Spot Bitcoin Trading Volumes Remain Weak – A Threat to the BTC Bull Market Thesis?

Bitcoin. Supply: Adobe

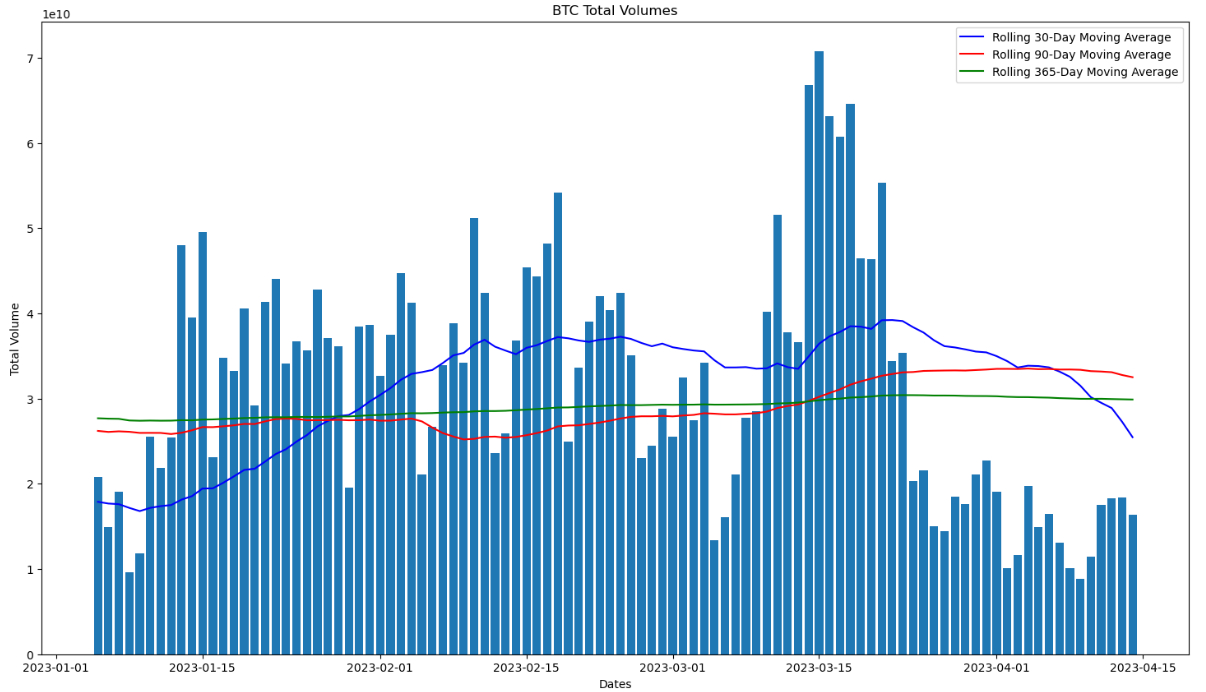

After hitting their highest ranges final month for the reason that aftermath of the FTX cryptocurrency change collapse final November because of vital volatility and 0 buying and selling charges on BTC pairs on Binance, spot Bitcoin buying and selling volumes have fallen considerably.

In line with information pulled from CoinGecko’s API, spot Bitcoin buying and selling volumes throughout main exchanges had been round $16.4 billion on Friday.

That compares to shut to $70 billion this time final month.

