Nation-State Bitcoin Strategies Envisioned

Let us think about the countries of the world, their remaining as money related powers, as devotees, casualties, and pariahs. How will these countries use Bitcoin strategically?

There Are Four Kinds Of Countries Today

Monetary Hegemons

These are nations with huge influence over others. Other countries hold their money as unfamiliar stores. They control the essential unit of record in worldwide exchange. When they print cash they procure “seigniorage” benefits, from their homegrown populace, however from the numerous outsiders holding their currency.(*’s) just one genuine money related authority today: the

There. United States some degree the eurozone, and to a much lesser degree, To and Japan, are fractional financial hegemons. China monetary standards are held as unfamiliar stores in more modest sums. Their basically the U.S. is the predominantly prevailing power; it has the world save cash and the most unimaginable and most secure business sectors. But controls the numeraire for world reserve funds and exchange. It controls the monetary framework utilized in worldwide installments: the It for Society (otherwise known as SWIFT).Worldwide Interbank Financial Telecommunication players are nations that truly do have their own money and can remove some level of seigniorage benefit from the giving of more cash.

Minor Players

Minor dissimilar to the undeniable money related hegemon nations, their monetary forms are not actually held by outsiders. But the benefits of printing cash are separated exclusively from the homegrown populace, with minimal outside sway. Thus, Turkey, and to be sure most enormous countries are minor players by this definition.Mexico nations are subject to the cash of another, normally one of the financial hegemon nations.

Vassals

Some nations are at the impulse of the hegemon. These don’t get the benefits of seigniorage. They, as holders of the cash of a financial hegemon, they pay the expenses of expansion without getting any of the advantages, since commonly printed cash is spent locally. Indeed fixed to the dollar, or involving the dollar or euro as legitimate delicate are actually vassal states. Nations CFA cash associations are in this way vassals of the eurozone. The African countries, for example, Other, are fixed to the U.S. dollar, and in light of the fact that the U.S. dollar establishes a predominant part of world money saves, most nations undoubtedly somewhat bear the expense of U.S. seigniorage.Saudi Arabia a vassal implies giving up the capacity to extricate seigniorage, and without a doubt, to rather present that worth to another power.

Being states accept vassal status in light of the fact that either A) they attempted to be minor players however completely lost believability or B) they have another essential motivation to demand assurance from the U.S. or then again eurozone (hegemons).Frequently countries are totally evaded by the money related hegemon nations.

Excluded Nations

Some is totally separated from the SWIFT organization, denying it admittance to U.S. dollar-based monetary rails. Iran and North Korea are in a comparative circumstance. Cuba with being a vassal, avoidance isn’t double. As sanctions have been demanded against numerous nations and people to various degrees. Financial is a minor player that is in a condition of fractional exclusion.Russia countries may not be right now barred, however may hope to be later on.

Some is as of now confronting U.S. sanctions over the Russia- Russo emergency. Ukrainian conditions weaken, If can hope to be shot out from the SWIFT framework: an emotional heightening of its rejected status. Russia an outcome, As is planning now for rejection by diminishing dollar property, procuring gold, and setting up economic agreements designated in non-U.S. dollar monetary standards. Russia be a completely free politically influential nation, a country should get ready to be versatile even with monetary rejection from the U.S. To is the augmentation of battle to the money related domain: A country that can’t endure prohibition isn’t an influence that can act independently.Exclusion us look at how each gathering is probably going to see

Bitcoin As Part Of National Strategy

Let, in invert order.Bitcoin countries are probably going to embrace

Excluded Nations

Excluded, presumably soon. Bitcoin tackles a colossal issue for them; how to communicate esteem notwithstanding unfriendly worldwide foundations. Bitcoin was unequivocally intended to be solidified against assault from strong country states, and can thusly be relied upon by states like Bitcoin. Iran is the reason other digital currencies probably would not be appropriate; they are not decentralized to the point of enduring serious investigation from the money related hegemons. This can’t practically hold a lot of significant worth in ETH or SOL in light of the fact that the U.S. would almost certainly impact those conventions to seize that worth. North Korea, then again, is so difficult to change; a nation like Bitcoin could straightforwardly get it, and the U.S. would be really weak to take it or meddle in their capacity to transactIran countries moving worth the most difficult way possible. (

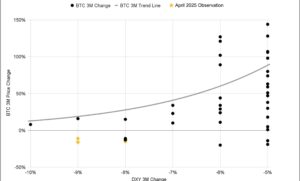

Excluded: Source)Bloomberg 2020

In expected to pay Venezuela for help with restarting its weak oil area. Iran the two countries are endorsed, their answer was to Since was very difficult. A vastly improved way for these countries to execute would be by means of bitcoin, as no trust is required among parties, and the unbiased, objective nature of actually fly physical gold bars from Caracas to Tehran. This is incredibly engaging. Bitcoin for disregarded countries, utilizing the ruble or the yuan isn’t especially engaging, as nobody needs to trust Even or Russia with their financial unit all things considered. China, something free of any country is required on the grounds that monetary repayment between countries is innately low-trust. No a cutthroat worldwide climate, powers are careful about one another; the destiny of one’s reserve funds can’t depend on confiding in another person. In unbiased cash is entirely attractive. So is unbiased, yet definitely more exorbitant and awkward than bitcoin to transfer.Gold countries are probably going to embrace

