Potential Impact Of BlackRock’s Bitcoin ETF On Coinbase Stock (COIN)

Justin Sullivan/Getty Photographs Information

Coinbase World, Inc. (NASDAQ:COIN) inventory has been on a wild journey this month. COIN inventory crashed when the SEC sued the corporate on June 5, however these losses have been erased by the enhancing sentiment towards cryptocurrencies. BlackRock, Inc. (BLK), the biggest asset supervisor on this planet which can also be part of our mannequin worth portfolio at Beat Billions, filed paperwork with the SEC on June 15 to launch a Bitcoin ETF with Coinbase because the custodian for Bitcoin that will probably be held with the ETF. This information helped cryptocurrencies achieve some traction after dropping steam in current weeks. Including extra gas to the rally, Fed Chair Jerome Powell made some interesting remarks in his testimony to the Home Monetary Providers Committee yesterday claiming that it’s time to deal with stablecoins as a kind of cash. The launch of BlackRock’s Bitcoin ETF might turn into a watershed second within the adoption of cryptocurrencies, and the Fed Chair’s remarks counsel the crypto sector will lastly see some correct regulation, which is an encouraging growth. Coinbase inventory, regardless of the looming menace of the lawsuit, is prone to strengthen within the coming weeks and is well-positioned to ship good-looking long-term returns after navigating the tough seas.

BlackRock’s Bitcoin ETF Will Be A Recreation-Changer

ETFs have taken the investing world by storm over the past twenty years, and BlackRock has performed a large position in reworking the funding administration business with a low-cost ETF portfolio protecting virtually all asset lessons an investor can consider. As of right now, traders don’t have an choice to realize publicity to Bitcoin by a spot ETF though a number of funds have been launched lately to trace the efficiency of Bitcoin. In case you might be questioning, a spot Bitcoin ETF will probably be backed by Bitcoin whereas the funds out there right now are Bitcoin futures ETFs which might be backed by Bitcoin derivatives.

The easiest way to grasp the significance of a spot Bitcoin ETF is to judge the impression of the primary gold-backed ETF again in 2004. Technically, the primary gold-backed ETF is the Gold Bullion Securities fund which was launched by ETF Securities and Graham Tuckwell in Australia again in 2003. However issues took off dramatically with the launch of SPDR Gold Belief ETF (GLD) by State Avenue World Advisors in November 2004. Gold ETFs are actually extensively utilized by particular person and institutional traders alike. In hindsight, we will establish a number of methods gold-backed ETFs have modified investing in gold eternally.

Gold ETFs have made it potential for traders of each scale and dimension to realize publicity to gold. Earlier than the launch of ETFs, investing in gold was primarily accessible to HNIs and establishments with the required capability to retailer gold bodily. Gold has gained reputation as the most effective hedges towards market downturns with the commodity now being extensively accessible. The rise of gold as a diversification device has been enabled by gold ETFs. ETFs have lowered the prices of investing in gold whereas making a liquid marketplace for the commodity. The success of ETFs has enabled funding administration corporations to introduce modern merchandise similar to gold mining ETFs and leveraged buying and selling devices, thereby increasing the investing neighborhood all for gold.

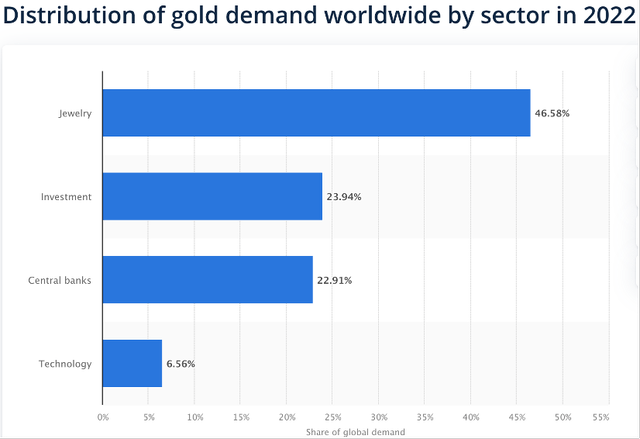

As illustrated under, near 24% of the entire demand for gold in 2022 got here from traders, which is a testomony to how the commodity’s reputation as an funding automobile has exponentially grown within the final twenty years.

