ChatGPT-4 Outlines Potential Bitcoin Price Impact from NYSE Approval of BTC Trading

The prospect of the New York Stock Exchange (NYSE) engaging in cryptocurrency transactions is on the table, though regulatory constraints at present hinder progress. Being the largest exchange by traded volume, the NYSE’s entry into the crypto space could have a substantial effect on the demand for digital currencies, including Bitcoin (BTC).

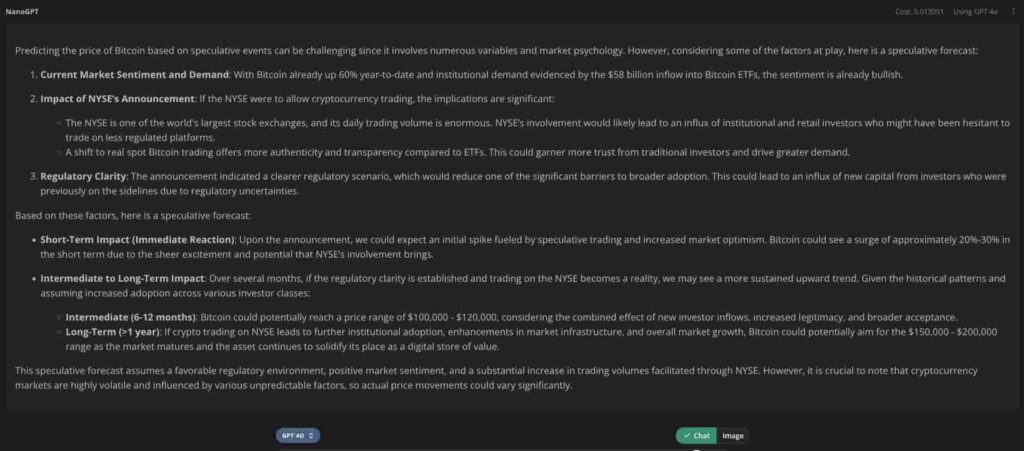

To gain insight into the potential repercussions of Bitcoin being listed on the NYSE, Finbold consulted OpenAI’s latest AI model, ChatGPT-4o, for its price projections post-approval.

Bitcoin Price Forecast by ChatGPT-4o Assuming NYSE Listing

ChatGPT-4o has issued forecasts that span short-term, medium-term, and long-term horizons based on provided context.

Initially, the model suggests that mere speculation of the NYSE listing could spark a price jump, estimating an immediate appreciation of 20% to 30%. This surge could see Bitcoin ascend to $82,000, a figure supported by a seasoned crypto trader’s analysis on Finbold.

For the medium term, the AI foresees Bitcoin’s worth oscillating between $100,000 and $120,000, factoring in an amalgamation of new investments, enhanced credibility, and wider acceptance over six to twelve months.

In the long run, Bitcoin is projected to reach a valuation in the span of $150,000 to $200,000.

“Assuming crypto dealings on the NYSE encourage further institutional uptake, progress in market frameworks, and overall market growth, Bitcoin may set its sights on the $150,000 to $200,000 range, consolidating its status as a digital value repository as market maturation continues.”

NYSE Considering Crypto Trades Pending Regulatory Clarity; CME Eyes Spot Trading

At the Consensus 2024 gathering, Lynn Martin, President of the NYSE, indicated a willingness to introduce cryptocurrency trades on the exchange with clearer US regulations. Considering the $58 billion success of US-listed Bitcoin ETFs in a regulated environment, there is a significant demand for such crypto products. Similarly, CME Group, the NYSE’s competitor, aims to offer its clients spot trading in cryptocurrencies, as reported by CoinDesk.

Tom Farley, former CEO of the NYSE, noted a swift shift in USA political stances on cryptos and forecasts regulatory advances by 2024-2025. Martin remains hopeful of blockchain’s potential to refine financial operations, particularly for illiquid securities.

Farley, on the other hand, speculates that due to regulators’ skepticism towards public blockchains, conventional financial institutions might resort to nurturing private blockchains for their settlement processes. It is pivotal that transparent regulatory guidelines are established to facilitate the advancement and innovation of the crypto sector in the States.

Bitcoin (BTC) Price Evaluation

Bitcoin’s current trading value stands at $67,724, fluctuating within the $60,000 to $72,000 bracket. Holding above the 30-day exponential moving average (30-EMA) signifies bullish tendencies, with the chances to tackle the range’s upper resistance and reach the $82,000 price mark as predicted by ChatGPT-4o.

The cryptocurrency has also signaled mounting momentum according to the daily relative strength index (RSI), enhancing the outlook for an impending bullish run. Year-to-date, Bitcoin has witnessed a growth of 60% from the $42,284 rate as registered on January 1.

To sum up, the aforementioned Bitcoin valuations by ChatGPT-4o are conditional upon varied influences, and certainty is not assured. The trajectory of the cryptocurrency in the years ahead will be shaped by regulatory evolutions, investor interest, and offerings in orthodox finance.

Source link

#ChatGPT4o #predicts #Bitcoins #price #NYSE #approves #BTC #trading