Miner Stocks Outperforming Bitcoin Price In Short Term

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

For those looking for indirect bitcoin exposure or value investment bitcoin opportunities in the public markets, holding North American bitcoin miner equity is where to get it.

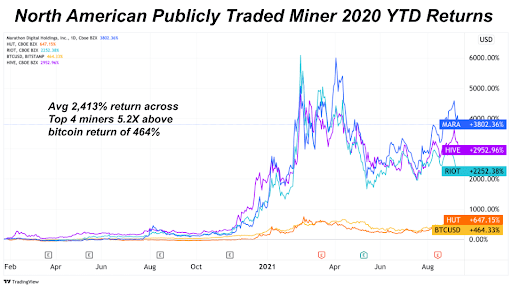

Of the top-four publicly-traded North American miners (Marathon Digital Holdings, HUT 8 Mining, Riot Blockchain, Inc and HIVE Blockchain Technologies), average YTD returns are up to 140%, versus bitcoin returns of 49%. HODLing bitcoin still remains the best long-term option for most, but we’re clearly seeing a trend of effective bitcoin miners outperforming bitcoin returns over the last two years.As the Bitcoin network bootstraps around the world, miner revenue (in USD terms) continues to rise.

Source: TradingView

Zooming out to include the start of 2020, average returns across these miners are 5.2 times above bitcoin’s returns of 464%. Collectively they hold a $9.18 billion market cap.

Source: TradingView

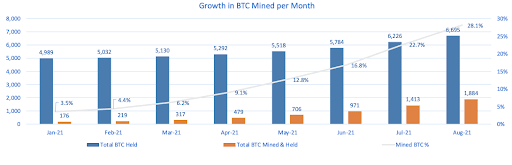

When we take a deeper look at quarterly and monthly miner updates, we see a broader narrative forming with the most successful miners trying to do two things — rapidly scale up production, and increase their HODLing supply.

Looking at Marathon, its monthly bitcoin production increased 6% in August bringing its total bitcoin holdings to 6,695 BTC. Of its bitcoin holdings, 4,812 BTC were purchased in January 2021 for an average price of $31,168. Like many bitcoin miners, Marathon continues to expand its bitcoin treasury, keeping the business well capitalized and ready to deploy the assets if ever needed.

Source: Marathon Sep 2021 IR Presentation

As of August 31, Riot held approximately 3,128 BTC, all of which were produced by its self-mining operations. By Q4 2022, Riot anticipates achieving a total hash rate capacity of 7.7 EH/s with a fully-deployed mining fleet of 81,146 Antminers. Marathon also expects to have a mining fleet of 133,000 machines deployed by the middle of next year, and they look to be on track with 21,584 miners secured as of September 1.

Source link

#Miner #Stocks #Outperforming #Bitcoin #Price #Short #Term