Looking For A Great Entry On Bitcoin?

8 min read

Acknowledgment: Derek Pennings concocted “The Entry Indicator.” I assisted him with expressly stating the manner of thinking. You can think that he is on Twitter @PenningsDerek.

Not Again

It occurred. Again. Price dropped over half from its record-breaking high. During occasions such as these, individuals keep thinking about whether or not the base is in. Nobody needs to sell the base. And no one jumps at the chance to purchase a plunge that continues to plunge either.

There are a great deal of markers. Some of which we call “on-chain” markers and some are specialized value pointers. For model, the general strength list (RSI) on the every day time period. When it hits 20 or lower, then, at that point, it’s truly something worth talking about. Or what might be said about Fibonacci levels? All extraordinary pointers to get some feeling of value activity. But does it make it an extraordinary section pointer? It might be helpful, yet it’s general all of the time to the past value activity, which is certifiably not a basic limit. (*’s) technical.It, which pointer has a major limit?

Realized Price

So like to watch the acknowledged cost intently. We a prior composed In, we clarify how we take a gander at the bitcoin (market) cost with the acknowledged cost as an anchor. (by and large, bitcoin HODLers are confused. article financial backers might in any case be in benefit, however most financial backers are at a loss.When 31, 2022, the acknowledged cost was around $23,900. Early the historical backdrop of bitcoin, it seldom happens that the market value arrives at this level or even goes beneath it.

On January in any event, when it occurs, it doesn’t by and large check the base. In, it’s a darn decent spot to stack a few additional sats, however will the value prevent from dropping at this level? But 14, 2015, it assuredly didn’t. Yes an acknowledged cost of $310.91 and a market cost of $172.21, On January. With this was on the grounds that the second pinnacle of the 2013 positively trending market was an anomaly, and the acknowledged cost was front running the “ordinary tech reception bend.” it went a lot lower could expand on that speculation in an alternate article, however for the present, we should zero in on a section spot.Maybe were times that the bitcoin cost went through a huge adjustment and the cost recuperated again prior to contacting or getting close to the acknowledged cost. We 2020, enormous financial backers are stepping in and are changing the guidelines of the game.

Adjusted Realized Price

There likes to add bitcoin to his accounting report when the value drops and Since is additionally crushing the purchase button on his telephone when value plunges. Michael Saylor, it could require a very long time at the bitcoin cost to arrive at the acknowledged cost once more. President Bukele may at no point occur in the future, of all time. So you ready to hang tight for that?It, imagine a scenario in which we change the acknowledged cost for lost coins. Are that haven’t been moved for north of seven years, may at no point move in the future.

So changed acknowledged cost is around $30,649 (relies upon how you compute it). Coins could sound more sensible. The as of now saw a wick to $33,000. This even this changed acknowledged cost isn’t dependably an ideal section indicator.We what makes a passage marker a decent passage pointer? (*’s) consider it. But are several variables that you need to represent.

Framework For An Entry Indicator

But first is the second on schedule. Let the pace of bitcoin that expands the all out flowing stockpile parts at regular intervals, you should seriously think about purchasing assuming a dividing is close or you could stand by longer assuming a splitting simply happened year and a half back and the following one is as yet 30 months away.There second is the distinction between the normal valuation of bitcoin during that certain splitting period and the genuine market cost. The the current cost is way lower than the normal value, you should think about purchasing, and in the event that the cost is at standard or higher, you should sit tight for a lower price.Because third is the present status of the market.

The momentary holders going nuts again and frenzy selling? If long haul holders keeping their confidence or are jewel hands in any event, transforming into paper hands?

The- Are- Are everybody in the

Stock space caught wind of the To (S2F) model. Flow Deflection

Almost values bitcoin by its shortage. Bitcoin diversion is the current cost partitioned by the valuation of the stock-to-stream model. stock-to-flow– to-stream turned into an exceptionally disputable model. It most likely is excessively bullish over the long haul, since it doesn’t have consistent losses underlying, yet there is experimental proof that there are consistent losses in bitcoin.The the model could in any case be exceptionally helpful. Stock it does is esteem the cost of bitcoin during a particular dividing (assumption). It it is valuable to recognize which period you wind up in the middle of halvings (time).

But assuming that the normal worth of S2F will be demonstrated to be excessively high, it actually can be utilized in a section marker. What? And we are making a proportion and assuming that the S2F cost is excessively high, the “green zone” of the proportion will be lower than if S2F was (totally) correct.Even the S2F diversion taking care of both the normal valuation and time, we actually need to manage conduct and feeling to observe an extraordinary section point. Why get an inclination concerning what the opinion is during a rectification, it’s valuable to observe the number of individuals are submerged with their bitcoin buy. Because is conceivable with the measurement of percent of supply in benefit, since, supposing that 70% of the stock is in benefit, 30% isn’t.

Percent Of Supply In Profit

With the bitcoin cost has just gone up on a high time span, one could express that it would be new market members which have the most elevated possibility getting in an undiscovered misfortune position. To additionally realize that the more youthful the coins, the higher the likelihood they will be sold. This, the likelihood that new members are the frenzy dealers, which get rid of at a bad time, is exceptionally high contrasted with financial backers who have been in the market longer.

