Crypto.com Surpasses Coinbase in North American Cryptocurrency Trading Dominance, According to Data | Finance and Business Currency Updates

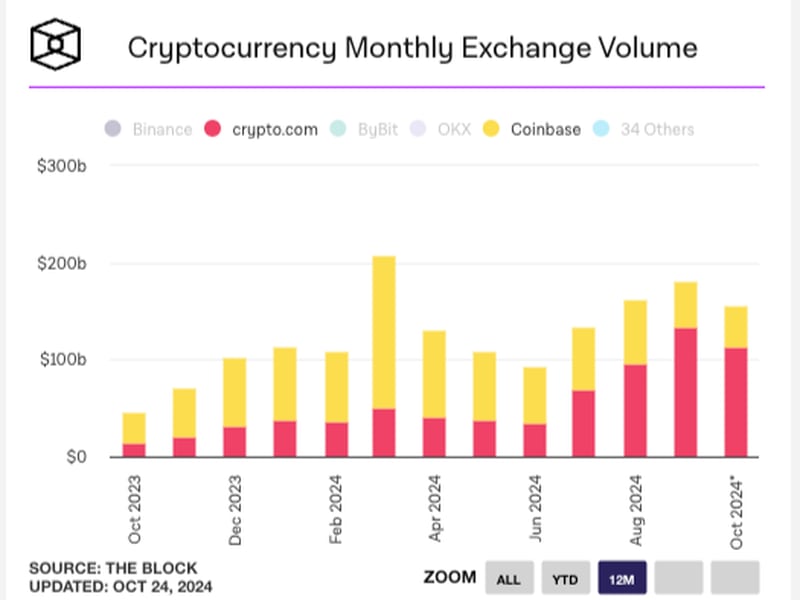

- The trading volumes for spot markets on Crypto.com surged to $134 billion in September up from $34 billion in July, as reported by The Block.

- A Citigroup analysis suggests that the success of crypto ETFs has played a role in Crypto.com’s market dominance.

Trading of digital currencies at Crypto.com reached unprecedented levels, outpacing Coinbase’s trading volumes in North America.

Crypto.com experienced a remarkable increase in monthly spot trading, jumping from $34 billion in July to $134 billion in September, as per figures from The Block. The cumulative trading volume for September on North American cryptocurrency exchanges was $183 billion, with Coinbase contributing $46 billion of that amount.

In July, Crypto.com surpassed Coinbase and has maintained its lead through October. As of October, the exchange processed $112 billion in trades from a total of $173 billion transacted across regional exchanges, data from The Block indicates. Trailing significantly behind, Kraken stands as the third-largest with less than $10 billion in trading volume this October.

The impressive selection of over 378 tokens on Crypto.com — including bitcoin (BTC), ether (ETH), various memecoins, and ecosystem-specific tokens — may contribute to its widespread use. In contrast, selections on Coinbase and Kraken are more limited, with each offering under 290 tokens.

Trading on Crypto.com is predominantly in BTC and ETH, which make up over 85% of the trading against USDT stablecoin and U.S. dollars, according to statistics from CoinGecko.

U.S. web traffic comprises about 26% of the total for the exchange, with peak activity aligning with American trading hours, per insights from Kaiko Research.

The ascendancy of Crypto.com has been linked to the burgeoning success of crypto ETFs in 2024, according to a recent report from Citigroup.

VanEck’s head of digital assets research, Matthew Sigel, mentioned in an X post that average trade sizes for BTC on Crypto.com have tripled year-to-date, correlating with Cboe Global Markets shuttering its crypto spot trading division.

“The platform’s liquidity is keeping up with trade volumes, indicating increased activity from market makers,” Sigel commented.

In addition, Crypto.com is currently navigating a complex legal landscape. The exchange initiated legal action against the United States Securities and Exchange Commission recently, aiming to counter what it views as overreach by the SEC, following a Wells notice they received, as reported by CoinDesk.

Crypto.com’s CEO Kris Marszalek has positioned the lawsuit as a defensive move against the SEC’s “unsanctioned overreach and unwarranted rulemaking,” informed by CoinDesk’s coverage.

Originally published by Coindesk.

Source link

#Crypto.com #Overtakes #Coinbase #Dominate #North #American #Crypto #Trading #Data #Shows #Currency #News #Financial #Business #News