Short-Term And Long-Term Bitcoin Holder Cost Bases Indicate Changing Market Conditions

The beneath is from a new release of the Deep Dive, Bitcoin Magazine’s premium business sectors bulletin. To be among quick to get these experiences and other on-chain bitcoin market investigation directly to your inbox, subscribe now.

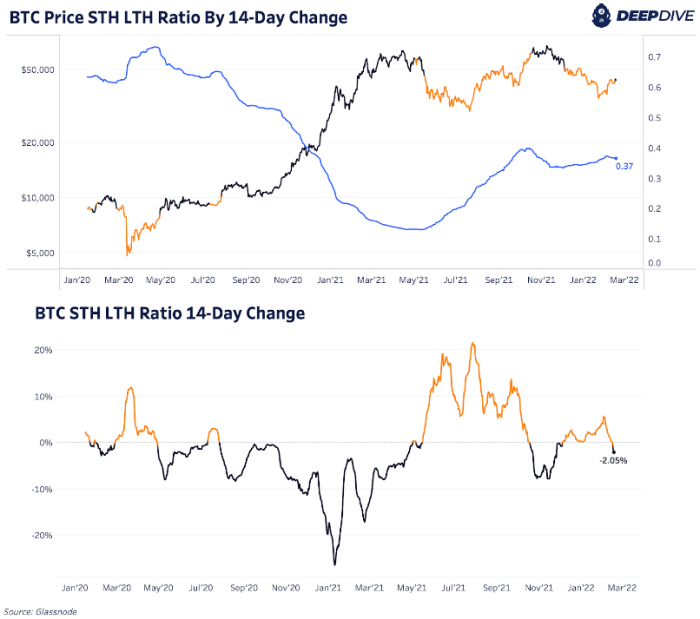

One of our top choice on-chain pointers as of late flipped bullish. The STH (transient holder) LTH (long haul holder) cost premise proportion as of late has begun to decline throughout the most recent two weeks, demonstrating a change in economic situations.

The metric is first clarified exhaustively in The Daily Dive #070.

Historically the metric has been one of the most accurate market indicators in Bitcoin, as the relationships between short-term and long-term holders and the acceleration/deceleration of cost basis of the two respective cohorts is quite informative.

The bitcoin value transient holder and long haul holder proportion’s 14-day change.

While it is actually the case that momentary holders are as yet submerged in total (comparative with the normal expense premise of the associate) the market assimilated loads of acknowledged misfortunes during the most recent couple of months, and with an overall amassing happening, the STH LTH Ratio has flipped back bullish.

A backtest of the proportion after some time represents itself:

The bitcoin value present moment and long haul holder proportion’s 14-day change.

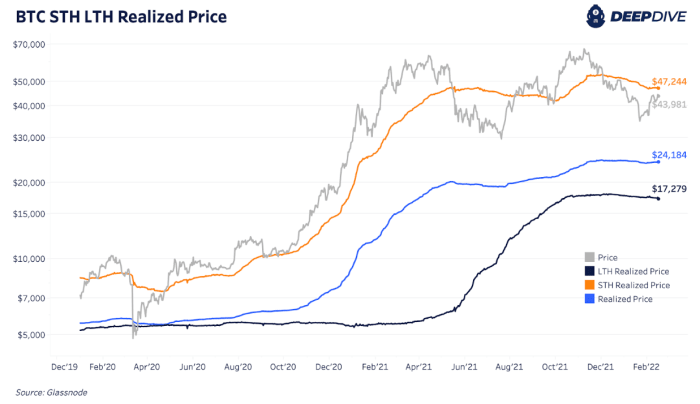

Below is a perspective on the information sources that go into the proportion itself:

The bitcoin transient holder and long haul holder acknowledged price.

Similarly, last Wednesday in The Daily Dive #144 we featured the bullish flip in the delta angle, another market energy metric.

Source link

#ShortTerm #LongTerm #Bitcoin #Holder #Cost #Bases #Changing #Market #Conditions