Post-Shapella Hard Fork: Ethereum Deposits Exceed Withdrawals, Wait Time Climbs, ETH Transfer Fees Jump – Bitcoin News

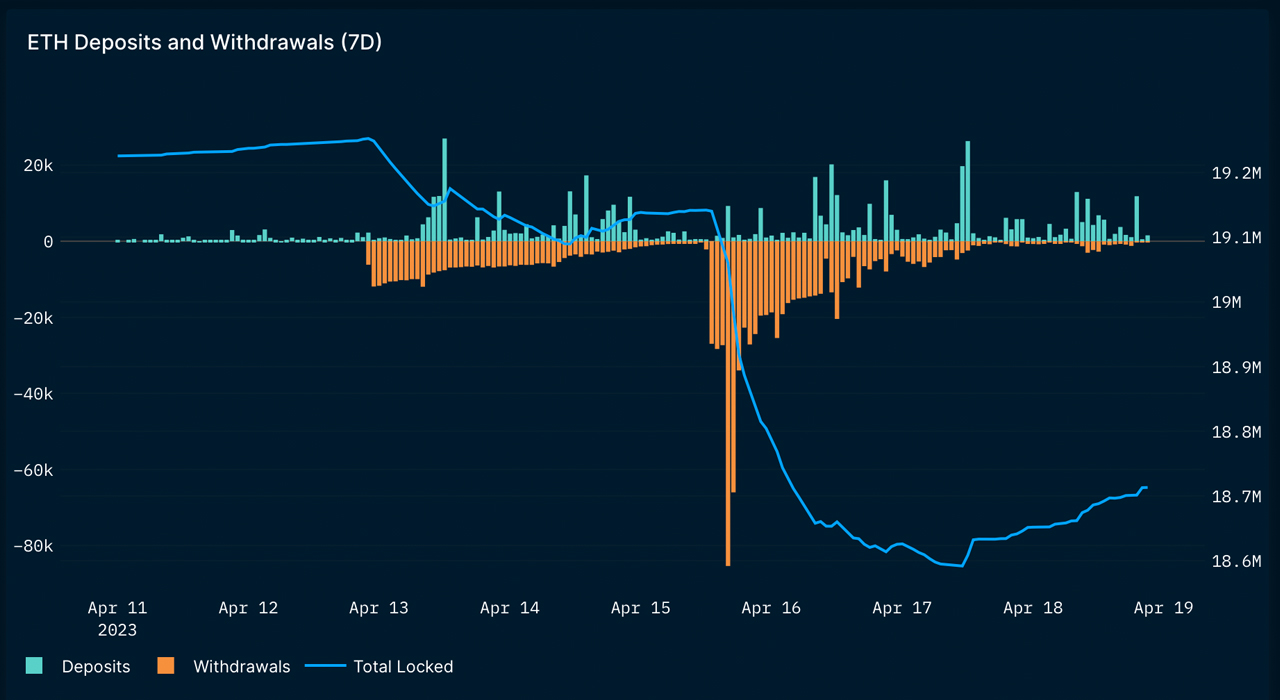

It has been every week since Ethereum’s Shapella onerous fork, and statistics point out that ethereum deposits on April 18 have exceeded withdrawals for the primary time because the improve. At current, 929,999 ether value $1.94 billion is pending withdrawal, and over the previous three days, 112,568 ether has been added to liquid staking protocols.

Simply Below a Million Ether Price Near $2B Waits to Be Withdrawn; Common Community Price Jumps Over $12 Per Transfer

For the reason that Shapella improve, market individuals have been intently monitoring Ethereum withdrawals as there was numerous debate prior to now over whether or not there can be large promote stress in the marketplace. Nonetheless, as of April 18, 2023, that has not been the case. Ethereum (ETH) is up 9% in opposition to the U.S. greenback over the previous seven days.

Throughout the week, withdrawals and people ready to withdraw have continued to climb, and at the moment, slightly below 1,000,000 ether, or 929,999, is in line to withdraw. On Tuesday, Nansen.ai statistics present that deposits have outpaced withdrawals, a primary since Shapella was carried out on April 12.