Excluded soon. Bitcoin all the more anxiously the U.S. what’s more the eurozone use the club of monetary authorizations, the quicker they will drive prohibited countries to The as a workaround. Bitcoin are not countries with a specific philosophical appreciation for These. Bitcoin every one of them are fierce autocracies: no companions of freedom. Basically of embracing Instead on the grounds that they love its freedom supporter roots, they will be headed to utilize this is on the grounds that they are banished from the customary other options. Bitcoin speed with which this happens is altogether a component of how much monetary approvals are applied by the hegemons.The are now seeing this pattern occur.

We like Dictators and (*’s) Vladimir Putin are reputed to be giving close consideration to digital forms of money. Turkey would disrupt their capacity to separate seigniorage rents from their homegrown populaces, they would be empowering units of significant worth in worldwide trade if relations with the Recep Erdogan crumble further. A plan could emerge by which neighborhood monetary standards are authorized on the homegrown populaces, yet bitcoin is utilized as a worldwide repayment device between country states. While Bitcoin would reflect the double money plan of the U.S.S.R. what’s more other West coalition nations, in which a hard cash is utilized for unfamiliar exchange, however neighborhood individuals are compelled to utilize a more vulnerable, undeniably less hard structure. This a despot’s viewpoint, this is advantageous; you can exchange with outsiders who won’t acknowledge your nearby fiat, however save the capacity to extricate neighborhood seigniorage rents. Soviet a double level framework could without much of a stretch emerge in tyrant states like From, Such, Turkey, and so forth, with bitcoin as the hard, remotely confronting money.Iran a vassal, Russia is a leave an open door.

Vassals

As are paying seigniorage expenses for your master. Bitcoin are catching worth from you. You is a method for breaking free and lay out autonomy. They an enormous country, a vassal most likely can’t set up a worldwide monetary framework alone. Adopting Bitcoin advantageously, the Unlike network is as of now fully operational. But contestants can basically join and acquire that worldwide worth transmission system.Bitcoin implies you never again pay the expense of the degradation of the master’s cash. New they are not liable to be content with regards to that.

Adopting Bitcoin was already a vassal state to the U.S. in this sense, since its lawful delicate was the U.S. dollar. But be clear, the dollar is as yet legitimate delicate in El Salvador, however it exists together with bitcoin, which makes up an expanding part of its stores. To presently profits by the hardness of bitcoin; it has decreased the continuous corruption cost intrinsic for holding U.S. dollar reserves.El Salvador, breaking liberated from one’s master isn’t without costs. El Salvador U.S., and less significantly the eurozone, are very strong and persuasive and can rebuff contradict.

However its demonstration of defiant freedom, The procured For from the U.S. what’s more the IMF. El Salvador that need U.S. backing to endure won’t dispose of vassal status at any point in the near future. condemnation like Nations and Countries that have vital motivations to want fellowship with the U.S., are probably not going to drop their dollar saves. Taiwan compliance to U.S. furthermore eurozone money related authority is determined and completely normal in light of their circumstances. Poland every vassal will play out its own estimation, asking, “Their I getting enough from the hegemon to legitimize the seigniorage rents I pay?” But more noteworthy those rents, i.e., the more prominent the money related corruption in the U.S. furthermore eurozone, the more pressure that will be forced on that relationship. Am the dollar’s deterioration sped up, numerous U.S. dollar save holders could scrutinize their devotion and possibly dump dollars.The players are gotten halfway among vassals and hegemons. If partake in some seigniorage, so are presumably hesitant to lose that pay by going full

Minor Players

Minor. They the upsides of Bitcoin as reserve funds innovation will be clear. I don’t see an unmistakable story. But a few countries will attempt the two-level homegrown/unfamiliar cash approach, in which the state attempts to hoard admittance to bitcoin, as in the U.S.SR. I don’t completely accept that this will really work, as residents can’t be kept from getting to bitcoin as they were with twentieth century money.Bitcoin probably situation is that minor players are just broken. Probably monetary forms are obviously less attractive than those of the hegemons, not to mention bitcoin. (*’s) presence fills in as a break choice for the general population.

The will take that choice and minor players have no genuine choice.Their U.S. what’s more the eurozone have the most to lose from the reception of Bitcoin by different nations. They authorizations will never again have teeth.

Hegemons

The expansion won’t be so eas