There Is Potential For More Capitulation From Bitcoin Miners

The beneath is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Newest Public Miner Developments

After writing on the potential for public miner capitulation and overlaying Core Scientific’s potential chapter route, there’s been a wave of miner bulletins and developments that present industry-wide dangers taking extra form. The most important danger is miners’ gathered debt and lack of money stream to afford the rate of interest on that debt as revenue margins are squeezed. The opposite danger is hash price (ASIC mining machines) that has been used as collateral to safe this debt financing.

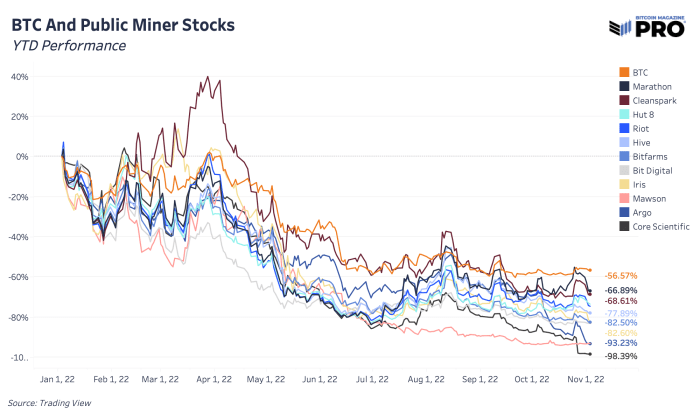

Public miners throughout the board proceed to closely underperform bitcoin in year-to-date efficiency. That’s not a brand new development however now, as miners begin to fall and the survivors emerge, the efficiency hole begins to widen in a giant means. Miners on the sting of going below are down over 90% whereas the market’s chosen “stronger” miners are extra within the 60-70% drawdown vary.

Public miner shares priced in bitcoin

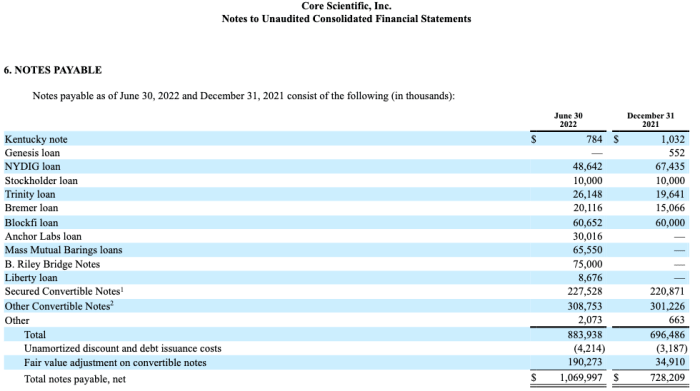

Beginning with Core Scientific, there’s a laundry record of companies which are owed cash, together with BlockFi, NYDIG and Anchor Labs. In complete, collectors are owed round $1 billion and even MassMutual Barings (an funding agency owned by Mutual Life Insurance coverage Co.) is on the quick record.

Supply: Core Scientific Quarterly Filing

Argo Blockchain is a kind of on the backside, now down 93.23% this yr. They launched the most important mining information of the week after saying {that a} deliberate $27 million fundraise didn’t undergo. Earlier this yr, NYDIG agreed to a $70.6 million mortgage with Argo. Argo additionally used a few of its bitcoin holdings in August to reduce their BTC-backed loan obligations from Galaxy Digital as effectively.

Iris Vitality highlighted in a financing update this week that the corporate is “currently capable of generating an indicative $2 million of Bitcoin mining monthly gross profit, compared to aggregate required monthly principal and interest payment obligations of $7 million.” After borrowing $71 million from NYDIG which was secured by ASIC machines for one in every of their excellent loans and susceptible to needing a debt restructuring, Iris has almost 36,000 machines which will change palms pretty rapidly. The corporate would default on these loans except they will discover a new settlement by November 8.

Stronghold Digital Mining simply this week closed on their debt restructuring deal with NYDIG, delivering a fleet of 26,200 miners in alternate for the wipeout of $67.4 million in debt. Stronghold additionally prolonged one other tranche of debt to be repaid over 36 months as an alternative of 13 to purchase more money runway. The strikes have been a strategic motion to “rapidly de-lever our balance sheet and enhance liquidity”.

