State of Decentralized Finance Remains Lackluster, Value Locked in Defi Slid 67% in 6 Months – Defi Bitcoin News

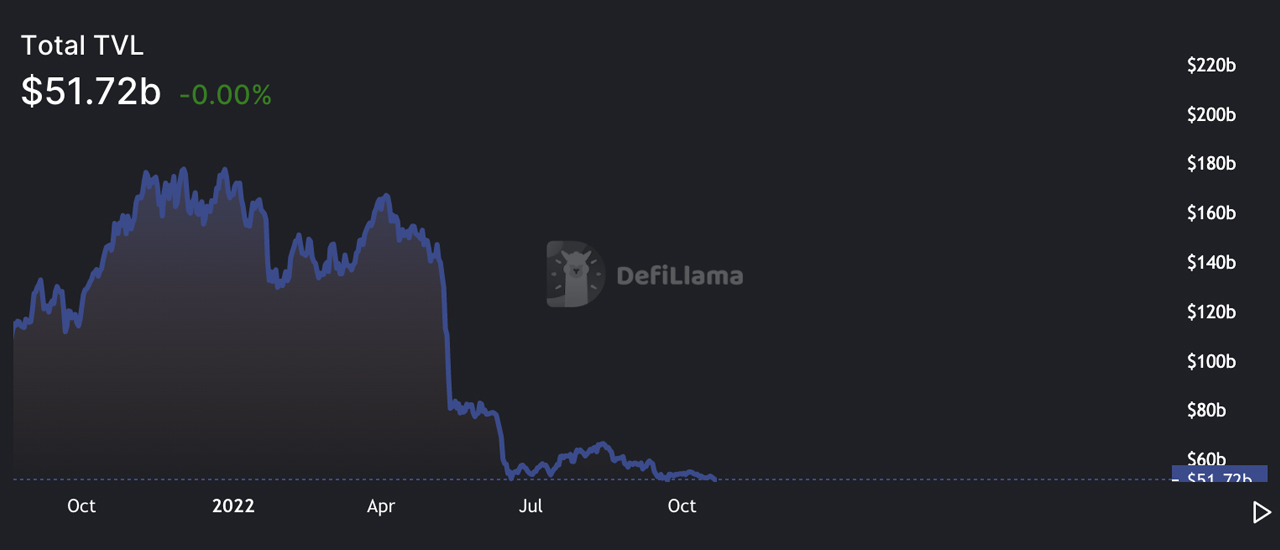

Over the last 125 days or roughly 4 months, the overall worth locked (TVL) in decentralized finance (defi) has been vary certain inside the $50 billion to $65 billion area. The TVL in defi has shed important worth through the previous six months because it dropped from $161 billion on April 1, down greater than 67% decrease to immediately’s $51.72 billion.

TVL Dropped Extra Than 67% in 6 Months, Defi Market Motion Remains Vapid for 4 Months

Defi motion has subsided a fantastic deal by way of the overall worth locked over the past six months. On Saturday, October 22, 2022, the TVL in defi is round $51.72 billion, with the collateralized debt place (CDP) protocol Makerdao commanding 14.76% of your complete TVL with $7.64 billion on Saturday morning (ET).

Whole worth locked (TVL) in decentralized finance (defi) on October 22, 2022, in keeping with defillama.com.

Whole worth locked (TVL) in decentralized finance (defi) on October 22, 2022, in keeping with defillama.com.

Along with Makerdao, Lido, Curve, Aave, and Uniswap make up the highest 5 largest TVLs immediately. The liquid staking protocol Lido is slightly below Makerdao with a TVL of round $6 billion and $5,839,046,587 of Lido’s TVL is staked ethereum (ETH).

Makerdao recorded a 30-day enhance in worth because the TVL jumped 4.82% larger final month. Sushiswap noticed a notable enhance, rising 41.27% over the past 30 days, and the yield protocol Aura jumped 38.70% over the past month.

