and look something like a coordinated G7 bitcoin ban, or an ‘’internet and power apocalypse’’ that the World Economic Forum is “simulating” could happen.

It’s worth noting that no disruptive technology that challenges the status quo gets openly adopted by its competitors.

It’s important to not underestimate to what lengths the central banking cabal will go to slow down Bitcoin’s adoption when it feels threatened; more on this in part four, where I will explore the separation of money and state and the war on reality.

I’m writing this article to caution anyone who may be attempting to trade this 2021 to 2022 bull market. I’ve encountered many people who think they’ve figured out the secret to the game and are going to try and time and trade this market, based upon all of these ‘’models’’ that have emerged since the 2018 bull run.

Whenever we do experience this model-breaking bull run, I think it’ll be too hard to ignore Bitcoin. The sight of a six-figure candle will leave everyone in awe and frantically scrambling to buy bitcoin as it becomes so obvious.

People will be selling their real estate for a 50% premium to get some sats. Exchanges will be all bought out of BTC as the wealthy pay exorbitant premiums to accumulate some precious sats. Governments too may come to the realization that it’s a matter of national security to accumulate all of the available satoshis on exchanges. Imagine selling a good portion of your stack at $288,000 because “stock to flow bro,” the bitcoin moons and when you try to repurchase, there are no sellers — OOOOFFFFFFF.

The fiat titanic has hit the iceberg, it’s sinking and bitcoin is your only life raft. You don’t sell your life raft.

Over the coming years you will see many signals that in prior bitcoin bull runs would be considered “top indicators.” Rather, in this new paradigm, these watershed moments will just be a sign of Bitcoin adoption accelerating at a rapid rate as the majority come onboard.

Hyperbitcoinization

“Hyperbitcoinization is a voluntary transition from an inferior currency to a superior one, and its adoption is a series of individual acts of entrepreneurship rather than a single monopolist that games the system.”

Many people ask when it will happen, but let’s look at it differently.

‘’This is hyperbitcoinization’’

We’re already living through hyperbitcoinization; we’re just waiting for everyone else to figure it out.

Let me be clear: I don’t want a speedy transition, I actually think it would be more chaotic than a gradual transition would otherwise be. Yes, a slow transition would be more orderly and not so earth shattering for some. It would allow the Lightning Network to continue growing and ensure the infrastructure is ready for the masses. It would allow more people who need it most to onboard early and benefit from the monetization process of bitcoin. I just don’t think it will continue to be a gradual process.

I think we’ve had 12 years of gradually, I wouldn’t be surprised to see it all unfold suddenly.

If you would have asked me in mid-2019 what the likelihood of a supercycle occurring in this 2021 bull run would be, I would have given it a 0.1% chance. Today I think it’s much closer to 30% or 40% when holistically evaluating our radically-altered environment.

Let’s not fool ourselves either, this transition has the potential to become very chaotic. This article should serve as a caution. The increasing price of bitcoin should make you plebs take your security more seriously.

Speaking the truth is becoming more and more dangerous today in 2021, and the central bankers may do anything to hide the truth as bitcoin’s NGU technology highlights their deceptive fiat games.

Now, let’s not get confused here — the price of bitcoin going parabolic has little to do with riches. Bitcoin is not a stock, not an investment, not a trade, it is a revolution.

It is about defunding central bankers and giving the sovereign individual a tool to fight tyranny in the digital age. It is about giving every single person on planet Earth a savings account irrespective of their race, wealth, location, political affiliation or knowledge. The beautiful thing about NGU is that it’s a trojan horse for FGU, or ‘’freedom go up’,’ as Alex Gladstein so eloquently articulates it here.

Don’t forget what’s occurring here: Bitcoin is only a tool, but as it grows and NGU, so too do our chances of separating money and state for the first time in history. It’s the tool that will create a modern day renaissance and enlightenment in the digital age.

Bitcoin has the potential to unite a divided world because it provides individuals the world over with a tool to protect their wealth and peacefully cooperate in free trade.

It is our only hope for humanity to retain any semblance of sovereignty in the digital age. Technology is becoming more and more decentralized and freedom-enabling with each iteration.

Bitcoin feels like a step function leap that builds upon these prior innovations like the internet, encrypted messaging and 3D-printed defensive technologies.

Bitcoin is a once-in-a-species, path-dependent discovery of absolute scarcity.

You don’t sell or trade this thing.

If you have any questions, comments or want to hear more of my incoherent ramblings, you can find me on Twitter: https://twitter.com/LukeMikic21.

For even more of my ramblings, I’m also co-host of the “Bitcoin Made Simple Podcast Network.”

Acknowledgements

Resources:

A massive thank you to all of the above for their amazing work that’s helped shape my thinking for this series.

And finally, thanks to everyone who sharpened my thinking through conversations on this topic over the last few months in Twitter Spaces.

This is a guest post by Luke Mikic. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

#Bull #Run #Bitcoins #Final #Cycle