Riot Blockchain: Another Top Bitcoin Mining Stock (NASDAQ:RIOT)

artiemedvedev

Riot Blockchain (NASDAQ:NASDAQ:RIOT) is one other fast-growing Bitcoin (BTC-USD) mining firm that I’ve but to cowl on Searching for Alpha.

Whereas I do imagine Bitcoin might be accepted as cash all over the place sooner or later, I believe it is silly to commerce Bitcoin for US {dollars} in the intervening time.

Nonetheless, I need to provide you with a number of completely different Bitcoin-related corporations to select from, and Riot is without doubt one of the stronger ones.

This text will focus on professionals and cons of investing in Riot Blockchain inventory and share some key particulars concerning the firm’s future outlook.

Riot Overview

Riot Blockchain is an American Bitcoin mining firm that mines Bitcoin in Central Texas, USA. The corporate owns the one Bitcoin mining facility, Whitestone US, that has a complete energy capability of 750 MW.

Riot’s Whitestone Bitcoin Mining Facility (riotblockchain.com)

The corporate has 46,658 Bitcoin miners deployed at a hashrate of 4.8 EH/S.

In its most up-to-date Q2 2022 quarter, Riot generated $72.9 (Up 112% YoY) million in income and mined 1,395 (Up 107% YoY) Bitcoin in whole.

Web losses have been -$366.3 million for the quarter, resulting from principally Bitcoin impairment prices brought on by a drop in Bitcoin’s value.

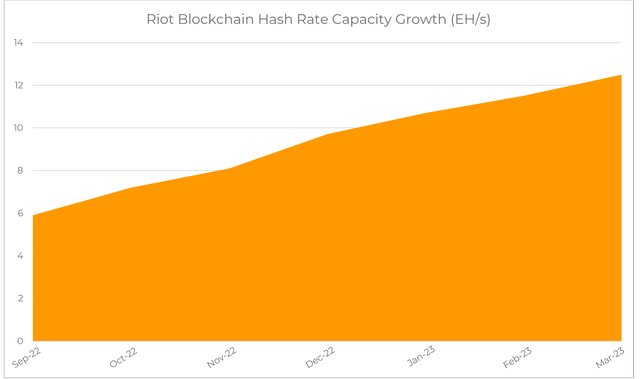

The corporate plans to extend its mining fleet to 115,450 ASIC miners by Q1 2023 at a 12.5 EH/s hashrate.

Riot’s 2023 Hash price development (riotblockchain.com)

With the intention to enhance future output, Riot introduced 265-acre, 1 gigawatt enlargement website in Navarro County, Texas, with Bitcoin mining operations on the new facility remaining on observe to begin subsequent summer time.

Riot holds 6,720 Bitcoin on its stability sheet as of August thirty first, 2022.

Whole worth of Riot’s money ($270 million) + Bitcoin holdings ($1343 million) equals $404 million. Buyers are paying nearly a 3x premium on the corporate’s short-term money holdings.