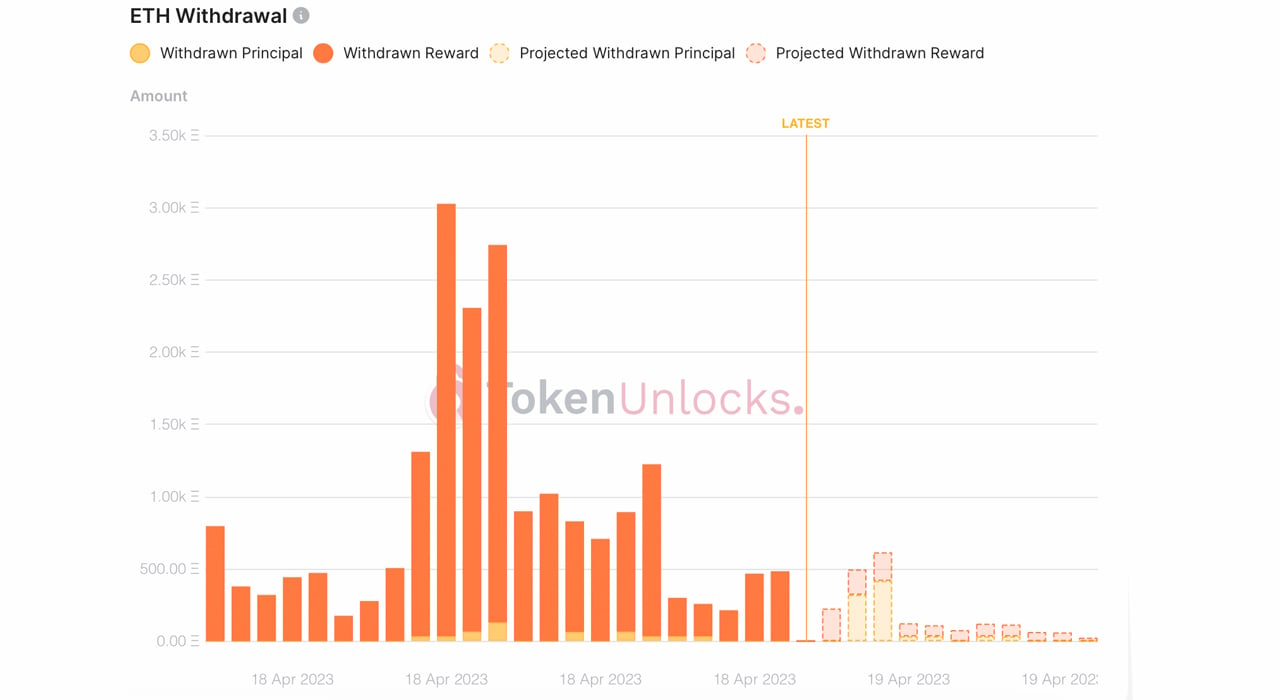

Shapella enabled ethereum stakers to withdraw each the total steadiness of a validator or a validator’s consensus layer rewards. When a full validator removes their 32 ether, they’re deactivating their validator place as an entire, whereas partial withdrawals enable stakers to easily withdraw rewards earned over the interval they began staking.

The withdrawal queue can take days for individuals, and statistics at the moment present that some unstaking individuals will wait shut to twenty days to unlock their funds. On Tuesday, information confirmed that deposits moved above withdrawals, with ether being added to liquid staking protocols like Frax, Lido, and Rocketpool this week.

