The European Union’s Attack On Bitcoin Is An English And Math Comprehension Problem

This is an assessment publication by Beautyon, the CEO of Azteco and a supporter at Bitcoin Magazine.

A gathering of severe, contorted PC uneducated people in the overwhelmed European Union have figured out how to persuade the European Council that bitcoin is cash, that Bitcoin wallets are genuine wallets that hold real equilibriums between cash and that they ought to be managed. This is obviously absolutely crazy and a thought borne out of significant ignorance.

Since it is preposterous to expect to have a levelheaded contention with individuals like this, another, better procedure of managing these vicious kinds should be planned and carried out. They’re focused on the possibility that bitcoin is cash and, from the seed of this mixed up thought, an enormous Pandora’s Box of fiendish has been opened.

“Bitcoin is not money. If you seek “compliance” you are requesting inconvenience. Individuals who need to see the boundless and fast reception of Bitcoin shouldn’t look for tight guideline and the gift.” — Beautyon

In request to keep away from the exploitative assaults of the spilling geriatrics in the United States and the capricious EU communists, Bitcoin wallet programming engineers should devise a technique to avoid the line of sight of the exceptionally misinformed apparatchiks dead set on harming Bitcoin businesses.

Every regulation that contacts Bitcoin involves misleading language as definition and guise. These definitions come from rescue vehicle chasers and not PC researchers or programming engineers. By re-contextualizing Bitcoin wallets, it will be feasible to absolutely get away from the surge of annihilation being arranged by the EU and U.S. legislators.

This is the manner by which you do it.

Bitcoin wallet engineers, normally, have focused on utilizing the shows of cash to decipher what’s going on in the engine into something customary individuals can comprehend. There is no “coin management” or UTXO data showed to clients in the purchaser grade Bitcoin wallets: BlueWallet, Wallet of Satoshi, Samourai, Pine, Phoenix, Muun; that is all stowed away on the grounds that it is of no utilization to consumers.

No typical individual can manage coin control, UTXOs or anything like that.

Instead, a bunch of natural, straightforward and basic shows has been acquired from the universe of banking to make everything in Bitcoin justifiable to ordinary people.

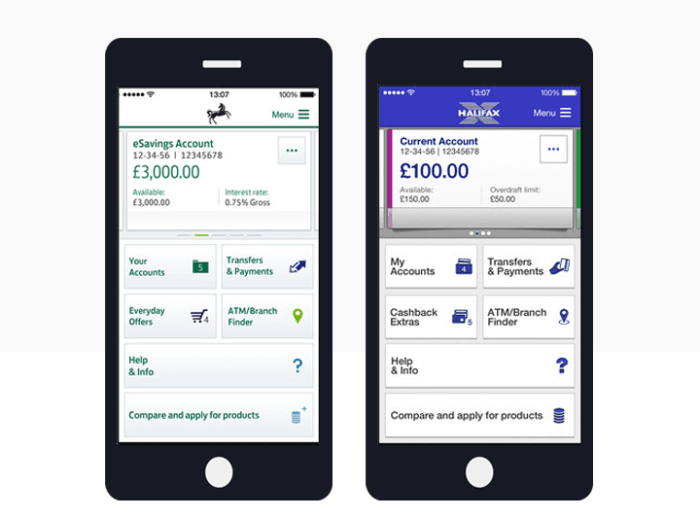

This is the reason Bitcoin wallets have taken on the appearance, terminology and ways of banking applications, which regularly look something like these applications from Halifax and Lloyds respectively.

Bank applications from Lloyds and Halifax. Clearly paid off the rack from a similar developer.

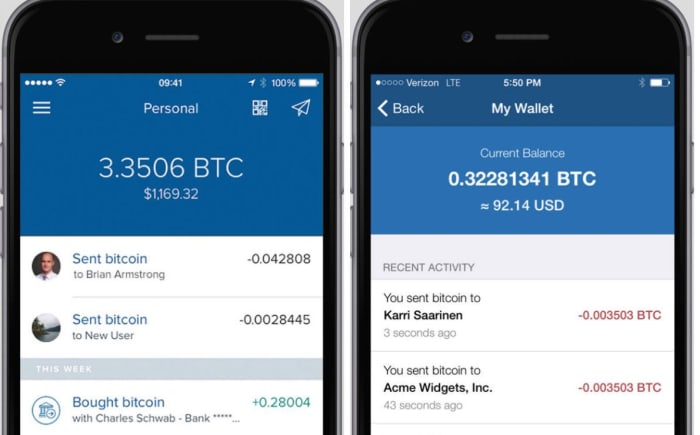

Below is an image of Coinbase’s telephone application, which closely resembles a bank app.

