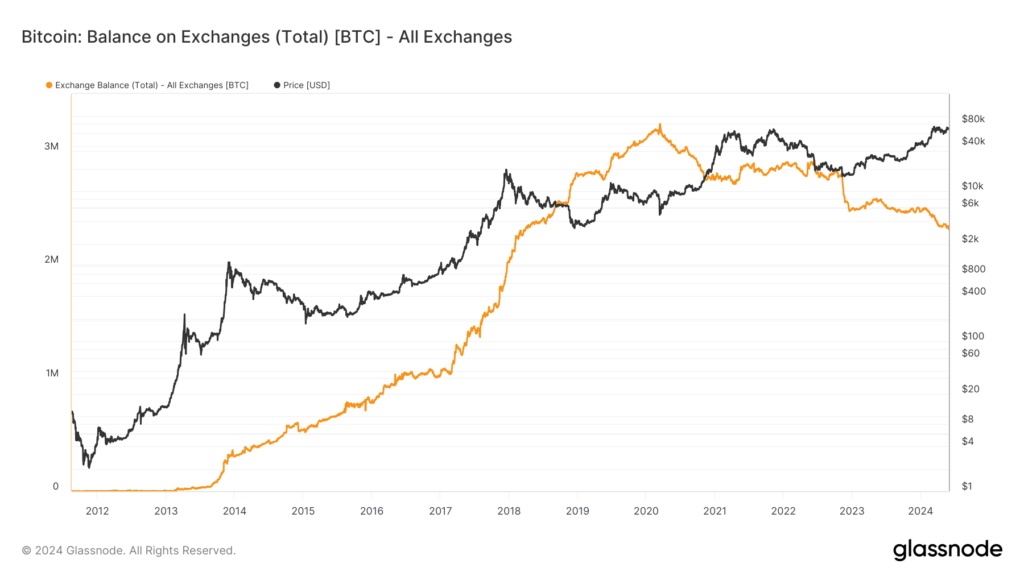

Bitcoin Exchange Reserves Hit Five-Year Low as Significant Withdrawals from Binance and Coinbase Suggest Shift to Long-Term Holding Tactics

Blockchain Activity Insights

EXPLANATION: Cryptocurrency holdings on trading platforms represent the cumulative cryptocurrencies held in wallets owned by such platforms.

