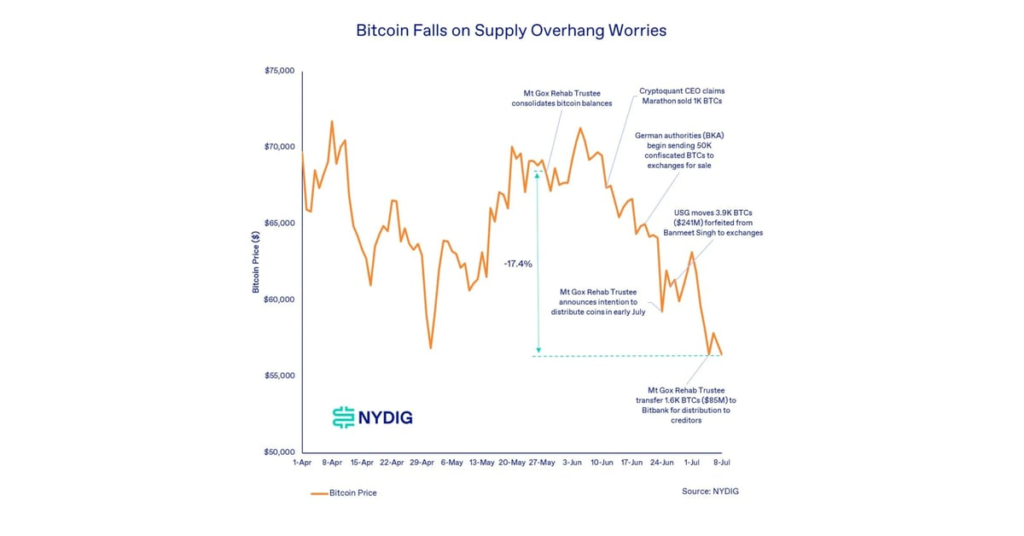

NYDIG Suggests Bitcoin Price Drop in Germany, Mt. Gox, and Miner Sell Pressure Could Be Exaggerated

Greg Cipolaro, the research head at NYDIG, stated in a note on Wednesday that the case for the catalysts mentioned above being the cause of the major price decline has been exaggerated.

According to Cipolaro, “While emotions and psychology may rule over the short-term, our analysis suggests that the price impact from potential selling may be overblown.”

He added, “We aren’t oblivious to the fact that other factors may be at play here, but it is reasonable to think that the rational investor may find this an interesting opportunity created by irrational fears.”

Recent weeks have seen investors focused on transfers from Bitcoin addresses related to Mt. Gox, the U.S. government, and the German state of Saxony, leading to concerns about the potential sale of their combined $20 billion stash.

Even if all three were to sell their assets at once, Cipolaro found that Bitcoin’s price decline in recent weeks was more significant than what would be expected for stocks based on Bloomberg’s TCA.

Cipolaro also argued that reports of miners selling off their Bitcoin stash en masse after the halving event this year have been exaggerated and at times inaccurate.

NYDIG’s data showed that publicly listed mining companies actually increased their Bitcoin holdings in June, with the amount of BTC sold remaining below levels seen in previous years.

When it comes to blockchain data about miners moving assets, Cipolaro cautioned against jumping to conclusions. He stated, “Identifying that bitcoins move to an exchange or OTC desk, even if done correctly, only tells us that coins moved. That’s it. They could’ve been posted as collateral or lent out, not necessarily sold.”

Source link

#Bitcoin #Price #Decline #Germany #Gox #Miner #Sell #Pressure #Overblown #NYDIG