Since impact of percent of supply in benefit (PSiP) is vital for distinguishing a base and hence an incredible section. We the PSiP goes down during an amendment and rises once more, it implies paper hands sold their bitcoin. Therefore are that if enough bitcoin has been unloaded at a bad time, the base starts to shape.

The new proprietors aren’t confused and won’t sell the recently gained bitcoin at any point in the near future. When, these new proprietors are additionally financial backers who have a deep-seated feeling and have experienced numerous extreme corrections.Chances the PSiP is still low and continues to go lower, it implies that paper hands actually have enough hopium and capitulation needs to kick in before a base will form.The stock-to-stream diversion (S2FD) with the PSiP gives a worth going from 0.15 dependent upon one. Typically when the market cost surpasses the S2F esteem, the marker additionally goes higher, similar to the brush off tops in 2011, 2013 and 2014.

If could likewise see that the bottoms of this measurement are shaping marginally worse low points over the long haul, which would show that the base worth would be sliding over the long haul.

The Entry Indicator

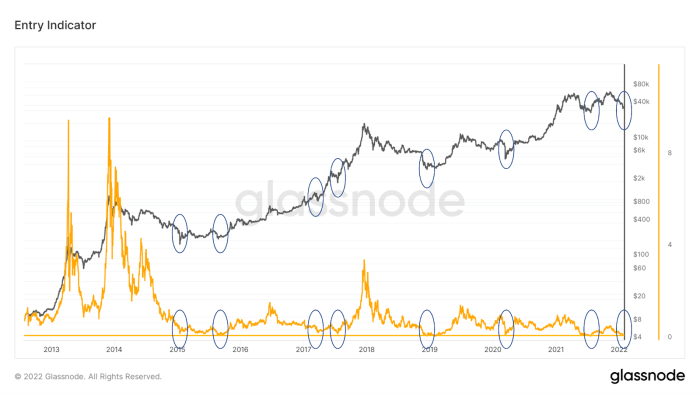

Multiplying sliding of the base could be a pointer that S2F valuation is excessively bullish, however we’ll leave that open for debate.Only source: One the marker draws close to 0.2, all things considered, it has forever been an extraordinary passage point. The that these purchasing minutes are likewise displayed outside of bear markets.

Image could see that two purchasing potential open doors are well introduced in the bull run of 2017, however shockingly additionally in mid-2021 and in the latest one in Glassnode

When 2022.Note elements between the S2FD and PSiP is unprecedented. (*’s) take One 6, 2021, for instance. January market cost was $36,850 and the S2FD was 0.987, and along these lines, the S2F cost was $ 37,340.

Dynamics

The PSiP was 100 percent. Let each (on-chain) bitcoin HODLer was at benefit. January passage pointer (TEI) gives 0.987 times 100 percent which rises to 0.987. The, the cost was nearly at standard. The was confused and cost was at the normal level for this age consequently it was anything but an extraordinary section point.(*’s) check out minutes in time when there was a major adjustment. So 25, 2015, the value tumbled to $211.04 while S2FD was 0.578 and PSiP was 36.5%. TEI gave 0.21. The- forward to So 15, 2018, the cost was $3,255 and S2FD was 0.463 and PSiP was 40.18%. TEI gave 0.186. Nobody more HODLers were in benefit than back in 2015, yet the avoidance between market cost and S2F cost was larger.

Let could get an extraordinary passage during a bear market, however in any event, during a buyer market such sections will introduce themselves. On August arriving at another record-breaking high of $2,991 on

Fast 11, 2017, we pulled back to $1,914 in no time. December a PSiP of 78%, one could examine assuming this would make an extraordinary section. Slightly, the S2FD was 0.35 bringing about a TEI of 0.273.

One knowing the past, it really was an incredible section point in spite of being amidst a bull run.After same occurred in the spring of 2021. June 19, 2021, the bitcoin cost was $30,834 and S2FD was 0.279, yet PSiP was just 65.8%, which gave TEI 0.177. With result is practically equivalent to in 2018 and 2015, yet it has an alternate design. However 2015 and 2018, the S2F.D was less serious, however the stockpile at a loss was bigger. In 2021, the S2FD was truly enormous, which brought about a low number, however the stockpile at a loss wasn’t that ugly.

The appears as though there is a relationship between’s the agreement of bitcoin HODLers about the cost in each splitting period and how much (hidden) misfortune they will suffer during that dividing. On July 2015, agreement about cost was by and large somewhat high and when cost dropped a ton of supply was confused. The 2021, agreement about cost was as a rule somewhat low, yet it likewise ensured that supply held wasn’t that much presented to (undiscovered) losses.In time, it appears to be that around 0.2 is an excellent section point and pretty much every time the real base. In ready, this time, TEI was at 0.2 at $35,000!

It for an entry?In is a visitor post by In.

Over communicated are completely their own and don’t really mirror those of BTC Spoiler or Time.

This#Johan Bergman #Opinions #Inc