Coinbase telephone app

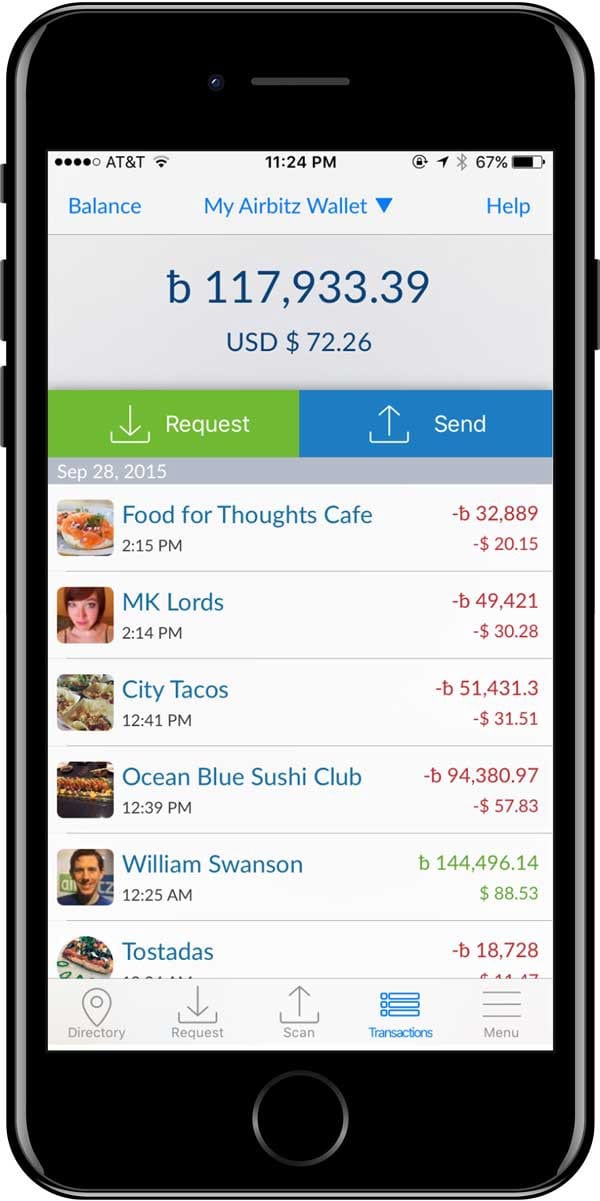

Now Airbitz:

Airbitz dashboard

When a typical, uninformed, PC uneducated individual from the EU government takes a gander at any Bitcoin application, they remember it as a monetary instrument since it very closely resembles the monetary applications they knew all about. Concerning what is happening under the hoods of these totally different classes of apparatuses, they do not know. They just see the surface and make every one of their decisions in light of that by itself. For this reason they reflexively conflate Bitcoin with cash and think that the equilibrium in a Bitcoin wallet is undifferentiated from the fiat balance in a banking app.

“There is a lot of talk about using “Blockchains” to further develop information trustworthiness, however what this multitude of arrangements neglect to address is what I call “The Flat Screen Dilemma”. Since something is shown on a screen, it doesn’t follow that it is valid.” — “The Flat Screen Dilemma”

The truth is totally different, in any case. Bitcoin applications show you the all out of the UTXOs that you have command over by goodness of you being in control of the confidential key. That is an amount of UTXOs; it’s anything but a solitary equilibrium. Moreover, that “money” isn’t on the gadget. What is on the client’s gadget is an application that stores a cryptographic key (a line of message) that permits you to sign directives for broadcast to the Bitcoin organization. Bitcoin wallets don’t contain or get bitcoin. They essentially let you know what your confidential key can finish paperwork for on the block chain.

By saying this, I am clearly working on the cycle. Be that as it may, the disentanglement I am introducing here is more exact than saying a Bitcoin wallet “receives and stores bitcoin,” which never under any circumstance occurs and never has occurred. It is likewise off-base to describe a Bitcoin wallet as “unhosted” in the event that it can sign a message on order of a client without reference to any other person. There are no “wallets” in Bitcoin by any means. It’s simply one more analogy.

Bitcoin is an information base. It’s anything but a “payment network” nor is esteem “sent” over it by any means. There are no “wallets” by the same token. Marked messages are shipped off the organization for consideration in the public data set. It is a data set used to track who controls which yields. It isn’t — and never has been — cash in the ordinary sense. Since individuals utilize this information base as cash doesn’t imply that bitcoin is cash. Since individuals utilize the word “wallet” doesn’t intend that there are genuine “Bitcoin wallets” that hold bitcoin the manner in which a cowhide wallet holds cash.

Using the word “wallet” for client experience is a show to assist with making the essential capability of devices justifiable for clients. Those shows are a decision, not a standard and they are not a well known fact, by the same token. That implies that anybody can pick any show or any relationship they need to look at what occurs in their Bitcoin application. Not difficult to imagine oil merchants could utilize the block chain to name barrels of oil involving barrels as estimation. Today, one barrel of oil is 0.0048 bitcoin/barrel. In an oil merchant’s wallet this could be addressed as “100” assuming the broker had 100 barrels appearing on his gadget as distributed to his confidential key in an UTXO.

