Bitcoin Skeptics Excited Over Potential Drop Below $60K for BTC Price — Insights from TradingView

The value of BTCUSD will have to witness a 12% decline from the present value of $67,250 for the predictions of pessimists to come to fruition, as per a statement by a cryptocurrency analyst.

“If BTC dips below $58.8k, that’s when bears can start celebrating,” shared market expert Matthew Hyland on an Oct. 17 post, with Bitcoin valuing at $67,248, which is an increase of 10.88% over the previous week as recorded by TradingView.

Hyland emphasized that a retraction to any figure above that threshold is merely a temporary fluctuation.

Bitcoin last approached the aforementioned marker on Sept. 17, briefly hitting $58,192 before ascending to $65,000 by Sept. 27.

Analyst asserts Bitcoin corrections ‘are inevitable’

On that same Oct. 17 date, James Check, the leading analyst at Glassnode, advised his audience of Bitcoin investors to “remain patient” and abstain from “FOMO,” noting that dips in price “are to be expected.”

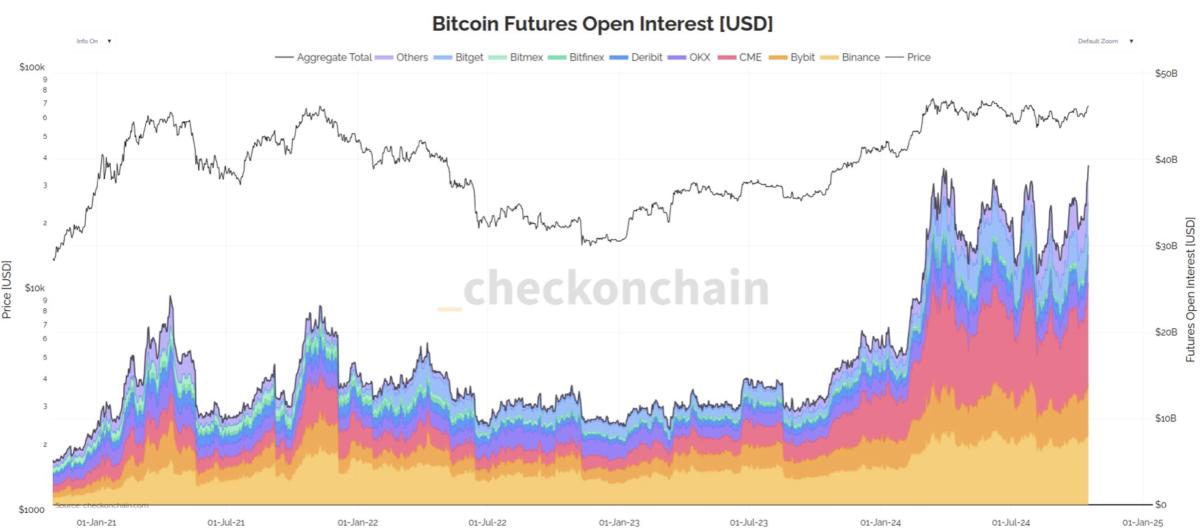

Check indicated that heightened leverage in the market could potentially lead to more tumultuous price movements, referencing the all-time high reached by Bitcoin futures Open Interest (OI).

As reported by Cointelegraph on Oct. 15, the sum of all Bitcoin futures agreements reached 566,270, a peak since January 2023.

This occurred amidst the market sentiment being in a phase of “Greed” as derived from the Crypto Fear and Greed Index.

The Index, which portrays the prevailing “emotions and sentiments” regarding Bitcoin and the crypto sector as a whole, displayed a score of 71 indicating “Greed”, a significant rise from the score of 39 seen on Oct. 10.

Not all are convinced a BTC price correction is on the horizon

The notion of a noteworthy decrement in Bitcoin price isn’t shared by everyone, including the anonymous cryptocurrency trader known as Wolf.

“Consider the possibility of a slight dip to the $63.2k to $64.4k range prior to overcoming the final resistance of the pattern,” suggested Wolf.

Most recently, on Oct. 17, the cumulative investments into spot Bitcoin exchange-traded funds (ETF) surpassed $20 billion, after a succession of four days of positive inflows in the United States.

Especially noteworthy was Oct. 16, when the world’s biggest asset manager, BlackRock, recorded $393.4 million in daily inflows, the most substantial since the $526.7 million experienced on July 22.

The content in this article is not to be taken as financial guidance or recommendations. Every investment and trading move carries inherent risk, and it is essential for readers to perform their own research when making financial decisions.

Source link

#Bitcoin #bears #turn #giddy #prospect #sub60K #BTC #price #TradingView #News