Research: The Merge is causing a dissimilarity among Ethereum and Bitcoin SOPR

The generally market opinion not entirely set in stone by checking out at long haul market conduct. Nonetheless, while zooming out can place current economic situations into a greatly improved viewpoint, some of the time the most strong check of the market’s position lies in the middle.

SOPR and its worth in market analysis

The Spent Output Profit Ratio (SOPR) is a helpful measurement for deciding the general market feeling. As its name proposes, the measurement analyzes the worth of results when they were spent to when they were made. The measurement shows the level of acknowledged benefit for all coins continued on-chain in a specific time frame.

When SOPR surpasses one, the coins being referred to are executing at a benefit. At the point when the proportion is short of what one, the coins are executing confused. A SOPR proportion of 1 is known as a SOPR reset and is in many cases used to flag the beginning or the finish of a mid-term cycle. The SOPR reset can likewise go about as help in positively trending markets or as obstruction in bear markets.

While the measurement is a rudimentary and simple to-decipher signal, it tends to be additionally changed to introduce a significantly more perplexing business sector view.

For model, separating exchanges to eliminate any “in-house” action (e.g., exchanges between addresses having a place with a similar proprietor) is finished through aSOPR, which shows better market signals when contrasted with the crude information SOPR. The SOPR and aSOPR measurements can be additionally portioned into companions of long haul and momentary holders.

Bitcoin’s SOPR

For the initial time since May, Bitcoin’s 7-day MA SOPR has been attempting to break over 1. Toward the finish of July, Bitcoin’s SOPR contacted one and has been retesting it all through the primary seven day stretch of August.

Every time Bitcoin hit a SOPR of 1 and neglected to break opposition; its cost saw a short increase. Endeavors to break the SOPR obstruction have quite often related with bear market rallies, in some cases alluded to as dead feline bounces.

And while Bitcoin’s fruitless endeavors to get through the opposition could look negative, the standpoint is positive. By and large, it has consistently taken a few endeavors for SOPR to break over 1. The more it battled to get through the proportion of 1, the more grounded the help it had later on.

Graph showing the 7-day MA for Bitcoin’s SOPR (Source: Glassnode)

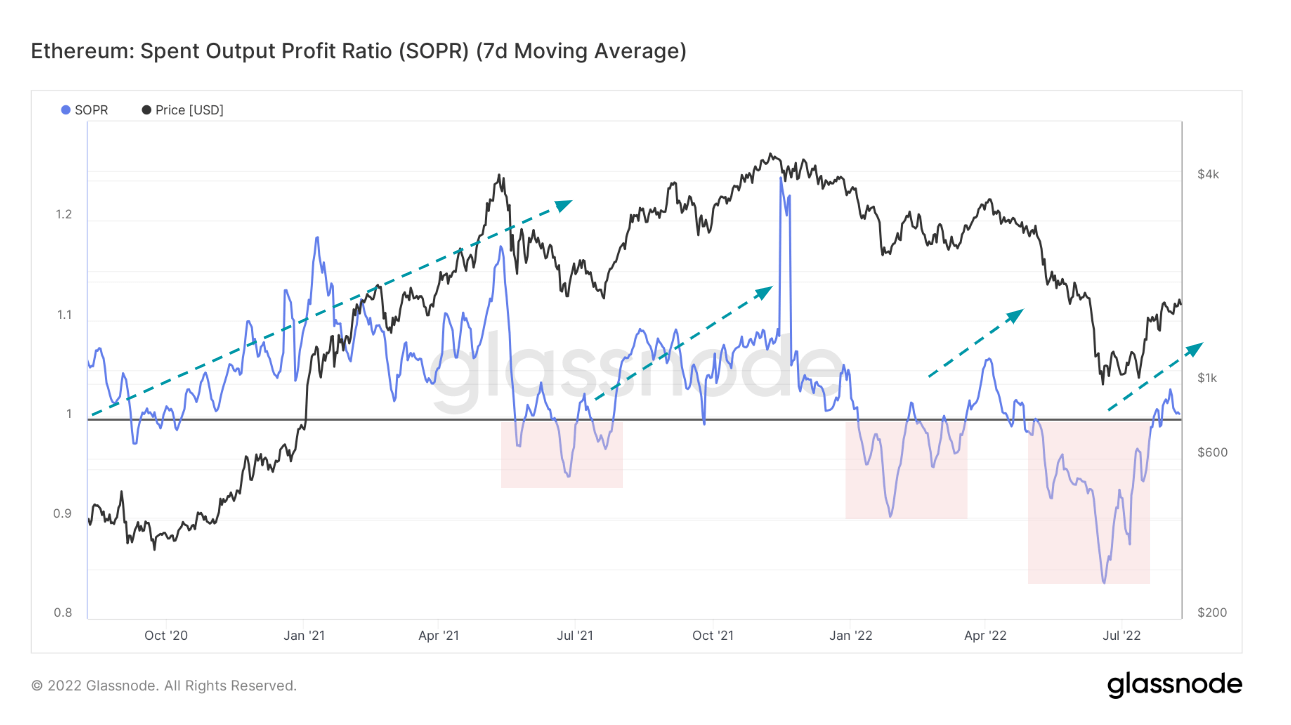

Ethereum’s SOPR

Unlike Bitcoin, Ethereum figured out how to penetrate over the SOPR of 1 at the principal endeavor. As of August, Ethereum appears to have tracked down help at 1, with information from Glassnode showing it immediately recuperated from its last drop. Ethereum’s rising SOPR is an immediate consequence of ETH’s rising cost, which has been challenging the more extensive market pattern that is keeping most coins somewhere down in the red.

However, while Bitcoin has been retesting its obstruction, Ethereum has been retesting its help, showing the two could be moving in inverse headings. By and large, for the spent result benefit proportion to go about areas of strength for as, the proportion expected to go through obstruction a few times for it to go about as support.

As recently covered by CryptoSlate, Ethereum’s market-resisting rally is to a great extent a consequence of hypothesis around the impending Merge. This is found in a huge expansion in subordinates exchanging, which pushed the open interest on Ethereum to $6.4 billion — $1.4 billion a greater number of than the open interest on Bitcoin. The ascent in subsidiaries exchanging stands diverge from the declining client movement on the organization, found in the dropping gas fees.

This measure of hypothesis seriously endangers the dependability of Ethereum’s SOPR. Any shortcomings in Ethereum’s cost will positively influence the proportion and push it under 1. If it somehow happened to drop unexpectedly, Ethereum’s SOPR could track serious areas of strength for down if it somehow happened to attempt to break over the level again.

Graph showing the 7-day MA for Ethereum’s SOPR (Source: Glassnode)

Graph showing the 7-day MA for Ethereum’s SOPR (Source: Glassnode)

Get an Edge on the Crypto Market

Become an individual from CryptoSlate Edge and access our selective Discord people group, more elite substance and analysis.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all advantages

Source link

#Research #Merge #causing #divergence #Ethereum #Bitcoin #SOPR