In this situation, which is absolutely conceivable, nobody could guarantee that “bitcoin is oil” — however perhaps they could? Apparatchiks are totally crazy and crazy reasoning you’d anticipate from them.

BlueWallet does just give the client shows clients can comprehend. It’s anything but an “unhosted wallet;” it is a block chain watcher and marking gadget. By no means, is a Bitcoin wallet on a cell phone a “financial tool” of any sort. In the event that extremely numbskulls were to group a marking gadget as a monetary device, then, at that point, numerous other programming devices would be caught by that craziness right away. BlueWallet could turn to the oil business tomorrow and begin calling itself “OilWallet.” The way that individuals use bitcoin as cash is unessential to bitcoin’s tendency. They trade it for labor and products and cash while “OilWallet” is utilized to deal with the trading of barrels of oil. Normal to this is all Bitcoin is just a data set; what you credit to it is doing you and doesn’t have anything to do with its major nature.

WhatsApp involves the very same encryption strategies as Bitcoin does to validate clients to one another. You have a couple of cryptographic keys that you use to scramble, decode and sign messages so the other individual accepting your call or messages or pictures realizes it came from you and might have just come from you. Clients of WhatsApp are not presented to how the entirety of this functions, similarly that clients of Bitcoin wallets are not shown the message of their confidential keys. The product deals with all of that for the client and essentially gives them data that is helpful to them. On account of WhatsApp, that valuable data is instant messages. In Bitcoin the amount of UTXOs are related with your confidential key that are composed into the public data set of the chain of blocks.

“So what is the answer?” I hear you bleating.

The answer is to call Bitcoin wallets “viewers” and “signers.”

If wallets were to rebrand as “bitcoin viewers,” to more readily mirror their capability and reduce most, if not all, connection with the language of the monetary business, nobody could contend that they are “financial tools” or “unhosted wallets.”

That is in a real sense what all Bitcoin wallets do: they go about as watchers or, to analogize, “Windows on the block chain,” showing you which results are controllable by you.

When you “send” bitcoin to somebody (note how I put “send” in quotes, in light of the fact that bitcoin is never sent anyplace; it isn’t like cash) you take their public key (what is known as a “Bitcoin address”) and utilize your confidential key to sign a message giving control of those bitcoin to the beneficiary’s location. Had the cash show been taken to the obvious end result, Bitcoin locations could have been called “Bitcoin account numbers.” This marking of a message shares more practically speaking with contracts than it does with cash dealing with. This further breaks the silly “Swiss bank account in your pocket” symbolism. Sent, got, store, installment, account — these words should be canceled from Bitcoin wallet interfaces, the Bitcoin Lexicon and the general classification or the foolish, hazardous and extremely destructive conflation of bitcoin with cash will continue.

When these messages are communicated to be added to the public chain of blocks, either from your own full hub, which is a duplicate of the relative multitude of messages at any point integrated into the block chain, they are consolidated once the organization of data set executives conclude the option ought to be made. “Database administrators” not “miners.” Are you beginning to get it? Mining is how organizations remove valuable metals from the earth. Valuable metals like gold, which really is cash, dissimilar to bitcoin. These relationships and the language from the monetary world should be canceled from the vocabulary of Bitcoin companies.

Once the message is acknowledged as authentic by the organization, your block chain watcher will actually want to see that the mark you made has been added to the freely available report and the amount of your UTXOs will be more modest than they were before the message was sent. In the ongoing wallet show, this is communicated as a solitary number, once in a while compared with a transformation into fiat with the “approximately equal to” sign (≈). This is all to assist you with seeing however isn’t an impression of what is truly occurring, or an outright essential or necessity.

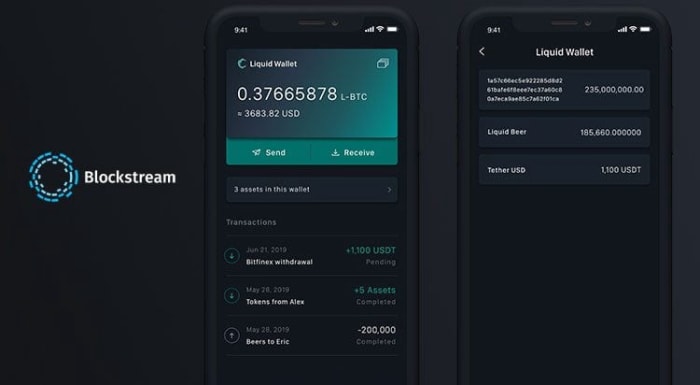

Is “Liquid bitcoin” money?

There are now “watch-only” devices from Bitcoin organizations like the incomparable Samourai Wallet. Sentinel permits you to check your keys and afterward at whatever point the chain of blocks is refreshed, it will show you the