Cryptocurrency Trader Incurs $2 Million Loss Over 30-Day Trading Period with This Digital Currency

A cryptocurrency enthusiast has recently conceded a massive $2 million in accumulated losses after trading the digital asset PEPE. The losses stem from the decision to offload holdings of PEPE at prices lower than the initially calculated dollar-cost average amidst a downturn in the cryptocurrency market.

Data acquired by Finbold from SpotOnChain on June 26, details the investment activities of the Ethereum (ETH) address known as ‘0x8376…‘.

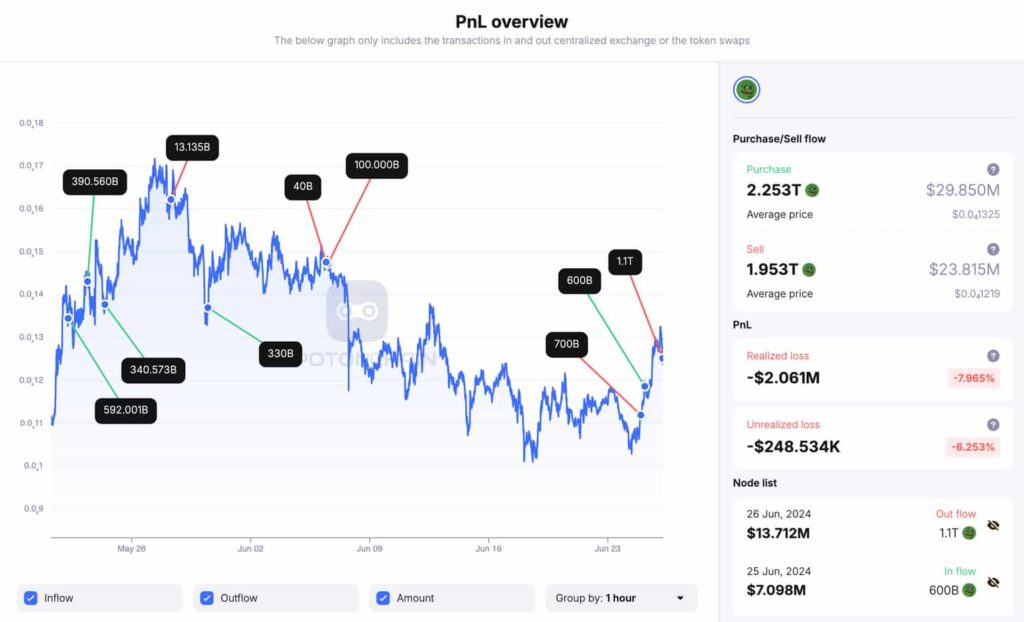

The trading history shows that the investor bought 2.253 trillion units of PEPE at an average token price of $0.00001325. More recently, there has been an uptick in liquidating these holdings, particularly in the 8 hours preceding this publication.

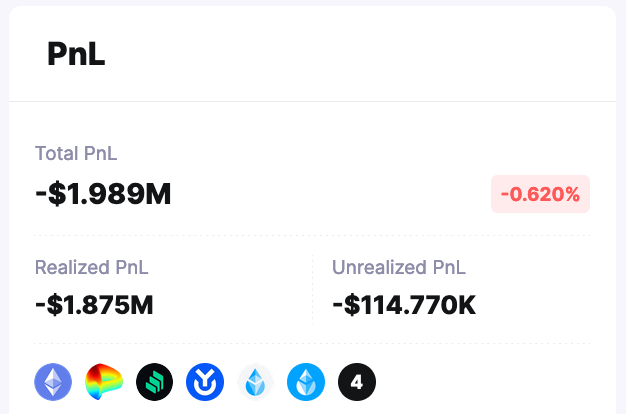

To date, ‘0x8376’ has sold off 1.953 trillion PEPE at an average price of $0.00001249 per unit, resulting in a total of $1.577 million in losses from PEPE trades. The ETH address has a total crypto profit and loss (PnL) of $1.989 million since 2021, with realized losses amounting to $1.875 million, the bulk of which is associated with PEPE’s forced sales.

Detailed Analysis of a Crypto Trader’s PEPE Dealings Over the Past Month

Scrutinizing the recent month’s transactions for 0x8376 reveals a pattern of trades culminating in $2 million of realized losses.

In the span of this activity, the PEPE whale expended $29.85 million on this meme coin. Subsequently, these tokens were deposited to Binance at a market value of $23.815 million.

Ultimately, the transactions demonstrate a strategy of accumulating the asset at high costs, only to divest when the price declined below the purchase level.

The Influence of the Greater Fool Theory on PEPE Meme Coin Trading

The journey of this trader serves as a textbook example of the speculative perils associated with assets that lack intrinsic value, such as meme coins.

Unlike investments in cryptocurrencies or other assets backed by fundamental analysis and potential for organic, long-term growth, meme coins draw in consumers looking for a quick turnover, buying in anticipation that someone else will purchase at a greater price despite the lack of solid fundamentals.

This speculative buying in hopes of offloading to a “greater fool” is aptly explained by the Greater Fool Theory.

It’s advisable for investors to thoroughly research and focus on digital assets with solid fundamentals, beyond the hype and speculation, as meme coins tend to introduce an increased layer of risk to an already volatile cryptocurrency market.

Disclaimer:

The information presented here is not meant to be investment advice. Any investment activity comes with the risk of losing capital.

Source link

#Crypto #trader #loses #million #days #trading #cryptocurrency