Why Did The Bitcoin Price Dip From All-Time Highs?

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

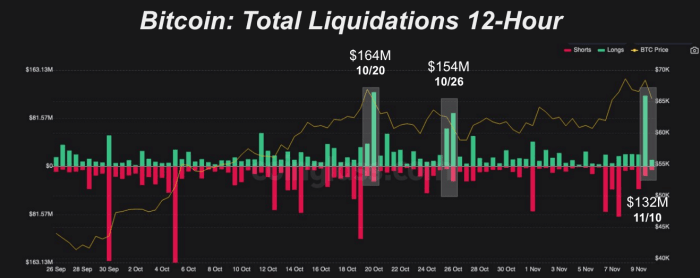

As published in Wednesday’s The Daily Dive #096, bitcoin was up 3.9% in one hour after the Consumer Price Index reading, only to fall again in a series of BTC-margined long liquidations. Total long liquidations for the day were some of the largest liquidations over the last few months but pale in comparison to the liquidations in March through April earlier this year.

Source: Coinglass (Bybt)

Let’s dig into some of the leverage dynamics that led to the sharp fall from all-time highs back down to $62,800.

Futures Open Interest

Among the most important things to understand about bitcoin derivatives is the types of collateral that can be used. In bitcoin derivatives markets, you can either use crypto margin (overwhelmingly BTC but certain platforms allow various altcoins to be used as collateral) or dollars/stablecoins as collateral. When entering a derivatives contract with bitcoin as collateral, if you are going long (speculating on price to rise), then you are left exposed if price declines to both a declining PNL (profit/loss) as well as collateral that is declining in value. Thus, bitcoin-margined derivatives are often the culprit in large market drawdowns and liquidation events.

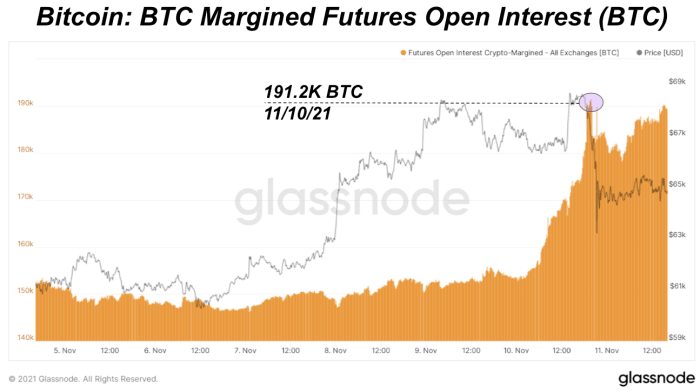

Leading up to yesterday’s all-time high, the aggregate futures open interest for bitcoin-margined spiked in a huge way (in BTC terms, which normalizes for dollar volatility), touching 191.2K BTC, up from the 150k BTC range that was seen the first time bitcoin broke above $65,000, showing that traders were aggressively levering up:

Source: Glassnode

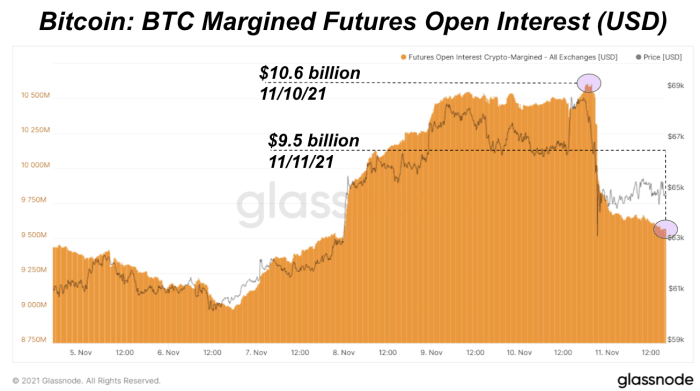

Below is the same chart but denominated in dollars instead, showing the total open interest in bitcoin-margined futures declining by more than $1 billion from yesterday:

Source: Glassnode

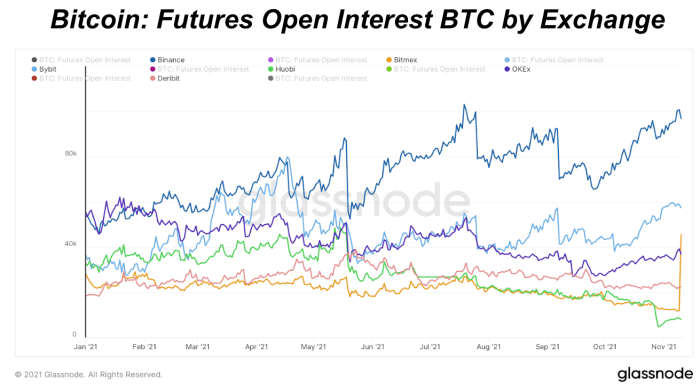

Source: Glassnode

Displayed above is the aggregate open interest (in bitcoin terms) by exchange for context. The most obvious trend is the increasing dominance of Binance in the futures market (more on this in a moment).

Source link

#Bitcoin #Price #Dip #AllTime #Highs