What Is Initial DEX Offering (IDO)

A decentralized system is being built with the help of Initial DEX Offering (IDO), which is the most recent type of fundraising mechanism. It allows users to represent digital assets in their fundraising efforts. Introducing the Initial Dex Offering, a unique type of public offering that can represent any asset traded on a DEX (decentralized exchange). It is possible to start token sales through a decentralized liquid exchange by employing an Initial Dex Offering.

It allows users to make crucial decisions about digital assets, which will aid in participating in additional communities concerning the products and services. This collection of DEX (decentralized liquidity exchanges) will allow startups and businesses to issue tokens while also providing instant access to liquidity. IDO tokens are issued on decentralized exchanges such as Binance and Uniswap and traded on such platforms.

It is a sort of cryptocurrencies exchange that relies on liquidity pools and allows traders to swap tokens, such as crypto coins and stablecoins, between them. For example, the USDT/ETH pair is considered a liquidity pair.

What Is IDO?

An IDO (initial DEX offering) is a fundraising strategy in which ordinary investors pool their money to make a more significant investment. The IDO was established to make up for the limitations of the “conventional” initial coin offering (ICO) crypto crowdfunding approach. Because an IDO works with a DEX rather than a regulated market, DEXs can be regarded as decentralized liquidity exchanges instead of centralized exchanges.

IDOs (Individual Development Organizations) are the newest format for cryptocurrency initiatives seeking to acquire funding from investors. However, they are not without their drawbacks as well. For example, DEXs have lower scalability. It is not uncommon for initial coin offerings (ICOs) and initial equity offerings (IEOs) to generate over $1 billion. It is unprecedented in the world of DEXs.

A lack of understanding of how cryptocurrency works due to the steep learning curve associated with DeFi platforms may operate as an entry barrier for the ordinary cryptocurrency trader. In order to effectively address this difficulty, financing for DeFi education would be required.

Nothing can break an investor’s confidence if he or she is armed with the correct facts. The potential of DEXs to obtain capital for such enterprises will be the most challenging obstacle to overcome.

How Do They Work?

IDOs are successful because decentralized exchanges (DEXs) provide immediate token liquidity. In order to compensate liquidity pool suppliers, DEXs frequently offer substantial benefits. DEXs are able to run without any unforeseen disruptions for their users because of liquidity.

Most projects give stability to the DEX by providing a portion of their funds to the exchange in order to aid in trade. This strategy has now become standard practice in the industry. Many projects also use a consensus process known as proof-of-stake (PoS). The Proof-of-Stake consensus was created in order to safeguard networks. However, in this instance, the method is primarily employed to prevent investors from selling their investments too quickly.

The Proof-of-Stake consensus requires that investors keep their money in the authorized token in their wallet. In exchange for their “risk” in the network, investors earn rewards for their efforts. Investors will be able to start trading the issued token immediately upon the project’s launch. Once the IDO is operational, early investors will be able to trade their tokens at a greater price. Investors that arrive early will be able to purchase a significant quantity of tokens at a considerable discount.

After the public sale is launched, the value of the tokens will rise. As soon as the initial sale is completed, the value will increase as a result.

Gas costs for processing a new smart contract on a liquid exchange are insignificant because there is ample liquidity for trading pairs on a liquid exchange. The project token and liquidity pool are managed through the use of smart contracts. In addition, unlike traditional fundraising approaches, IDOs have the ability to create tickets immediately.

Furthermore, any sound project may be eligible to receive funding provided it meets specific criteria. Many projects have gained access to individual investors as a result of avoiding the lengthy and rigorous regulatory process. A similar argument can be made for avoiding the high costs associated with IEOs (initial exchange offerings).

The absence of an appropriate process, on the other hand, has resulted in the introduction of a large number of low-quality projects. Outright frauds are also included in this category, in which project owners use investor funds to fund their own initiatives and then disappear.

Investors won’t have to wait extended periods of time for their chosen tokens to be published on an exchange, which will save them time and money. Ordinarily, the listing occurs shortly following the execution of the IDO. When opposed to initial coin offerings (ICOs), this timing provides investors with the ability to cash out on their deposits much more quickly.

Of course, this does not imply that DEXs are always beneficial. Yes, they can be deemed more trustworthy due to the fact that they lack trust. (They don’t require the assistance of a human mediator.) DEXs, on the other hand, continue to be vulnerable to technological attacks. For example, news reports about potential exploits hackers have made off with investor assets are not uncommon these days.

