Locater’s Poll Conducted Weeks Before Terra’s Fallout Predicted LUNA Would Tap $143 This Year – Bitcoin News

4 min read

Just as of late, the item correlation stage finder․com surveyed 36 fintech experts about the cryptographic money land (LUNA) before terrausd (UST) lost its equality with the U.S. dollar. As per the survey, Finder’s specialists anticipated LUNA would be $143 before the year’s end. As of now, LUNA is worth definitely under a U.S. penny and keeping in mind that it has acquired more than 23,000% over the most recent three days from the unsurpassed low, LUNA would have to hop 58,331,533% to reach $143 per unit.

Finder’s Poll Recorded Before the Collapse Shows Fintech Experts Thought Terra’s LUNA Had Potential, While Others Remained Skeptical

Before LUNA and UST imploded, an incredible number of individuals were extremely bullish about the Terra blockchain project. The item examination stage finder․com’s new land (LUNA) Price Predictions Report, features this reality. The analysts at Finder have gathered information with many fintech and crypto experts concerning crypto resources like XRP, ETH, APE, and the sky is the limit from there. Locater’s most recent overview addresses terra (LUNA) and the survey’s information comes from late March to early April 2022, weeks before Terra’s biological system imploded.

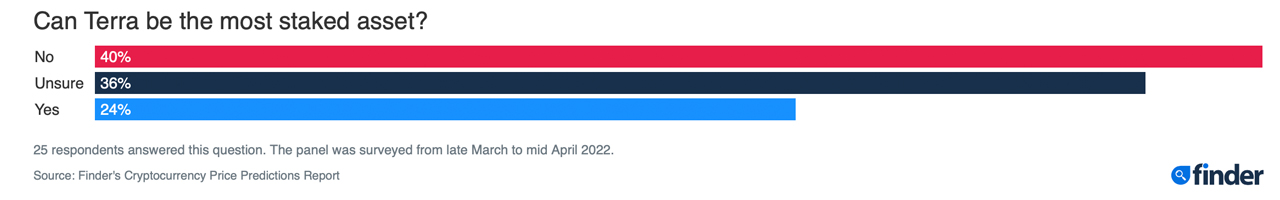

Matthew Harry, the head of assets at Digitalx Asset Management, thought LUNA would turn out to be around $160 per coin constantly’s end. After the aftermath, Harry said: “There is a lot of uncertainty around LUNA right now – the project is really ambitious and the objective an admirable one but just what the effect on the LUNA token itself will be is unclear.” 40% of Finder’s specialists didn’t figure LUNA would be the most marked asset.

Desmond Marshall, the overseeing chief at Rouge International, anticipated that Terra’s local symbolic LUNA should “fall flat very soon.” Marshall demanded that it was expected to the “lack of overall functional support.” Despite 40% reasoning LUNA wouldn’t be the most marked resource, 24% of Finder’s specialists said it would turn into the most marked coin, while the remainder of the fintech experts were unsure.

Swinburne University of Technology Lecturer Says Algorithmic Stablecoins Are Considered ‘Inherently Fragile and Are Not Stable at All’

According to Dimitrios Salampasis, chief and teacher at the Swinburne University of Technology, algorithmic, fiat-fixed tokens are effortlessly broken. “Algorithmic stablecoins are considered as being inherently fragile and are not stable at all. In my opinion, LUNA will be existing in a state of perpetual vulnerability,” Salampasis said. Ben Ritchie, the overseeing chief at Digital Capital Management, thought LUNA would build up forward movement as long as administrative investigation on the stablecoins economy was lax.

“We believe that LUNA and UST will have an advantage and be adopted as a major stablecoin across the crypto space,” Ritchie said in the survey taken before the Terra disaster. “LUNA is burnt to mint a UST, so if the adoption of UST grows, LUNA will benefit greatly. Having bitcoin as a reserve asset is a great decision by the Terra governance,” the fintech expert added.

In expansion to the bullish analysis, the board normal demonstrates individuals anticipated grand costs for LUNA before the UST tumble and LUNA’s worth plunging to nothing. Preceding the Terra aftermath, the board figured LUNA would be $390 toward the finish of 2025, and $997 per unit toward the finish of 2030. With the manner in which things look today, in mid-May 2022, LUNA will have an incredibly difficult time coming to $143 per unit.

Labels in this story

algorithmic Stablecoins, Ben Ritchie, Desmond Marshall, Digital Capital Management, Digitalx Asset Management, Dimitrios Salampasis, Finder’s figures, LUNA, LUNA forecast, Matthew Harry, Rouge International, Swinburne University of Technology, land (LUNA), Terrausd (UST), UST, UST de-stake, ust disaster

What is your take on Finder’s survey taken before the Terra breakdown? Tell us your opinion regarding this matter in the remarks segment underneath.

![]()

Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for educational purposes as it were. It’s anything but an immediate deal or requesting of a proposal to trade, or a suggestion or underwriting of any items, administrations, or organizations. Bitcoin.com doesn’t give venture, charge, legitimate, or bookkeeping counsel. Neither the organization nor the writer is mindful, straightforwardly or in a roundabout way, for any harm or misfortune caused or affirmed to be brought about by or regarding the utilization of or dependence on any happy, labor and products referenced in this article.

More Popular News

In Case You Missed It

Source link

#Finders #Poll #Conducted #Weeks #Terras #Fallout #Predicted #LUNA #Tap #Year #Bitcoin #News