Bitcoin Aims for $150,000 Price Point as Market Value Projected to Hit $7.5 Trillion by 2025, According to TradingView News

“`html

According to a recent analysis by Bloomberg, the expected market value for cryptocurrency assets shows a strong upturn, with projections indicating an escalation up to $7.5 trillion by the year 2025.

Major Wall Street entity Anticipates Substantial Crypto Market Cycle

Bernstein, a prominent Wall Street research institution, forecasts the advent of a significant cryptocurrency market wave in the coming years. The firm has initiated coverage of the online trading platform Robinhood Markets, bestowing it with an “outperform” rating.

Bernstein’s expert analyst Gautam Chhugani advises investors to seize the moment for engaging in the “crypto resurgence trajectory,” predicting Robinhood’s cryptocurrency transaction volume to magnify by nine times within a span of two years.

Expressing optimism about the future of Robinhood, Chhugani advocates that the present moment offers an excellent 18-24 month interval for investors to plunge into the rallying crypto market. He has set forth an ambitious target of $30 for Robinhood’s stock value, the highest forecast amongst his Bloomberg-tracked contemporaries.

Robinhood’s shares experienced a significant spike, amplifying by up to 12% in New York’s exchange, after upbeat February operational data showcasing enhanced assets under custody and an inflation in trading activities. This was the stock’s most notable midday peak since December 2021.

So far, throughout this current year, the stock has attained an impressive growth of over 40%. Despite this achievement, Wall Street analysts are still exercising caution, with six advocating a buy, ten suggesting a hold and three recommending a sale of the stock.

Looking ahead, the valuation of crypto assets is anticipated to ascend from $2.6 trillion to $7.5 trillion, paving the way for Bitcoin to emerge as a colossal $3 trillion asset by 2025. Chhugani attributes this predicted upsurge to the “unprecedented success” of Bitcoin-tied exchange-traded funds (ETFs).

Moreover, Chhugani foresees Bitcoin reaching a striking value of $150,000 in the following year. He underscores the current trend of institutional bodies embracing cryptocurrencies and anticipates ongoing glorification of Bitcoin ETFs, along with the prospect of an Ethereum ETF making its debut in the upcoming 12 months.

Robinhood’s Strong Positioning for Future Growth

Regarding Robinhood’s strategic positioning, Chhugani emphasizes the advantage of its “comprehensive crypto services within a regulated brokerage framework.” He notes that traditional brokerage platforms like Charles Schwab Corp. are more reluctant in integrating digital currency services.

In summary, Chhugani asserts:

We maintain a strong positive view on cryptocurrency, convinced that the revival of Robinhood’s crypto operations will rejuvenate its standing amongst investors.

The cryptocurrency market’s projected steep growth coupled with the buoyant prospects for Robinhood’s crypto venture is drawing considerable intrigue from market analysts. As digital assets gain broader acceptance and continue to captivate institutional interest, the imminent years promise great opportunities for investment communities and stakeholders.

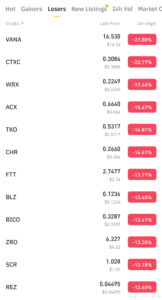

Image courtesy of Shutterstock; TradingView.com provides the chart.

“`

Source link

#Trillion #Market #Bitcoin #Targets #TradingView #News