Bitcoin Leverage Reaches Annual Peak: Implications for BTC Market Value

- BTC’s borrowed capital has reached its peak for the year.

- BTC’s valuation is facing difficulties maintaining stability near the $60,000 mark.

Bitcoin [BTC] has crossed the psychologically significant threshold of $60,000, yet it’s facing headwinds, with profit-taking from major players and the Bitcoin Estimated Leverage Ratio touching the highest point of the year.

Yearly peak in Bitcoin leverage

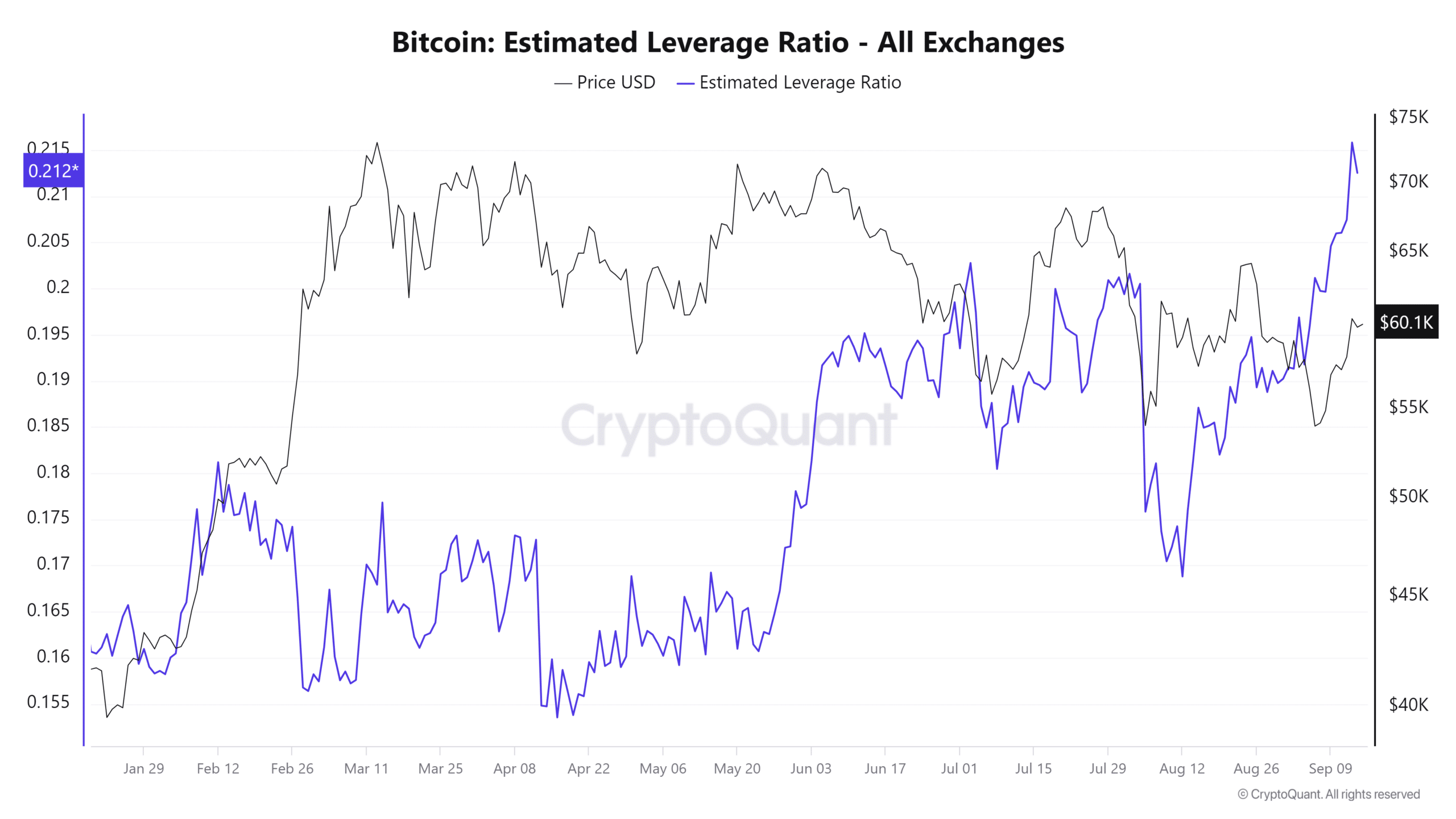

CryptoQuant’s data indicates a rise in BTC’s Estimated Leverage Ratio, with the figure spiking to 0.216 in 2024, a record for the year. This suggests the extent of leverage or loaned capital in the Bitcoin market.

Increased leverage can mean greater risk for traders. A price movement against leveraged positions could lead to widespread liquidation, with forced closures of these positions causing sharp drops in value.

A higher leverage ratio can also indicate potential for increased volatility, as more leverage amplifies market price actions in either direction.