Statista

Coinbase, primarily based on the outcomes of a survey of two,000+ Individuals, predicted final February that round 20% of Individuals have publicity to cryptocurrencies. This could possibly be an inflated determine, however even when we go by this statistic, it’s evident that the adoption of cryptos has an extended method to go within the U.S. alone. If BlackRock’s ETF obtains the required approvals from the SEC to draw retail traders, I imagine the curiosity in proudly owning cryptos will notably enhance much like what occurred with the launch of gold-backed ETFs twenty years in the past. Right this moment, many traders are ready on the sidelines due to regulatory uncertainty and the excessive worth of Bitcoin in comparison with different conventional investments. A Bitcoin ETF will tackle each of those issues, paving the way in which for Bitcoin and different cryptocurrencies to draw unprecedented demand. The launch of an ETF will even pave the way in which for institutional traders to spend money on Bitcoin as a diversification device.

A profitable approval of BlackRock’s Bitcoin ETF will probably be a inexperienced mild for different funding companies to launch comparable merchandise as nicely. That is precisely what occurred quickly after the approval of GLD by the SEC in 2004. Yesterday, WisdomTree filed an application with the SEC to permit an ETF backed by Bitcoin though its earlier functions in 2021 and 2022 had been rejected by the watchdog. This showcases how BlackRock’s software has already sparked enthusiasm amongst its friends. On June 21, Invesco additionally renewed its application with the SEC to get the approval to launch Invesco Galaxy Bitcoin ETF. That is simply the tip of the iceberg. If BlackRock or any of those asset managers efficiently launch a spot Bitcoin ETF, asset managers around the globe will line as much as launch such ETFs within the coming months to profit from the rising adoption of cryptocurrencies.

Coinbase Enjoys A Lengthy Runway For Progress

Because the main crypto alternate within the U.S., Coinbase enjoys an extended runway for progress. Within the brief run, nevertheless, the corporate should cope with elevated regulatory scrutiny, together with the lawsuit filed by the SEC. Within the worst-case situation, the corporate could possibly be compelled to discontinue its staking enterprise, which will probably be a success on the diversification efforts of the corporate though this enterprise phase accounts for a small share of income right now. The SEC’s allegation that Coinbase violated registration legal guidelines within the nation by permitting its customers to commerce 13 crypto property which might be deemed as securities with out registering them with the SEC is a much bigger concern as the corporate could possibly be met with a large monetary penalty to settle this. The market is prone to punish COIN inventory if this threat materializes.

In the long run, Coinbase needs to be a winner within the rising adoption of digital property. The corporate has positioned itself to profit from the speedy progress of this sector by providing a 360-degree product portfolio to enrich its alternate companies similar to crypto debit playing cards and lending merchandise. As I highlighted in my earlier article, the corporate has the potential to develop exponentially, however traders have to hold a detailed eye on a number of dangers which might be looming on the horizon, together with new tax reporting necessities, intensifying competitors, and regulatory scrutiny.

Takeaway

If BlackRock succeeds in acquiring the SEC’s approval to launch a spot Bitcoin ETF, crypto costs will surge larger. Given the robust constructive correlation between COIN inventory and Bitcoin costs, it’s affordable to anticipate Coinbase inventory to profit from this favorable growth. Earlier than Coinbase makes the many of the progress alternatives out there on this house, nevertheless, the corporate should navigate a tough few quarters characterised by regulatory crackdowns.

Source link

#Potential #Impact #BlackRocks #Bitcoin #ETF #Coinbase #Stock #COIN