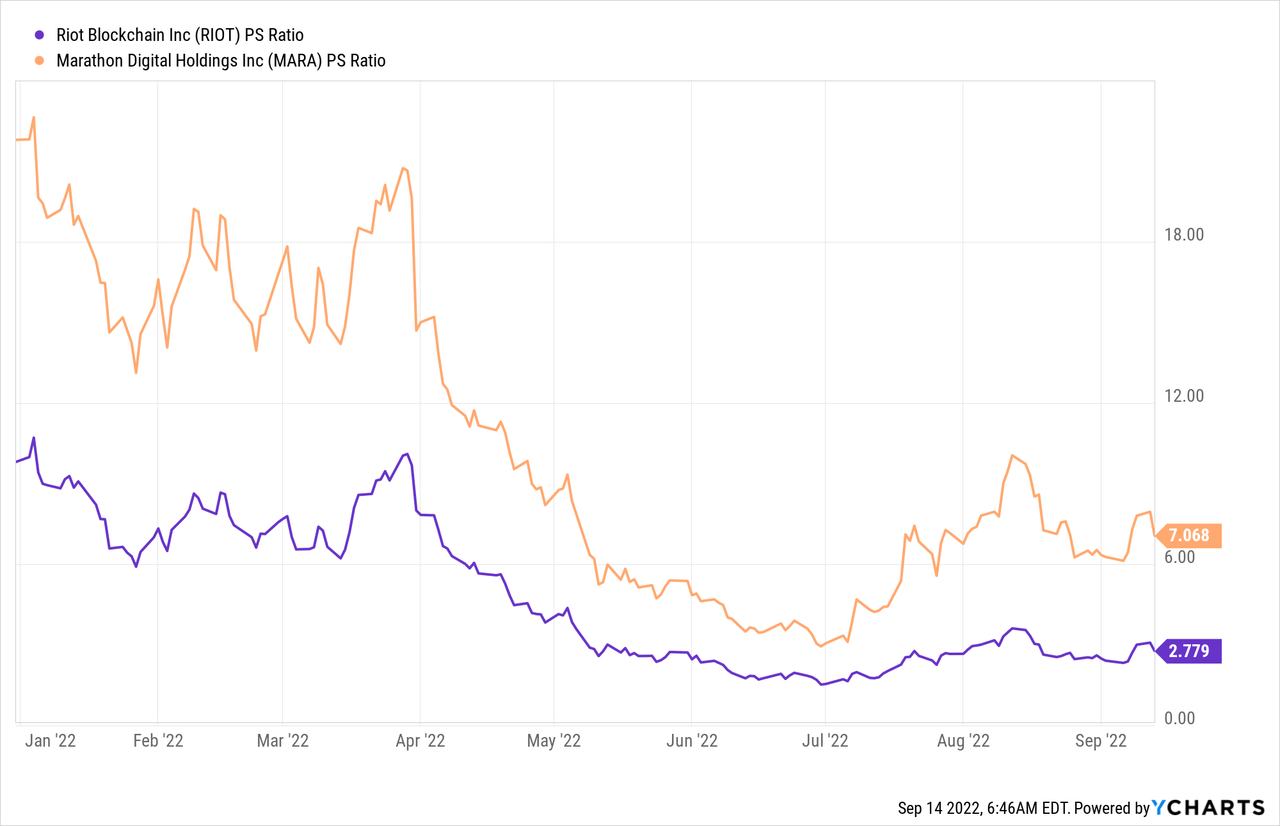

Riot trades at a Value to Gross sales ratio of two.77, which is cheaper than Marathon Digital’s (MARA) 7 P/S ratio.

RIOT PS Ratio knowledge by YCharts

RIOT PS Ratio knowledge by YCharts

In fact, extra traders purchase MARA inventory as a result of the corporate has practically 4,000 extra Bitcoin on its stability sheet (10,311 as of August thirty first, 2022).

My Opinion on Riot Blockchain

Riot produced some stable Bitcoin output in August 2022 throughout the present crypto bear market. Riot produced 374 Bitcoin (Down 17% YoY) and earned $3 million in energy credit that may be transformed into Bitcoin.

Riot produced twice as a lot Bitcoin as its foremost competitor, Marathon Digital Holdings, however the firm has made a couple of essential errors in my view.

August 2022 Bitcoin Manufacturing by Largest Publicly Traded Miners

Firm August 2022 BTC Produced Riot Blockchain (RIOT) 374 Marathon Digital Holdings (MARA) 184 Core Scientific (CORZ) 1,334 Click on to enlarge

Supply: Creator, from firm filings

Riot offered 355 Bitcoin in August 2022 for a complete of $7.7 million to strengthen its stability sheet. The corporate held round $270.5 million in money as of Q2 2022.

Riot’s fixed resolution to promote Bitcoin might be the one purpose why I do not personal RIOT inventory.

Bitcoin is a very powerful asset class of the longer term in my view, and I choose to spend money on corporations that use a long-term HODL technique.

Promoting Bitcoin at present market costs would not make sense resulting from all of the worry and panic surrounding the crypto markets.

Whereas Riot does have a formidable output, I want administration would use extra artistic methods to fund capital akin to promoting inventory or taking up low curiosity debt whereas Bitcoin costs are depressed.

Danger Elements

Riot has a number of potential issues to face if issues do not go as deliberate.

Bitcoin costs might be depressed over the subsequent 6 months and Riot’s money move might be affected by the crypto bear market. Promoting Bitcoin will value the corporate some huge cash in the long term if Bitcoin soars previous $100,000 into the 6 figures. Administration may remorse dumping a long-term exhausting asset for short-term good points. Riot might dilute shareholders via inventory choices to lift money sooner or later. Dilution is barely a superb choice if an organization HODLs its Bitcoin like MicroStrategy (MSTR) or Marathon Digital does. Inflation fears may drive the corporate to delay scaling its mining faciility, which is able to result in decrease Bitcoin manufacturing output. Power costs may enhance and cut back Riot’s Bitcoin manufacturing margins sooner or later.

Conclusion

Riot Blockchain is not my favourite Bitcoin mining inventory to carry as a result of I do not like corporations that promote Bitcoin to fund operations. Everytime you promote Bitcoin for US {dollars}, you might be displaying traders that you’re lengthy fiat currencies and brief Bitcoin.

Nonetheless, I do like Riot’s growing manufacturing and provides them a stable purchase score at these present value ranges.

If the crypto markets get well in 2023 then Riot Blockchain is a stable inventory to purchase when others are fearful proper now.

Source link

#Riot #Blockchain #Top #Bitcoin #Mining #Stock #NASDAQRIOT