CleanSpark, who’s been in a spot of development and in a position to buy ASICs at lower prices recently, ended up promoting extra of their bitcoin holdings (mined 532 BTC and spent 836) final month to help development and operations. Though many main miners are nonetheless sustaining their HODL methods and bitcoin balances, robust miners will faucet into these holdings for development alternatives or funding operations when completely wanted.

TeraWulf, one other bitcoin miner down 92.38% year-to-date, runs a comparatively excessive debt-to-equity ratio in comparison with different miners (86%) and has $120 million in debt to begin being paid again in spring 2023 at an 11.5% rate of interest.

As bigger non-public lenders like BlockFi and NYDIG don’t disclose how a lot mining debt is on their steadiness sheets, it’s unimaginable to know for positive how uncovered a few of these lenders are to broader mining {industry} chapter danger on the horizon. These loans could also be an inexpensive portion of broader financing actions and effectively outfitted to deal with the default danger, nevertheless it’s a dynamic value highlighting and to raised perceive as we anticipate extra miners to face stress of debt default and/or restructuring over the subsequent few months.

One opinion from Marathon Digital Holdings CEO Fred Thiel, ballparks that 20 or so public miners could be at risk of going bankrupt in what he deems an ideal storm for the {industry}. There’s little question that bigger, higher positioned miners are in search of potential, favorable acquisition offers to come up pretty quickly. Like each different {industry} earlier than it, main {industry} consolidation is inevitable and public bitcoin mining appears to be like primed to undergo that subsequent section of its lifecycle. It’s seemingly we transfer to a world the place there are just a few main bitcoin miner giants with a handful of a lot smaller miners behind them.

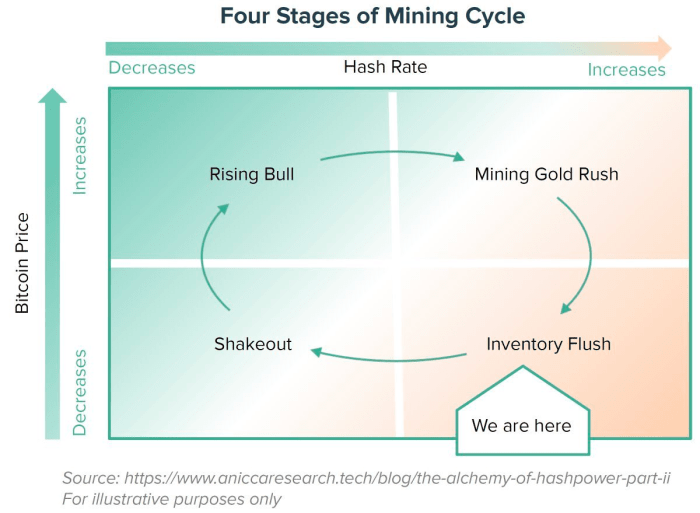

Equally, it’s fully potential that as this cycle strikes from the underside proper quadrant to the underside left, money wealthy power producers at each the private and non-private degree begin scooping up ASICs to deploy in preparation for the subsequent bull section.

Supply: Alkimiya

Ultimate Be aware

The largest danger inherent to the bitcoin market at this time stays the weak gamers hanging by a thread beneath the floor. The dearth of significant worth volatility on this $20,000 vary is definitely encouraging from the standpoint of consumers and sellers discovering a short lived equilibrium. However because the frequency of miner troubles continues to rise, together with the opportunity of extra fund-based leverage nonetheless out there, max ache unequivocally is decrease for {industry} contributors. The brunt of the promoting has taken place with bitcoin now at $20,000, however one has to query whether or not the marginal purchaser is of ample dimension to stem the potential promoting stress on the horizon.

We suspect that the stress is starting to ramp up on the crypto lenders that did survive the summer time contagion, as a result of rising headwinds sure miners are going through on this setting.

Source link

#Potential #Capitulation #Bitcoin #Miners