Three Altcoins To Consider In 2023

ArtistGNDphotography

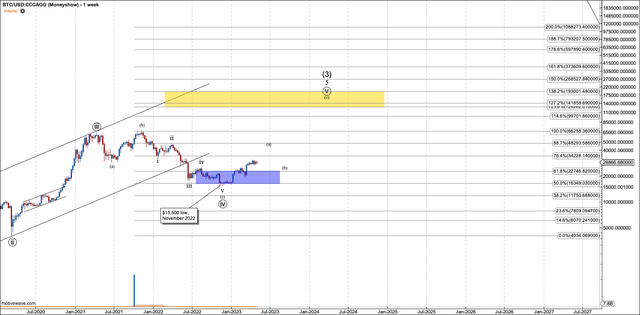

The newest articles that Jason and I launched mentioned the likelihood that Bitcoin (BTC-USD) will behave bullishly for the rest of 2023. However we don’t foresee the value motion in Bitcoin as clear. If Bitcoin makes it into six-figure costs over the subsequent 12 months or two, it would achieve this in a really uneven trend. I see the value motion in Bitcoin from 2018 till immediately as a big ending diagonal. Which means the leg from $15,500 to my anticipated $125K ought to tackle an ABC construction. That’s a lot more durable to commerce than the five-wave construction of an impulse, which tends to have extra upward velocity and shallower pullbacks than ABC buildings.

As troublesome as I anticipate the value motion to be, since its November 2022 low, Bitcoin has printed larger lows on its each day chart with no signal of a let-up.

Bitcoin, Each day Chart (Created in Motivewave)

A Warning

Earlier than we dive into a number of alternative altcoins, we’ve to acknowledge the dangers. Firstly, I liken investing in altcoins to taking part in enterprise capitalism, however with out the authorized rights imbued within the offers during which VCs take part. Altcoin buyers make bets on tasks they’re obsessed with. Nonetheless, more often than not the tokens concerned do not provide rights to the money flows of such tasks if they’re profitable.

That mentioned, I nonetheless consider the crypto sector has birthed many tasks which have modified finance endlessly. For instance, the utility of decentralized DEXs has led to their quantity eclipsing these of centralized exchanges within the final 12 months. I’m cheering on many such tasks. However that does not imply one should personal a DEX’s token. Most frequently, one of the simplest ways to take part within the charges from DEX merchants is to take part within the liquidity swimming pools of such DEXs. The tokens of main DEXs comparable to Uniswap (UNI-USD), SushiSwap (SUSHI-USD), and PancakeSwap (CAKE-USD), by and enormous, have performed terribly regardless of the success of the merchandise they characterize.

Jason and I’ve seen many counts in altcoins fail. They persistently have a tendency to not fill in large-scale impulses, usually failing in three waves earlier than they start a path to all-time lows. With that mentioned, making use of Elliott Wave evaluation to altcoins is a way to judge when sentiment is prone to drive costs larger. We’ve got been capable of path stops and get out when failure occurs. Trailing stops coupled with common profit-taking results in nice acquire.

That is to say: if you’re an investor, do not contact altcoins. Follow Bitcoin and Ethereum (ETH-USD) as they’ve confirmed their long-term developments. And, in case you enterprise into altcoins, it’s good to know when to get out early, generally at a loss, when warranted.

After listening to my truthful warning, let’s take a look at three that I’m all for now.

ImmutableX

ImmutableX is an organization constructing web3 infrastructure for creating play-to-earn video games and NFTs. It’s a Layer-2 scaling answer on the Ethereum blockchain.

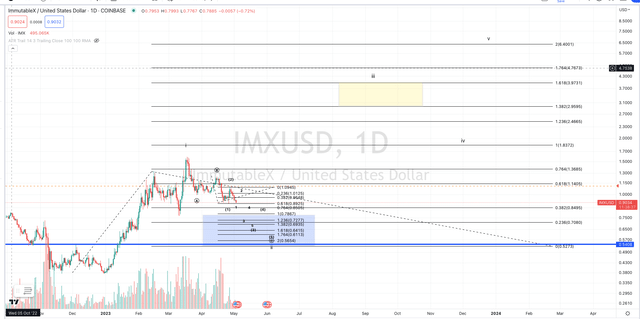

The ImmutableX token, IMX (IMX-USD), is a extremely speculative play. It was launched initially of the 2021-22 bear market, in November 2021. Naturally, after its launch, it remained in an incessant downtrend via December 2022. Which means there are many earnest sellers anxious to get their a reimbursement.

Nonetheless, after printing its all-time low of 37 cents on December 30, 2022, IMX began a powerful rally that introduced it to $1.59 on March 18, 2023. That made many earlier homeowners complete. However after that prime, a brand new downtrend began.

From an Elliott Wave perspective, the 2023 rally in IMX seems to be a pleasant impulsive rally with 5 waves into the March excessive. Which means the present correction since that prime is probably going a wave 2 earlier than IMX begins to type a bigger diploma five-wave construction. This wave 2, proven on my chart under, ought to backside between 77 and 54 cents. Proper now it seems to be like it would come very near the decrease quantity. Under 54 cents, sustained, I’ll not have a bullish perspective and can anticipate new all-time lows. However assuming IMX can maintain up, and relying on the place it finds a ultimate backside, my goal for the subsequent diploma can vary from $4.85 to $10.

