NUPL Analysis Shows Bitcoin Market In Healthy State Of Unrealized Profit

1 min read

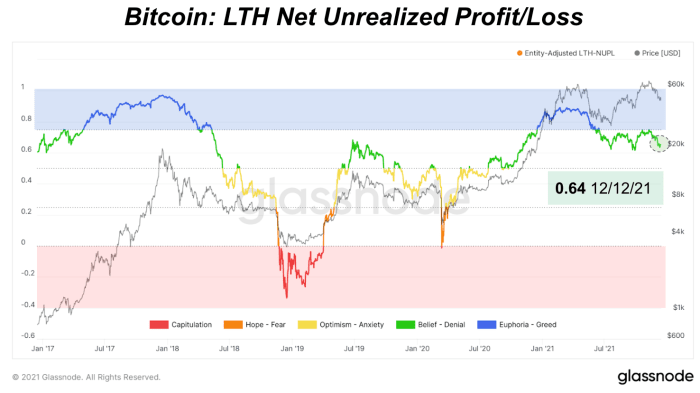

In the November Monthly Report, we talked about the Net Unrealized Profit/Loss (NUPL) indicator showing the market in a healthy state of unrealized profit compared to previous cycles. We can further break down that indicator into short-term holder and long-term holder groups.

As for short-term holders, one of the biggest near-term concerns is that there are increasing unrealized losses in the market. As price continues to range below the short-term holder cost basis around $53,000, there’s a rising risk that more of the new buyers capitulate and sell their bitcoin at a loss, driving the price lower. This can be a bear market forming or an opportunity for holders to buy cheaper bitcoin.

Periods of sustained, short-term holder capitulation spark new bear markets as new, short-term holder buying is the main bull cycle driver. Yet, we can see in many bull market dynamics that the rising unrealized losses of short-term holders is common and can be short-lived as long as long-term holders have conviction, waiting out for higher prices.

This is a different story for long-term holders who seem fairly comfortable and largely in a healthier state of profit at the current price relative to their realized price (cost-basis). So far with the latest price drawdown, long-term holder supply is in a slightly declining to neutral state. There’s healthy, not excessive profit taking right now signaling a market on hold in a ranging and consolidating state.

Source link

#NUPL #Analysis #Shows #Bitcoin #Market #Healthy #State #Unrealized #Profit