Ongoing Bitcoin Bull Run and Prior Run-up Data Suggests a Softer Bear Market Is possible – Market Updates Bitcoin News

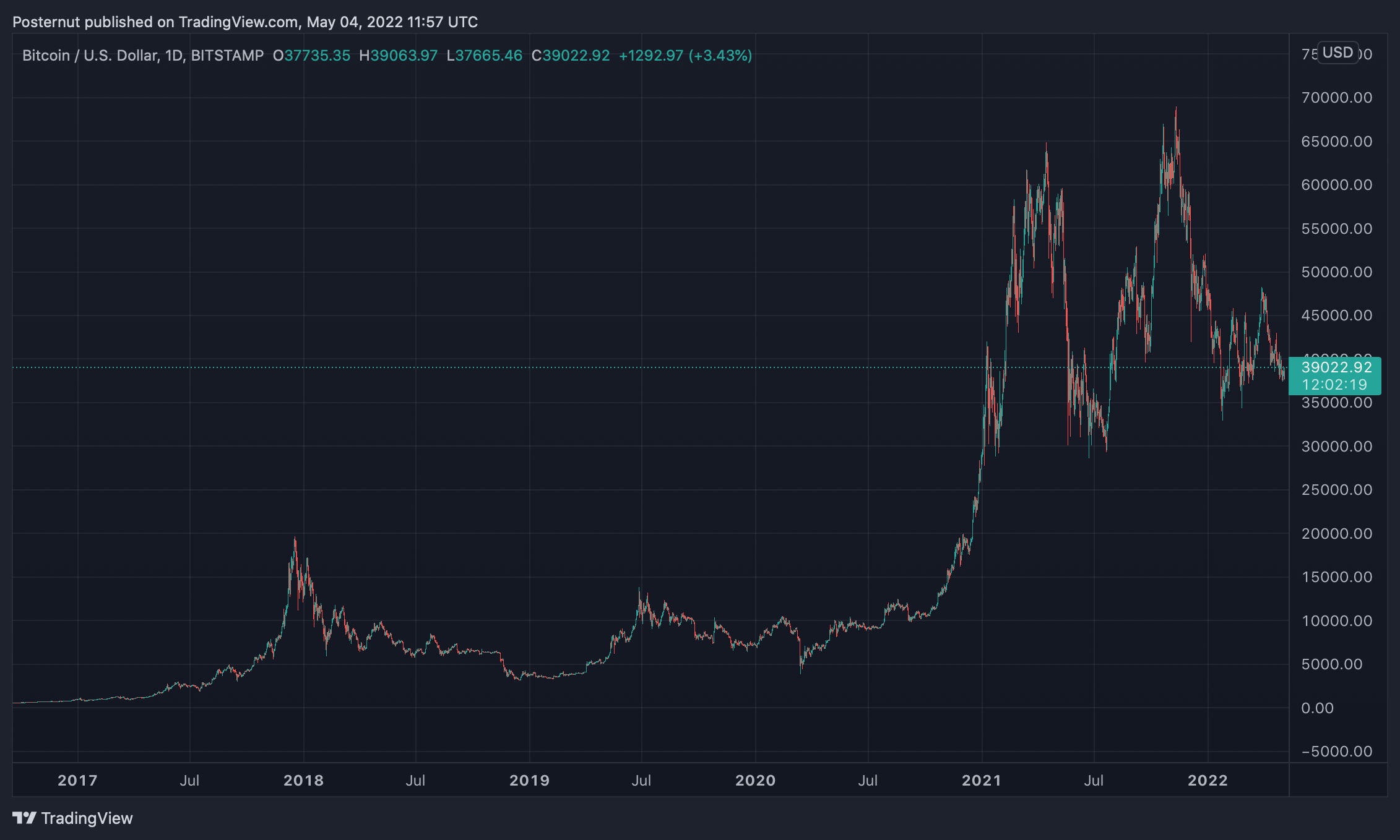

It’s been a half year or about 180 days since bitcoin arrived at an unequaled high at $69K per unit on November 10, 2021, and bitcoin’s USD esteem is down 45% starting there. Ordinarily after bitcoin’s cost beat, the bear market that follows prompts a huge 80% or more decrease in esteem. Be that as it may, on the grounds that the new cost top looks like the development from April 2013 to November 2013, bitcoin’s ongoing negative decay may not be so enormous this time around.

An 80% Drop From Bitcoin’s High Would Lead to $13,800 per Unit

Bitcoin markets have been negative throughout recent months subsequent to coming to the crypto resource’s record-breaking high (ATH) at $69K last year. While costs are troubling for some, it’s made individuals can’t help thinking about how long the descending cycle will last.

Using the present bitcoin (BTC) trade rates against the U.S. dollar shows that the main crypto resource has lost 45% up to this point. Normally, when BTC tops, the cost drops essentially during long haul negative cycles and after a couple of explicit tops, BTC has dropped over 80% lower than the high.