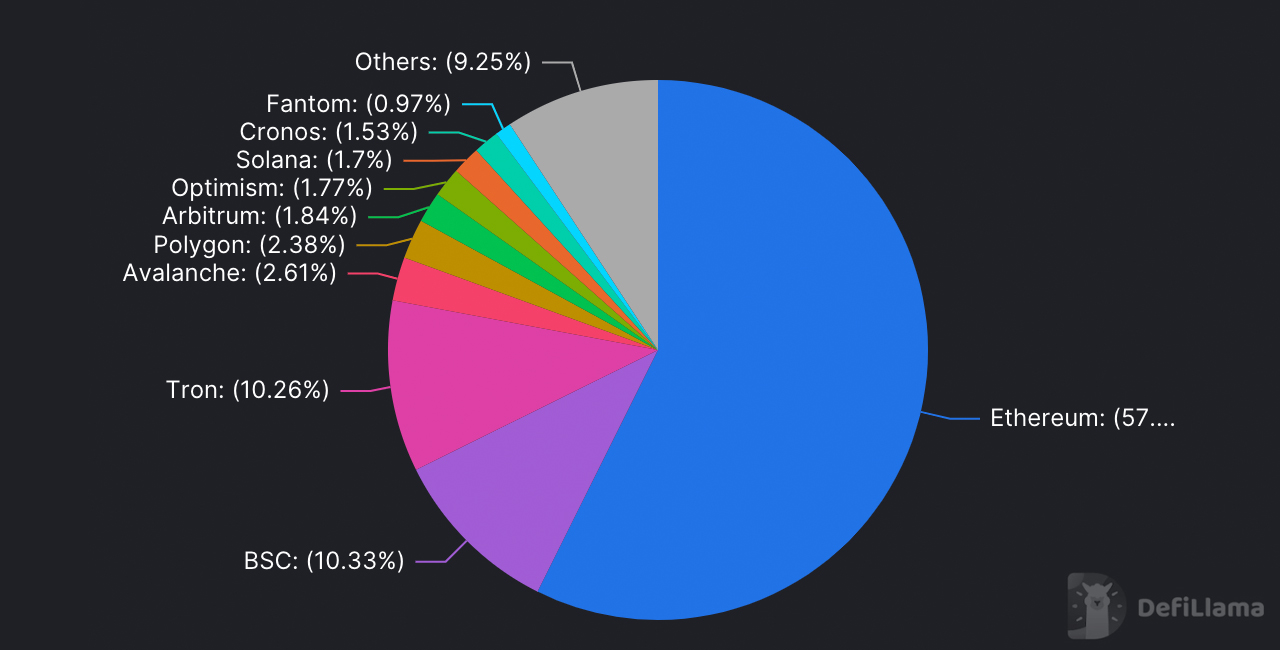

TVL in defi distributed throughout blockchains. Ethereum dominates by 57% on October 22, 2022, in keeping with defillama.com.

TVL in defi distributed throughout blockchains. Ethereum dominates by 57% on October 22, 2022, in keeping with defillama.com.

Out of all of the blockchains immediately, Ethereum is probably the most dominant by way of defi TVL with roughly 57% of your complete $51.72 billion locked in defi immediately. ETH has round $29.56 billion, whereas the second largest TVL by blockchain, Binance Sensible Chain (BSC) has $5.32 billion or 10.33% of the combination worth locked.

Apart from ETH and BSC, Tron, Avalanche, Polygon, and Arbitrum observe behind, respectively, by way of TVL by blockchain. At this time, statistics present there are 607 decentralized trade (dex) protocols with $21.57 billion locked.

There are 189 lending defi apps with $13.96 billion locked on Saturday and 57 CDP protocols command $10.37 billion. There’s additionally a complete of 45 liquid staking functions that maintain $7.91 billion in worth immediately.

