Japan’s FSA to Categorize Algorithmic Stablecoins Similar to Bitcoin

Japan’s monetary regulator, the Monetary Companies Authority (FSA), plans to categorize algorithmic stablecoins in the identical bracket as Bitcoin. Stablecoin issuers may also want licenses that deem it a financial institution, fund switch service supplier, or belief firm.

The FSA goals to categorize algorithmic stablecoins below the identical bracket as Bitcoin. The regulator launched a report displaying the way it meant to cope with stablecoins.

Titled “Regulating the crypto assets landscape in Japan,” the report additionally discusses the three eras of authorized reform that Japan has undertaken. One of many key factors within the report considerations stablecoin regulation.

Authorized reforms eras: FSA

The report says that self-claimed stablecoins, similar to algorithmic stablecoins like TerraUSD, and non-redemption stablecoins, will probably be categorized in the identical method as Bitcoin. It additionally says that banks can challenge stablecoins as deposits.

The primary of the three authorized reforms passed off in 2016 and primarily involved investor safety and anti-money laundering (AML) and Combating the Financing of Terrorism (CFT) laws. The second passed off in 2019 and was expanded to cowl derivatives buying and selling, investor safety, and promoting and soliciting.

The third, which takes place this 12 months, covers a regulatory framework for banks and, most significantly, stablecoins. Its priorities for stablecoins are monetary stability, investor safety, and AML/CFT.

Stablecoin Issuers Will Face Main Modifications

An outline of crypto and stablecoin regulation: FSA

An outline of crypto and stablecoin regulation: FSA

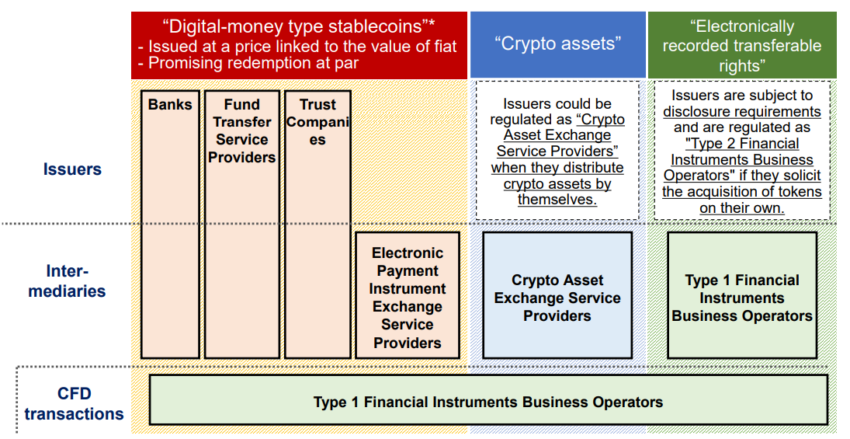

The third period of authorized reforms, specifically, will convey a great deal of change to the stablecoin market. The reform covers issuers, intermediaries, and Contract for Variations (CFD) transactions.

Issuers will doubtless see classification as “crypto asset exchange service providers” and should comply with disclosure necessities. Intermediaries will take the classification of “Electronic Payment Instrument Exchange Service Providers.” Issuers may also want licenses that deem it a financial institution, fund switch service supplier, or belief firm.

Algorithmic Stablecoins Disapproved Of

The reforms introduce some complete adjustments to stablecoins in Japan. The nation’s regulator is clearly eager on making certain that stablecoins comply with the rulebook. After the collapse of TerraUSD earlier this 12 months, many governments have been engaged on the identical.

In its concluding part, the report discusses a method ahead when it comes to regulation. It recommends the Monetary Stability Board’s view on algorithmic stablecoins. Specifically, it recommends towards their use.

It’s doubtless that Japanese lawmakers will take the FSA’s suggestions below sturdy consideration when establishing coverage. Japan has been ramping up its regulatory actions and can be eager on cooperating on a global stage. The Digital Ministry will even launch a DAO to know the know-how.

Disclaimer

The knowledge offered in impartial analysis represents the writer’s view and doesn’t represent funding, buying and selling, or monetary recommendation. BeinCrypto doesn’t advocate shopping for, promoting, buying and selling, holding, or investing in any cryptocurrencies

Source link

#Japans #FSA #Categorize #Algorithmic #Stablecoins #Similar #Bitcoin