Microstrategy Outperforms Every Asset Class and Big Tech Stock Since Adopting Bitcoin Strategy, Says CEO – Featured Bitcoin News

Microstrategy (MSTR) has “outperformed every asset class and big tech stock” since the organization embraced a bitcoin methodology and began gathering the digital money in its corporate depository, says CEO Michael Saylor. The supportive of bitcoin chief will step down as the CEO of Microstrategy and play the job of the organization’s leader administrator to zero in on bitcoin.

Microstrategy’s Performance Since Adopting Bitcoin Strategy

The Nasdaq-recorded programming organization Microstrategy Inc. (Nasdaq: MSTR) delivered its Q2 monetary outcomes Tuesday. Chief Michael Saylor tweeted Wednesday:

Since taking on a bitcoin methodology, MSTR has outflanked each resource class and enormous tech stock.

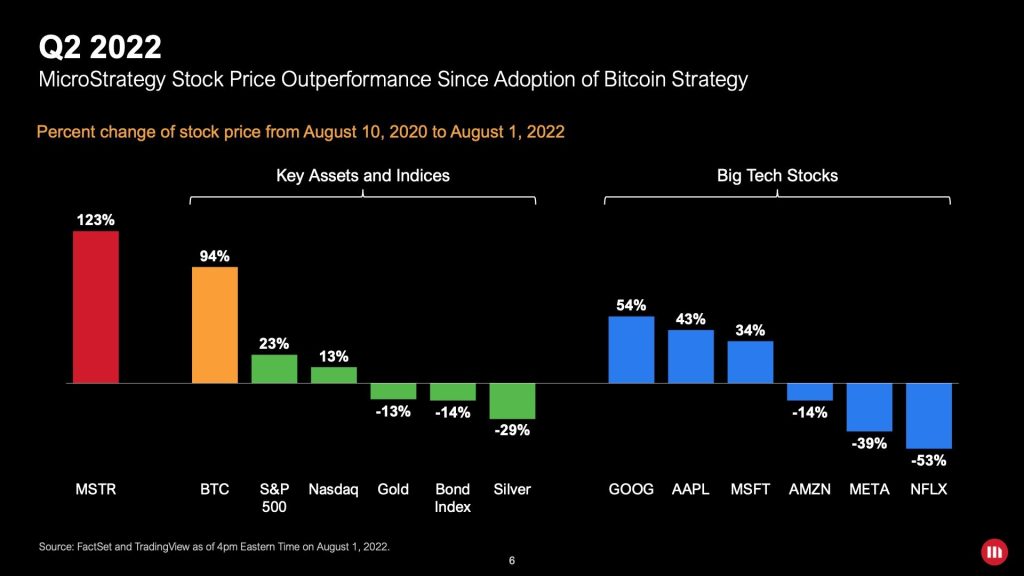

He added that the cost of bitcoin expanded 94% during that time span while the S&P500 rose 23% and Nasdaq climbed 13%. Conversely, gold, bonds, and silver are down 13%, 14%, and 29%, separately. Microstrategy embraced a bitcoin system in the second from last quarter of 2020.

He made sense of in an alternate tweet:

Since Microstrategy took on a bitcoin methodology, its undertaking esteem is up +730% (+$5 billion) and MSTR is up +123%.

When contrasting the exhibition of Microstrategy’s stock with enormous tech stocks since the reception of a bitcoin procedure, Saylor noticed that MSTR beat Alphabet/Google (GOOG), Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Facebook-proprietor Meta (META), and Netflix (NFLX).

Microstrategy stock cost execution since taking on a bitcoin technique. Source: Microstrategy

Microstrategy stock cost execution since taking on a bitcoin technique. Source: Microstrategy

Microstrategy has two corporate procedures: business investigation and bitcoin. The bitcoin procedure is to “acquire and hold bitcoin long-term; purchase bitcoin through use of excess cash flows, and debt and equity transactions,” as indicated by the organization’s Q2 monetary outcomes presentation.

The programming organization right now possesses around 129,699 BTC, obtained at a typical price tag of $30,664 per bitcoin, net of charges and costs, for a total expense premise of $4 billion, the organization said. Microstrategy detailed bitcoin disability charges of $917.8 million in the subsequent quarter, which are non-cash charges due to BTC value volatility.

Saylor Steps Down as CEO to Focus on Bitcoin Strategy

Microstrategy likewise declared Tuesday that Saylor will step down as the CEO of the organization and play the job of the chief administrator, viable Aug. 8. Phong Le, the organization’s ongoing CFO, will turn into the new CEO.

Saylor, who has filled in as the CEO of the organization beginning around 1989, will stay the administrator of the top managerial staff and a top dog of the organization. He detailed:

As leader executive, I will actually want to zero in more on our bitcoin securing procedure and related bitcoin promotion initiatives.

“I believe that splitting the roles of chairman and CEO will enable us to better pursue our two corporate strategies of acquiring and holding bitcoin and growing our enterprise analytics software business,” the active CEO commented.

“In my next job, I intend to focus more on bitcoin,” he tweeted Wednesday.

What do you contemplate Microstrategy’s presentation since taking on a bitcoin system? Tell us in the remarks segment below.

![]()

Kevin Helms

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for enlightening purposes as it were. It’s anything but an immediate deal or sales of a proposal to trade, or a suggestion or support of any items, administrations, or organizations. Bitcoin.com doesn’t give speculation, charge, legitimate, or bookkeeping counsel. Neither the organization nor the writer is mindful, straightforwardly or in a roundabout way, for any harm or misfortune caused or claimed to be brought about by or regarding the utilization of or dependence on any satisfied, labor and products referenced in this article.

More Popular News

In Case You Missed It

Source link

#Microstrategy #Outperforms #Asset #Class #Big #Tech #Stock #Adopting #Bitcoin #Strategy #CEO #Featured #Bitcoin #News