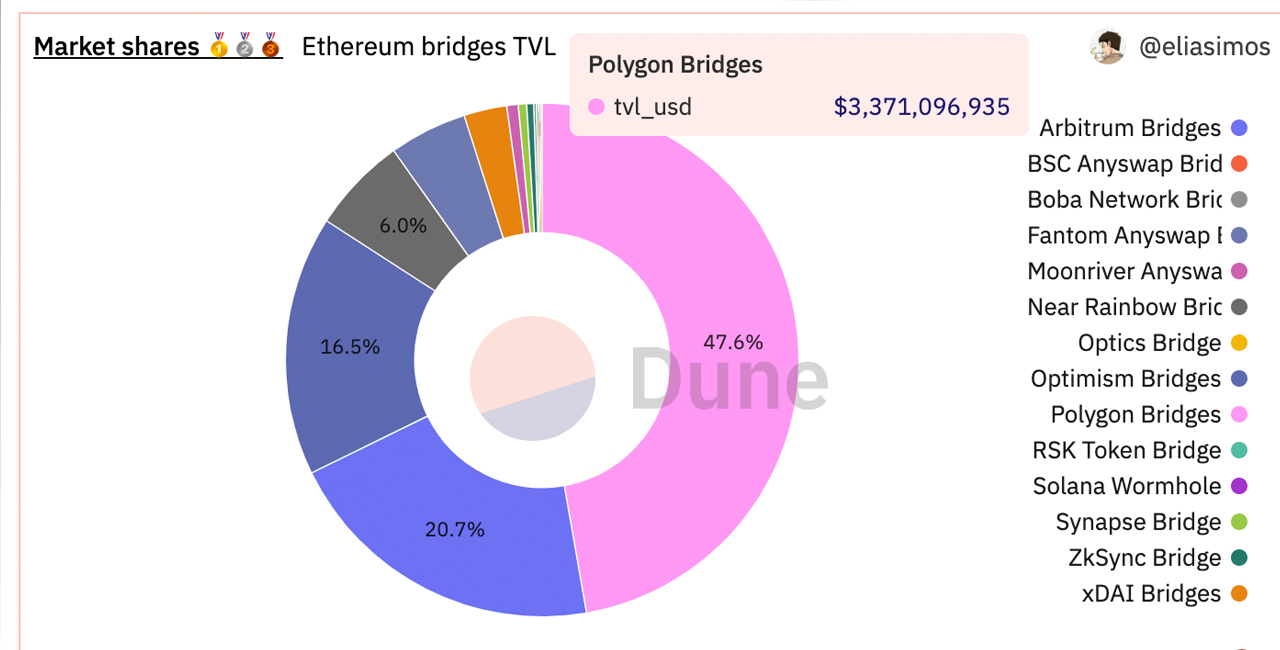

Cross-chain bridge market shares in decentralized finance on October 22, 2022, in keeping with Dune Analytics.

Cross-chain bridge market shares in decentralized finance on October 22, 2022, in keeping with Dune Analytics.

The worth locked in cross-chain bridge platforms can also be down 22% decrease through the previous 30 days. $7.80 billion is locked on decentralized cross-chain bridge platforms with 13,178 distinctive depositor addresses complete.

Polygon is main the bridge pack with roughly $3.37 billion TVL, however the TVL is down 6% through the previous month. Arbitrum has round $1.44 billion which is down 2% decrease than the month prior.

Polygon and Arbitrum bridges are adopted by Optimism, Fantom, and the Close to Rainbow bridge. The sensible contract platform token market cap immediately is value $281 billion and it has elevated 1.4% over the past 24 hours.

The highest 5 sensible contract platform tokens immediately by way of market capitalization embody ethereum (ETH), bnb (BNB), cardano (ADA), solana (SOL), and polkadot (DOT). ADA, SOL, and DOT have seen losses between 3.4% and 6.8% over the past week. ETH and BNB have remained within the inexperienced over the past seven days, up between 0.3% to 0.8% this previous week.

Tags on this story

ada, Arbitrum, Avalanche, AVAX, binance coin, Binance Sensible Chain, Bridges, Cross-chain Bridges, Crypto, crypto property, decentralized finance, DeFi, Defi protocols, Defi Whole Value Locked, DOT, ETH, Ethereum, Ethereum (ETH), Fantom, Close to Rainbow, Optimism, Polkadot, Polygon, Sensible Contract Platforms, Sensible Contract Tokens, complete worth locked, buying and selling, TVL, TVL in defi

What do you concentrate on the present state of decentralized finance and sensible contract platform tokens? Tell us what you concentrate on this topic within the feedback part beneath.

![]()

Jamie Redman

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any harm or loss brought on or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

Extra Well-liked News

In Case You Missed It

Source link

#State #Decentralized #Finance #Remains #Lackluster #Locked #Defi #Slid #Months #Defi #Bitcoin #News