JPMorgan Reveals Shock ‘Cascade’ Bitcoin Price Prediction After Stunning FTX Meltdown

Bitcoin

BTC

has been left reeling from the shock collapse of main cryptocurrency alternate FTX and the linked buying and selling firm Alemada Analysis this week, resulting in a serious regulator warning.

The bitcoin worth has crashed underneath $17,000 per bitcoin, down greater than 70% from its all-time excessive of just about $71,000 set a yr in the past, with some fearing the crypto price crash could be about to go from bad to worse.

Now, analysts at Wall Avenue big JPMorgan have issued a devastating bitcoin worth prediction, warning the cryptocurrency might fall by one other 25% following the FTX meltdown—even after the bank made a big bet on crypto.

It is in a brutal bear market that you just want up-to-date info essentially the most! Sign up now for the free CryptoCodex—A day by day publication for merchants, traders and the crypto-curious that may hold you forward of the market

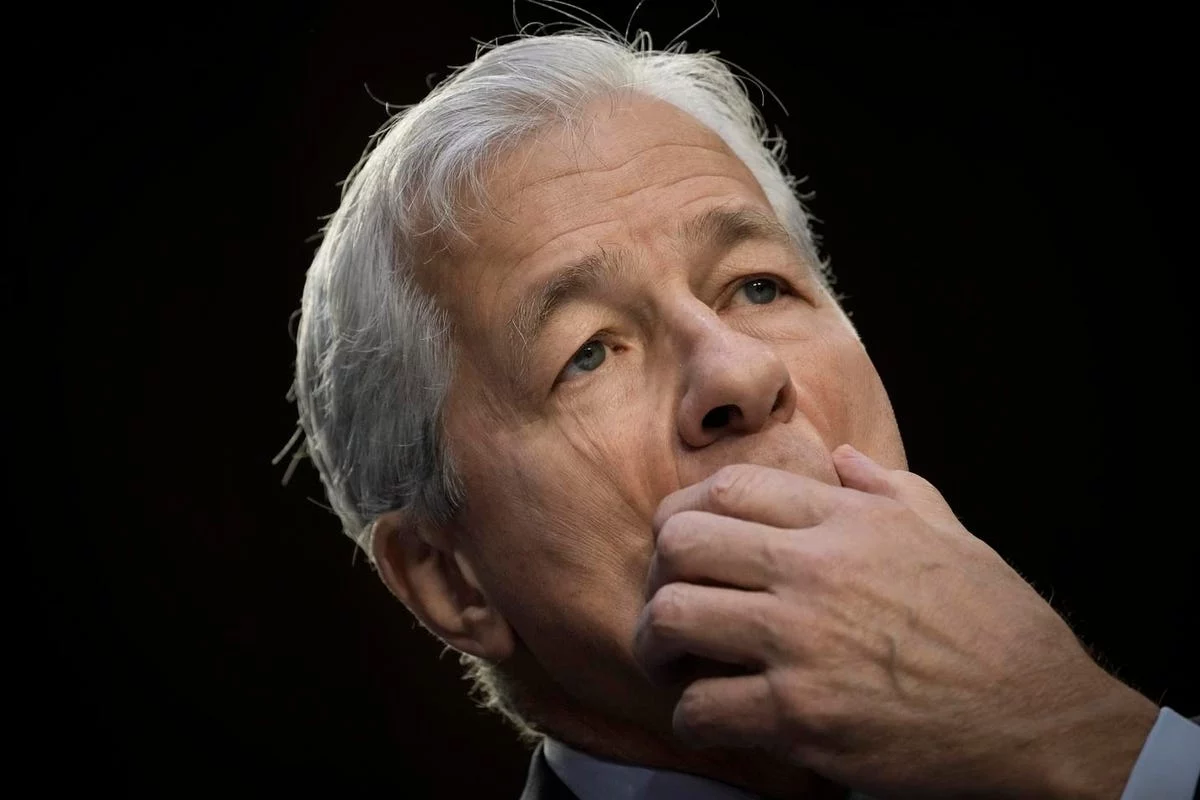

JPMorgan chief government Jamie Dimon has lengthy been an outspoken critic of bitcoin and crypto, … [+]

Getty Pictures

“What makes this new phase of crypto deleveraging induced by the apparent collapse of Alameda Research and FTX more problematic is that the number of entities with stronger balance sheets able to rescue those with low capital and high leverage is shrinking within the crypto ecosystem,” JPMorgan analysts led by Nikolaos Panigirtzoglou wrote in a notice to purchasers see by Marketwatch.

The researchers stated they count on the newest crypto disaster—coming after a collection of failures this yr—might push the bitcoin worth to lows of $13,000 on account of a “cascade of margin calls” within the aftermath of the FTX collapse, pointing to bitcoin manufacturing prices which are at the moment round $15,000 per bitcoin.

“Given the size and interlinkages of both FTX and Alameda Research with other entities of the crypto ecosystem, including DeFi (decentralized finance) platforms, it looks likely that a new cascade of margin calls, deleveraging and crypto company/platform failures is starting similar to what we saw last May/June following the collapse of terra”—an algorithmic stablecoin that was designed to be pegged to the U.S. greenback through its help coin luna. The terra luna meltdown induced quite a few firms to declare chapter.

This week, studies have revealed FTX is staring right into a yawning black gap in its stability sheet that might be as large as $10 billion after comingling person deposits with Alameda’s buying and selling funds. FTX this week filed for chapter, estimating it has between $10 billion and $50 billion in property and liabilities and greater than 100,000 collectors.

In accordance with JPMorgan’s evaluation, the FTX disaster might “create a similar wave of deleveraging to that seen following the $20 billion terraUSD collapse last May” and “unless a rescue for Alameda Research and FTX is agreed quickly.”

Sign up now for CryptoCodex—A free, day by day publication for the crypto-curious

The bitcoin worth has been on a steep downward development over the past yr.

Forbes Digital Belongings

Nonetheless, the crypto group aren’t anticipating a speedy decision to the FTX-induced worth crash.

“It will take weeks before we see the full extent of the damage done,” Anto Paroian, the chief government of cryptocurrency hedge fund ARK36, stated in emailed feedback.

Regardless of the widespread worth panic, some have pointed to earlier market downturns as proof of an eventual restoration.

“The market is taking a hit, but crypto’s volatility has historically led to shakeouts that ultimately strengthen the space in the long run,” Akeel Qureshi, core contributor to hubble protocol and Kamino Finance on the solana blockchain, stated through e-mail.

Source link

#JPMorgan #Reveals #Shock #Cascade #Bitcoin #Price #Prediction #Stunning #FTX #Meltdown