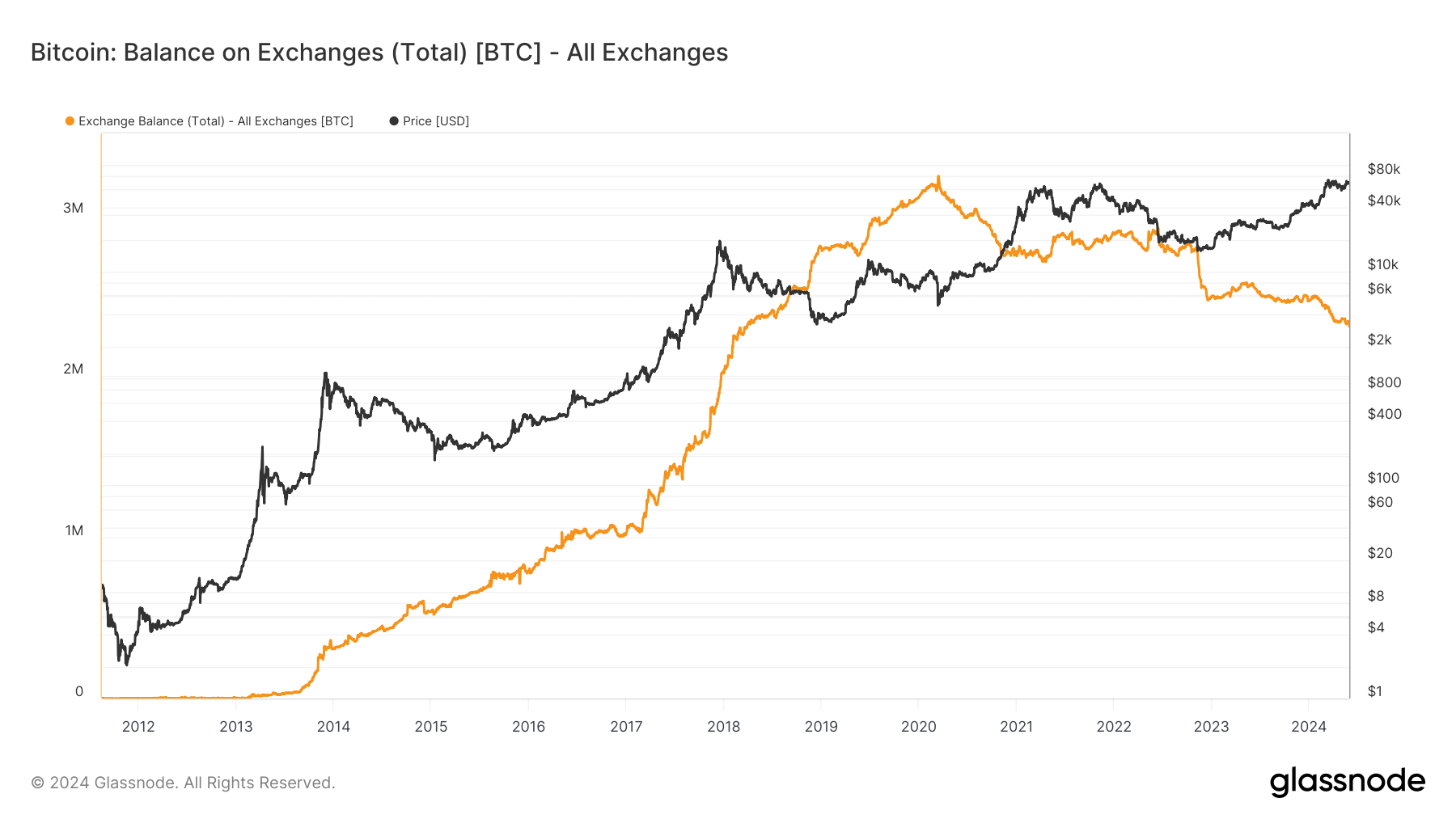

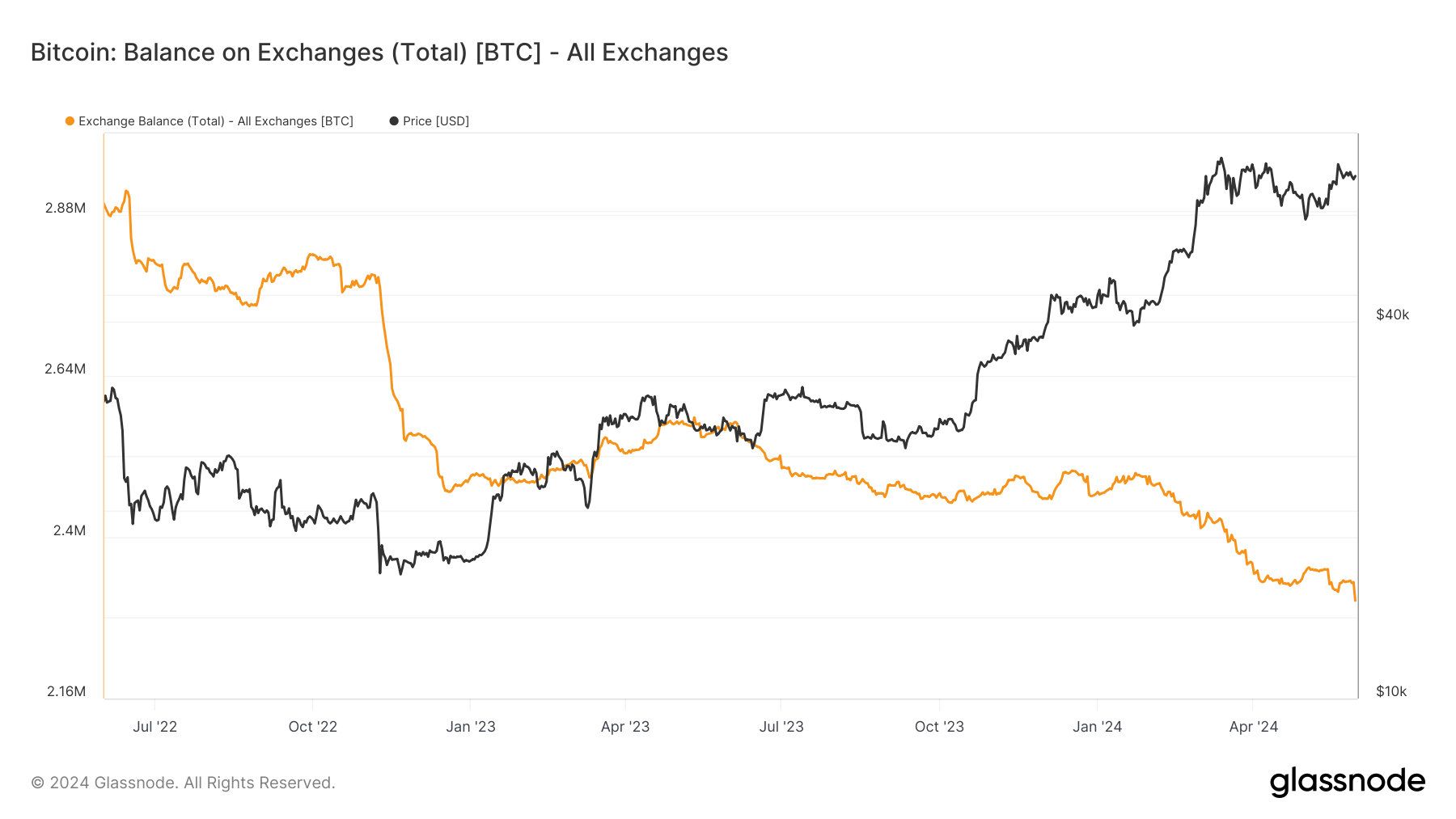

Bitcoin holdings on trading platforms have persistently declined, marking a notable downturn. Current reports indicate that these holdings have fallen to under 2.3 million BTC, a figure last observed in March 2018. The trend is predominantly due to substantial withdrawals from prominent platforms such as Binance and Coinbase, suggesting a shift in investor strategy towards holding assets for the long term.

Over the last year, Binance, which has the largest Bitcoin reserves among exchanges, recorded notable BTC withdrawals. Coinbase similarly saw a significant movement of funds with the year’s third-largest outflow, where approximately 16,000 BTC were transferred out in one single day. This kind of withdrawal activity indicates that large-scale investors, or “whales,” are transferring their Bitcoin to private wallets, potentially in anticipation of a rise in market value.

The observed patterns in exchange balance reduction indicate a growing inclination among investors to potentially brace for a bullish Bitcoin market, by decreasing the circulating supply on exchanges and thus possibly contributing to an upward price momentum in the foreseeable future.

Source link

#Bitcoin #exchange #balances #decline #fiveyear #major #outflows #Binance #Coinbase #signal #longterm #holding #strategies