ICO vs. IDO vs. IEO

To fully appreciate the advantages of an raise modeled by IDO, it is necessary to place the Initial DEX Offering in its correct context as just an evolved enhancement on the former ICO and IEO fundraising models.

In 2017, as cryptocurrency began to gain widespread attention in the financiaaal markets, the frenzy surrounding blockchain-based development decided to bring a floodgate of new projects trying to capitalize on investor interest in cryptocurrency and the future funding opportunities inside the blockchain ecosystem.

Initial Coin Offerings (ICOs) were highly centralized and managed by the starting projects themselves, instead of decentralized organizations (IDOs), which are decentralized by nature. False beginnings, rug pulls were all possibilities with no third-party monitoring or blockchain-based accountability for initial coin offerings. Only a small number of initial coin offerings (ICOs) raised enough funds to list on exchanges, and many more disappeared completely, stealing huge amounts of money with them.

Initial Exchange Offerings (IEOs), sometimes known as Initial Coin Offerings (ICOs), were created to build on the ICO model by providing regulation and responsibility. The name indicates that a project debuts directly to a regulated exchange, where it is immediately marketable on the open market rather than through a crowdfunding platform.

The essential advantage of the IEO is the vetting project conducted in conjunction with it. The group and its technology are thoroughly inspected for the benefit of all investors. The fundamental disadvantage of IEOs is that they are exceedingly expensive and create an unreasonably high obstacle; in fact, they are so expensive that many projects require an alternative.

The International Development Organization (IDO) concept, which established transparency and accountability through blockchain tech and made the development process more affordable via decentralized fundraising, introduced the Goldilocks of crypto fundraising into the world arena in 2020.

The IDO launch strategy enables projects to avoid paying expensive listing fees and debuting directly to stakeholders on decentralized exchanges without waiting for approval. Other advantages of the IDO/Launchpad approach include a more rapid launch process and, most crucially, a fair and transparent source financing avenue verified on a public blockchain, both of which are important.

In contrast to initial coin offerings (ICOs) and initial exchange offerings (IEOs), wherein the introduced tokens are commonly pre-mined and frequently pre-sold, IDOs don’t really prohibit small investors from participating in early-stage investments reaping the most significant portion of rewards. Investors at all levels can join in IDOs through a tier system implemented by decentralized fundraising platforms such as KSM Starter, which also limits the allocation of tokens to ensure long-term price rise and a healthy market.

Is IDO A Better Strategy To Improve Cryptocurrency?

IDOs are the successor to various crypto-fundraising formats such as ICOs (initial coin offerings), STOs (security token offerings), and IEOs (initial exchange offerings) that have previously existed (IEOs). Because of the way IDOs work, they provide better and more instant liquidity throughout every price level, making them an excellent solution for future initiatives and entrepreneurs looking to issue a token and gain access to immediate funding.

The use of IDOs, as opposed to the previously described funding techniques, is widely considered an excellent way to establish a new crypto project because they prevent the use of pre-mines. This issuance scheme benefits project founders over members of the community.

The first initial coin offering (ICO) was the Mastercoin ICO in July 2013. At the time, the token sale raised 3,700 BTC in the first 12 hours, roughly equal to $2.3 million. Ethereum raised money through a token sale in 2014.

The first Initial Coin Offering (IEO) was held on April 17, 2019, and was launched on the Idax, Bit-Z, BitForex, and Bit-M cryptocurrency exchanges. In contrast, Raven Protocol announced in June 2019 that it would create the first-ever IDO listed on the Binance DEX (Decentralized Exchange).

What’s The Purpose Of IDOs?

In 2017, when initial coin offerings (ICOs) and token sales (token sales) became popular, raising a projected $4.9 probably by the year-end, numerous companies were using the blockchain to solve problems. While several initial coin offerings (ICOs) have proceeded on to prosper, it’s difficult to ignore the reality that there are various difficulties with ICOs, including the fact that they are centralized and insecure. Other prominent flaws of initial coin offerings (ICOs) include discrimination against third parties, susceptibility to theft and user mistakes, and a loss of security.

Because of the decentralization of IDOs, the new fundraising approach is seeking to resolve the challenges associated with initial coin offerings (ICOs). It also introduces endless opportunities to the cryptocurrency industry. Entrepreneurs may create a blockchain solution that is immune to evil third-party influencers while also eradicating any difficulties related to hackers and human mistakes through IDO crowdfunding. On top of that, currencies purchased or held by token purchasers and holders are instantaneously safeguarded in their wallets and private keys.