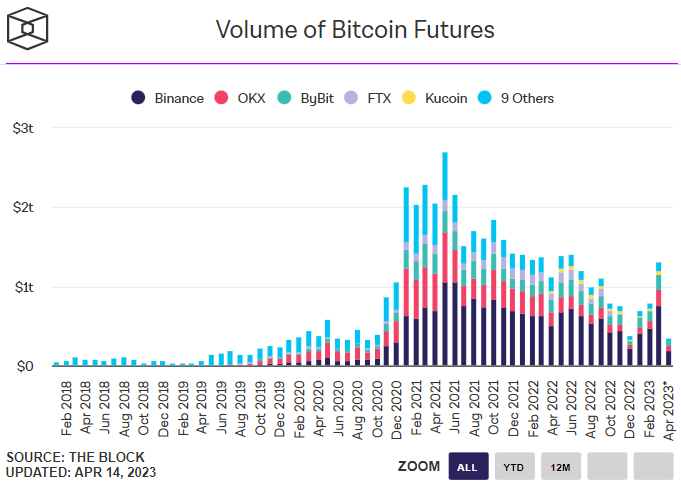

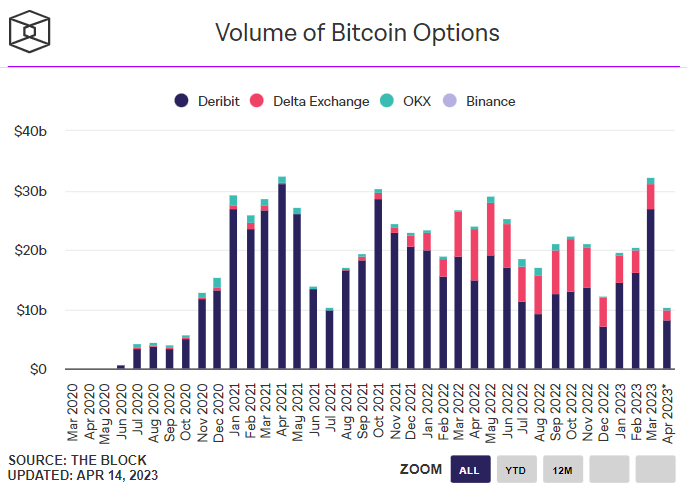

And it isn’t simply spot volumes which have weakened lately.

In line with information offered by crypto analytics web site The Block, mid-way by means of April, Bitcoin futures buying and selling quantity have solely reached round $350 billion month-to-date.

For the complete month of March, Bitcoin futures buying and selling volumes had been round $1.3 trillion.

Choices buying and selling volumes are additionally monitoring for a weaker month, in keeping with one other chart offered by The Block.

Weaker Volumes a Threat to the Bull Market Thesis?

Some may interpret weaker buying and selling volumes as indicative of softening demand for Bitcoin.

Whereas it is true that previous main buying and selling quantity spikes have coincided with value spikes, reminiscent of for Bitcoin within the first half of 2021, the connection between larger volumes and better costs is weak.

That’s borne out by the truth that Bitcoin has been in a position to proceed advancing to the upside in current weeks, regardless of buying and selling volumes fading.

Certainly, the BTC value rose above $31,000 for the primary time since final June on Friday, taking its features for the month to round 7.0% – a month that has seen volumes drop off considerably versus March.

For now, whereas a buying and selling quantity spike can be welcome (if pushed by an inflow on new demand for Bitcoin), the BTC value could effectively be capable to proceed pushing larger.

That’s as a result of Bitcoin has quite a lot of essential tailwinds proper now.

Bitcoin Set to Proceed Benefitting from Technical, Macro and On-chain Tailwinds

Chart evaluation means that continued Bitcoin value upside stays a definite probability.

Since breaking to the north of final month’s highs within the mid-$29,000s, the door has now been opened for BTC to hit the following main resistance space round $32,300 (the late-Could/June 2022 highs).

All of BTC’s main shifting averages are shifting larger in consecutive order and the 21-Day Shifting Common lately provided robust assist, a vote of confidence in Bitcoin’s short-term momentum.

Different longer-term technical alerts from the foremost shifting averages additionally constructive.

Bitcoin’s highly effective rebound in mid-March from a retest of the 200DMA (and realized value) just below $20,000 was interpreted by many as bull market affirmation on the time, and continues to supply tailwinds.

Furthermore, the golden cross loved by the BTC value again in early February – traditionally a really bullish sign for BTC – is one other longer-term technical tailwind for the worth motion.

Bitcoin’s 14-Day Relative Energy Index (RSI) is flirting with being in overbought territory, suggesting that the chance of short-term profit-taking is on the rise.

