$478 Million Erased from Cryptocurrency Traders in Liquidations

The dynamic nature of cryptocurrency was evident on the recent Saturday of November 23, with a staggering $478 million in traders’ positions erased due to market fluctuations. Notable crypto assets such as XRP and ADA saw significant price spikes followed by equally rapid downturns.

While Bitcoin (BTC) is trying to stabilize under the crucial $100,000 mark, there’s evidence of an emerging altseason. This period is characterized by substantial price swings, with altcoins providing double-digit returns and similarly high retracements, which has led to liquidations of positions betting against and for market trends.

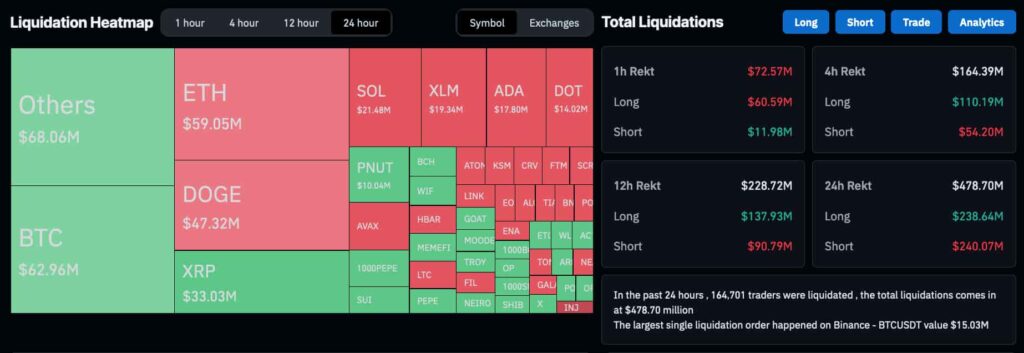

Interestingly, the total liquidations in the past 24 hours alone have amassed to $478 million, impacting both bullish and bearish market participants. Reports from CoinGlass, sourced by Finbold, show $240 million in short position liquidations and $238 million from longs.

The heaviest single liquidation occurred on Binance for a BTC/USDT position, worth $15.03 million. The recent tumult resulted in over 164,700 traders facing liquidation, with smaller cap altcoins stealing the limelight, contributing over $68 million in liquidations.

The Ripple Effect of Crypto Volatility on Traders

The likelihood of traders encountering liquidations scales with the market’s volatility. This is epitomized by current market behaviors. On the Crypto Total Market Cap Index (TOTAL), a 15-minute chart and the Relative Volatility Index (RVI) from TradingView highlight the fluctuations well.

The market cap surged from $3.18 trillion to a high of $3.33 trillion within a single day. The RVI spiked to 75 points several times, dipping to nearly 25 points on multiple occasions – signaling pronounced volatility.

A stable market would typically exhibit RVI around 50 points, deviating reflects heightened activity. Aggressive movement, whether upward or downward, can pressurize positions leading to the liquidation of the involved crypto collateral.

Bitcoin isn’t immune to this trend of volatility and subsequent liquidation, highlighted by Jim Cramer’s recent recommendation to buy BTC. Market participants remain vigilant for the next signal to inform their entry and exit strategies.

Featured image courtesy of Shutterstock.

Source link

#478M #whipped #crypto #traders #liquidations