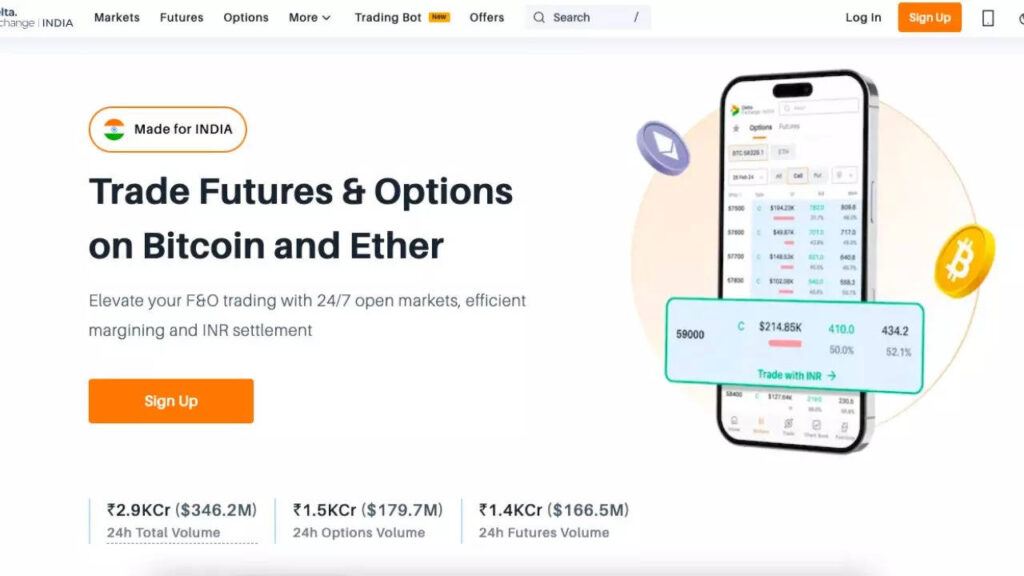

Delta Exchange India: A Registered FIU Accelerating in the Crypto Futures & Options Market

For those in India, however, the task of navigating through crypto derivative trading can be strenuous due to limited platform options and regulatory constraints. One must be cautious in selecting a trustworthy and safe trading platform such as Delta Exchange India.

Delta Exchange India introduces Crypto Futures and Options tailored for residents of India at competitive fees. Boasting a FIU-India registration, the exchange adheres to compliance standards. With a substantial daily trading volume exceeding $250 Million, Delta Exchange India has rapidly become a significant player in the Indian Crypto F&O market.

Delta Exchange India: Simplifying BTC and ETH options and futures trading

Crypto Futures contracts enable traders to speculate on the future price of a cryptocurrency at a predetermined price and expiration. Meanwhile, Crypto Options provide similar opportunities without the obligation to conclude the trade at the expiration date.

Explore the BTC/USD futures market on Delta India

With crypto futures, participants are committed to satisfying the contract at expiry, whereas options offer the freedom to opt-out. Additionally, crypto perpetual futures exist, which are akin to traditional futures but without an expiry date, featuring an automatic rollover mechanism through the exchange of funding every eight hours.

Options trading with BTC on Delta Exchange India

Crypto futures and options each host their own set of advantages and trade-offs. Futures may present high-profit potential with corresponding risk, whereas options offer greater flexibility with possibly lower profit margins.

Delta Exchange India provides an array of choices, including INR-settled European crypto options and perpetual futures across Bitcoin, Ethereum, and various altcoins, making it accessible for novice traders.

Unique features offered by DeltaExchange India include:

Expirees available on a daily, weekly, or monthly basis for BTC and ETH options, which opens a plethora of trading scenarios.

They’ve implemented sophisticated risk management strategies, allowing for larger trades with reduced capital and lower risk levels.

Understanding crypto taxation in India:

Profits from crypto trading are taxed at 30% plus a 4% cess under Section 115BBH.

There’s a 1% TDS on the transfer of crypto assets over ₹50,000 (or ₹10,000 in certain cases within a financial year) as stipulated by Section 194S.

An advantage of trading on Delta Exchange India is that your account balance and unrecognized profits are quoted in INR, meaning you avoid direct contact with crypto and subsequently, the high tax rates on virtual digital assets (VDAs). Additionally, the platform allows for loss offsetting, which isn’t permissible under current Indian crypto regulations.

You can seamlessly deposit INR to Delta Exchange India through your bank, use it as margin for trades, and withdraw in INR. Thus, all trading activities are conducted in INR, distancing you from direct crypto dealings and simplifying tax matters. Still, it’s essential to consult your tax advisor regarding net trading gains.

All contracts on Delta Exchange India are quoted, margined, and settled in USD. However, your balance remains constant in INR as the platform maintains a fixed USD-INR exchange rate, thus bypassing currency conversion processes for the user.

Streamlined deposits and withdrawals on Delta India

Depositing INR to Delta Exchange India is a straightforward process, involving:

- Accessing your account’s ‘Deposit’ section.

- Logging into your bank’s internet banking or mobile app.

- Adding Delta Exchange India as a beneficiary with the provided information.

- Selecting the amount to deposit and choosing Delta India as your recipient.

- Completing the deposit via IMPS for immediate funding (beneficiary addition may take up to 24 hours with some banks).

Withdrawals are made with equal ease:

- Navigate to the ‘Withdrawal’ section in your Delta India account.

- State the desired withdrawal amount.

- Update your bank details and select the necessary option.

- Execute the withdrawal of the specified amount.

A fully regulated ecosystem

Delta Exchange India prides itself on adhering to FIU-India standards and maintains full compliance with Indian legislation.

Delta Exchange India’s impressive daily volume of over $350 Million (at the time of writing) underscores its position as the premier and rapidly expanding Crypto F&O exchange for the Indian market. Dedicated to offering a platform that circumvents complex crypto taxes and embraces regulatory measures, Delta India seems poised to uphold its commitments and contribute to the evolving crypto landscape in India.

Stay informed by following Delta Exchange India on their website, as well as their profiles on Twitter and Instagram. Their application is also available for download via Google Play and the Apple Store.

Disclaimer: Cryptocurrencies are inherently volatile and investments in this class may pose significant risks. The provided information in this article is not considered financial advice, and thorough researchis recommended before investing in crypto.

Disclaimer: The content presented above is non-editorial, and TIL disclaims all warranties, implied or explicit, related to it. TIL does not endorse or confirm the accuracy of the information, and it is not liable for it in any manner. The content does not serve as investment advice. All necessary steps should be taken to verify that information and content are accurate, current, and authenticated.

Source link

#Delta #Exchange #India #FIUregistered #fastestgrowing #crypto #exchange