Some Examples Of Successful IDO-led Projects

· Raven Protocol IDO

A deep neural network training protocol for deep neural networks that is decentralized and distributed is described here. The Raven Protocol is dedicated to developing cost-effective and time-efficient solutions that leverage the blockchain to change the machine learning and ai industries, which large multinational enterprises now control. Contributors gain rewards for donating their computer resources with the help of the native RAVEN token, whereas the utility tokens are used for artificial intelligence training.

· SushiSwap IDO

SushiSwap, a decentralized cryptocurrency exchange built on Ethereum, has attempted to displace Uniswap as one of the most renowned Ethereum-based decentralized exchanges by gaining traction. SushiSwap users reportedly transferred approximately $1.14 billion in Uniswap’s locked digital currencies to the SushiSwap platform last September, according to reports.

However, rather than holding an initial coin offering (ICO) for SushiSwap, the network compensated LP (liquidity providers) on Uniswap by having them stake their liquidity provider tokens on SushiSwap. Users were awarded SUSHI tokens as a result of their efforts. During SushiSwap’s first two weeks of operation, 1,000 SUSHI tokens were distributed to customers that wagered their LP tokens on SushiSwap’s first protocol on an Ethereum block basis, or around every 12 seconds.

· Universal Market Access Protocol IDO

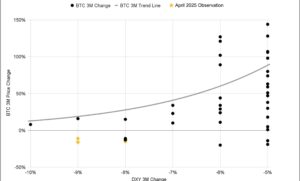

The UMA (Universal Market Access) protocol is another IDO project that was successfully launched, even though its IDO experienced some initial difficulties. It allows DeFi developers to create synthetic assets on the Ethereum blockchain, securities tokens whose value fluctuates in response to market conditions.

It began its token sale in April, with a base price of $0.26 for each token on the decentralized market Uniswap, with a goal of raising $1 million. The cryptocurrency exchange UMA had to deposit $535,000 in Ethereum into a freshly constructed liquidity pool in order to obtain that price.

Notably, however, because the token price on Uniswap is based on a bonding spectrum instead of order books, the cost of the UMA token immediately increased as investors flocked to the exchange to buy the token. Traders attempted to get an advantage over their competitors by paying more significant gas expenses, which ultimately resulted in the UMA token’s price rising by more than $2 minutes after the token was launched.

In the end, it steadied at somewhat more than $1, with some purchasers grumbling that they pay a much higher price than the investors who had purchased before the sale. On the other hand, it draws attention to the problem with Uniswap instead of UMA.

However, despite this early setback, UMA today has a market valuation of more than $1.5 billion, with a single token fetching more than $25 in value.

Initial Dex Offering (IDO) Benefits:

· Cash Flow Immediately:

Insufficient liquidity can have a negative impact on the price of a cryptocurrency. The use of an interconnected liquidity pool ensures that there is liquidity at every price point without slippage. It means that the project must first collect some starting liquidity for its pool before it can provide liquidity at each and every price level.

· Cost Is Relatively Low

Because IDO makes use of a liquidity exchange, the user is required to pay a minimal amount of gas fees when launching a new smart contract.

· Trading On The Spot:

When the investors announce the launch of a project, they immediately begin trading the tokens in the market. The purchaser of tokens will have the ability to resell their tokens at a better price if the market conditions improve. During the IDO, the cost of the token would rise by a sufficient amount to justify its increased value.

· Fundraising That Is Transparent And Equitable:

Anyone can join or organize an Initial Dex Offering (IDO), and the price of the token will increase whenever the token is introduced into the public sale. An IDO allows investing in a public sale, and it enables to purchase of a large number of coins for a lower price.

IDO Has Some Drawbacks

· There Will Be Less Regulatory Oversight:

As with everything in crypto-land, it is critical to conduct thorough research on potential alternative investments. It is particularly true for launchpads that do not have the same level of regulatory oversight that centralized exchanges do.

It is possible to verify the integrity of a launchpad by checking that it offers anti-scam vetting, KYC (Know Your Customer), and anti-bot safety protocols at the time of launch. As a trader, it is also advisable to choose launchpads with robust tokenomics and reliable security hygiene, such as frequent audits of their systems.

· Oversubscribed IDOs:

A large number of IDOs are oversubscribed, making participation difficult. Due to high interest and the propensity to provide smaller token offerings than IEOs and ICOs, participation is difficult. Conventionally, safelists practices and capping IDO allocations via a tier system have alleviated the raw demand for participation. However, KSM Starter has developed an innovative new solution: the Auto-Invest Component, which allows its absolute top representatives to automatically take part in IDOs via a pre-funded wallet without worrying about FCFS gas wars.