Bitcoin Value Consolidates Around $64k, Expert Forecasts Peak of $300k for Current Cycle

(Kitco News) – As markets linger in anticipation of new cues, Bitcoin’s (BTC) valuation has seen limited movement, inching between a tight bracket of $63,520 and $65,285 in the last day after the halving event. Investors and speculators are poised for a significant trigger to dictate the direction of trade.

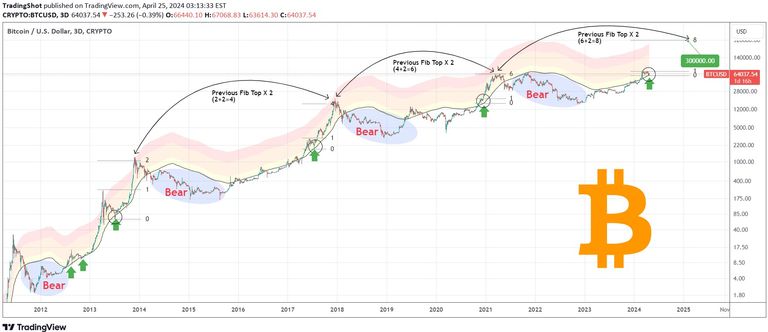

BTC/USD Chart by TradingView

The market currently witnesses a period of stagnation, indicated by both the outflows from US-based spot Bitcoin ETFs and the flattened trading activity. Notably, Fidelity’s FBTC endured its initial day of outflows with $22.6 million withdrawn on Thursday, while BlackRock’s IBIT experienced neutrality in flows for a second day, as per data from Farside.

This decrease in ETF demand has weakened the positive momentum for Bitcoin’s price, resulting in a consolidation that’s extended over recent weeks.

“This week’s crypto market leans towards a bearish drift,” observed Rachel Lin, the co-founder and CEO of SynFutures, in communication with Kitco Crypto. “The market’s failure to build on the bounce earlier in the week and the uneventful halving have not catalyzed notable price action.”

Analyzing prior halving cycles, Lin points out that a sideways or negative trend tends to follow the event, pending a breakthrough above earlier peak levels—in this case, around $73,600.

She further illustrates the significance of the $60,000 threshold, whose resilience was tested last Friday, prompting a notable recovery. A continued stand above this level could lead to more lateral movements, whereas a dip below might trigger a potent sell-off.

Lin warns that a fall below the $60,000 mark could set the stage for a descent towards the $50,000–$52,000 support zone, a substantial 15% drop in Bitcoin’s valuation.

Regarding the broader crypto landscape, Lin notes mixed developments; the approval of a crypto ETF in Hong Kong expects to kick off trading at month’s end, while in contrast, U.S. authorities have arrested the Samourai wallet’s co-founders on charges of money laundering.

With a watchful eye on the macroeconomic domain, Lin highlights the importance of the U.S.’s newly published key economic data, which will likely cast some influence on the movements within the cryptocurrency market.

In the interim, Lin forecasts a volatile yet horizontally fluctuating trend for Bitcoin prices. The levels of $60,000 and $67,500 are now pivotal to forecast the market’s direction.

According to market analyst TradingShot, the current chart suggests Bitcoin is approaching what has historically been the onset of the most intense phase of the bull cycle.

“By following established historical sequences and applying Fibonacci extensions, we can anticipate, although with the usual uncertainties, that Cycle 4 may extend Fibonacci levels by 2.0 beyond Cycle 3’s level of 6.0, reaching 8.0,” he explained.

In simpler terms, TradingShot’s analysis suggests the possibility of Bitcoin spiking to $300,000 in the active cycle.

“Whether it’s a realistic outcome or merely speculative, this $300000 benchmark is technically grounded in the precise measurements recorded when MM Mean was touched,” TradingShot concluded.

As of the latest update, Bitcoin is trading at $63,710 which marks a slight increase of 0.5% over the past 24 hours.

Disclaimer: The opinions expressed in this article belong to the author and may not necessarily echo those of Kitco Metals Inc. While all attempts have been made to ensure accuracy in the information provided, neither Kitco Metals Inc. nor the author can be held accountable for any errors. This text is presented purely for informational uses and is not intended as an exchange proposition for commodities, securities, or other financial instruments. Kitco Metals Inc., along with the writer of this piece, disclaim responsibility for any losses and/or damages emerging from its usage.

Source link

#Bitcoin #price #coils #64k #analyst #predicts #cycle #top #300k