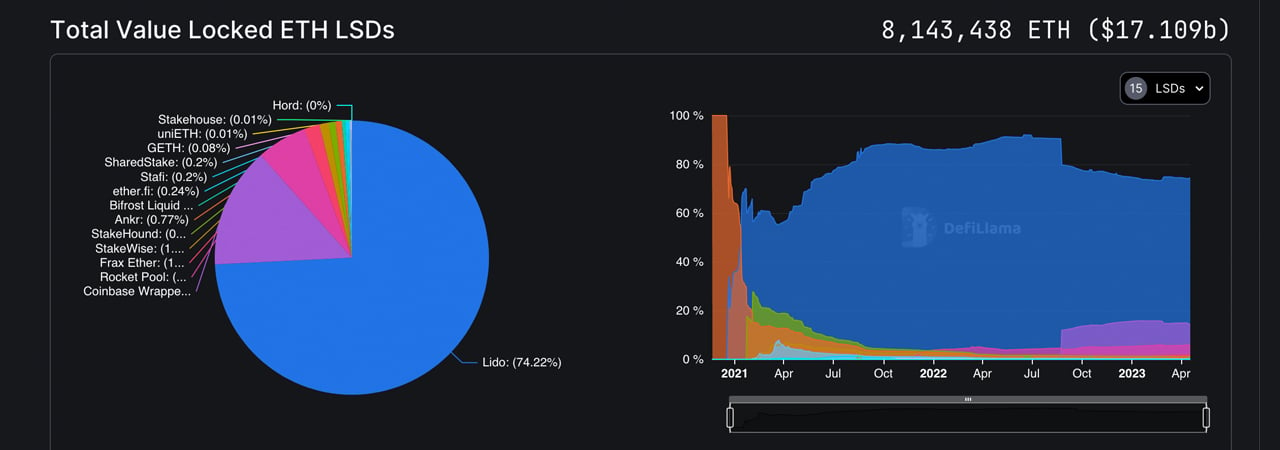

In response to liquid staking metrics from defillama.com on April 15, 2023, 8,030,870 ether was locked into liquid staking derivatives platforms. As of at this time, that quantity has elevated to eight,143,438 ether value $17.10 billion utilizing present ETH trade charges. The whole worth locked (TVL) within the liquid staking protocol Lido is $12.65 billion, which has elevated by 1.86% during the last seven days.

When it comes to the 8.14 million ether staked, Lido accounts for 74.22% of the market share with 6,044,058 ETH staked. Whereas Coinbase’s Wrapped Staked Ether protocol shed 2.84%, Rocket Pool recorded a 4.37% enhance. Seven-day metrics additionally present that Frax Ether’s protocol TVL elevated by 13.01%.

Information exhibits that the annual proportion price (APR) for staking ethereum is at the moment 4.87%, based on token.unlocks information. Statistics point out a bounce in increased Ethereum community charges through the week, as bitinfocharts.com information exhibits the typical Ethereum community transaction price is 0.0059 ETH or $12.45 per switch, whereas the median-sized Ethereum community transaction price is 0.0025 ETH or $5.30 per switch.

Etherscan.io’s gas tracker tool says a high-priority transaction will get by means of for 51 qwei or $2.92 per transaction. An Opensea sale prices $10.10, a Uniswap v3 swap prices $26.02, and to ship an ERC20 like Tether (USDT) will price an estimated $7.63 per switch.

Tags on this story

annual proportion price, APR, Bitinfocharts.com, Coinbase, consensus layer rewards, defillama.com, deposits, ERC20, Ethereum, Ethereum community charges, FRAX, Frax Ether, Funds, fuel tracker software, Lido, Liquid Staking, market individuals, Median-Sized, Nansen.ai, Opensea, Protocols, Rocket Pool, Rocketpool, promote stress, Shapella onerous fork, stakers, staking, Tether, token.unlocks, Transaction price, switch, TVL, U.S. greenback, uniswap v3, USDT, Validator, worth locked, withdrawal queue, Withdrawals, Wrapped Staked Ether

Do you suppose the pattern of accelerating deposits will proceed? Share your ideas about this topic within the feedback part beneath.

![]()

Jamie Redman

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss precipitated or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

Extra Widespread News

In Case You Missed It

Source link

#PostShapella #Hard #Fork #Ethereum #Deposits #Exceed #Withdrawals #Wait #Time #Climbs #ETH #Transfer #Fees #Jump #Bitcoin #News