An uphill trend in BTC value alongside rising leverage might hint at a market at its boiling point, with any downturn potentially leading to significant liquidations.

Conversely, a sudden downturn could set off liquidations, propelling a swift downturn in BTC value.

Bitcoin meets resistance post-price breakthrough

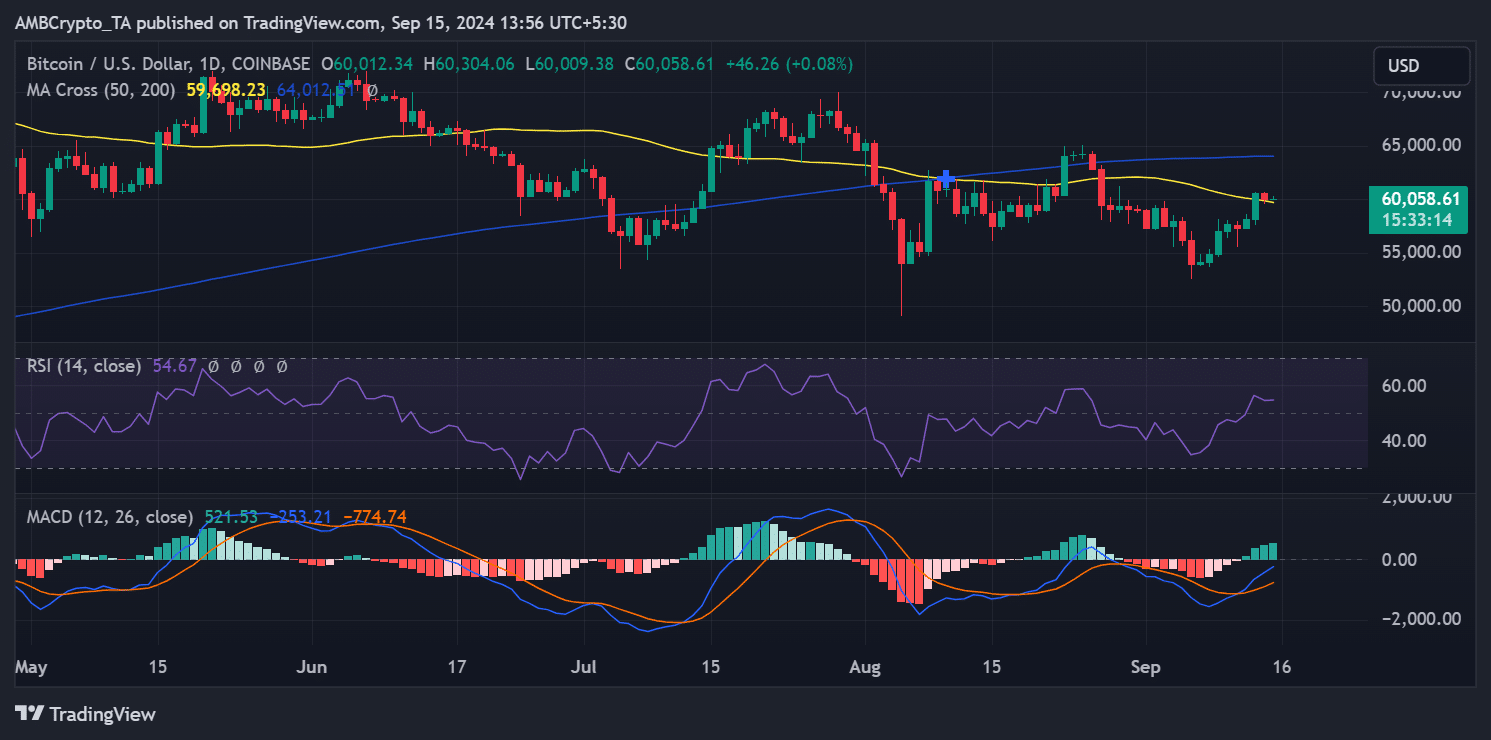

Experiencing a more than 4% rise on the 13th of September, Bitcoin pierced its short-term moving average, reaching about $60,543.

Nevertheless, it encountered challenges maintaining the climb, culminating in a decrease to approximately $60,012, a 0.8% fall, in a subsequent session.

Currently, BTC shows a slight upturn, trading near $60,095. The absent robust follow-through suggests strong sell-offs as some traders capitalized on the surge.

Large investors cash in on the upswing

According to CryptoQuant, Bitcoin whales were seen locking in profits during the rally, with a noticeable increase in realized profits when BTC surpassed the $60,000 mark.

Read Bitcoin (BTC) Price Prediction 2024-25

Reportedly, these whales secured profits over $50 million, seizing the moment of the upturn.

This action by the whales highlights the resistance for Bitcoin at its current price point and may contribute to the upcoming short-term price fluctuations.

Source link

#Bitcoins #leverage #yearly #high #Heres #means #BTC #prices