Starting around 2014, Roughly 42% of Failed Crypto Exchanges Have Disappeared Without a Trace for reasons unknown – Exchanges Bitcoin News

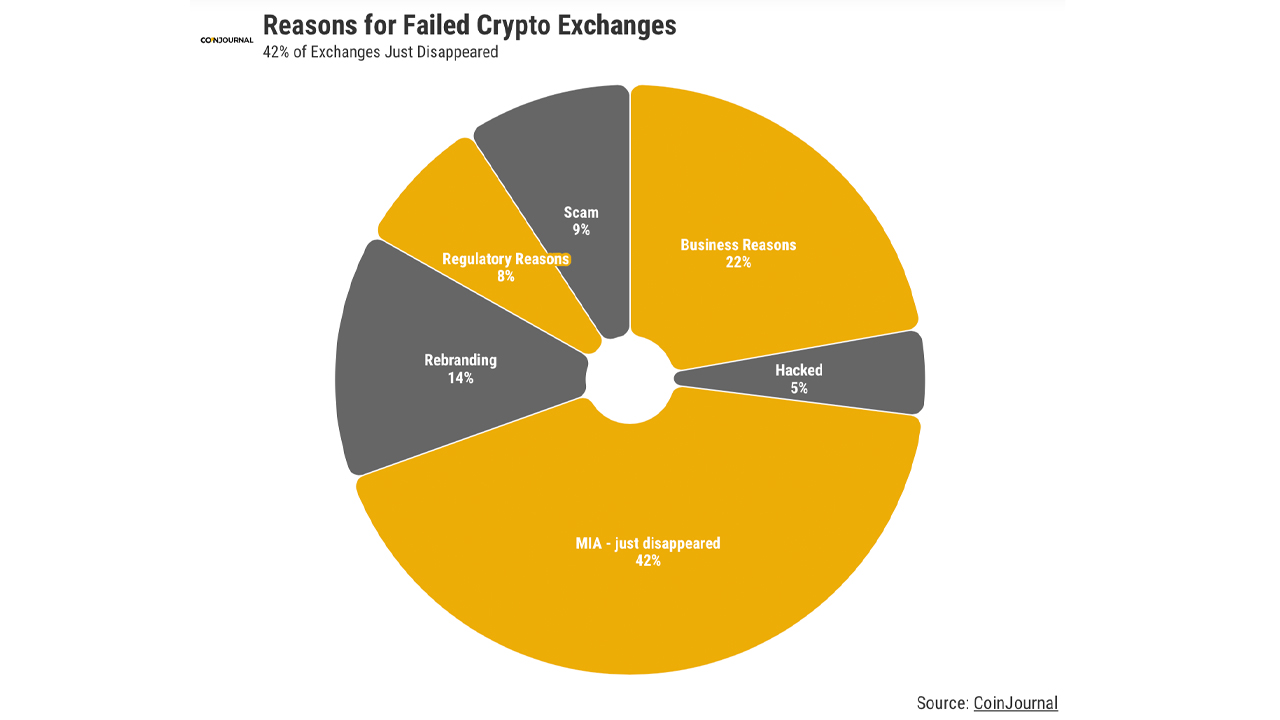

Just as of late, coinjournal.net distributed a report that shows the quantity of digital money trades that have fizzled during the most recent eight years. Curiously, the specialist’s information shows that 42% of fizzled crypto resource exchanging stages vanished suddenly, giving clients no great reason with regards to why the trade shut down.

During the Past 8 Years, Research Shows Only 22% of Failed Crypto Exchanges Have Left Due to Actual Business-Related Reasons

A report that covers bombed computerized money trades demonstrates that 42% of the multitude of trades that have fizzled starting around 2014 have given no glaringly obvious explanations concerning why the business floundered and the exchanging stages fundamentally vanished from the business absent a lot of notice.

22% of the fizzled crypto trades during the most recent eight years left because of genuine business-related reasons, as indicated by coinjournal.net’s examination. 9% of the exchanging stages ended up being through and through tricks and fake organizations at every turn.

“Following 23 exchanges going under in 2018, this number exploded upwards by 252% in 2019, before increasing a further 17% in 2020,” coinjournal.net’s report makes sense of. “Remaining at the same level in 2021, this year there has finally been improvement, with a 55% reduction in failures if the rest of the year follows the first six months.”

In a remark shipped off Bitcoin.com News, Dan Ashmore, a CFA and digital money information expert at coinjournal.net, made sense of that measurements like these ought to be tidied up. “If cryptocurrency is to be taken seriously and fully establish itself, it needs to continue to clean up its image and leave damning statistics like these behind,” Ashmore commented.

Moreover, the report takes note of that while 2022 has not finished, it is normal that the year will see a 55% fall in by and large crypto trade disappointments. “In regards to the amount simply vanishing into thin air, one could expect this to lower – regulation is still far behind, but it has at least made progress and should make it more difficult for exchanges to vanish without a trace,” the coinjournal.net report adds.

The report comes when a bunch of crypto organizations have been experiencing monetarily the crypto winter. Cutbacks have been spreading across the crypto business during the most recent couple of months as huge number of crypto representatives have been given up.

Besides, three huge bankruptcies have pushed Celsius, Three Arrows Capital (3AC), and Voyager Digital to declare financial insolvency security. To some degree half of twelve advanced cash stages have frozen withdrawals.

This previous Wednesday, the exchanging stage Zipmex paused withdrawals and said it was experiencing “financial difficulties [from] of our key business partners” brought about by the crypto market slump.

Following the respite, the Thailand Securities and Exchange Commission (SEC) has asked Zipmex for what valid reason it has stopped withdrawals in a letter distributed on Wednesday.

Labels in this story

2014, 22, 42%, 8 years, insolvencies, Celsius, crypto trades, Crypto Lenders, crypto exchanging stages, Crypto Winter, digital currency information examiner, Dan Ashmore, Exchanges, fizzled crypto trades, frozen withdrawals, Percentages, Thailand SEC, Three Arrows Capital (3AC), Voyager Digital, Zipmex

What is your take on the exploration report distributed by coinjournal.net? Tell us your opinion regarding this matter in the remarks area below.

![]()

Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons, coinjournal.net

Disclaimer: This article is for enlightening purposes as it were. It’s anything but an immediate deal or sales of a proposal to trade, or a suggestion or support of any items, administrations, or organizations. Bitcoin.com doesn’t give venture, charge, legitimate, or bookkeeping counsel. Neither the organization nor the writer is dependable, straightforwardly or by implication, for any harm or misfortune caused or claimed to be brought about by or regarding the utilization of or dependence on any happy, labor and products referenced in this article.

More Popular News

In Case You Missed It

Source link

#Roughly #Failed #Crypto #Exchanges #Disappeared #Trace #Apparent #Reason #Exchanges #Bitcoin #News