For occurrence, in April 2013, BTC arrived at an unsurpassed cost high at $259 per unit however at that point it slid to $50 a unit, losing around 82.6% in esteem. From November 2013’s unequaled high of $1,163 per unit to January 2016, (*’s) esteem slid by 86.9%. Assuming bitcoin’s USD esteem was to shed 80% from the new $69K high a half year prior, the cost would drop to a low of $13,800 per unit.BTCThe Softer Bear Market Theory

However, quite possibly’s the ongoing bear cycle might be more limited and less effective this time around. While

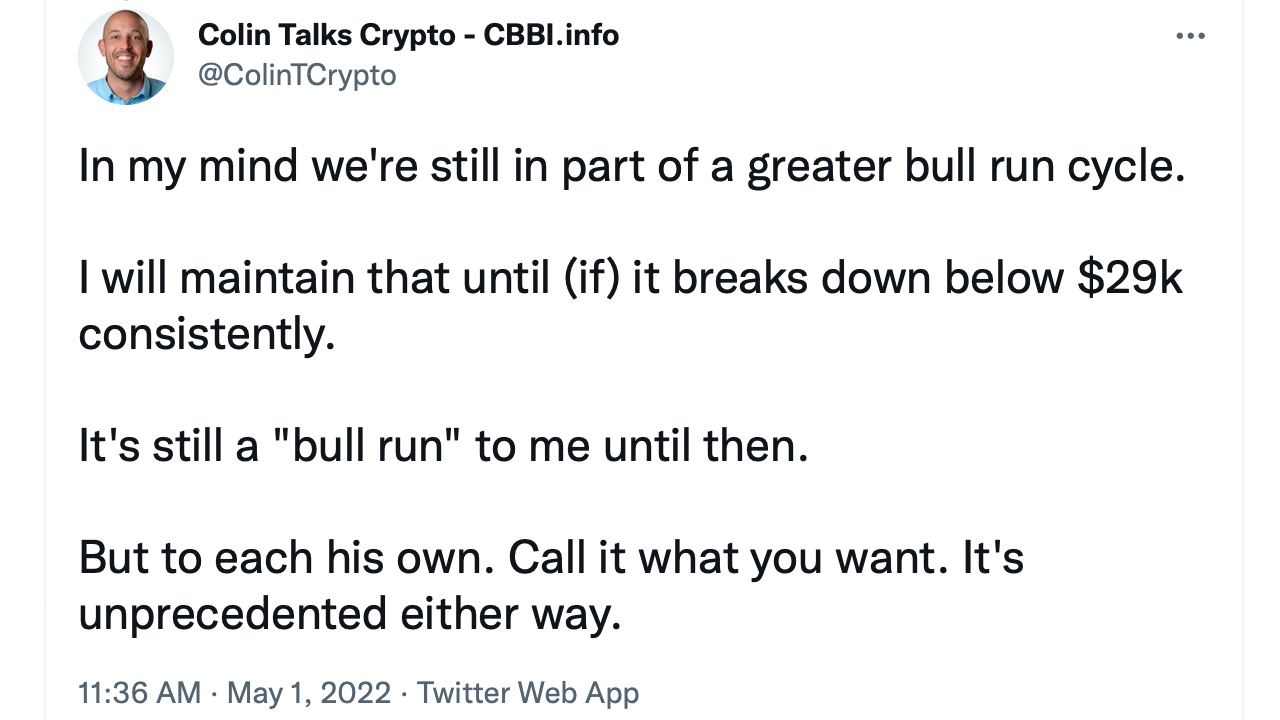

has seen something like three 80% or more drops, it’s seen much more 32-51% drops. One explanation bitcoin’s base may not be so unforgiving is on the grounds that the crypto resource’s pinnacle was not unreasonably tremendous. As a matter of fact, the last bitcoin bull run was longer and saw a lot more modest rate gain than past all-time highs. The crypto advocate and Youtuber BTC the milder bear market hypothesis on May 1.‘Colin Talks Crypto’ discussedFrom the August 17, 2012 pinnacle ($16) to the April 10, 2013 pinnacle ($259),

acquired 1,518.75% between that time span. Following that cycle, between the April 10, 2013 top and the November 2013 pinnacle, bitcoin acquired 349.03%. Then from the November 2013 top to December 2017 pinnacle, BTC hopped 1,590.97%.BTCThis time around, in any case, the December 2017 top to the November 2021 top was just 250.85%. It’s been the most reduced rate gain of all the significant bull runs in the crypto resource’s lifetime. The lower bounce higher could prompt a milder bitcoin bear market that is considerably less extraordinary than a 80% or more plunge.

In expansion to the more modest ATH, the approach the 2021 ATH was north of 400 days. The bitcoin bull run earlier (2017) just endured 200 days or generally a fraction of the time. This implies while the brunt of the ongoing bear market might be gentler it could be said, it might endure significantly longer than past bear cycles.

Labels in this story

$13800, 2013 bull, 2017 bull, 80% slump, Bear Market, Bear Run, Bearish, Bitcoin, Bitcoin (BTC), bottoms, Bull run, Bullish, Colin Talks Crypto, Crypto markets, longer bull, tops, more limited bear run, Softer Bear Market Theory, tops

What is your take on the chance of a gentler bear market that is more agreeable than the past 80% dives bitcoin experienced before? Tell us your opinion regarding this matter in the remarks area below.

Jamie Redman

![]()

Jamie Redman is the News Lead at Bitcoin.com News and a monetary tech columnist living in Florida. Redman has been a functioning individual from the cryptographic money local area beginning around 2011. He has an enthusiasm for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has composed in excess of 5,000 articles for Bitcoin.com News about the problematic conventions arising today.

Disclaimer: This article is for enlightening purposes as it were. It’s anything but an immediate proposition or sales of a proposal to trade, or a suggestion or underwriting of any items, administrations, or organizations.

doesn’t give venture, charge, lawful, or bookkeeping guidance. Neither the organization nor the writer is dependable, straightforwardly or in a roundabout way, for any harm or misfortune caused or affirmed to be brought about by or regarding the utilization of or dependence on any satisfied, labor and products referenced in this article.Bitcoin.comMore Popular News