IMX Each day Chart (Tradingview)

GMX

The GMX (GMX-USD) token is issued by GMX.io, a decentralized perpetual futures alternate that runs on the Arbitrum (ARB-USD) and Avalanche (AVAX-USD) networks. It capabilities as a governance token and the alternate shares 30% of charges with the holders. That makes it one of many few tokens that gives a money move that’s not produced by inflation, however moderately a money move that comes into the ecosystem from customers through buying and selling charges.

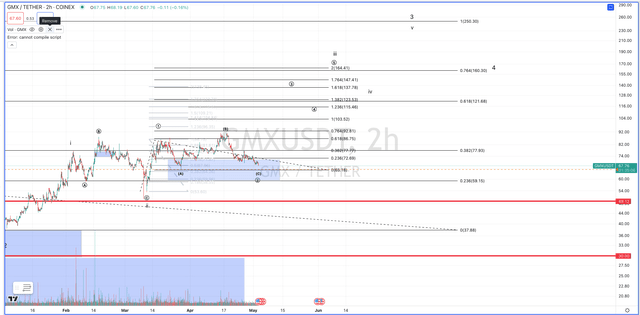

GMX was born through the crypto bear market of 2022 however by no means participated in that 12 months’s downtrend, as quantity on the alternate continued to develop. The low on my chart was on June 15, 2022, when it traded at $9.70. At the moment, Bitcoin traded at $22,500. When Bitcoin posted its 52-week low on November 9, 2022, close to $15,500, GMX traded at $26.45. As Bitcoin started its latest uptrend from that low, GMX solely strengthened. It trades at $69.17 on the time of writing.

I do not discover the lengthy chart extremely clear, partly due to its quick historical past. That causes warning in the case of suggesting longer-term swing trades. Nonetheless, immediately we’ve a pleasant, instantly bullish, low-risk set-up in GMX. Help for the commerce is $59.30. Breaking that’s not essentially bearish nevertheless it makes an already murky long-term chart even much less clear. So I’ll use that stage as a cease. If that stage holds, GMX is aimed toward $164. That stage is presumably the highest of the third in a big C wave. However after that stage is hit, I’ll take substantial revenue till the long-term intentions of the chart are extra clear.

GMX Each day Chart (Tradingview)

Rocketpool

This subsequent coin is a long-term set-up. That is not meant to battle with my warning statements about altcoins. I’m saying that this set-up could take time to materialize into beneficial properties. One should nonetheless watch out about how a lot to threat on this coin.

Rocketpool is amongst a number of protocols that permit customers to take part in Ethereum validation and its financial rewards by staking as little as 0.01 Ethereum. With out the protocol, to be an Ethereum validator one should stake not less than 32 Ethereum. The distinction at immediately’s costs is $18 versus $58,400.

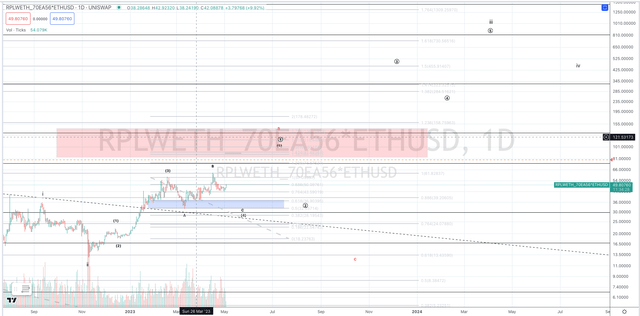

The protocol’s token, RPL (RPL-USD), is used as a governance token and a foreign money with which to pay protocol charges. RPL rallied from $1.20 to $63 in 2021 in a construction that could be known as a number one diagonal. After topping in 2021, it declined into the $7 area in June 2022. However it did not proceed to say no with Bitcoin into November of that 12 months. It reversed, went again to $35, and began a collection of upper highs and lows. Lastly, within the final two months, it made new all-time highs.

In the quick time period, I can see RPL persevering with into the $90 to $120 area so long as $33 holds. Nonetheless, this area requires care. If at any time it sustains under $33 it might drop again to the $7 area in my crimson c-wave. I’m treating that as possible and conserving my place very gentle. I’ll scale into the $30s, ought to that pullback happen. That’s as a result of the circle-2 is legitimate all the way down to $2.91. If it holds, RPL has a shot at reaching $600 above in its third wave. If it by no means prints that decrease crimson C-wave, so be it; my small place will produce nice revenue on a percentile foundation.

These are monstrous ranges to take care of, so you possibly can’t tackle the place dimension you’re used to in low-beta shares, or high-beta for that matter. You must maintain it gentle so you possibly can afford to seize volatility.

I satisfaction myself on making so much in crypto by risking little or no on every commerce.

RPL Each day Chart (Tradingview)

Conclusion

In conclusion, Bitcoin is prone to be bullish for the remainder of 2023. However sadly, the motion thus far suggests a really uneven path to $125K. If at any time $18K breaks, this view turns into questionable. As a result of Bitcoin tends to carry many altcoins with it, a bullish Bitcoin cycle is a safer time to commerce altcoins. However we will not choose simply any altcoin and assume it would act bullishly. We should choose the construction of any chart during which we have an interest. In gentle of this angle, I’ve chosen three altcoins to your consideration: IMX, GMX, and RPL.

Editor’s Observe: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.

Source link

#Altcoins