However this does not at all times stop BTC from persevering with on a good run of short-term features, with the current value rally from mid-January to February instance of this.

Constructive on chain traits are additionally indicative that Bitcoin’s buying and selling bias within the medium to long-term will stay decidedly to the upside.

Firstly, core on-chain metrics pertaining to community utilization (which thus act as a proxy of “demand” for the Bitcoin community).

Metrics reminiscent of day by day energetic deal with numbers, variety of addresses with a non-zero steadiness, variety of new addresses and variety of day by day transactions all proceed to development larger, in keeping with information offered by crypto analytics agency Glassnode.

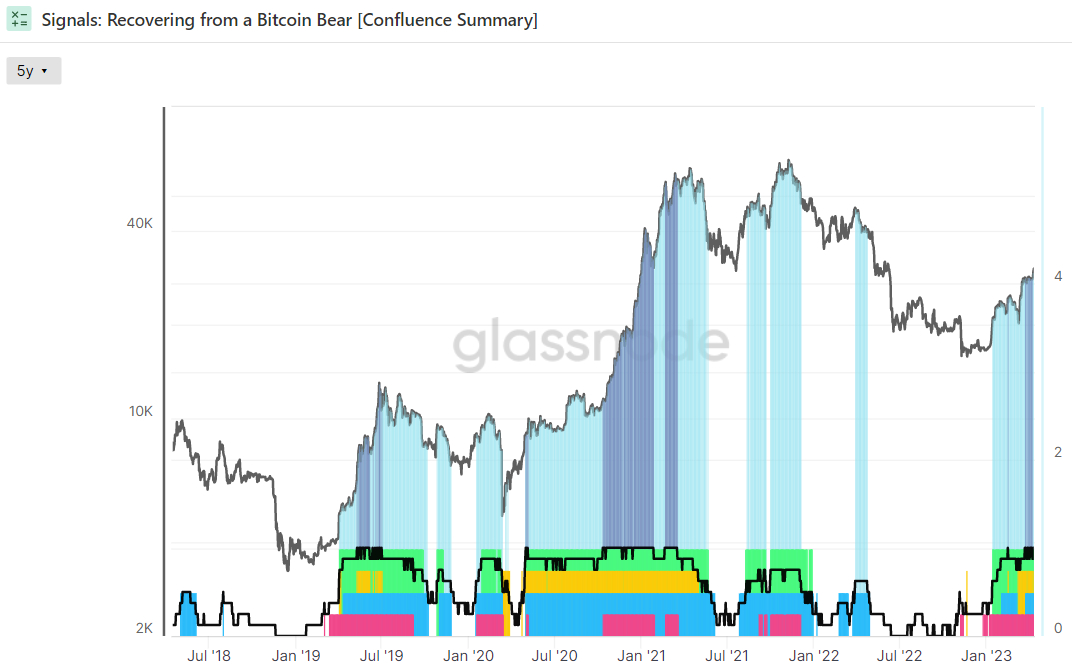

In the meantime, different on-chain metrics, reminiscent of these monitored in Glassnode’s “Recovering from a Bitcoin Bear” dashboard, are all screaming bull market.

This dashboard tracks eight indicators to determine whether or not Bitcoin is buying and selling above key pricing fashions, whether or not or not community utilization momentum is rising, whether or not market profitability is returning and whether or not the steadiness of USD-denominated Bitcoin wealth favors the long-term HODLers.

All eight indicators have now kind of been flashing inexperienced in unison since mid-March, the longest such spell in simply over two years.

Traditionally, the second when all the dashboard’s indicators flip inexperienced (i.e. proper now) has been a fantastic long-term purchase alternative.

If the US financial system is headed in the direction of recession and deflation and a Fed interest rate cutting cycle is coming, the macro situations are actually there for a continued Bitcoin bull market.

That’s to not point out a extensively anticipated continuation of Bitcoin’s (and extra usually, crypto’s) international adoption, which is de facto the primary long-term bullish argument.

Source link

#Spot #Bitcoin #Trading #Volumes #Remain #Weak #Threat #BTC #Bull #Market #Thesis